CHAPTER 9

Functional Business Systems

Introduction

Every business is managed through multiple business functions, each responsible for managing certain aspects of the business. The finance function is responsible for acquiring capital needed for research and development (R&D) and other investment processes. The marketing function is responsible for product promotion and pricing, identifying target customers, and improving the customer experience (CX). The operations function plans and coordinates all the resources needed to design, manufacture, and transport products. The IT function is responsible for the technology infrastructure, data management, and social, mobile, and cloud services. Accounting manages assets and meets compliance mandates. Human resource (HR) recruits, trains, and develops a talented workforce. These business functions involve complex processes that depend on access to data, collaboration, communication, and data analysis to pinpoint what must be done and employees’ workflows to make that happen.

While most attention is on external interests—customers, competitors, and partners—they are only part of the solution. Business success also depends on internal factors—the efficiency and effectiveness of managers, employees, core business processes and functions. A wide range of specialized technologies, such as Salesforce.com and eXtensible Business Reporting Language (XBRL) for financial reporting, support problem-solving, decision-making, and compliance. Ultimately, data from functional systems are used by enterprise applications, including business intelligence (BI), e-commerce, customer relationship management (CRM), and supply chain management (SCM), as shown in Figure 9.1.

FIGURE 9.1 Data from functional area ISs support enterprise applications.

Business is messy, sometimes chaotic. Resolving those situations requires human creativity, critical thinking, and judgment—all of which relate back to corporate culture, training, and empowerment of employees. The technology and software applications described in this chapter are designed to help employees and managers make better decisions and improve efficiency and performance in the functional areas of a typical business organization.

9.1 Business Management Systems and Functional Business Systems

In this section, we will provide an overview of two types of information systems (ISs) that support different areas or activities in an organization. Business Management Systems (BMS) are ISs designed to support planning and the implementation process across the entire organization. Functional Business Systems (FBSs) are ISs designed to improve the efficiency and performance of a specific functional area within the organization.

Business Management Systems (BMSs)

BMSs aid leadership teams by using technology to improve cross-functional collaboration, clarify the relationship between steps in the planning and implementation process, assign responsibilities, and monitor progress toward objectives and outcomes. BMSs typically employ a variety of visual aids (e.g. flowcharts, dashboards, process charts) to communicate alignment of strategies, goals, objectives, and tactics as well as the metrics selected to measure performance and progress. Typical features or modules in a BMS include the following:

- Definition of Organizational Mission

- Identification of Strengths, Weakness, Opportunities, and Threats (SWOT Analysis)

- Establishing Goals and Measurable Objectives

- Defining Strategies and Key Performance Indicators (KPIs)

- Articulation of Tactical or Action Plans—Assigning Responsibilities and Time Tables

- Monitoring and Reporting Progress and Performance

Planning occurs at three levels of the organization—strategic, managerial, and operational, as illustrated in Figure 9.3. Managers at each level operate with a different time frame, which transitions from long term (a few years) at the strategic level to “in the moment” (daily) at the operations level.

FIGURE 9.3 Three organizational levels, their concerns, and strategic and tactical questions, planning, and control.

For the organization to be fully effective, operational, tactical, and strategic plans and goals must be aligned. That is, they must be consistent, mutually supportive, and focused on achieving the enterprise’s mission. BMSs help optimize organizational performance by aligning the planning and activities at each of these three levels.

Management Levels

Strategic planning is a top management activity that establishes goals and objectives, identifies strategies, allocates resources, and aligns operational activity for achieving desired outcomes. Strategic plans are visionary and future-oriented. As part of the strategic planning process, companies conduct a SWOT analysis of their strengths, weaknesses, opportunities, and threats. Data from external sources—the economy, markets, competitors, and business trends—are used in a BMS to evaluate opportunities and threats. Data from internal sources are captured in a BMS to provide insight into a company’s financial, human, marketing, and production resources and capabilities. Many BMSs employ Application Programming Interfaces (APIs) that allow companies to import data from sources from FBSs and other sources outside the system for use in the strategic planning process. (You read about APIs in Chapter 7 and the role they play in the development of Web 2.0 and social media.) Over time, strategic plans are reexamined and adjusted as elements of the internal and external environment change. Good BMSs anticipate the need to change plans, goals and outcomes and possess functionality that allows organizations to make these changes without undue difficulty.

At the tactical level, mid-level managers design business processes, procedures, and policies to implement strategic plans.

At the operations level, managers and supervisors work closely with the workforce and customers. They are on the “front lines” so to speak, ensuring that employees have the resources necessary to carry out their roles and ensuring that customers are well-served and satisfied with their experience. They depend on detailed data in real time or near real time to do their jobs, get work done, and close the deal. They need to track work schedules and employee performance; inventory levels, sales activity, and order fulfillment; production output and delivery schedules; and resolve disruptions or deviations from expected outcomes. In many companies today, operations-level managers and employees use handheld technologies to both gather data and receive real-time reporting on the processes they are responsible for. Decision-making is mostly immediate or short term because decisions are made to close the deal or control ongoing activities and operations. Feedback and control are vital to identify deviations from goals as soon as possible in order to take corrective action. Data captured or created within the company are most important at this level.

Business Functions vs. Cross-Functional Business Processes

FBSs are ISs designed to improve an organization’s efficiency and performance in a functional business area. Traditional functional business areas include the following:

- Finance and Accounting

- Production/Operations & SCM

- Marketing and Sales

- HR Management

In addition, managers and business scholars frequently expand this list of functional areas to include Strategic Planning, Information Technology & Support, Business Development, R&D, and Customer Service. While each of these additional areas make important contributions to the success of an organization, our goal in this chapter will be to describe ISs designed for the four traditional functional areas listed earlier. In some cases, there is considerable overlap between areas on both lists. For instance, business development and customer service might easily be considered part of the marketing and sales function. While we do not list strategic planning as a traditional functional area, we have described BMSs as a technology that supports strategic planning activities.

Cross-Functional Coordination and Integration

Originally, ISs were designed to support the accounting function. Systems for other functions were rolled out later. This fragmented roll-out approach created data silos where information was effectively trapped in one functional area of the business and could not support cross-functional business processes. For example, accounting systems record sales, payments, customer profile information, product pricing, promotional expenses, and so on. To effectively evaluate the impact of past promotional activities and pricing decisions, the marketing department must be able to analyze the relationship between the product’s price, promotional expenditures, and sales volume during a specific time period. In addition, the marketing unit might need to analyze the revenue generated by each customer to determine how the salesforce should prioritize accounts. However, if this information is trapped in the accounting system, it may not be available to the marketing unit. In some cases, employees in marketing may not be granted access to the accounting system, or even more problematic, the system may only be programmed to use the data for creating standard accounting reports and statements and might not permit retrieval of information in ways that are useful to the marketing department or other units in the company.

In today’s fast-paced, competitive business environment, departments or functions must be able to coordinate in the development of strategic plans and the performance of operations-level actions. FBSs that do not support cross-functional collaboration are an impediment to organizational success. Workflows and data flows between departments that are not coordinated result in delays, errors, poor customer service, and higher costs. When FBSs do allow for cross-functional coordination, it becomes possible for the company to monitor and evaluate progress toward goals and objectives established during the strategic planning process. It also becomes easier to identify problems or barriers to achieving objectives and develop solutions to those problems.

