Chapter 2

The accounting background

‘Living up to his reputation, he brooks no nonsense, adds no frills. A murmured thank you to the chair, then: “Let us never forget that we are all of us in business for one thing only. To make a profit.” The hush breaks, the apprehension goes. Audibly, feet slide forward and chairs ease back. Orthodoxy has been established. The incantation has been spoken. No one is going to be forced to query the framework of his world, to face the terrible question, why?’

Graham Cleverly, Managers and Magic (1971), Longman, pp. 25–6.

Learning Outcomes

After completing this chapter you should be able to:

- Explain the nature of financial accounting.

- Appreciate the basic language of accounting.

- Identify the major accounting conventions and concepts.

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

Chapter Summary

- Financial accounting is about providing users with financial information so that they can make decisions.

- Key accounting terminology includes income, expenses, equity or capital, assets and liabilities.

- The three major financial statements are the income statement (also known as the profit and loss account), statement of financial position (also known as the balance sheet) and statement of cash flows (also known as the cash flow statement).

- The most widely agreed objective is to provide information for decision making.

- The most important external users for companies are the shareholders.

- Four major accounting conventions are entity, money measurement, historic cost and periodicity.

- Three major accounting concepts are going concern, accruals and consistency

- Prudence is a fourth much disputed accounting concept.

Introduction

Financial accounting is the process by which financial information is prepared and then communicated to the users. It is a key element in modern business. For limited companies, it enables the shareholders to receive from the managers an annual set of accounts which has been independently checked by auditors. For sole traders and partnerships, it allows the tax authorities to have a set of accounts which is often prepared by independent accountants. There are thus three parties to the production and dissemination of the financial accounts: the preparers, the users and the independent accountants. The broad objective of financial accounting is to provide information for decision making. Its preparation is governed by basic underpinning principles called accounting conventions and accounting concepts.

Financial Accounting

Once a year company shareholders receive through the post an annual report containing the company's annual accounts. These comprise the key financial statements as well as other financial and non-financial information. Sole traders and partnerships annually prepare a set of financial statements for the tax authorities. Managers will also use these financial statements to evaluate the performance of the business over the past year. The whole process is underpinned by a set of overarching accounting principles (i.e., accounting conventions and accounting concepts) and by detailed accounting measurement and disclosure rules. Essentially, financial accounting is concerned with providing financial information to users so that they can make decisions. Definition 2.1 provides a more formal definition from the International Accounting Standards Board (a regulatory body which seeks to set accounting standards which will be used worldwide) applicable to all commercial, industrial and business reporting enterprises as well as a fuller definition from the Chartered Institute of Management Accountants.

Financial Accounting

Working definition

The provision of financial information to users for decision making.

Formal definitions

‘The objective of general purpose financial reporting is to provide financial information about the reporting entity that is useful to existing and potential investors, lenders and other creditors in making decisions about providing resources to the entity. Those decisions involve buying, selling or holding equity and debt instruments, and providing or settling loans and other forms of credit.’

Source: International Accounting Standards Board (2010), The Conceptual Framework for Financial Reporting. © 2012 IFRS Foundation. All rights reserved. No permission granted to reproduce or distribute.

Classification and recording of the monetary transactions of an entity in accordance with established concepts, principles, accounting standards and legal requirements and their presentation, by means of income statements, balance sheets [statements of financial position] and cash flow statements [statements of cash flow], during and at the end of an accounting period.

Source: Chartered Institute of Management Accountants (2005), Official Terminology. Reproduced by Permission of Elsevier.

Money

‘Money never meant anything to us. It was just sort of how we kept the score.’

Nelson Bunker Hunt, Great Business Quotations, R. Barron and J. Fisk

Source: The Book of Business Quotations (1991), p. 155.

Financial accounting meets the common needs of a wide range of users. It does not, however, provide all the information users may need. An important additional role of financial accounting is that it shows the stewardship of management (i.e., how successfully they run the company). Shareholders may use this information to decide whether or not to sell their shares.

At a still broader level, accounting allows managers to assess their organisation's performance. It is a way of seeing how well they have done or, as Soundbite 2.1 shows, of keeping the score. The main financial statements for sole traders, partnerships and companies are the income statement (profit and loss account) and the statement of financial position (balance sheet). These contain details of income, expenses, assets, liabilities and equity or capital. For companies (and often for other businesses), these two statements are accompanied by a statement of cash flows (cash flow statement), which summarises a company's cash flows. Generally, the principal user is assumed to be the shareholder. These three statements are sent to shareholders once a year in a document called an annual report. However, managers need more detailed and more frequent information to run a company effectively. Monthly accounts and accounts for different parts of the business are, therefore, often drawn up.

