CHAPTER 4

Asset Pricing

The next chapters cover the development of Monte-Carlo simulations. This chapter introduces the theoretical context. We cover asset pricing in general terms, introduce derivatives markets and the asset pricing theory, and establish the necessary formalism, abstractions, definitions, and notations for the rest of the publication. Derivatives markets and asset pricing are vast subjects, covered in a multitude of publications. Our short introduction is necessarily partial and dense. Derivatives markets are covered in detail in Hull's classic [26], updated in 2017. Asset pricing theory is covered in many textbooks, like [27].

4.1 FINANCIAL PRODUCTS

In order to design generic pricing libraries, we must abstract the notions of financial products and models and define them in a general manner. Starting with financial products, we need a formalism encompassing underlying assets (shares, currencies, zero-coupon bonds,…), linear transactions (forward contracts, forward rate agreements, interest rate swaps,…), European options (calls and puts, caps and floors, swaptions,…), path-dependent and early exerciseable options (collectively known as exotics), multi-underlying options, including derivatives written on assets of different classes (known as hybrids), as well as portfolios of transactions and regulatory amounts like xVA.

Products and cash-flows

We therefore define a financial product as a collection of cash-flows paid over a given schedule. The payment schedule can be either discrete, in which case the product is a set ![]() of cash-flows paid on dates

of cash-flows paid on dates ![]() , or continuous, in which case the product is a continuous set of cash-flows

, or continuous, in which case the product is a continuous set of cash-flows ![]() paid over the time interval

paid over the time interval ![]() ,

, ![]() being the payment date of the last cash-flow, called the product's maturity.

being the payment date of the last cash-flow, called the product's maturity.

Valuation is linear, so the value ![]() of a product at a time

of a product at a time ![]() is the sum of the values of its subsequent cash-flows:

is the sum of the values of its subsequent cash-flows: ![]() .

.

Cash-flows may be deterministic, linear in underlying asset prices, optional, or exotic. In its most general form, a cash-flow ![]() paid at time

paid at time ![]() is a

is a ![]() -measurable random variable. This means that it may depend on the state of the market on and before its payment date

-measurable random variable. This means that it may depend on the state of the market on and before its payment date ![]() , and is fully determined at

, and is fully determined at ![]() . Formally,

. Formally, ![]() is a functional

is a functional ![]() of the path (which we also call scenario) and denote:

of the path (which we also call scenario) and denote:

where ![]() is the “state of the market” at time

is the “state of the market” at time ![]() (which we call sample): the values at time

(which we call sample): the values at time ![]() of the market variables that affect the cash-flow.

of the market variables that affect the cash-flow.

A European call of strike ![]() and maturity

and maturity ![]() on some underlying asset

on some underlying asset ![]() pays one cash-flow:

pays one cash-flow:

at maturity. A call ![]() up and out on a barrier

up and out on a barrier ![]() also pays one cash-flow but it is contingent on not breaching the barrier before maturity:

also pays one cash-flow but it is contingent on not breaching the barrier before maturity:

The floating leg of an interest rate swap (IRS) pays ![]() Libor coupons over a discrete schedule; for instance, a

Libor coupons over a discrete schedule; for instance, a ![]() quarterly floating leg pays 40 cash-flows:

quarterly floating leg pays 40 cash-flows:

where ![]() is the Libor rate of matuirty

is the Libor rate of matuirty ![]() fixed at

fixed at ![]() .1

.1

Scenarios

A cash-flow ![]() paid at time

paid at time ![]() depends on the scenario, generally defined as the evolution of the market up to the maturity, but its specific meaning depends on the cash-flow: for a European call, the scenario is the underlying asset price at maturity. For a barrier option, it is the continuous path of the underlying price series from now to maturity. For an interest rate swap (IRS), the scenario is the discrete set of Libor fixings on the floating schedule. Cash-flows don't depend on the complete state of the world market at all times in

depends on the scenario, generally defined as the evolution of the market up to the maturity, but its specific meaning depends on the cash-flow: for a European call, the scenario is the underlying asset price at maturity. For a barrier option, it is the continuous path of the underlying price series from now to maturity. For an interest rate swap (IRS), the scenario is the discrete set of Libor fixings on the floating schedule. Cash-flows don't depend on the complete state of the world market at all times in ![]() . Depending on the particular cash-flow, the scenario is specified by two characteristics:

. Depending on the particular cash-flow, the scenario is specified by two characteristics:

- The subset of

of dates where the state of the market affects the cash-flow, called timeline. For a European call, the timeline is the maturity date:

of dates where the state of the market affects the cash-flow, called timeline. For a European call, the timeline is the maturity date:  . For a barrier, it is the entire interval

. For a barrier, it is the entire interval  .

.