The data requirements of operations-level units are extensive and relatively routine because they have fixed sources of input and tasks that follow standard operating procedures (SOPs). Functional area ISs help companies and employees adhere to SOPs, which are often easily automated. SOPs are an integral part of a quality control (QC) system because they provide individuals with information to perform jobs properly. A key benefit of SOPs is that they minimize variation and promote quality through consistent implementation of a process or procedure within the organization, even if there are temporary or permanent personnel changes. For example, SOPs are written for handling purchase orders, order fulfillment, customer complaints, recruitment and hiring, emergency response, and disaster recovery. Data that are lost or compromised have financial implications. As such, it is critical that businesses have SOPs to maintain three related data properties in company ISs:

- Data security Data security refers to the protection of data from malicious or unintentional corruption, unauthorized modification, theft, or natural causes such as floods. The purpose of data security is to maintain data integrity.

- Data validity Data validation involves tests and evaluations used to detect and correct errors, for instance, mistakes that might occur during data entry in fields such as customer name and address.

- Data integrity Data integrity refers to the maintenance of data accuracy and validity over its life cycle including the prevention of unintended modification or corruption.

Transaction Processing Systems

Transaction processing is information processing that is divided into distinct, undividable operations called transactions. While transaction processing certainly applies to the financial transactions that take place in a business (i.e., the data generated by a store cash register), transaction processing is used in the FBSs of all areas. For example:

- Production/Operations The tracking of materials or component parts as they enter and exit a warehouse or manufacturing facility.

- Marketing and Sales Management of sales orders and order fulfillment.

- Human Resources Processing of payroll and employee records.

- Finance/Accounting Processing of credits and debits to a customer’s checking account at a bank.

Transaction processing systems (TPSs) are software and/or hardware technologies that collect, monitor, store, process, and distribute transactional data according to certain criteria referred to as the ACID test, which is short for atomicity, consistency, isolation, and durability:

- Atomicity If all steps in a transaction are not completed, then the entire transaction is canceled. For example, if you transfer funds from your savings account to your checking account, a debit is made to savings, while a credit is made to the checking account. If one of these actions fails, the other is not allowed to occur, effectively canceling the transaction.

- Consistency Only operations that meet data validity standards are allowed. For instance, systems that record checking accounts only allow unique check numbers for each transaction. Any operation that repeats a check number will fail in order to maintain accuracy in the database. Network failures can also cause data consistency problems.

- Isolation Transactions must be isolated from each other. For example, bank deposits must be isolated from a concurrent transaction involving a withdrawal from the same account. Only when the withdrawal transaction is successfully completed will the new account balance be reported.

- Durability Backups by themselves do not provide durability. A system crash or other failure must not cause any loss of data in the database. System failures can occur for any number of reasons including human error, computer virus or an attack by computer hackers, hardware failure, or natural disasters. Durability is achieved through separate transaction logs that can be used to recreate all transactions from a known checkpoint. Other ways include the use of recovery manager programs that utilize a range of solutions including cloud-based database mirrors that replicate the database on another server.

Real Time and Batch Processing

Transactions can be processed in two ways: batch processing and real time. Batch processing involves the collection of transactional data over some period of time, and then all of the transactions are processed as a batch at one time. The opposite of batch processing is real-time processing where transactions are processed as they occur, which means that account balances and other related counts are kept up to date. For instance, when you purchase two tickets to a show at a Broadway theater, not only is the count of remaining tickets immediately reduced by two, but also the specific seats indicated on your tickets are blocked off so that the ticketing system doesn’t sell your seats to someone else.

Online Transaction Processing Systems

Increasingly, organizations today are employing Online Transaction Processing Systems (OTPS). These are TPSs that employ client server systems that allow transactions to run on multiple computers on a network, processing transactions in real time. Data are accessed directly from the database, and reports can be generated automatically (Figure 9.4).

FIGURE 9.4 Information flows triggered by a transaction or event.

Concept Check 9.1

- Business Management Systems are designed to help companies with ________________.

- Originally, information systems were designed to support the _________ function.

- Which of the following terms is used to describe when information is be trapped in one functional area of the business and unavailable to support cross-functional business processes?

- _________________processing is information processing that is divided into distinct, undividable operations called transactions.

- The _________ requirement of the ACID test dictates that if all steps in a transaction are not completed, then the entire transaction is canceled.

9.2 Production and Operations Management Systems

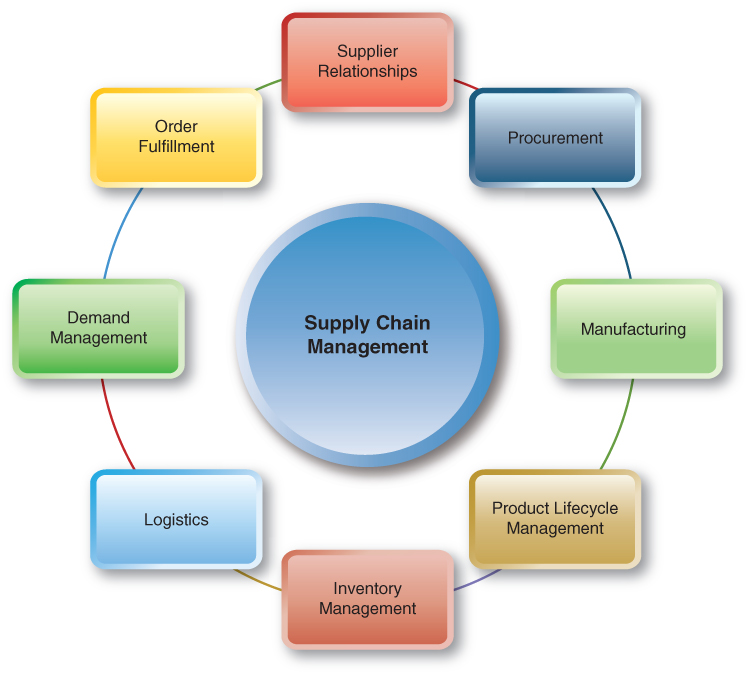

Historically, the production and operations area focused primarily on activities within the company related to the manufacture of products and services. Considerable emphasis was placed on increasing product quality and reducing manufacturing costs, believing that these were critical factors in business success. More recently, businesses have developed a broader perspective, understanding that customer value is a more critical success factor. Significant advances in customer value require more than just improvements in product quality and reduced costs. In addition, because of globalization, many companies began outsourcing tasks traditionally performed by the company. As a result, SCM was adopted as a way to coordinate all of the factors that contribute to customer value, including supplier relationships, logistics, inventory management across the supply chain, order fulfillment, and so on. In some companies, manufacturing simply became a supply chain factor that could be performed internally, outsourced or both, as conditions in different markets evolved (see Figure 9.5). As a result, production and operations are sometimes viewed in the larger context of SCM, and ISs have been developed to support organizations with traditional production and operations management (POM) as well as SCM processes. It is not always clear if a function such as logistics is part of a company’s production and operations process or part of the company’s supply chain. Oftentimes, the way a function is managed will depend on if the company is responsible for the function or if it outsources the function, relying on supply chain partners. In either case, production operations management and SCM ISs both play a critical role in managing these important functions and facilitating coordination between different divisions within an organization or between the organization and its partners. In this section, we will describe FBSs commonly associated with POM. As you will read in Chapter 10, some of these process are also considered part of SCM and supported by SCM ISs.

