DEFINITION OF TRACKING ERROR

The risk of a portfolio can be measured by the standard deviation of portfolio returns. This statistical measure provides a range around the average return of a portfolio within which the actual return over a period is likely to fall with some specific probability. The mean return and standard deviation (or volatility) of a portfolio can be calculated over a period of time.

The standard deviation or volatility of a portfolio or a market index is an absolute number. A portfolio manager or client can also ask what the variation of the return of a portfolio is relative to a specified benchmark. Such variation is called the portfolio's tracking error.

Specifically, tracking error measures the dispersion of a portfolio's returns relative to the returns of its benchmark. That is, tracking error is the standard deviation of the portfolio's active return where active return is defined as:

![]()

A portfolio created to match the benchmark index (i.e., an index fund) that regularly has zero active returns (i.e., always matches its benchmark's actual return) would have a tracking error of zero. But a portfolio that is actively managed that takes positions substantially different from the benchmark would likely have large active returns, both positive and negative, and thus would have an annual tracking error of, say, 5% to 10%.

To find the tracking error of a portfolio, it is first necessary to specify the benchmark. The tracking error of a portfolio, as indicated, is its standard deviation relative to the benchmark, not its total standard deviation. Exhibit 10.1 presents the information used to calculate the tracking error for a hypothetical portfolio and benchmark using 30 weekly observations. The fourth column in the exhibit shows the active return for the week. It is from the data in this column that the tracking error is computed. As reported in the exhibit, the standard deviation of the weekly active returns is 0.54%. This value is then annualized by multiplying by the square root of 52—52 representing the number of weeks in a year. This gives a value of 3.89%. If the observations were monthly rather than weekly, the monthly tracking error would be annualized by multiplying by the square root of 12.

Given the tracking error, a range for the possible portfolio active return and corresponding range for the portfolio can be estimated assuming that the active returns are normally distributed. For example, assume the following:

Then, the range for portfolio returns and associated probabilities are as follows:

EXHIBIT 10.1 Data and Calculation for Active Return, Alpha, and Information Ratio

Tracking Error for an Active/Passive Portfolio

A manager can pursue a blend of an active and a passive (i.e., indexing) strategy. That is, a manager can construct a portfolio such that a certain percentage of the portfolio is indexed to some benchmark index and the balance actively managed. Assume that the passively managed portion (i.e., the indexed portion) has a zero tracking error relative to the index. For such a strategy, we can show (after some algebraic manipulation) that the tracking error for the overall portfolio would be as follows:

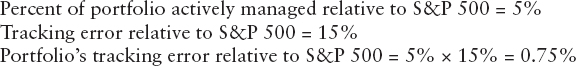

An enhanced index fund differs from an index fund in that it deviates from the index holdings in small amounts and hopes to slightly outperform the index through those small deviations. In terms of an active/passive strategy, the manager allocates a small percentage of the portfolio to be actively managed. The reason is that in case the bets prove detrimental, then the underperformance would be small. Thus, realized returns would always deviate from index returns only by small amounts. There are many enhancing strategies. Suppose that a manager whose benchmark is the S&P 500 pursues an enhanced indexing strategy allocating only 5% of the portfolio to be actively managed and 95% indexed. Assume further that the tracking error of the actively managed portion is 15% with respect to the S&P 500. The portfolio would then have a tracking error calculated as follows: