Chapter 6

Preparing the financial statements

‘Mr Evans was the chief accountant of a large manufacturing concern. Every day, on arriving at work, he would unlock the bottom drawer of his desk, peer at something inside, then close and lock the drawer. He had done this for 25 years. The entire staff was intrigued but no one was game to ask him what was in the drawer. Finally, the time came for Mr Evans to retire. There was a farewell party with speeches and a presentation. As soon as Mr Evans had left the buildings, some of the staff rushed into his office, unlocked the bottom drawer and peered in. Taped to the bottom of the drawer was a sheet of paper. It read, “The debit side is the one nearest the window”.’

R. Andrews, Funny Business, C.A. Magazine, April 2000, p. 26. Copyright The Institute of Chartered Accountants of Scotland.

Learning Outcomes

After completing this chapter you should be able to:

- Show how the trial balance is used as a basis for preparing the financial statements.

- Prepare the income statement (profit and loss account) and the statement of financial position (balance sheet).

- Understand the post-trial balance adjustments commonly made to the accounts.

- Prepare the income statement (profit and loss account) and the statement of financial position (balance sheet) using post-trial balance adjustments.

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

Chapter Summary

- The trial balance when rearranged creates an income statement and a statement of financial position.

- The income statement presents revenue, cost of sales, other income and other expenses.

- The statement of financial position consists of assets, liabilities and equity.

- Revenue less cost of sales less other expenses gives net profit.

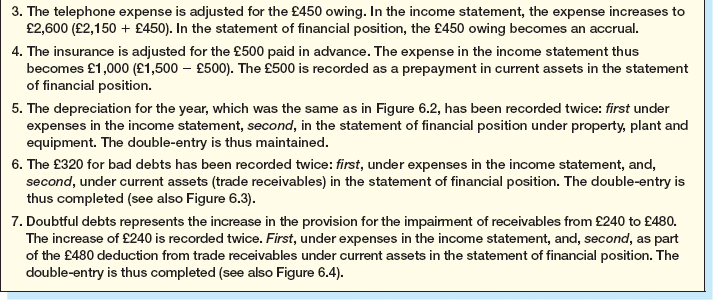

- There are five main post trial-balance adjustments to the accounts: closing inventory, accruals, prepayments, depreciation, and bad and doubtful debts.

- All five adjustments are made twice to maintain the double-entry: first, in the income statement and, second, in the statement of financial position.

Introduction

A trial balance is prepared after the bookkeeping process of recording the financial transactions in a double-entry form. The bookkeeping stage is really one of aggregating and summarising the financial information. The next step is to prepare the income statement (profit and loss account) and the statement of financial position (balance sheet) from the trial balance. In essence, the income statement sets out income less expenses and thus determines profit. Meanwhile, the statement of financial position presents the assets and liabilities, including equity. The two statements are seen as complementary. Chapters 4 and 5 discussed the nature and purpose of the income statement and the statement of financial position. This present chapter looks at the mechanics of how we prepare the final accounts from the trial balance. It is thus a continuation of Chapter 3. These mechanics are the same for sole traders, partnerships and companies. However, in companies the final unabridged accounts are then used to provide summarised accounts for publication.

Main Financial Statements

Essentially, the two main financial statements rearrange the items in the trial balance. The profit for the year effectively links the income statement and the statement of financial position. In the income statement profit is income less expenses paid, while in the statement of financial position, closing equity add drawings less opening equity gives profit. Looked at another way profit represents the increase in equity over the year. Profit is a key figure in the accounts and plays a vital part in linking the income statement to the statement of financial position. Profit is often reported graphically by companies in their annual reports. Stage Coach plc's profit figure is given in Company Snapshot 6.1.

Source: Stagecoach Group plc, Annual Report and Financial Statements 2011.

Accounting Equation and Financial Statements

What is the relationship between the accounting equation, income statement and statement of financial position?