FIGURE 9.5 Companies recognize that careful management of supply chain processes is critical for success in the highly competitive global economy.

Transportation Management Systems

Transportation management systems (TMSs) are relied on to handle transportation planning, which includes shipping consolidation, load and trip planning, route planning, fleet and driver planning, and carrier selection. TMSs also support vehicle management and accounting transactions.

Four trend factors contributing to the growth of TMS are as follows:

- Outdated transportation systems need to be upgraded or replaced Many systems were installed over 10 years ago—before tablet computers and mobile technologies had become widespread in business. They are considered legacy (old) systems, and are inflexible, difficult to integrate with other newer systems, and expensive to maintain.

- Growth of intermodal transport Intermodal transportation refers to the use of two or more transport modes, such as container ship, air, truck, and rail, to move products from source to destination. Many more companies are shipping via intermodals, and their older TMSs cannot support or deal with intermodal movement, according to Dwight Klappich, a research vice president for Gartner.

When brick-and-mortar manufacturers began selling online, for example, they learned that their existing TMSs were inadequate for handling the new line of business. Shippers that expand globally face similar challenges when they try to manage multiple rail, truck, and ocean shipments. Thus, there is a growing need for more robust TMSs to handle multidimensional shipping arrangements.

- TMS vendors add capabilities The basic functions performed by a TMS include gathering data on a load to be transported and matching those data to a historical routing guide. Then the TMS is used to manage the communication process with the various carriers. New feature-rich TMSs are able to access information services to help the shipper identify optimal routes, given all current conditions. For example, the latest TMSs can interact directly with market-data benchmarking services. An automated, real-time market monitoring function saves shippers time and errors and cuts costs significantly.

- TMSs handle big data Transportation tends to generate a high volume of transactional data. Managing the data is not easy. TMS vendors are developing systems that make valuable use of the big data that are collected and stored. By drilling down into specific regions or focusing on particular market trends, for example, shippers can use their big data to make better decisions.

Logistics Management

Logistics management deals with the coordination of several complex processes, namely ordering, purchasing or procurement, inbound logistics, and outbound logistics activities. Logistics management systems:

- Optimize transportation operations.

- Coordinate with all suppliers.

- Integrate supply chain technologies.

- Synchronize inbound and outbound flows of materials or goods.

- Manage distribution or transport networks.

These systems enable real-time monitoring and tracking of supply chain shipments, schedules, and orders.

Inventory Control Systems

Inventory control systems are important because they minimize the total cost of inventory while maintaining optimal inventory levels. Inventory levels are maintained by reordering the quantity needed at the right times in order to meet demand. POM departments keep safety stock as a hedge against stockouts. Safety stock is needed in case of unexpected events, such as spikes in demand or longer delivery times. One of the crucial decisions involved in inventory management is weighing the cost of inventory against the cost of stockouts. Stockouts of materials and parts can slow or shut down production while stockouts of final products result in reduced sales. Both of these situations can have significant short and long-term financial consequences that need to be balanced against the potential savings associated with lower inventory levels.

Managing inventory is important to profit margins because of numerous costs associated with inventory, in addition to the cost of the inventory. Inventory control systems minimize the following three cost categories:

- Inventory carrying costs

- Inventory ordering costs

- Cost of shortages

To minimize the sum of these three costs (see Figure 9.6), the company must decide when to order and how much to order. One inventory model that is used to answer both questions is the economic order quantity (EOQ) model. The EOQ model takes all costs into consideration.

FIGURE 9.6 Inventory Control Systems help companies balance inventory ordering and carrying costs against the costs inventory shortages.

Just-in-Time Inventory Management Systems

Just-in-time (JIT) and lean manufacturing are two widely used methods or models to minimize waste and deal with the complexity of inventory management. Minimizing inventory costs remains a major objective of SCM.

JIT inventory management attempts to minimize holding costs by not taking possession of inventory until it is needed in the production process. With JIT, costs associated with carrying large inventories at any given point in time are eliminated. However, the trade-off is higher ordering costs because of more frequent orders. Because of the higher risk of stockouts, JIT requires accurate and timely monitoring of materials’ usage in production.

Everything in the JIT chain is interdependent, so coordination and good relationships with suppliers are critical for JIT to work well. Any delay can be very costly to all companies linked in the chain. Delays can be caused by labor strikes, interrupted supply lines, bad weather, market demand fluctuations, stockouts, lack of communication upstream and downstream in the supply chain, and unforeseen production interruptions. In addition, inventory or material quality is critical. Poor quality causes delays, for example, fixing products or scrapping what cannot be fixed and waiting for delivery of the reorder.

JIT was developed by Toyota because of high real-estate costs in Tokyo, Japan, which made warehousing expensive. It is used extensively in the auto manufacturing industry. For example, if parts and subassemblies arrive at a workstation exactly when needed, holding inventory is not required. There are no delays in production, and there are no idle production facilities or underutilized workers, provided that parts and subassemblies arrive on schedule and in usable condition. Many JIT systems need to be supported by software. JIT vendors include HP, IBM, CA, and Steven Engineering.

Despite potential cost-saving benefits, JIT is likely to fail in companies that have the following:

- Uncooperative supply chain partners, vendors, workers, or management.

- Custom or non-repetitive production.

Lean Manufacturing Systems

In a lean manufacturing system, suppliers deliver small lots on a daily or frequent basis, and production machines are not necessarily run at full capacity. One objective of lean manufacturing is to eliminate waste of any kind, that is, to eliminate anything that does not add value to the final product. Holding inventory that is not needed very soon is seen as waste, which adds cost but not value. A second objective of lean manufacturing is to empower workers so that production decisions can be made by those who are closest to the production processes.

Oracle, Siemens, and other vendors offer demand-driven lean manufacturing systems. As any IS, JIT needs to be justified with a cost−benefit analysis. And all JIT success factors apply to lean manufacturing. For example, JIT requires that inventory arrive on schedule and be of the right quality. For companies subject to bad weather or labor strikes, lean manufacturing may not be suitable.

Quality Control Systems

Manufacturing quality control (QC) systems can be stand-alone systems or part of an enterprise-wide total quality management (TQM) effort. QC systems provide data about the quality of incoming materials and parts, as well as the quality of in-process semifinished and finished products. These systems record the results of all inspections and compare actual results to expected results.

QC data may be collected by sensors or radio frequency identification (RFID) systems and interpreted in real time, or they can be stored in a database for future analysis. Reports on the percentage of defects or percentage of rework needed can keep managers informed of performance among departments. KIA Motors introduced an intelligent QC system to analyze customer complaints, so it could more quickly investigate and make corrections.

Other Production/Operations Technologies

Many other areas of production/operations are improved by ISs and tools. Production planning optimization tools, product routing and tracking systems, order management, factory layout planning and design, and other tasks can be supported by POM subsystems. For example, a Web-based system at Office Depot matches employee scheduling with store traffic patterns to increase customer satisfaction and reduce costs. Schurman Fine Papers, a manufacturer/retailer of greeting cards and specialty products, uses special warehouse management software to improve demand forecasting and inventory processes. Its two warehouses efficiently distribute products to over 30,000 retail stores.

Computer-integrated Manufacturing and Manufacturing Execution Systems

Computer-integrated manufacturing (CIM) systems control day-to-day shop floor activities. In the early 1980s, companies invested greatly in CIM solutions even though they were complex, difficult to implement, and costly to maintain. They had required the integration of many products and vendors.

