Chapter 3

Recording: Double-entry book keeping

Learning Outcomes

After completing this chapter you should be able to:

- Outline the accounting equation.

- Understand double-entry bookkeeping.

- Record transactions using double-entry bookkeeping.

- Balance off the accounts and draw up a trial balance.

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

Chapter Summary

- Double-entry bookkeeping is an essential underpinning of financial accounting.

- The accounting equation provides the structure for double-entry.

- Assets and expenses are increases in debits recorded on the left-hand side of the ‘T’ (i.e., ledger) account.

- Income and equity are increases in credits recorded on the right-hand side of the ‘T’ (i.e., ledger) account.

- Debits and credits are equal and opposite entries.

- Initial recording in the books of account using double-entry, balancing off and preparing the trial balance are the three major steps in double-entry bookkeeping.

- The trial balance is a listing of all the balances from the accounts.

- The debits and credits in a trial balance should balance.

Kissing Your Accountant

It has been a week for displays of affection in the market. The darlings of the entertainment industry have long been accustomed to hugging and kissing in public – anyone who has watched the Oscars ceremony knows this only too well. Now, this tendency towards overtly physical contact has spread into the financial world. The latest way to convey to the market that a deal is truly wonderful is for the leading figures to share a moment of intimacy.

The chief executives of Time Warner and AOL were photographed cuddling up after announcing their tie up. Chris Evans was even seen planting a smacker on his accountant after pocketing a cool £75m, when Scottish Media Group bought out Ginger Productions. Of course, if I had made £75m I might even be tempted to kiss my accountant – despite the fact that he still hasn't completed my income tax return and the January 31 deadline is getting ever closer.

Source: James Montier, Showbiz values come to the City, The Guardian, 15 January 2000, p. 31. Guardian Newspapers Limited 2000. Reproduced by permission of James Montier.

Introduction

Accounting is a blend of theory and practice. One of the key elements to understanding the practice of accounting is double-entry bookkeeping (see Definition 3.1). Although mysterious to the uninitiated, double-entry bookkeeping, in fact, is a mechanical exercise. It is a way of systematically recording accounting transactions into an organisation's accounting books.

Working definition

A way of systematically recording the financial transactions of a company so that each transaction is recorded twice.

Formal definition

Most commonly used system of bookkeeping based on the principle that every financial transaction involves the simultaneous receiving and giving of value, and is therefore recorded twice.

Source: Chartered Institute of Management Accountants (2005), Official Terminology. Reproduced by permission of Elsevier.

In a way it is like a business diary where all the financial transactions are recorded. Therefore, in essence, double-entry bookkeeping is the systematic recording of income, expenses, assets, liabilities and equity. Double-entry bookkeeping's importance lies in the fact that the income statement (also known as the profit and loss account) and statement of financial position (also known as the balance sheet) are prepared only after the accounting transactions have been recorded. The accounting equation and double-entry bookkeeping apply to all businesses. In this chapter, unless otherwise specified, the terminology used applies to sole traders, partnerships and non-listed companies.

The Accounting Equation

The reason why each transaction is recorded twice in the accounting books is not that accountants like extra work. In effect, it is a method of checking that the entries have been made correctly. As we will see later in this chapter, a trial balance can be prepared which helps to check that the bookkeeping transactions have been made properly.

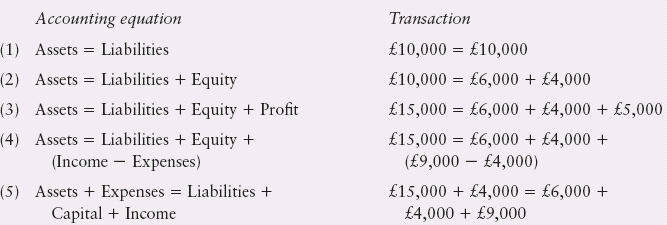

At the heart of the double-entry system is the accounting equation. This starts from the basic premise that assets equal liabilities. Liabilities are, in effect, claims that somebody has over assets. It then logically builds up in complexity, as follows:

Accountants sometimes use the term ‘Capital’ to describe the amount invested by the owner. However, for consistency in this book the term equity is used. In a company, like Tesco (see Company Snapshot 3.1), the equity is share capital and will have been invested by shareholders.

The Accounting Equation

John decides to start a business and puts £10,000 into a business bank account. He also borrows £5,000 from the bank. How does this obey the accounting equation?

The asset here is easy. It is £15,000 cash. There is also clearly a £5,000 liability to the bank. However, the remaining £10,000, at first glance, is more elusive. A liability does, however, exist. This is because of the entity concept where the business and John are treated as different entities. Thus, the business owes John £10,000. We therefore have:

Where a business has a liability to its owner, this is known as equity.

Share Capital

Note 29 Called up Share Capital

During the financial year, 37 million (2010 – 62 million) shares of 5p each were issued in relation to share options for aggregate consideration of £97m (2010 – £166m).

During the financial year, 25 million (2010 – 27 million) shares of 5p each were issued in relation to share bonus awards for consideration of £1m (2010 – £1m).

Between 27 February 2011 and 15 April 2011 options over 2,137,647 ordinary shares have been exercised under the terms of the Savings-related Share Option Scheme (1981) and the Irish Savings-related Share Option Scheme (2000). Between 27 February 2011 and 15 April 2011, options over 1,020,924 ordinary shares have been exercised under the terms of the Executive Share Option Schemes (1994 and 1996) and the Discretionary Share Option Plan (2004).

As at 26 February 2011, the Directors were authorised to purchase up to a maximum in aggregate of 802.1 million (2010 − 790.1 million) ordinary shares.

The owners of ordinary shares are entitled to receive dividends as declared from time to time and are entitled to one vote per share at the meetings of the Company.

Source: Tesco Plc, Annual Report and Financial Statements 2011, p. 140.

Illustration of Accounting Equation

A firm starts the year with £10,000 assets and £10,000 liabilities (£6,000 third party liabilities and £4,000 owner's equity). During the year, the firm makes £5,000 profit (£9,000 income, £4,000 expenses). Show how the accounting equation works.

The ‘T’ account is central to the concept of double-entry bookkeeping. In turn, double-entry bookkeeping is the backbone of financial accounting. As Helpnote 3.1 shows, it is underpinned by three major rules.

Basic Rules of Double-Entry Bookkeeping

- For every transaction, there must be a debit and a credit entry.

- These debit and credit entries are equal and opposite.

- In the cash book all accounts paid in are recorded on the debit side, whereas all amounts paid out are recorded on the credit side.

In practice, there are many types of asset, liability, equity, income and expense. Figure 3.1 provides a brief summary of some of these.

Figure 3.1 does not provide an exhaustive list of all assets and liabilities. For instance, it only deals with tangible assets (literally assets you can touch). It thus ignores intangible assets (literally assets you cannot touch) such as royalties or goodwill. However, for now, this provides a useful framework. Intangible assets are most often found in the accounts of companies and are discussed later. More detail on the individual items in Figure 3.1 is provided in later chapters.

Figure 3.1 Summary of Some of the Major Types of Assets, Liabilities and Equity, Income and Expenses

What do the terms ‘debit’ and ‘credit’ actually mean?

Debit and credit have their origins in Latin terms (debeo, I owe) and (credo, I make a loan). Debtor (one who owes, i.e., a customer) and creditor (one who is owed, i.e., a supplier) have the same origins. Over time, these terms have changed so that nowadays perhaps we have the following:

| Debit = | An entry on the left-hand side of a ‘T’ account. Records principally increases in either assets or expenses. However, may also record decreases in liabilities, equity or income. |

| Credit = | An entry on the right-hand side of a ‘T’ account. Records principally increases in liabilities, equity or income. However, may also record decreases in assets or expenses. |

HEALTH WARNING

HEALTH WARNING

Those students not wishing to gain an in-depth knowledge of double-entry bookkeeping can miss out pages 64–76.

Worked Example

Let us now look at an example. Gavin Stevens has decided to open a hotel to cater for conferences and large functions.

It is now time to enter the transactions for Gavin Stevens into the books of account. This will be done in the next section. As Figure 3.2 shows, there are three main parts to recording the transactions (recording, balancing off and the trial balance).

The bookkeeping role is an essential function of an accountant. However, as Real-World View 3.2 explains the accountant who is only a bookkeeper is very rare. Most of an accountant's work is the more challenging job of analysing and interpreting the information.

Keepers of the Books

As Keeper of the Books … the accountant has a rational and useful role. But the accountant who sticks to it is a rare fish. Certainly the officers of the established institutions would claim that it was a minor part of their usefulness. After all, it doesn't offer much in the way of power or esteem to an ambitious or intelligent man – and Valerie Barden's studies showed accountants on the whole as more intelligent than the average manager.

Source: Graham Cleverly (1971), Managers and Magic (as amended), Longman, London, p. 39.

Step 1 The Initial Recording Using Double-Entry Bookkeeping

The individual amounts are directly entered into two different ledger accounts, one on each side. Thus, on 1st January we credit the equity (capital) account with £700,000, but debit the bank account with £700,000. This represents the initial £700,000 capital invested. We record three items (1) date of transaction, (2) account which is equal and opposite to complete the double-entry and (3) amount. Each ‘T’ account (i.e., ledger page in the books of account) is treated separately. So that the transactions are easier to follow, each separate transaction is given a letter. Thus, the first transaction (investing £700,000 equity) is recorded as ‘A’ on the credit (i.e., right-hand side) in the equity account and also as ‘A’ on the debit (i.e., left-hand side) in the bank account (see Figure 3.3). For standardisation purposes, I use the term equity for sole traders (rather than capital, the term sometimes used).

It must be remembered that all organisations will structure their accounts books in slightly different ways. In particular, very small businesses may not keep any proper books of accounts, just filing the original invoices and passing them on to their accountants. Nonetheless all businesses will keep records of cash received and cash paid. However, bigger businesses will keep day books (such as the sales day book and purchases daybook) in which they will list their credit sales and credit purchases. Double-entry using daybooks is considered too complex for this book. Interested readers are referred to Alan Sangster and Frank Wood's Business Accounting.

Note that each entry in Figure 3.3 appears on both sides (i.e., as a debit and a credit, equal and opposite) of different accounts. For example, equity of £200,000 is a credit in the equity account of £200,000 and a debit in the bank account of £200,000. Each account represents one page. So, for example, the sales account has nothing on the left-hand side of the page.

In most businesses, the initial transactions are now recorded using a computer system. The individual ledger accounts are then stored in the computer. However, it is necessary to appreciate the underlying processes involved. These are now explained, both for Gavin Stevens and more generally. If we look at the double-entry in terms of debit and credit for Gavin Stevens, we have the following, see Figure 3.4.

Step 2 Balancing Off

Helpnotes 3.3 and 3.4 provide a number of rules to guide us through double-entry book-keeping. When all the entries for a period have been completed then it is time to balance off the accounts and carry forward the new total to the next period. We are, in effect, signalling the end of an accounting period. It is convenient to carry all the figures forward. These carried forward figures will form the basis of the trial balance. However, the revenue, purchases, sales returns, purchases returns and expenses accounts will then be closed off on the last day of the accounting period as they will not be carried forward to the next period. This is because in the next period all we are concerned with is that period's income and expenses. The statement of financial position items will be brought forward on the first day of the new accounting period. This is because assets, liabilities and equity continue from accounting period to accounting period. Accounting periods may be weekly, monthly or annually. The aim of balancing off is threefold.

Double-Entry Checks

Because of the way double-entry is structured, a number of rules can guide us when we make the initial entries.

- Revenue and purchases

There will never be a debit in a sales account or a credit in a purchases account. Assets and liabilities never pass through these accounts

- Returns

Sales returns and purchases returns have their own accounts. You will never find a credit in a sales returns account or a debit in a purchases returns account

- Assets and expenses

When making the initial entries you never credit a non-current asset such as property, plant and equipment or expenses account

- The bank account represents cash at bank. We always talk of cash received, and cash paid. Given the number of cash transactions the normal business conducts, there would normally be a separate cash book. The totals from the cash book would be summarised and then transferred to the bank account.

Finally, if all else fails and you are still struggling with double-entry then Helpnote 3.4 may be useful.

The Bank Account

If you are having trouble remembering your double-entry, work back from the bank account; remember

The smiling face represents money received so the business is better off. By contrast, the grumpy face represents money out, so the business is worse off.

1. To prepare a trial balance from which we will prepare the statement of financial position and income statement.

2. To close down income and expenses accounts which relate to the previous period.

3. To bring forward to the next period the assets, liabilities and equity balances.

First of all the accounts are balanced off. We then close off the revenue and expenses items to the income statement.

Why should the trial balance balance?

A trial balance is simply a list of all the balances on the individual accounts. If the double-entry process has been completed correctly, each debit will be matched by an equal and opposite credit entry. There will thus be equal amounts on the debit and credit sides. If the trial balance fails to balance – and it often will even for experts – then you know a mistake has been made in the double-entry process. You need, therefore, to find it. This process of trial and error is the reason why a trial balance is so called.