Annual Financial Accounts

Why do sole traders, partnerships and limited companies produce financial accounts?

There are several reasons. First, those running the business wish to assess their own performance and regular, periodic accounts are a good way to do this. Second, businesses may need to provide third parties with financial information. In the case of sole traders and partnerships, the tax authorities need to assess the business's profits. Bankers may also want regular financial statements if they have loaned money. Similarly, companies are accountable not only to their shareholders, but to other users of accounts.

Language of Accounting

Accounting is a language. As with all languages, it is important to understand the basics. Five basic accounting terms (income, expenses, assets, liabilities and equity or capital) are introduced here as well as the three main financial statements: the income statement (the profit and loss account), the statement of financial position (balance sheet) and the statement of cash flows (cash flow statement). These concepts are explained more fully later in the book.

Income

Income is essentially the revenue earned by a business. Sales revenue is a good example. Income is income, even if goods and services have been delivered but customers have not yet paid. Income thus differs from cash received. Revenues are closely watched by analysts. Deloitte, a leading professional accountancy firm, for example, analyses football sales annually. An extract from its 2009/10 analysis is given in Real World View 2.1.

Europe's Premier Leagues

- Despite significant economic headwinds, the European football market grew by 4% to €16.3 billion in 2009/10.

- The ‘big five’ leagues’ revenues grew by 5% to €8.4 billion, with all five leagues demonstrating revenue growth. Broadcasting revenue was the main driver of growth (up 8%) and now stands at over €4 billion.

- The Premier League increased its revenue to almost €2.5 billion in 2009/10. The gap to the second highest revenue generating league, the Bundesliga, now exceeds €800m.

- The Bundesliga's revenue grew 6% to €1,664m, driven by an impressive increase in commercial revenues, and the largest average attendance (42,700) in European football.

Source: Deloitte (13 June 2011) as reproduced in www.accountacyageinsight.com/abstract/football-finance-highlights.

Expenses

Expenses are the costs incurred in running a business. Examples are telephone, business rates and wages. The nature of expenses varies from business to business. Real-World View 2.2 shows that the biggest expense for football clubs is their wages. Expenses are expenses, even if goods and services have been consumed but the business has still not paid for them. Expenses are, therefore, different from cash paid.

Football Club Expenses

It takes a lot to convince a former Conservative cabinet minister that wage caps are necessary. Yet that is the impact football had on our former chairman, Lord Mawhinney.

Instinctively, I don't believe in salary controls. It is all a little bit too ‘Soviet’ for my liking. But as far as league football is concerned, it looks like being a necessary evil.

It is necessary because people leave their business brains behind when they enter the emotionally charged world of football. Clubs are chasing a dream – they all want to gain promotion or win something for their fans. In doing so, the usual rules of business go out the window.

At the Football League, we spend a great deal of time devising ways of protecting clubs from themselves.

In the Championship during the 2007/08 season, the ratio of total wages against turnover was between 58% and 124%, averaging at 87%, up from 79% in the previous year. Last season's figures are expected to be even higher. It should be, at worst, between 60% and 70%.

Indeed, player wages in the 2008/09 tax year totalled £197m, some 24% higher than in 2007/08 and 45% higher than those in 2006/07.

It is clear to everyone in the game that clubs spend too much of their income on player wages.

Source: Tad Detko, Fever Pitch, Accountancy Magazine, May 2010, p. 18. Copyright Wolters Kluwer (UK) Ltd.

Assets

Assets are essentially items owned (or leased) by the business which will bring economic benefits. An example might be a building or inventory awaiting resale. Assets may be held for a long time for use in the business (such as motor vehicles) or alternatively be short-term assets (such as inventory) held for immediate resale). As Real-World View 2.3 shows, a solid asset base often underpins a successful company.

Assets

With assets of £2.6 billion and 2,300 staff, Pennon is a ‘bog standard’ utility with a waste disposal business bolted on the side. For investors this need not be a turn-off. Pennon generates oodles of cash relative to its size, and – like all utilities – gives most of it to shareholders in the form of dividends.

Source: Philip Aldrick, Pennon's Safe Enough but Doesn't Hold Water for Growth Prospects, Daily Telegraph, 10 December 2004, p. 36.