In essence, the accounting equation develops into the financial statements. Remember from Chapter 3 that the expanded accounting equation was:

![]()

Rearrange thus:

Trial Balance to the Income Statement (Profit and Loss Account) and the Statement of Financial Position (Balance Sheet)

The elements of the trial balance need to be arranged to form the income statement and the statement of financial position. Different organisations (for example, sole traders, partnerships and limited companies) all have slightly different formats for their statement of financial position. However, the basic structure remains the same. For the sole trader, sometimes the terminology used is ‘trading and profit and loss account’, rather than ‘income statement’. For illustrative purposes, we continue the example of Gavin Stevens, a sole trader, who is setting up a hotel. The format used here is that followed by most UK companies and broadly adheres to the requirements of the UK Companies Acts. There is no prescribed format for sole traders, therefore, for consistency this book broadly adopts the format used by listed companies that follow the requirements of the International Financial Reporting Standards. The individual items were explained in more detail in Chapters 4 and 5. It is worth pointing out that the statement of cash flows is usually derived from the income statement and the statement of financial position once they have been prepared and not from the trial balance (see Chapter 8).

Gavin Stevens, Continued

In Chapter 3, we prepared the trial balance. We now can use this to prepare the income statement, and the statement of financial position. However, when we prepare the financial accounts we also need to collect information on the amount of inventory and on any expenses which are yet to be paid or have been paid in advance. In this example, we set out more details about inventory, amounts owing for telephone and amounts prepaid for electricity in the notes to the trial balance. It is important to realise that none of these items has so far been entered into the books. We deal with these adjustments in more depth later in this chapter.

1. Gavin Stevens does not use all the catering supplies. He estimates that the amount of catering supplies left as closing inventory is £50.

2. There is a special arrangement with the electricity company in which Gavin Stevens pays £300 in advance for a quarter. By 7 January he has used £50 which means he has prepaid £250. This is known as a prepayment.

3. There is a telephone bill yet to be received. However, Gavin Stevens estimates that he owes £100. This is known as an accrual.

We now prepare the income statement following the steps in Helpnote 6.1.

Presentational Guide to the Four Steps (Given as A–D in Gavin Stevens’ Income Statement (Trading and Profit and Loss Account))

In terms of presentation, we should note:

- We must first determine cost of sales (Step A). This is, at its simplest, opening stock add purchases less closing inventory. Purchases must be adjusted for purchases returns.

- Sales less cost of sales gives gross profit (Step B). Sales must be adjusted for sales returns.

- We list and total all expenses (Step C).

- We determine net profit (Step D) by taking expenses away from gross profit.

1. All the figures are from the trial balance except for closing inventory £50, electricity £50 and telephone £100 (from notes) and profit £3,330 (calculated).

2. The first part of the statement down to gross profit (B) (revenue less cost of sales (A)) is sometimes called the trading account. It deals with revenue and purchases. Essentially sales returns and purchases returns are deducted from revenue and purchases, respectively. Inventory is simply unsold purchases.

3. Gross profit (B) is revenue minus cost of sales.

4. Net profit (D) is revenue minus cost of sales minus other expenses (C).

5. Net profit of £3,330 increases equity in the statement of financial position. It is the balancing item, simply income minus expenses.

We now prepare the statement of financial position following the steps in Helpnote 6.2.

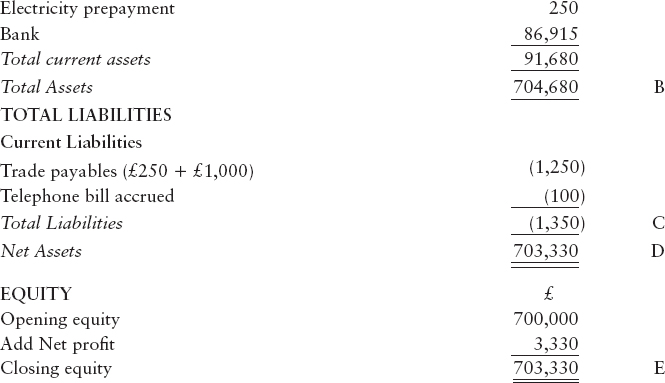

Presentational Guide to the Five Steps (Given as A–E in Gavin Stevens’ Statement of Financial Position (Balance Sheet))

In terms of presentation, we should note:

- All the property, plant and equipment (i.e., tangible non-current assets) are added together (Step A).