Prior to CIM, production managers were given many pieces of information such as time, attendance, receiving reports, inspection reports, and so on to figure out how to accomplish production tasks. The information was frequently late, rarely current or reliable, voluminous, and extremely difficult to assimilate. CIM helps production managers better use information to execute manufacturing plans.

Manufacturing execution systems (MESs) manage operations on the shop floors of factories. Some MESs schedule a few critical machines, while others manage all operations on the shop floor. Functions of MES programs include the following: compiling a bill of materials, resource management and scheduling, preparing and dispatching production orders, preparing work-in-progress (WIP) reports, and tracking production lots. For instance, an MES can schedule and track each step of the production phase of a particular job and then print out the bill of materials for the operator and the production steps to complete at each phase. It repeats this process for each operator and each step until a particular job is complete.

CIM and MES are very similar concepts, but there are differences. MES typically refers to a broader infrastructure compared to CIM. MES is based much more on standard reusable application software, instead of custom-designed software programs on a contract-by-contract basis. MES tries to eliminate the time and information gap of early years on the shop floor by providing the plant with information in real time. Corporate business functions are given timely plant information to support business planning decisions. For the most part, the term CIM is more commonly used and will be used in the rest of this section.

Today’s CIM systems provide scheduling and real-time production monitoring and reporting. CIM data-driven automation affects all systems or subsystems within the manufacturing environment: design and development, production, marketing and sales, and field support and service. CIM systems can perform production monitoring, scheduling and planning, statistical process monitoring, quality analysis, personnel monitoring, order status reporting, and production lot tracking. The manufacturer BAE has implemented CIM.

MESs are generally installed on-premises, but cloud-based solutions are becoming available. MES is a subset of enterprise resource planning (ERP) systems, which you will read about in Chapter 10.

BAE Systems Uses CIM in Its Combat Aircraft Facility

BAE Systems is a global company headquartered in London, England, engaged in the development, delivery, and support of advanced defense, security, and aerospace systems. BAE is among the world’s largest military contractors.

In September 2010, BAE opened a titanium-machining facility to manufacture components for the F-35 Lightning II combat aircraft. It took 10 months to complete the facility, during which time engineers at BAE considered a number of ways to ensure that it would be able to accommodate the high throughput of titanium military aircraft parts cost-effectively. According to Jon Warburton, BAE’s F-35 program manager, after conducting a thorough examination of numerous potential manufacturing solutions, the BAE team finally decided to deploy a highly automated CIM system (Wilson, 2011). The CIM system ensures that titanium parts for the aircraft can be manufactured on a JIT basis. To do so, it coordinates the orders received at the plant, as well as the movement of raw materials and tooling, and optimizes the use of the machine tools.

A key element of the CIM strategy was the deployment of two flexible manufacturing systems (FMSs) that can accommodate the manufacture of different parts at different volumes. When an order for a part is received, the data relating to it are passed to the FMSs, which schedule the manufacture of a part in the most expedient way by examining the current workload across each of eight machine tools. Each FMS can store up to 1,000 cutting tools in a racking system ready to be loaded into the machine tools. A series of twin robot systems deliver the stored cutting tools into each machine, as well as replenishing any worn tools. The biggest challenge faced by the team in the development of the facility was to ensure that the FMS and the machine tools communicated effectively with one another and with BAE’s CIM system.

Reasons Why Companies Invest in CIM

The benefits of CIM are as follows: (1) It simplifies manufacturing technologies and techniques, (2) automates as many of the manufacturing processes as possible, and (3) integrates and coordinates all aspects of design, manufacturing, and related functions. CIM is comprehensive and flexible, which is especially important in the redesign or elimination of business processes. Without CIM, it may become necessary to make large investments to change existing ISs to fit new processes.

Concept Check 9.2

- The production and operations management area is most related to which of the following?

- _______________ management systems are relied on to handle transportation planning, which includes shipping consolidation, load and trip planning, route planning, fleet and driver planning, and carrier selection.

- ______________ management systems enable real time monitoring and tracking of supply chain shipments, schedules, and orders.

- Which of the following is not one of the inventory costs discussed in the text?

- Stockouts of materials and parts can slow or shut down production while stockouts of final products result in ______________.

9.3 Sales and Marketing Systems

As a result of the Internet and other technology, significant changes have occurred in the field of marketing over the last decade. Not only has technology created entire new service and product categories, but also many traditional marketing functions including product development, pricing, distribution, and promotion have changed. ISs and digital networks that have emerged in the last 10–15 years have resulted in new revenue streams, new business models, new retail, promotion and distribution channels, and entirely new industries. IT at Work 9.1 describes such an example. In general, sales and marketing systems support the following:

- Digital advertising

- Social media monitoring and promotions

- Sales and customer support

- Automated ad placement and media buying

- Market research

- Intelligence gathering

- Distributing products and services to customers

- Order tracking

- Online and mobile order processing

- Online and mobile payment methods

Many of these systems are depicted in Figure 9.7. Chapters 7, 8, and 10 covered or will discuss sales and marketing systems and strategies, including e-commerce and CRM. This chapter, specifically this section, focuses on data-driven marketing and the capabilities of sales and marketing ISs.

FIGURE 9.7 Sales and marketing systems and subsystems.

Data-Driven Marketing

Data-driven, fact-based decision-making increasingly relies on data that are hot—impacting the business or potential customer right now or in real time. One use of hot data is pay-per-click (PPC) website advertising that “appears” on the screens of consumers’ devices based on their location, behavior, interests, or demographic information. Unlike search engine PPC ads that appear based on the user’s keyword searches, website ads use data about the person to determine whether the ad should appear. This capability creates opportunities for highly targeted advertising programs. For example, Facebook members self-report data about their location, age, interests, and so on. Based on these data, advertisers can request that their ad be pushed to Facebook members who fit a specific profile based on demographic, geographic, or behavioral factors.

Sales and Distribution Channels

Marketers need to determine the optimal ways to distribute their products and services through a combination of electronic, mobile, and physical channels. For example, integrating a PPC advertising campaign with other online and offline advertising initiatives generally provides the best overall results.

Here are representative topics relating to sales and distribution channels:

- In Macy’s stores and many other retailers, customers can check current sale prices on digital screens with barcode readers.

- Customers use Exxon Mobil Speedpass to fill their tanks by waving a token, embedded with an RFID device, at a gas-pump sensor. Then the RFID starts an authorization process, and the purchase is charged to the debit or credit card linked to the account.

- Home Depot and many supermarkets installed self-check-out machines. Self-service kiosks cut labor costs for retailers and can reduce customers’ check-out times, as shown in Figure 9.8.

FIGURE 9.8 Self-check-out kiosks reduce labor costs.

Social Media Customer Service

As described in Chapter 7, many companies now employ customer support representatives to monitor social media platforms such as Twitter and Facebook to identify customers with questions or who are frustrated because of a problem they are having with a product or service. These social media customer service representatives are trained to offer support and solutions to customer problems in order to retain the customer’s loyalty and demonstrate the brand’s commitment to customer satisfaction. Failure to respond to these customers has public consequences, since by definition, social media tends to be a public forum and both the customer’s complaint and the company’s response can be viewed by other people using the social media platform. On the other hand, companies that have learned how to handle these situations stand to benefit by demonstrating their responsiveness to a wide audience of prospective customers. As with more traditional forms of customer service, such as call centers, social customer service engagement is recorded in a customer service IS so that performance metrics, volume and type of complaint can be analyzed.