Liabilities

Liabilities are amounts the business owes to a third party. An example might be money owed to the bank following a bank loan. Alternatively, the company may owe money to the suppliers of goods (known as trade payables or creditors).

Equity (Capital)

Equity equals the assets of a business less its liabilities to third parties. Equity represents the owner's interest in the business. In effect, equity is a liability as it is owed by the business to the owner. Owners may be sole traders, partners or shareholders. Under IFRS terminology ‘equity’ is preferred to ‘capital’.

Income Statement

An income statement, at its simplest, records the income and expenses of a business over time. Income less expenses equals profit. By contrast, where expenses are greater than income losses will occur. It is important (as Real-World View 2.4 shows) for even the world's largest companies to ensure that income (or revenue) exceeds expenses (or costs). The net profit (or net loss) in the income statement is added to (or subtracted from) equity in the statement of financial position. Over the years the accepted terminology has changed. The income statement was formally known as the profit and loss account. Under IFRS, there is a separation of profit generated from continuing operation such as sales and other comprehensive income (for example, gains on foreign exchange translations, property valuation and actuarial gains (i.e., from pensions)). IAS 1 permits two presentations. First, one statement called the ‘statement of comprehensive income’ (this combines both profits from continuing operations and other comprehensive income). Alternatively, two statements can be provided. First, an income statement for continuing operations and then a statement of comprehensive income. Given the nature of this introductory book, I generally use income statement as small businesses (sole traders, partnerships and non-listed limited companies) do not usually have other comprehensive income. For listed companies, however, I do sometimes use ‘statement of comprehensive income, even though I do not deal in any depth with ‘other comprehensive income’ in this book. In this book, I follow current usage and reserve statement of comprehensive income for a separate statement showing items such as gains from foreign currency. This is explained more fully in Chapter 7.

Revenues and Expenses

HSBC has outlined plans to cut costs by as much as $3.5bn (£2.1 bn) over the next three years as part of an attempt to boost its returns to shareholders. … Analysts at Bank of America, Merill Lynch, said the envisaged cuts could shave close to 10pc off the bank's total cost base, with HSBC looking to reduce costs as a proportion of revenues from 55.2 pc today to 48pc – 52pc by 2013 … Among the businesses that will benefit from the plan is wealth management, with HSBC targeting annual revenues of $4bn as it looks to grab a large slice of the profits from managing the money of the world's richest people. HSBC aims to shave costs by up to $3.5bn in three years.

Source: Daily Telegraph, 12 May 2011, p. 1.

Can you think of two examples of income, and three examples of expenses, assets and liabilities which a typical business might have?

These are many and varied. A few examples are given below:

Company Snapshot 2.1 shows a reconstruction of the summary consolidated income statement for Marks & Spencer plc in 2010. The full statement can be seen in Appendix 2.1. From Company Snapshot 2.1 it can be seen that expenses are deducted from sales and other income to give profit before taxation. Once taxation has been deducted, we arrive at the profit for the year (£523 million for 2010) and £507 million for 2009. The 2010 accounts of Marks & Spencer plc follow the IFRS format set out by the International Accounting Standards Board for listed companies. In Appendix 2.4, the income statement for Volkswagen also prepared using International Accounting Standards is provided.

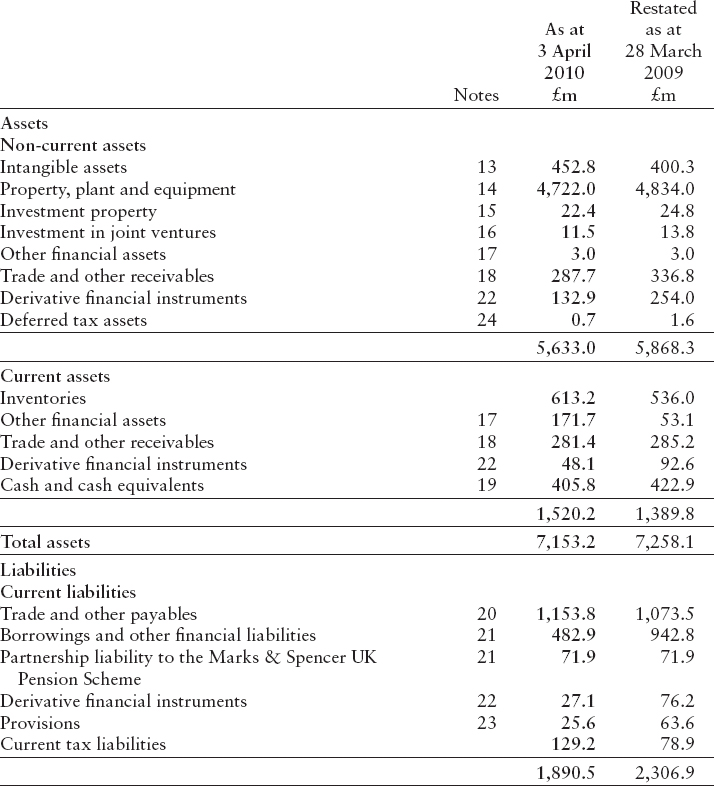

Statement of Financial Position (Balance Sheet)