- Total assets (non-current assets and current assets) are determined next. This will give total assets (Step B).

- The total liabilities are determined. This is current liabilities and non-current liabilities added together (Step C).

- Total assets less total liabilities gives net assets (Step D).

- Equity is determined. Effectively, net profit is added to opening equity to give closing equity (Step E).

Points to notice:

1. Thus, in this example we have:

| A = | The sum total of the non-current assets (property, plant and equipment) £613,000. |

| B = | The total assets £704,680 (£613,000 non-current assets plus £91,680 current assets). |

| C = | Total liabilities (in this case the current liabilities of £1,350 as there are no non-current liabilities). |

| D = | Net assets £703,330 (total assets £704,680 (B) less total liabilities £1,350 (C)). |

| E = | Equity £703,330 (opening equity plus net profit). |

2. All figures are from the trial balance except for closing inventory £50, electricity prepayment £250, telephone bill (from notes) and profit £3,330 (balancing figure). Except for electricity all these figures are the same in the income statement. Electricity is different because in effect, we are splitting up £300. Thus:

| Total paid £300 = | £50 used up as an expense in the income statement, and £250 not used up recorded as an asset in the statement of financial position. |

3. Our statement is divided into non-current assets, current assets, current liabilities and equity.

4. The trade receivables are the trial balance figures for Ireton and Hepworth; the trade payables those for Hogen and Lewis.

5. Our opening equity plus our net profit gives us our closing equity. In other words, the business ‘owes’ Gavin Stevens £700,000 at 1 January, but £703,330 at 7 January.

6. Net profit of £3,330 is found in the income statement. It is the balancing item. As we saw from Pause for Thought 6.1, the profit can be seen as the increase in net assets over the year. Or, alternatively, it can be viewed as assets less liabilities less opening equity.

7. The statement of financial position balances. In other words total net assets equals closing equity.

Accounting Equation and Gavin Stevens

How does the Gavin Stevens example we have just completed fit the accounting equation?

If we take our expanded accounting equation:

![]()

and rearrange it,

![]()

Now, if we substitute the figures from Gavin Stevens, we have:

∴ £613,000 + £91,680 − (£1,350 + £700,000) = £8,930 − (£4,450 + £1,150)

∴ £704,680 − £701,350 = £8,930 − £5,600

∴ £3,330 = £3,330

The £3,330 represents net profit. This net profit, therefore, provides a bridge between the statement of financial position and the income statement.

Adjustments to Trial Balance

The trial balance is prepared from the books of account and is then adjusted for certain items. These items represent estimates or adjustments which typically do not form part of the initial double-entry process. Five of the main adjustments are closing inventory, accruals, prepayments, depreciation, and bad and doubtful debts. The mechanics of their accounting treatment is discussed here. However, the items themselves are discussed in more depth in Chapters 4 and 5 on the income statement and the statement of financial position.

Inventories (Stock)

Inventories are an important asset to any business, especially manufacturing businesses. Stock control systems in large businesses can be very complex and sophisticated. In most sole traders and in many other businesses it is normal not to record the detailed physical movements (i.e., purchases and sales of inventory). Inventory is not, therefore, formally recorded in these organisations in the double-entry process. However, at the financial reporting date inventory is counted and the accounting records updated. To maintain the double-entry, the asset of inventory is entered twice: first in the trading part of the income statement; and second, in the current assets section of the statement of financial position. These two figures for accounting purposes cancel out and thus the double-entry is maintained. Last year's closing inventory figure becomes the current year's opening inventory figure. The term inventories is often used in listed company accounts to denote the fact that a company may have many individual inventories. An alternative commonly used term is stock.