Marketing Management

The following are some representative examples of how marketing management is being accomplished.

Pricing of Products or Services

Sales volume as well as profits are determined by the prices of products or services. Pricing is a difficult decision, particularly during economic recessions. ISs used in conjunction with data collected from online markets are able to help companies maximize profits using a variety of yield management practices. For instance, online retailers can personalize the Web pages shown to individual customers and display a combination of products and prices customized to entice that customer to make a purchase. The automated decisions about what products and prices to display to a customer are determined by a complex algorithm based on the customer’s previous purchases, Web viewing history, activity on social media, and product searches. While airlines have been charging different ticket prices for the same flight for years, the practice is now employed by many different businesses as part of a mass-customization strategy made possible by information and computing technologies. Another example of technology-driven pricing and promotional strategies includes flash sales designed to engage customers and trigger a quick spike in sales. Flash sales work by offering customers an incredible deal for a very short time, usually announced via mobile text message, e-mail, or social media.

Salesperson Productivity

The performance of salespeople is collected in the sales and marketing TPS and used to compare performance along several dimensions, such as time, product, region, and even the time of day. Actual current sales can be compared to historical data and to expectations. Multidimensional spreadsheet software facilitates this type of analysis.

Sales productivity can be boosted by Web-based call centers. When a customer calls a sales rep, the rep can look at the customer’s history of purchases, demographics, services available where the customer lives, and more. This information enables reps to provide better customer service.

Sales automation software is especially helpful to small businesses, enabling them to rapidly increase sales and growth. One leading software is Salesforce.com, which is a CRM application that is offered as a software as a service (SaaS). You will read about Salesforce.com in detail in the CRM section of Chapter 10.

Profitability Analysis

In deciding on advertising and other marketing efforts, managers need to know the profit contribution or profit margin (profit margin = sale price − cost of good) of certain products and services. Profitability metrics for products and services can be derived from the cost-accounting system. For example, profit performance analysis software available from IBM, Oracle, SAS, and Microstrategy is designed to help managers assess and improve the profit performance of their line of business, products, distribution channels, sales regions, and other dimensions critical to managing the enterprise. Several airlines, for example, use automated decision systems to set prices based on profitability.

Marketing activities conclude the primary activities of the value chain. Next, we look at the functional systems that are support activities, also called secondary activities, in the value chain: accounting, finance, and HR management.

Concept Check 9.3

- Information systems and ___________ that have emerged in the last 10-15 years have resulted in new revenue streams, new business models, new retail, promotion and distribution channels, and entirely new industries.

- Which of the following functions would not typically be part of a sales and marketing information system?

- Which of the following is not a factor used by digital marketers to determine the placement of digital PPC ads?

- Responding to customer complaints or answer questions that come through on Twitter and Facebook is referred to as ___________________________.

- Online retailers can personalize the webpages shown to individual customers and display a combination of products and prices customized to entice that customer to make a purchase. Which of the following was not one of the factors listed as influencing how the personalized pages are created?

9.4 Accounting, Finance, and Regulatory Systems

Accounting and finance departments control and manage cash flows, assets, liabilities, and net income (profit). Financial accounting is a specialized branch of accounting that keeps track of a company’s financial transactions and prepares financial statements, such as balance sheets and income statements. Investors, regulators, and others rely on the integrity and accuracy of external financial statements. Accounting must comply with generally accepted accounting principles (GAAP) and the Financial Accounting Standards Board (FASB).

Corporations whose stock is publicly traded must also comply with the reporting requirements of the Securities and Exchange Commission (SEC), a regulatory agency of the U.S. government. Using standardized guidelines, the transactions are recorded, summarized, and presented in a financial report or financial statement such as an income statement or a balance sheet. However, the objective of financial accounting is not simply to report the value of a company. Rather, its purpose is to provide sufficient and accurate information for others to assess the value of a company for investment or other purposes.

Financial Disclosure: Reporting and Compliance

As part of an organization’s compliance obligations, the accounting function must attest (verify) that there are no material weaknesses in internal controls. A weakness in an internal control is a major cause of fraud, which is also known as white-collar crime. The prevention, detection, and investigation of financial fraud are needed to reduce the risk of publicly reporting inaccurate information. High-profile examples of financial misrepresentations are Bernard L. Madoff Investment Securities (2008), Lehman Brothers (2008), Enron (2001), and many related to the subprime mortgage crisis. Table 9.2 describes three of the worst accounting fraud cases of all time. The FBI investigates white-collar crime and reports on the subject at its website FBI.gov.

TABLE 9.2 Three of the Worst Accounting Scandals of All Time

| Company and Fraudsters | Damages | How They Did It | Penalties |

|

Bernie Madoff Investment Securities LLC (2008) Bernie Madoff, his accountant David Friehling, and CFO Frank DiPascalli |

Tricked investors out of $64.8 billion through the largest Ponzi scheme in the history. | Investors were paid returns out of their own money or money from other investors—rather than from profits. | 150 years in prison for Madoff + $170 billion restitution. Prison time for Friehling and DiPascalli. |

|

Lehman Brothers (2008) Lehman executives and the company’s auditors, Ernst & Young |

Hid over $50 billion in loans disguised as sales. | Allegedly sold toxic assets to Cayman Island banks with the understanding that they would be bought back eventually. Created the impression that Lehman had $50 billion more in cash and $50 billion less in toxic assets than it actually had. | Forced into the largest bankruptcy in U.S. history. |

|

Enron (2001) CEO Jeffrey Skilling and former CEO Ken Lay |

Shareholders lost $74 billion, thousands of employees and investors lost their retirement accounts, and many employees lost their jobs. | Kept huge debts off its balance sheets. | Lay died before serving time; Skilling received 24 years in prison. The company filed for bankruptcy. Arthur Andersen was found guilty of fudging Enron’s accounts. |

Accounting Software Packages

Accounting software is a foundational technology for many companies, and as a business grows, powerful and effective accounting solutions are critical. Most accounting software packages offer the same basic features necessary for managing finances: accounts receivable (A/R), accounts payable (A/P), general ledger, billing and invoicing, purchase and sales orders, and reporting. In addition to basic functionality, the top accounting solutions offer additional features to give users more power, flexibility, and customization. Often, accounting solutions are closely integrated with enterprise systems, such as ERP systems that include an extensive accounting module.

Many providers offer cloud-based solutions. SaaS accounting software solutions include the features of traditional systems, with the added benefit of anytime, anywhere accessibility and updating.

Financial Disclosure

The SEC’s financial disclosure system is central to its mission of protecting investors and maintaining fair, orderly, and efficient markets. Since 1934, the SEC has required financial disclosure in forms and documents. In 1984, the SEC began collecting electronic documents to help investors obtain information, but those documents made it difficult to search for and find specific data items. To eliminate that difficulty and improve how investors find and use information, the SEC now requires public companies, called filers, to submit their financial reports as tagged interactive data files (FASB.org, 2012) formatted in eXtensible Business Reporting Language (XBRL). In addition, data in the reports must be tagged according to standards established by the Financial Accounting Securities Board (FASB). Each year, FASB updates the list of over 15,000 computer readable tags known as the GAAP Financial Reporting Taxonomy. Annual updates reflect changes in accounting standards and other enhancements designed to improve the reporting process and usability.