A statement of financial position records the assets, liabilities and equity of a business at a certain point in time. Assets less liabilities will equal equity. Equity is thus the owners’ interest in the business. The statement of financial position for Marks & Spencer as at 3rd April 2010 is presented in Company Snapshot 2.2. Here the assets are added together and then the liabilities are taken away. The net assets (i.e., assets less liabilities) equals the total equity employed by the business. A statement of financial position (balance sheet) in a listed company format following international accounting standards is presented for Volkswagen in Appendix 2.5. This is prepared using a format where the total assets are totalled, these then equal total equity and liabilities. This approach is commonly used by non-UK companies under International Financial Reporting Standards. UK companies more typically use a net assets approach as demonstrated already by Marks and Spencer in Appendix 2.2 and in Company Snapshot 7.4 by the British company AstraZeneca. This approach is used in this book.

Marks & Spencer Summarised Consolidated Income Statement

Marks & Spencer

Summary income statement for the 53 weeks ended 3rd April, 2010

Note: The income statement has been simplified and reconstructed. The original summary income statement can be found as Appendix 2.1 at the back of this chapter. Appendix 2.1 also includes the consolidated statement of comprehensive income.

Source: Marks & Spencer plc, Annual Review and Summary Financial Statements 2010, p. 78.

Illustration of a Summarised Consolidated Statement of Financial Position

Marks & Spencer

Summary statement of financial position for the 53 weeks as at 3rd April, 2010

Note: The statement of financial position been simplified and reconstructed. The original summary statement of financial position can be found as Appendix 2.2 at the back of this chapter.

Source: Marks & Spencer plc, Annual Report and Financial Statements 2010, p. 79.