To illustrate balancing off we take three items from Gavin Stevens’ accounts: revenue (an income statement item), electricity (an income statement item) and the bank account (a statement of financial position item). We balance off after the first week. We will then draw up a trial balance.

1. Income statement items

Note that the balance (bal.) would be carried forward (c/f) above the totals and brought forward (b/f) below them.

2. Income statement item

3. Statement of financial position item

Note that there is no need to close off the bank account because it will be used at the start of the next period. However, note the date is the starting date for the next period.

NOW GO BACK TO THE DOUBLE-ENTRY STAGE ON PAGE 66 AND COMPLETE THE ‘T’ ACCOUNTS SHOWN THERE. MAKE SURE YOU UNDERSTAND HOW TO BALANCE OFF PROPERLY. THEN CHECK YOUR ANSWER WITH THE ANSWER BELOW ON PAGES 72 AND 73.

Balancing Off

| 1 Always find which side has the greatest total (in the case below, £250) | (a) |

| 2 Record the greatest total twice, once on the debit side and once on the credit side | (b) |

| 3 Carry forward the balancing figure (bal. c/f) | (c) |

| 4 Bring forward the balancing figure (bal. b/f) | (d) |

| 5 For trading and profit and loss account items, only transfer the balance | (e) |

In this case, we use a telephone account for period to 31 January.

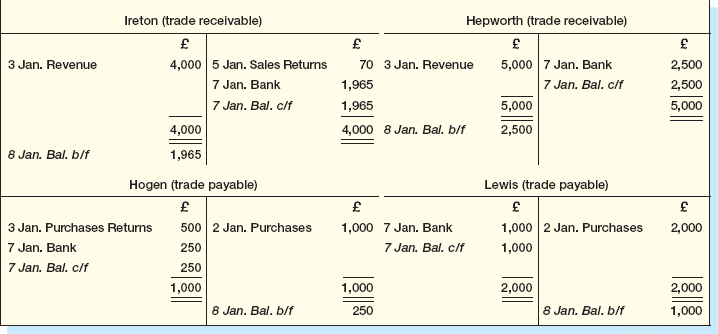

The completed ‘T’ accounts are shown in Figure 3.5. The balancing off is shown in italics for ease of understanding. We have abbreviated balance brought forward (to Bal. b/f) and balance carried forward (to Bal. c/f), transfer to income statement (to IS). Note that statement of financial position items brought forward (Bal. b/f) are brought forward on the first day of the new accounting period, i.e. 8th January.

Note: We have closed off the income statement as at 7th January (revenue, purchases, sales returns, purchases returns, electricity, wages) so that we can transfer these accounts to the income statement on that day. Statement of financial position items are, however, brought forward on 8th January ready for the new period. In practice, we would probably not bring forward accounts with only one entry in, such as equity.

Step 3 Trial Balance

Trial Balance

Working definition

A listing of debit and credit balances to check the correctness of the double-entry system.

Formal definition

‘A list of account balances in a double-entry accounting system. If the records have been correctly maintained, the sum of the debit balances will equal the sum of the credit balances, although certain errors such as the omission of a transaction or erroneous entries will not be disclosed by a trial balance.’

Source: Chartered Institute of Management Accountants (2000), Official Terminology. Reproduced by permission of Elsevier.

The trial balance for Gavin Stevens may now be prepared. Prepare your own answer before you look at the ‘answer’ shown in Figure 3.6.

Note that the debit items in Figure 3.6 are either assets or expenses and the credit items are income, liabilities or equity. This conforms to the accounting equation:

![]()

These balances are analysed for Gavin Stevens in Figure 3.7.

Essentially, the trial balance is a check on the accuracy of the double-entry process. If the double-entry has been done properly the trial balance will balance. If it does not, as Soundbite 3.1 shows, there is an error somewhere. Ideally, the books are then checked to find the error. Even when the trial balance balances, as Pause for Thought 3.5 shows, the accounts may not be totally correct.

Nowadays, you hear a lot about fancy accounting methods, like LIFO and FIFO, but back then we were using the ESP method, which really sped things along when it came time to close those books. It's a pretty basic method: if you can't make your books balance you take however much they're off by and enter it under the heading ESP, which stands for Error Some Place.

Sam Walton in Sam Walton p. 53

Source: The Executive's Book of Quotations (1994), pp. 3–4.