Accruals

Accruals are the amounts we owe to the suppliers of services such as the telephone or light and heat. In small businesses, accruals are normally excluded from the initial double-entry process. We adjust for accruals so that we will arrive at the expenses incurred for the year not just the amount paid. Accruals appear in the final accounts in two places. First, the amount owing is included in the income statement under expenses. Second, a matching amount is included under current liabilities in the statement of financial position. The double-entry is thus maintained. Figure 6.1 on the next page gives an example of accruals and prepayments (payments in advance for services).

Prepayments

Prepayments represent the amount paid in advance to the suppliers of services, for example rent paid in advance. In many ways prepayments are the opposite of accruals. Whereas accruals must be added to the final accounts to achieve the matching concept, a prepayment must be deducted. The amount paid in advance is treated as an asset which will be used up at a future date. We adjust for prepayments so that we will arrive at the expenses incurred for the year and not include payments for future years.

Accruals and Prepayments

Can you think of four examples of accruals and prepayments?

We might have, for example:

| Accruals | Prepayments |

| Electricity owing | Rent paid in advance |

| Business rates owing | Prepaid electricity on meter |

| Rent owing | Prepaid standing charge for telephone |

| Telephone owing | Insurance paid in advance |

Depreciation

As we saw in Chapter 5, property, plant and equipment wear out over time and depreciation seeks to recognise this. Depreciation in the accounts is simply recording this – twice. First, a proportion of the original cost is allocated as an expense in the income statement. Second, an equivalent amount is deducted from the property, plant and equipment in the statement of financial position (see Figure 6.2).

Rentokil Initial plc's property, plant and equipment (as recorded in its 2009 statement of financial position) are then given as an illustration in Company Snapshot 6.2. As you can see, they can be quite complex. In essence, however, two years’ accounts are shown: 2008 and 2009. The amounts recorded at cost are shown and then adjusted for additions and disposals at cost. Adjustments for depreciation and impairment (where there is a write down in the value of an asset over and above depreciation) are shown. The cost less the depreciation and impairment equals the net book value.

Source: Rentokil Initial plc, Annual Report 2009, p. 62.

Bad and Doubtful Debts

This is the last of the five adjustments. Bad and doubtful debts are also considered in Chapter 5 on the statement of financial position. Essentially, some debts may not be collected. These are termed doubtful debts.

Other debts will almost certainly not be collected; they are called bad or irrecoverable debts. The accounting entries to record this are in the income statement as an expense and in the statement of financial position as a reduction in trade receivables. Some businesses, such as building societies and banks, typically carry a high level of bad and doubtful debts. Company Snapshot 6.3 shows the bad and doubtful debts for Vodafone, the UK mobile phone company.

Doubtful Debts

The Group's trade receivables are stated after allowances for bad and doubtful debts based on management's assessment of creditworthiness, an analysis of which is as follows:

The carrying amounts of trade and other receivables approximate their fair value. Trade and other receivables are predominantly non-interest bearing.

Source: Vodafone Group plc, Annual Report 2010, p. 99.

When considering the accounting treatment of bad and doubtful debts, it is crucial to distinguish between bad and doubtful debts.

1. Bad Debts

Bad debts are recorded as an expense in the income statement and written off trade receivables in the statement of financial position (see Figure 6.3).