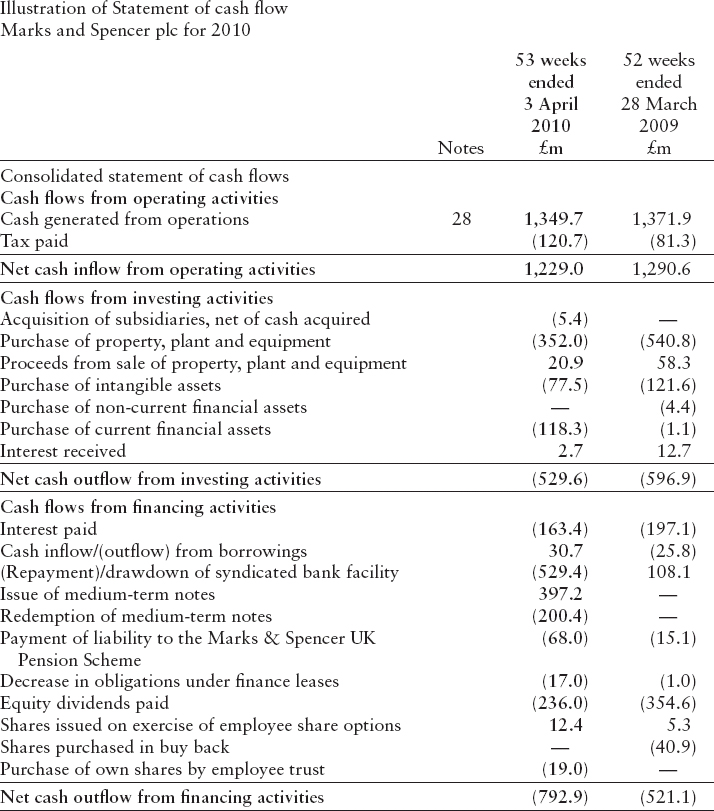

Statement of Cash Flows

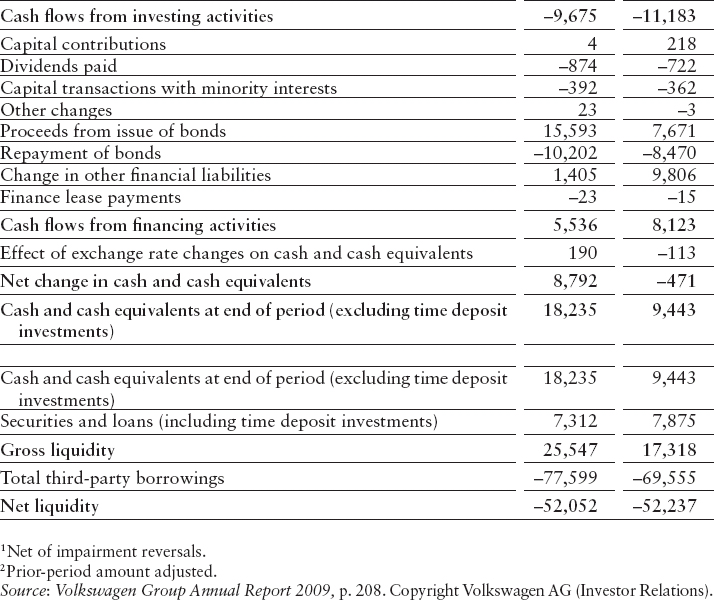

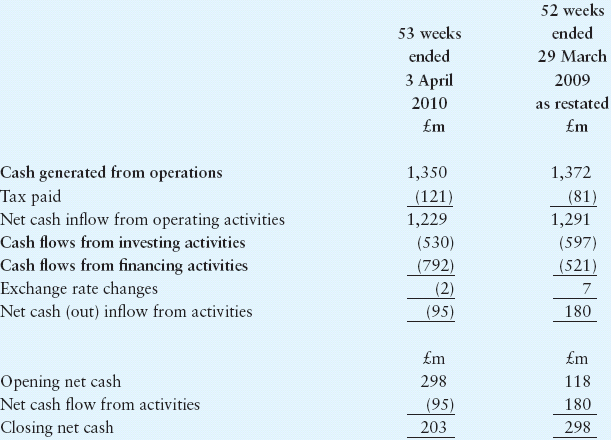

A statement of cash flows shows the cash inflows and outflows of the business. These are normally calculated by comparing the statements of financial position for two consecutive years. As Chapter 8 shows, this can be very complicated. The statement of cash flows which deals with actual historic cash flows can be compared to future cash flows that are presented in a cash budget (see Chapter 17) Company Snapshot 2.3 shows a summary statement of cash flows for Marks & Spencer for 2010. Cash flows are split into three categories: operating (such as buying and selling goods or paying wages), investing (such as buying and selling machinery or receiving interest or dividends on investments) and financing (such as borrowing money and paying interest on loans). Overall, Marks & Spencer has a positive net cash flow from operating activities of £1,229 million in 2010. In Appendix 2.3 the statement of cash flows for Marks and Spencer is reproduced. Then in Appendix 2.6, the statement of cash flows (cash flow statement) for Volkswagen, a German listed company following international accounting standards, is presented.

Illustration of a Summarised Consolidated Statement of Cash Flows

Marks & Spencer

Summary statement of cash flows for the 53 weeks ended 3rd April, 2010

Note: The statement of cash flows has been simplified and reconstructed. The original statement of cash flows can be found as Appendix 2.3 at the back of this chapter.

Source: Marks & Spencer plc, Annual Report and Financial Statements 2010, p. 81.