XBRL Tagging

XBRL is a language for the standards-based exchange of business information between business systems. Each item, such as cash or depreciation expense, is tagged with descriptive metadata or labels, such as calendar year, audited/unaudited status, currency, and so on, as defined by the GAAP Financial Reporting Taxonomy. The taxonomy is like a data dictionary that defines financial concepts and the relationships between various types of data that might be included in a financial report. The XBRL language and data tags make it possible for the reports to be read by any software that includes an XBRL processor. Interactive (tagged) data make it easier for investors to analyze and compare the financial performance of public companies, increasing the efficiency and transparency of reporting processes and the ability to consolidate financial data from different operating systems. Prior to XBRL, reports were noninteractive. Investors who wanted specific data had to manually search lengthy corporate annual reports or mutual fund documents. As more companies use interactive data, sophisticated analysis tools used by financial professionals are now available to average investors.

Creating XBRL documents does not require XML computer programming. As requirements for XBRL reporting become increasingly common around the world, more vendors are developing software products for marking up reports, tagging data, submitting reports to various recipients, as well as receiving and analyzing tagged data from other sources. Figure 9.9 shows how XBRL documents are created. XBRL helps companies:

- Generate cleaner data, including written explanations and supporting notes.

- Produce more accurate data with fewer errors that require follow-up by regulators.

- Transmit data more quickly to regulators and meet deadlines.

- Increase the number of cases and amount of information that staffers can handle.

FIGURE 9.9 Overview of the creation of XBRL documents.

XBRL Reporting Compliance

In addition to the public companies required by the SEC to submit their financial reports as XBRL documents, other businesses are being required to use XBRL-formatted reporting. For instance, the SEC requires mutual funds to submit risk return summaries in XBRL format, and banks in the United States must submit certain types of XBRL reports to the Federal Deposit Insurance Corporation (FDIC). Globally, regulators in many other countries require companies to file reports using XBRL. When international firms file XBRL reports, they will oftentimes use the International Financial Reporting Standards (IFRS) Taxonomy created by the International Accounting Standards Board (IASB). We anticipate that XBRL reporting will increase over time as regulatory agencies, investors, and organizations responsible for setting accounting standards increasingly argue that XBRL reporting is good for both business and the economy.

Fraud Prevention and Detection

Fraud is a crime with severe financial consequences, as you observed in Table 9.2. Fighting fraud is an ethical duty—and essential to public trust and the integrity of a company’s brand. Insider fraud is a term referring to a variety of criminal behaviors perpetrated by an organization’s employees or contractors. Other terms for this crime are internal, employment, or occupational fraud.

Why Fraud Occurs

Fraud occurs because internal controls to prevent insider fraud—no matter how strong—will fail on occasion. Fraud risk management is a system of policies and procedures to prevent and detect illegal acts committed by managers, employees, customers, or business partners against a company’s interests. Although each corporation establishes its own specific procedures, fraud risk management involves assessing a company’s exposure to fraud; implementing defenses to prevent and detect fraud; defining procedures to investigate, prosecute, and recover losses from fraud. Analyzing why and how fraud could occur is as important as detecting and stopping it. This analysis is used to identify necessary corporate policies to deter insider fraud and fraud detection systems when prevention fails.

Fraud Risk Factors

Factors that increase a company’s exposure to fraud are illustrated in Figure 9.10. ISs are implemented to harden it against these factors. Companies make themselves targets because of the interaction of these four factors:

- A high level of trust in employees without sufficient oversight to verify that they are not stealing from the company

- Relying on informal processes of control

- A mindset (belief) that internal controls and fraud prevention systems are too expensive to implement

- Assigning a wide range of duties for each employee, giving them opportunities to commit fraud

FIGURE 9.10 Factors that make companies targets for fraud.

When a small manufacturer was the victim of theft of intellectual property, the computer network logs identified the computer that had been used to commit the alleged crime. But there was no way to connect that computer to one specific individual. A manager’s conviction that he knew who had perpetrated the crime was not sufficient evidence. The lesson learned was that the internal control—separation of duties—is important not only to fraud prevention but also to fraud prosecution and recovery of losses. At the company, employees had shared computer accounts, so they were not able to link the fraud to the person who committed it. Designing effective fraud response and litigation-readiness strategies (postincident strategies) is crucial to be able to do the following:

- Recover financial losses.

- Punish perpetrators through lawsuits, criminal charges, and/or forfeited gains.

- Stop fraudsters from victimizing other organizations.

History has shown that if the punishment for committing fraud is not severe, the fraudster’s next employer will be the next victim, as described in IT at Work 9.2.

Trying to keep fraud hidden can mean either doing nothing or simply firing the employee. These approaches to dealing with fraud are not sustainable because they erode the effectiveness of fraud prevention measures and produce moral hazard—that is, they take the risk out of insider fraud.

One of the most effective fraud prevention techniques is the perception of detection and punishment. If a company shows its employees that it can find out everything that every employee does and will prosecute to the fullest extent anyone who commits fraud, then the feeling that “I can get away with it” drops drastically (Johnson et al., 2011). The Catch-22 is that companies may have limited resources that hinder a proper fraud diagnosis or forensic accounting investigation, even though they cannot afford unrecoverable losses either.

Financial Meltdowns Triggered by Fraud

In the early 2000s, the U.S. business economy was significantly impacted by fraud scandals that involved senior executives at a number of major corporations. Lawmakers believed that the scope of the crimes destroyed the public’s confidence in the country’s financial systems and markets. A number of laws were passed that heightened the legal responsibilities of corporate management to actively guard against fraud by employees, established stricter management and reporting requirements, and introduced severe penalties for failure to comply. As a result, fraud management became a necessary functional process. These frauds played a role in the SEC’s rule for XBRL data reporting.

Internal Controls

In companies with lax accounting systems, it is too easy for employees to misdirect purchase orders and payments, bribe a supplier, or manipulate accounting data. When senior managers are involved in a fraud, preventing fraud is extremely tough. Consider Bernie Madoff, who committed a record-setting fraud scheme for many years even after the Sarbanes–Oxley Act was passed in 2002 to help prevent financial fraud.

In a much smaller but still serious fraud case involving a New York-based nonprofit, a volunteer was responsible for counting cash receipts at the annual fundraiser. The volunteer had performed this task for 30 years. One year, an accountant was assigned to assist the volunteer with the count. The volunteer offered the accountant a “cut” of the cash in exchange for her silence about the theft.

Strong internal controls, which depend on IT for their effectiveness, consist of the following:

- Segregation of duties tops the list of best practices in control procedures. When handling a company’s assets, the work of managers and employees needs to be subject to approval or authorization. For example, any attempt to issue a check to a vendor not in the database of approved vendors will be prevented by the accounting IS.

- Job rotation More than one person should be familiar with each transaction cycle in the business wherever possible. Rotation of jobs helps prevent overreliance on a single individual—and is a way to expose fraudulent activities.

- Oversight Management—whether a single owner or a team of individuals—must monitor what is actually happening in the business. Auditing ISs are part of a strong oversight function. Unannounced periodic walk-throughs of a process or review of how things are really being done can reveal existing or potential problem areas.

- Safeguarding of assets is essential to a fraud prevention program. Access to networks, financial systems, and databases must be controlled with strong passwords and other security measures. Similarly, bank checks, petty cash funds, and company credit cards need to be locked up when not in use.