The Trial Balance II

If the trial balance balances that is the end of all my problems, I now know the accounts are correct. Is this true?

Unfortunately, this is not true! Although you can be happy that the trial balance does indeed balance, you must still be wary. There are several types of error (listed below) which may have crept in, perhaps at the original double-entry bookkeeping stage.

- Error of omission

You have omitted an entry completely. The trial balance will still balance, but your accounts will not be correct. - Reverse entry

If you have completely reversed your entry and entered a debit as a credit, and vice versa, then your trial balance will balance, but incorrectly. - Wrong amount

If the wrong figure (say £300 for the van instead of £3,000) was entered in the accounts, the books would still balance, but at the wrong amount. - Wrong account

One of the entries might have been entered in the wrong account, for example, the van might be recorded in the electricity account. - Compensating errors

If you make errors which cancel each other out, your trial balance will once more wrongly balance.

HEALTH WARNING

HEALTH WARNING

Those students who did not wish to gain an in-depth knowledge of double-entry bookkeeping can restart here.

Computers

Double-entry bookkeeping is obviously very labour-intensive, therefore, computerised packages, such as Sage, are very popular. Normally, an entry is keyed into the bank account (e.g., hotel £610,000) or into a trade receivable or trade payable account (e.g., sales to Ireton £4,000). The computer automatically completes the entries. Sales, purchases and bank transactions are standard and, therefore, only require one entry by the user. For non-standard items both a debit and a credit entry is recorded. The computer, after all the transactions have been input, can produce a trial balance, an income statement and the statement of financial position. Nowadays, there are numerous software packages which help with bookkeeping and accounts production. Organisations purchase off-the-shelf accounting packages and specialised accountancy packages customised for their particular businesses.

At first sight, therefore, computerised accounting packages which perform the double-entry transactions and then prepare the income statement and statement of financial position would seem to be a gift from heaven. They are quick, efficient and save labour. However, there are problems. The principal one is that, as many organisations have found to their cost, if you put rubbish into the computer, you get rubbish out. In other words, computer operators who are unskilled in accounting can create havoc with the accounts. To enter items correctly, it is necessary to have an understanding of the accounting process. Otherwise, disasters may occur with meaningless accounts. Therefore, unfortunately, understanding double-entry bookkeeping is just as important in this computer age.

Conclusion

The double-entry process is a key part of financial accounting. Without understanding double-entry it is difficult to get to grips with accounting itself. However, there is no need to be scared of double-entry. Essentially, it means that for every transaction which is entered on one side of a ledger account, an equal and opposite entry is made in another ledger account. These entries are called debit and credit. All the debits will equal all the credits. This is proved when the accounts are balanced off. The balance from each account is then listed in a trial balance. The trial balance shows that the double-entry process has been completed. However, a balanced trial balance does not necessarily guarantee that the double-entry has been correctly carried out (for example, there may be some errors of omission). Once the trial balance has been prepared it is possible to complete the income statement and the statement of financial position.

Discussion Questions

Discussion Questions

Questions with numbers in blue have answers at the back of the book.

| Q1 | Why is double-entry bookkeeping so important? |

| Q2 | How do you think that the books of account kept by different businesses might vary? |

| Q3 | Computerisation means that there is no need to understand double-entry bookkeeping. Discuss. |

| Q4 | How much trust can be placed in a trial balance which balances? |

| Q5 | Why are there usually more debit balances in a trial balance than credit balances? |

| Q6 | State whether the following are true or false. If false, explain why.

(a) We debit cash received, but credit cash paid. (b) Revenue is debited to a revenue account, but purchases are credited to a purchases account. (c) If a business purchases a car for cash we debit the car account and credit the bank account. (d) Purchases, hotel, electricity and wages are all debits in a trial balance. (e) Revenue, rent paid and equity are all credits in a trial balance. |

Numerical Questions

Numerical Questions

Questions with numbers in blue have answers at the back of the book.

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

REAL-WORLD VIEW 3.1

REAL-WORLD VIEW 3.1 DEFINITION 3.1

DEFINITION 3.1 PAUSE FOR THOUGHT 3.1

PAUSE FOR THOUGHT 3.1 COMPANY SNAPSHOT 3.1

COMPANY SNAPSHOT 3.1 HELPNOTE 3.1

HELPNOTE 3.1

SOUNDBITE 3.1

SOUNDBITE 3.1