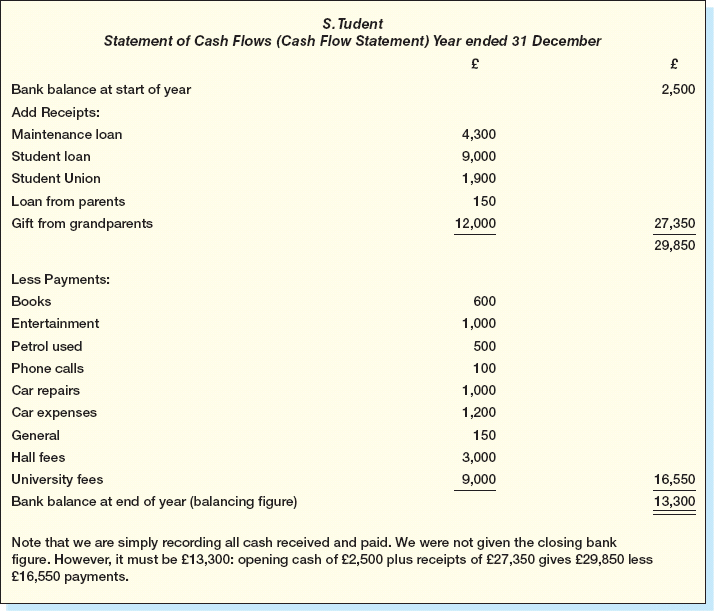

We will now look at three summary financial statements for a business called Gavin Stevens which we will meet in more depth in Chapter 3. Gavin Stevens runs a hotel and summary details of his income, expenses, assets, liabilities and equity are given below. At this stage, the financial statements for Gavin Stevens (Figure 2.1) and for Simon Tudent (see Figure 2.2) are drawn up using only broad general headings. More detailed presentation is covered in later chapters.

Figure 2.1 Preparation of Summary Income Statement, Statement of Financial Position and Statement of Cash Flows for Gavin Stevens

Student Example

In order to give a further flavour of the nature of the main accounting terms, this section presents the income and expenditure of Simon Tudent. Simon is a student.

Student Loan

Students are often granted loans by the government. Why would a student loan from the government or a loan from one's parents be a liability, but a gift from parents be income?

This is because the loans must be repaid. They are, therefore, liabilities. When they are repaid, in part or in full, the liability is reduced. By contrast, a gift will be income as it does not have to be repaid.

Why Is Financial Accounting Important?

Financial accounting is a key control mechanism. All businesses prepare and use financial information in order to help them measure their performance. It is also useful in a business's relationship with third parties. It enables sole traders and partnerships to provide accounting information to the tax authorities or bank. For the limited company, it makes company directors accountable to company shareholders. For small businesses, the accounts are normally prepared by independent qualified accountants. In the case of large businesses, such as limited companies, the accounts are normally prepared by the managers and directors, but then audited by professional accountants. Auditing means checking the accounts are ‘true and fair’. This term ‘true and fair’ is elusive and slippery. It is probably best considered to mean faithfully representing the underlying economic transactions of a business. The independent preparation and/or auditing of the financial accounts by accountants and auditors is an essential task in the protection of the users. The tax authorities need to ensure that the sole traders and partnership accounts have been properly prepared by an expert. Similarly, the shareholders need to have confidence that the managers have prepared a ‘true and fair’ account. For shareholders, this is particularly important as they are not usually directly involved in running the business. They provide the money, then stand back and allow the managers to run the company. So how can shareholders ensure that the managers are not abusing their trust? Bluntly, how can the shareholders make sure they are not being ‘ripped off’ by the managers? Auditing is one solution.

Directors’ Self-Interest

How might the directors of a company serve their own interests rather than the interests of the shareholders?

Both directors and shareholders want to share in a business's success. Directors are rewarded by salaries and other rewards, such as company cars, profit-related bonuses or lucrative pensions. Shareholders are rewarded by receiving cash payments in the form of dividends or an increase in share price. The problem is that the more the directors take for themselves, the less there will be left for the shareholders. So if directors pay themselves large bonuses, the shareholders will get smaller dividends.

Accounting Principles

There are several accounting principles which underpin the preparation of the accounts. For convenience, we classify them here into accounting conventions and accounting concepts (see Figure 2.3). Essentially, conventions concern the whole accounting process, while concepts are assumptions which underpin the actual accounts preparation. There are four generally recognised accounting conventions and four generally recognised ‘potential’ accounting concepts.

Accounting Conventions

Entity

The entity convention simply means that a business has a distinct and separate identity from its owners. This is fairly obvious in the case of a large limited company where shareholders own the company and managers manage the company. However, for a sole trader, such as a small baker's shop, it is important to realise that there is a theoretical distinction between personal and business assets. The business is treated as a separate entity from the owner. The business's assets less third party liabilities represent the owner's equity or capital.

Monetary Measurement

Under this convention only items which can be measured in financial terms (for example, in pounds or dollars) are included in the accounts. If a company pollutes the atmosphere this is not included in the accounts, since this pollution has no measurable financial value. However, a fine imposed for pollution is measurable and should be included in the accounts. A recent innovation in accounting is that a market in carbon emissions is emerging.

Historical Cost

Businesses may trade for many years. The historical cost convention basically states that the amount recorded in the accounts will be based on the original amount paid for a good or service. Nowadays, in the UK, and under International Financial Reporting Standards (IFRS), there are some departures from historical cost. For example, many companies remeasure land and buildings to reflect their increase in value. Company Snapshot 2.4 shows that Tesco plc prepared its accounts using the historical cost convention. It also shows that it used fair value (which is effectively a market value) for some financial assets and liabilities.