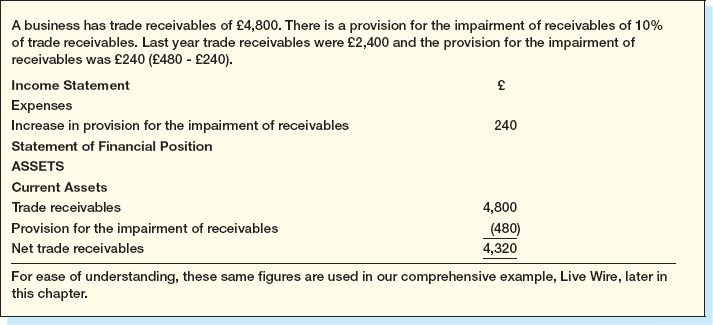

2. Provision for the impairment of receivables

A ‘provision for the impairment of receivables’ is set up by a business for those debts it is dubious about collecting. The word ‘impairment’ indicates that it is doubtful whether the full money will be recovered for the trade receivables. This provision is always deducted from trade receivables in the statement of financial position. However, only increases or decreases in the provision are entered in the income statement. An increase is recorded as an expense and a decrease as an income (see Figure 6.4). Where there are both bad and doubtful debts then either the provision for the impairment of trade receivables is calculated first and then bad debts are deducted or vice versa. There are arguments both ways. In this example the provision for the impairment of receivables is calculated first. In effect, using this method bad debts are those debts which are definitely irrecoverable.

Debts

‘A small debt makes a man your debtor, a large one makes him your enemy.’

Seneca (Ad Lucilium xix)

Source: The Executive's Book of Quotations (1994), p. 80.

It is now time to introduce some items commonly found in accounts. These are briefly explained in Figure 6.5. Mainly we focus on the accounts of a sole trader. Goodwill and other intangible assets (i.e., assets that we cannot touch) such as brands are discussed in more detail in Chapter 12.

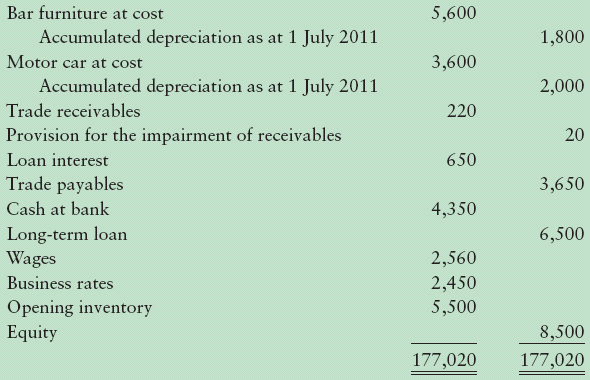

Comprehensive Example

We now close this chapter with a comprehensive example. This example includes most items normally found in the accounts of a sole trader. We use the example of a small engineering business run by Live Wire, which buys and sells electrical products. The trial balance is provided in Figure 6.6(a), and then in Figure 6.6(b) are the income statement, the statement of financial position and the explanatory notes.

Conclusion

The two main financial statements – the income statement and the statement of financial position – are both prepared from the trial balance. The income statement focuses on income, such as sales or dividends receivable, and expenses, such as telephone or electricity. The statement of financial position, by contrast, focuses on assets, liabilities and owner's capital or equity. In both financial statements, profit becomes the balancing figure. After the trial balance has been prepared, the accounts are often adjusted for items such as closing inventory, accruals (amounts owing), prepayments (amounts prepaid), depreciation (the wearing out of property, plant and equipment), and bad and doubtful debts. In each case, we adjust the accounts twice: first in the income statement and second in the statement of financial position The double-entry and the symmetry of the accounts are thus maintained.

Discussion Questions

Discussion Questions

Questions with numbers in blue have answers at the back of the book.

| Q1 | What is a sole trader and why is it important for the sole trader to prepare a set of financial statements? |

| Q2 | ‘Profit is the figure which links the income statement and the statement of financial position.’ Discuss. |

| Q3 | Why do we need to carry out post trial-balance adjustments when we are preparing the final accounts? |

Numerical Questions

Numerical Questions

The numerical questions which follow are graded in difficulty. Those at the start are about as complex as the illustrative example, Gavin Stevens. They gradually become more complex, until the final questions equate to the illustrative example, Live Wire.

Questions with numbers in blue have answers at the back of the book.

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

COMPANY SNAPSHOT 6.1

COMPANY SNAPSHOT 6.1 PAUSE FOR THOUGHT 6.1

PAUSE FOR THOUGHT 6.1 HELPNOTE 6.1

HELPNOTE 6.1

SOUNDBITE 6.1

SOUNDBITE 6.1