- IT policies Understand your IS. Heavy reliance on IT staff can open up opportunities for fraud. Establish a computer use policy and educate employees on the importance of securing information. Strictly enforce the use of separate logins and keep passwords confidential.

Auditing Information Systems

Fraud can be easy to commit and hard to detect. Just ask any auditor. The problem is worse in government and nonprofit entities that have inadequate accounting and internal control systems. The problem is so bad at the federal level that auditors have been unable to express an opinion on the fairness of the consolidated financial statements of the United States. For example, space agency NASA had been unable to explain about the $565 billion in year-end adjustments to its books. It could be bad accounting, fraud, waste, or abuse. Without adequate records, no one really knows. This amount is astounding, especially when one considers that the combined cost of fraud at Enron and WorldCom was less than $100 billion in shareholder equity.

Because the physical possession of stolen property is no longer required and it is just as easy to program a computer to misdirect $100,000 as it is $1,000, the size and number of frauds have increased tremendously. Auditing ISs aid auditors in the analysis of large amounts of financial data and accounting records to uncover fraud as well as unintentional accounting errors.

Financial Planning and Budgeting

The management of financial assets is a major task in financial planning and budgeting. Financial planning, similarly to any other functional planning, is tied to the overall organizational planning and to other functional areas. It is divided into short-, medium-, and long-term horizons, much as activities planning. Accounting ISs help companies create and manage budgets, improving the organization’s ability to monitor performance and quickly identify departures from planned financial activity when they occur.

Knowing the availability and cost of money is a key ingredient for successful financial planning. Especially important is projecting cash flows, which tells organizations what funds they need and when and how they will acquire them. In today’s tough economic conditions with tight credit and limited availability of funds, this function has become critical to most companies’ survival.

Inaccurate cash flow projection is the #1 reason why many small businesses go bankrupt. The inability to access credit led to the bankruptcy of investment bank Lehman Brothers in September 2008.

Budgeting

The best-known part of financial planning is the annual budget, which allocates the financial resources of an organization among participants, activities, and projects. The budget is the financial expression of the enterprise’s plans. Management allocates resources in the way that best supports the mission. IT enables the introduction of financial logic and efficiency into the budgeting process. Several software packages, many of which are Web-based, are available to support budget preparation and control.

Capital budgeting is the process of analyzing and selecting investments with the highest return on investment (ROI) for the company. The process may include comparing alternative investments, for example, evaluating private cloud vs. public cloud computing options.

The major benefits of using budgeting software are that it can reduce the time and effort involved in the budget process, explore and analyze the implications of organizational and environmental changes, facilitate the integration of corporate strategic objectives with operational plans, make planning an ongoing continuous process, and automatically monitor exceptions for patterns and trends.

Forecasting

As you read, a major reason why organizations fail is their inability to forecast and/or secure sufficient cash flow. Underestimated expenses, overspending, financial mismanagement, and fraud can lead to disaster. Good planning is necessary, but not sufficient, and must be supplemented by skillful control. Control activities in organizations take many forms, including control and auditing of the ISs themselves. ISs play an extremely important role in supporting organizational control, as we show throughout the text. Specific forms of financial control are discussed in the next section.

Financial Ratio Analysis

A major task of the accounting/finance department is to watch the financial health of the company by monitoring and assessing a set of financial ratios. These ratios are also used by external parties when they decide whether to invest in an organization, extend credit, or buy it.

The collection of data for ratio analysis is done by the TPS, and computation of the ratios completed through financial analysis models. Interpretation of ratios and the ability to forecast their future behavior require expertise, which is supported by decision support systems (DSSs).

Profitability Analysis and Cost Control

Companies are concerned with the profitability of individual products or services, product lines, divisions, or the financial health of the entire organization. Profitability analysis DSS software allows accurate computation of profitability and allocation of overhead costs. One way to control cost is by properly estimating it. This is done by using special software. For example, Oracle Hyperion Profitability and Cost Management software is a performance management app that provides insights into costs and profitability. This app helps managers evaluate business performance by discovering the drivers of cost and profitability and improving resource alignment. Sophisticated business rules are stored in one place, enabling analyses and strategies to be shared easily across an enterprise.

Concept Check 9.4

- Which of the following is not one of the basic features offered by most accounting software packages?

- Often accounting solutions are closely integrated with enterprise systems, such as ______ systems that include an extensive accounting module.

- The Securities and Exchange Commission requires public companies to file reports formatted in __________ with metadata tags that make it easier for investors to analyze and compare the financial performance of public companies, increasing the efficiency and transparency of reporting processes and the ability to consolidate financial data from different operating systems.

- _______________________ is a system of policies and procedures to prevent and detect illegal acts committed by managers, employees, customers, or business partners against a company’s interests.

- Which of the following was not one of the strong internal controls discussed in the chapter for preventing fraud?

9.5 Human Resource Systems, Compliance, and Ethics

Companies cannot simply hire a great workforce. They have to find, recruit, motivate, and train employees to succeed in their workplace. Retaining high-performance people requires monitoring how people feel about the workplace, their compensation, value to the company, and chances for advancement—and maintaining workplace health and safety.

HR is a field that deals with employment policies, procedures, communications, and compliance requirements. Effective HR compliance programs are a necessity for all organizations in today’s legal environment. HR needs to monitor workplace and employment practices to ensure compliance with the Fair Labor Standards Act (FLSA), Occupational Health & Safety Agencies (OSHA), and the antidiscrimination and sexual harassment laws. Seven other employment laws to protect against discrimination are listed in Table 9.3.

TABLE 9.3 HR Monitors Compliance with Antidiscrimination Employment Laws

| Title VII of the Civil Rights Act of 1964 | Prohibits discrimination on the basis of race, color, religion, national origin, and sex. It also prohibits sex discrimination on the basis of pregnancy and sexual harassment. |

| Civil Rights Act of 1966 | Prohibits discrimination based on race or ethnic origin. |

| Equal Pay Act of 1963 | Prohibits employers from paying different wages to men and women who perform essentially the same work under similar working conditions. |

| Bankruptcy Act | Prohibits discrimination against anyone who has declared bankruptcy. |

| Americans with Disabilities Act | Prohibits discrimination against persons with disabilities. |

| Equal Employment Opportunity Act | Prohibits discrimination against minorities based on poor credit ratings. |

| Age Discrimination in Employment Act (ADEA) | Prohibits discrimination against individuals who are age 40 or above. |

HR Information Systems

Effective human resource information systems (HRISs) reduce the workload of the HR department. PeopleSoft Human Capital Management, which is one of the market-leading HRISs, provides a global foundation for HR data and improved business processes.

HRISs have been moved to intranets and clouds—wherein HR applications are leased in SaaS arrangements. Using intranets, HR applications have shifted many routine tasks to employees who log in to manage their retirement benefits, payroll deductions, direct deposits, health-care benefits, and the like. When employees manage their own HR services, HR professionals can focus on legal and compliance responsibilities, employee development, talent management, hiring, and succession planning.

Benefits of SaaS for HR

Three real-world examples illustrate the benefits of tying SaaS to global HR transformation efforts:

- A global medical device manufacturer needed to create an independent HR system as it divested from its parent company. Cloud computing was at the core of its new global HR delivery model, which reduced the demand on internal business and IT resources. The company was able to establish fully independent HR operations within 10 months.