Historical Cost Convention: Basis of Preparation of Financial Statements

The financial statements are presented in Pounds Sterling, generally rounded to the nearest million. They are prepared on the historical cost basis, except for certain financial instruments, share-based payments, customer loyalty programmes and pensions that have been measured at fair value.

Source: Tesco Plc, Annual Report and Financial Statements 2010, p. 10.

Periodicity

This simply means that accounts are prepared for a set period of time. Audited financial statements are usually prepared for a year. Financial statements prepared for internal management are often drawn up more frequently. This means, in effect, that sometimes rather arbitrary distinctions are made about the period in which accounting items are recorded.

Accounting Assumptions or Concepts

There are four generally recognised potential accounting concepts. The International Accounting Standards Board recognises two overriding underlying assumptions (going concern and accruals). The UK Companies Act, however, recognises in addition two extra assumptions: consistency and prudence. However, the IASB has severe reservations about prudence which is the most contentious of the concepts.

Going Concern

This concept assumes the business will continue into the foreseeable future. Assets, liabilities, income and expenses are thus calculated on this basis. If you are valuing a specialised machine, for example, you will value the machine at a higher value if the business is ongoing than if it is about to go bankrupt. If it were bankrupt the machine would only have scrap value. In Company Snapshot 2.5, we can see that J.D. Wetherspoon's directors have assured themselves that the company is a going concern.

Going Concern

The Directors have made enquiries into the adequacy of the Company's financial resources, through a review of the Company's budget and medium-term financial plan, including capital expenditure plans, cash flow forecasts; they have satisfied themselves that the Company will continue in operational existence for the foreseeable future. For this reason, they continue to adopt the going-concern basis in preparing the Company's financial statements.

Source: J.D. Wetherspoon plc, Annual Report 2010, p. 55.

Accruals

The accruals concept (often known as the matching concept) recognises income and expenses when they are accrued (i.e., earned or incurred) rather than when the money is received or paid. Income is matched with any associated expenses to determine the appropriate profit or loss. A telephone bill owing at the accounting year end is thus treated as an expense for this year even if it is paid in the next year. If the telephone bill is not received by the year end, then the amount of telephone calls will be estimated.

Consistency

This concept states that similar items will be treated similarly from year to year. Thus consistency attempts to stop companies choosing different accounting policies in different years. If they do this, then it becomes more difficult to compare the results of one year to the next.

Prudence

This is the most contentious of the four accounting concepts. Indeed, the IASB in the latest version of its Conceptual Framework in 2010 has replaced it completely. Prudence introduces an element of caution into accounting. Income and profits should only be recorded in the books when they are certain to result in an inflow of cash. By contrast, provisions or liabilities should be made as soon as they are recognised, even though their amount may not be known with certainty. Prudence is contentious because it introduces an asymmetry into the accounting process. Potential incomes are treated differently from potential liabilities. Some accountants believe that prudence is an out-of-date concept, while others feel that it is needed to stop management providing an over-optimistic view of the accounts. However, the IASB feels that prudence conflicts with a neutral view of accounts. It is, therefore, undesirable as it introduces bias into accounting.

Personal Finances

Draw up a set of financial statements for yourself for the last twelve months.

I hope they are not too gruesome!

Conclusion

Financial accounting, along with management accounting, is one of the two main branches of accounting. Its main objective is to provide financial information to users for decision making. Shareholders, for example, are provided with information to assess the stewardship of managers so that they can then make decisions such as whether to buy or sell their shares. Understanding the accounting language is a key requisite to understanding accounting itself. Four accounting conventions (entity, money measurement, historical cost and periodicity) and three accounting concepts (going concern, accruals and consistency) underpin financial accounting. In addition, many people believe prudence is an important accounting concept.

Discussion Questions

Discussion Questions

Questions with numbers in blue have answers at the back of the book.

| Q1 | What is financial accounting and why is its study important? |

| Q2 | Formal definitions

‘The objective of general purpose financial reporting is to provide financial information about the reporting entity that is useful to existing and potential investors, lenders and other creditors in making decisions about providing resources to the entity. Those decisions involve buying, selling or holding equity and debt instruments, and providing or settling loans and other forms of credit.’ International Accounting Standards Board (IASB) (2010), The Conceptual Framework for Financial Reporting Discuss the key aspects highlighted in bold of this formal definition of the objective of general purpose financial reporting as formulated by the IASB in its conceptual framework. |

| Q3 | Sole traders, partnerships and limited companies all have different users who need financial information for different purposes. Discuss. |

| Q4 | Classify the following as an income, an expense, an asset or a liability:

(a) Friend owes business money (b) Football club's gate receipts (c) Petrol used by a car (d) Photocopier (e) Revenue or Sales (f) Telephone bill outstanding (g) Long-term loan (h) Cash (i) Wages (j) Equity or capital |

| Q5 | State whether the following are true or false. If false, explain why.

(a) Assets and liabilities show how much the business owns and owes. (b) The income statement shows the income, expenses and thus the net assets of a business. (c) Stewardship is now recognised as the primary objective of financial accounting. (d) When running a small business the owner must be careful to separate business from private expenditure. (e) The matching and prudence accounting concepts sometimes conflict. |

Numerical Questions

Numerical Questions

Questions with numbers in blue have answers at the back of the book.

| Q1 | Sharon Taylor has the following financial details:

Required: Prepare Sharon Taylor's (a) Income Statement (Profit and Loss Account) (b) Statement of Financial Position (Balance Sheet) (c) Statement of Cash Flows |

| Q2 | Priya Patel is an overseas student studying at a British University. Priya has the following financial details:

*Still worth £200 at end of year. Required: Priya's: (a) Income Statement (Profit and Loss Account) (b) Statement of Financial Position (Balance Sheet) (c) Statement of Cash Flows |

Appendix 2.1: Illustration of a Consolidated Income Statement for Marks & Spencer plc 2010

Consolidated income statement

Consolidated statement of comprehensive income

Appendix 2.2: Illustration of a Consolidated Statement of Financial Position for Marks and Spencer plc 2010

Consolidated statement of financial position

Appendix 2.3: Illustration of a Consolidated Statement of Cash Flows for Marks and Spencer 2010

Consolidated cash flow information

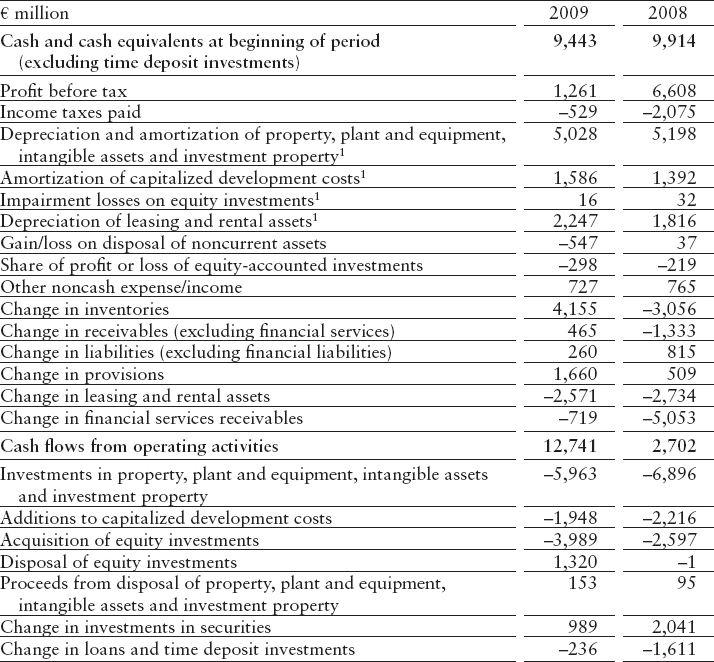

Appendix 2.4: Illustration of a Consolidated Income Statement for Volkswagen 2009

Consolidated Financial Statements of the Volkswagen Group

Appendix 2.5: Illustration of a Consolidated Balance Sheet (Statement of Financial Position) for Volkswagen 2009

Balance Sheet of the Volkswagen Group as of December 31, 2009

Appendix 2.6: Illustration of a Consolidated Cash Flow Statement (Statement of Cash Flows) for Volkswagen 2009

Cash Flow Statement of the Volkswagen Group for the Period January 1 to December 31, 2009

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

DEFINITION 2.1

DEFINITION 2.1 SOUNDBITE 2.1

SOUNDBITE 2.1 PAUSE FOR THOUGHT 2.1

PAUSE FOR THOUGHT 2.1 REAL-WORLD VIEW 2.1

REAL-WORLD VIEW 2.1 COMPANY SNAPSHOT 2.1

COMPANY SNAPSHOT 2.1