- A national nonprofit foundation with a fast-growing employee population wanted to improve the effectiveness of HR operations. The organization selected a cloud-based solution, which dramatically improved time to value without overstretching internal IT resources. Because little front-end investment was required, the foundation hit its budget target.

- A global entertainment company needed a learning management system that could deliver content varying from instructor-based training to 30-second video how-to snippets. It chose to deploy a new learning management system in the cloud. With this approach, it quickly got the new system up and running.

Figure 9.11 illustrates how IT facilitates the work of the HR department. The figure summarizes the role HR plays in acquiring and developing talented people in organizations.

FIGURE 9.11 HR management activities.

Recruitment

Recruitment is the process of finding potential employees with the skills and talent needed by the company, testing them, and deciding which ones to hire. Most companies are flooded with applicants, but might still have difficulty finding the right people. LinkedIn is a primary social media site for recruitment and headhunters. Some reports suggest that over 90% of U.S. companies use LinkedIn as their primary source of identifying job candidates. HR managers using LinkedIn must become familiar with the website’s search tools for finding candidates that meet certain criteria for the position they are trying to fill. Using the advanced search features, HR managers can develop search queries that screen user profiles on the basis of things such as current job title, current industry, seniority level, and years of education. Keywords can be used to find candidates with specials, training, or experience. Job hunters should consider the search strategies HR professionals are likely to use when searching for candidates and include information in their profiles that will increase the chances of being included in search results.

Management and Employee Development

Once recruited, employees become part of the corporate HR talent pool, which needs to be maintained and developed. Several activities supported by IT include the following.

Performance Evaluation

Employees are evaluated periodically by their immediate supervisors. Peers or subordinates may also evaluate others. Evaluations are usually recorded on paper or electronic forms. Using such information manually is a tedious and error-prone job. Once digitized, evaluations can be used to support many decisions, ranging from rewards to transfers to layoffs. For example, Cisco Systems is known for developing an IT-based human capital strategy. Many universities evaluate professors online. The evaluation form appears on the screen, and the students fill it in. Results can be tabulated in minutes. Corporate managers can analyze employees’ performances with the help of intelligent systems, which provide systematic interpretation of performance over time. Several vendors provide software for performance evaluation, such as HalogenSoftware.com and Capterra.com.

Training and Human Resources Development

Employee training and retraining are important activities of the HR department. Major issues are planning of classes and tailoring specific training programs to meet the needs of the organization and employees. Sophisticated HR departments build a career development plan for each employee. IT can support the planning, monitoring, and control of these activities by using workflow applications.

HR Planning, Control, and Management

In some industries, labor negotiation is an important aspect of HR planning, and it may be facilitated by IT. For most companies, administering employee benefits is also a significant part of the HR function. Here are several examples of how IT can help.

Personnel Planning and HR Strategies

The HR department forecasts requirements for people and skills. In some geographical areas and for overseas assignments, it may be difficult to find particular types of employees. In such cases, the HR department plans how to locate sufficient HR or develop them from within.

Benefits Administration

Employees’ contributions to their organizations are rewarded by salary/wage, bonuses, and other benefits. Benefits include those for health and dental care as well as contributions for pensions. Managing the benefits system can be a complex task, due to its many components and the tendency of organizations to allow employees to choose and trade off benefits. In large companies, using computers for self-benefits selection can save a tremendous amount of labor and time for HR staff.

Providing flexibility in selecting benefits is viewed as a competitive advantage in large organizations. It can be successfully implemented when supported by computers. Some companies have automated benefits enrollments. Employees can self-register for specific benefits using the corporate portal or voice technology. Employees self-select desired benefits from a menu. Payroll pay cards are now in use in numerous companies, such as Payless Shoes, which has 30,000 employees in 5,000 stores. The system specifies the value of each benefit and the available benefits balance of each employee. Some companies use intelligent agents to assist employees and monitor their actions.

Employee Relationship Management

In their effort to better manage employees, companies are developing human capital management, facilitated by the Web, to streamline the HR process. These Web applications are more commonly referred to as employee relationship management. For example, self-services such as tracking personal information and online training are very popular in ERM. Improved relationships with employees result in better retention and higher productivity.

Ethical Challenges and Considerations

HRIS applications raise ethical and legal challenges. For example, training activities that are part of HRM may involve ethical issues in recruiting and selecting employees and in evaluating performance. Similarly, TPS data processing and storage deal with private information about people, their performance, and so forth. Care should be taken to protect this information and the privacy of employees and customers.

The federal law related to workplace substance abuse, the Drug-Free Workplace Act of 1990, requires employers with federal government contracts or grants to ensure a drug-free workplace by documenting and certifying that they have taken a number of steps. Dealing with alcoholism and drugs at work entails legal risks because employees have sued for invasion of privacy, wrongful discharge, defamation, and illegal searches. Employment laws make securing HR information necessary for the protection of employees and the organization.

Concept Check 9.5

- HRISs have been moved to _______________wherein HR applications are leased in SaaS arrangements.

- Some reports suggest that over 90% of U.S. companies use _______________ as their primary source of identifying job candidates.

- Which of the following HR functions is not listed in the chapter as being facilitated by information systems or technology?

- Which of the following bests describes a primary ethical concern related to human resource management information systems and applications?

- Human resource applications have shifted many routine tasks to employees who log in to manage their retirement contributions, payroll deductions, direct deposits, and health care benefits. What is the primary benefit of these applications to human resource managers?

Key Terms

ACID test

auditing

capital budgeting

computer-integrated manufacturing (CIM)

economic order quantity (EOQ)

eXtensible Business Reporting Language (XBRL)

Financial Accounting Standards Board (FASB)

financial misrepresentation

flexible manufacturing systems (FMSs)

fraud risk management

GAAP Financial Reporting Taxonomy

inbound logistics

income statement

insider fraud

internal employment or occupational fraud

inventory control systems

just-in-time (JIT)

lean manufacturing system

manufacturing execution systems

manufacturing quality control (QC) systems

mission

moral hazard

online transaction processing systems (OTPS)

operations level

outbound logistics

red flag

safety stock

standard operating procedures (SOPs)

stockouts

Strategic plans

strategic planning

tactical level

total quality management (TQM)

Assuring Your Learning

References

- Accenture.com. “Ducati Motor Holding S.p.A: SAP Dealer Communication System.” 2014.

- Apple.com. “Ducati.” 2014.

- BusinessWire. “SAS Fraud Management Speeds Real time Processing Boosts Detection and Prevention.” June 15, 2011.

- Ducati Motor Holding S.p.A. 2014. http://www.ducatiusa.com/index.do-fasb.org. “US GAAP Financial Reporting Taxonomy.” 2012.

- Johnson, P., L. Volonino, and I. Redpath. “Fraud Response and Litigation-Readiness Strategies for Small and Medium Businesses: A Handbook on How to Prepare for Litigation, Prosecution & Loss Recovery in Response to Insider Fraud.” IFP.org, November 2011.

- Justice.com, 2014.

- Oracle.com. 2014.

- Reuters. “HSBC Holdings plc Company Profile.” 2014. http://www.reuters.com

- Salesforce.com. 2014.

- SAP.com. 2014.

- SAS.com. “Reduce Losses from Fraudulent Transactions.” http://www.sas.com

- sec.gov. 2014

- Wilson, D. “Manufacturing Technology: Hard Work.” The Engineer 33, April 25, 2011.

- xbrl.sec.gov. 2014.