A product's timeline is the union of its cash-flows timelines. The dates

in the timeline are called event dates; they are the contractual dates where something meaningful happens to determine the cash-flows, in reference to the state of the market on those dates: the exercise of a call, the monitoring of a barrier, the fixing of a Libor, or the payment of a cash-flow. For the floating leg of an IRS, the timeline is the discrete set of fixing and payment dates on the floating schedule.

in the timeline are called event dates; they are the contractual dates where something meaningful happens to determine the cash-flows, in reference to the state of the market on those dates: the exercise of a call, the monitoring of a barrier, the fixing of a Libor, or the payment of a cash-flow. For the floating leg of an IRS, the timeline is the discrete set of fixing and payment dates on the floating schedule. - The nature of the sample

for every event date

for every event date  on the timeline. For a European call or a barrier option, this is the underlying asset price on time

on the timeline. For a European call or a barrier option, this is the underlying asset price on time  . For a floating leg cash-flow, it is the Libor of a given maturity fixed at

. For a floating leg cash-flow, it is the Libor of a given maturity fixed at  . In general, a sample

. In general, a sample  for the event date

for the event date  is a collection of market variables (asset prices, rates,…) observed at time

is a collection of market variables (asset prices, rates,…) observed at time  . It is the snapshot of the fraction of the market at time

. It is the snapshot of the fraction of the market at time  that is useful for the determination of the cash-flows. In principle, its dimension could be infinite or even continuous. The dimension and contents of different samples on the timeline may be different from one another.

that is useful for the determination of the cash-flows. In principle, its dimension could be infinite or even continuous. The dimension and contents of different samples on the timeline may be different from one another.

The time

sample for a product is the union of the time

sample for a product is the union of the time  samples of its cash-flows. The collection of all the samples

samples of its cash-flows. The collection of all the samples  across the timeline is called scenario, and denoted

across the timeline is called scenario, and denoted  .

.

The scenario is therefore a multidimensional, and sometimes continuous, collection of samples over a timeline. The timeline, and the nature and the dimension of its samples, depend on the product. The cash-flows are a function(al) of the scenario, more precisely, of the scenario before the payment date:

Underlying assets

The notions of products, cash-flows, timelines, samples, and scenarios are the building blocks of the product side of a generic financial library (the other sides being models, discussed next, and algorithms that articulate the two to produce values and risk, like the Monte-Carlo simulations of the next chapter). We illustrate these notions with a few examples, starting with the underlying assets. Underlying assets, like stocks or currencies, are not exactly financial products, but they can be modeled as financial products with the introduction of a holding horizon ![]() . A stock is not a financial product, but the strategy of buying the stock and holding it to some horizon

. A stock is not a financial product, but the strategy of buying the stock and holding it to some horizon ![]() is one.

is one.

A stock without dividends, with value ![]() at time

at time ![]() , can be assimilated, given a holding horizon

, can be assimilated, given a holding horizon ![]() , to a financial product with a single cash-flow

, to a financial product with a single cash-flow ![]() on the horizon date

on the horizon date ![]() . The timeline is therefore the singleton

. The timeline is therefore the singleton ![]() and the scenario is

and the scenario is ![]() .

.

With a discrete schedule of dividends ![]() paid on times

paid on times ![]() , a stock is modeled as a schedule of cash-flows

, a stock is modeled as a schedule of cash-flows ![]() , plus a final cash-flow

, plus a final cash-flow ![]() . The timeline is the set of ex-dividend dates before horizon

. The timeline is the set of ex-dividend dates before horizon ![]() , plus the horizon date

, plus the horizon date ![]() , and the scenario is

, and the scenario is ![]() .

.

A stock or stock index with a continuous dividend yield ![]() is modeled as a continuous schedule of cash-flows

is modeled as a continuous schedule of cash-flows ![]() and a final cash-flow

and a final cash-flow ![]() . The timeline is the interval

. The timeline is the interval ![]() ; the scenario is

; the scenario is ![]() .

.

A foreign currency, which is economically identical to a stock with dividend yield the foreign short rate, is modeled as a financial product in the same way.

In interest rate markets, the notion of “underlying assets” is typically associated with zero-coupon bonds, although they are not directly traded instruments. The zero-coupon bond of maturity ![]() is a financial product that pays a unique cash-flow of one monetary unit at time

is a financial product that pays a unique cash-flow of one monetary unit at time ![]() . Its timeline is

. Its timeline is ![]() . Its cash-flow is deterministic and independent of a scenario.

. Its cash-flow is deterministic and independent of a scenario.

The value of a zero-coupon bond of maturity ![]() at a time

at a time ![]() , denoted

, denoted ![]() , acts as a conversion rate between payments at

, acts as a conversion rate between payments at ![]() and

and ![]() , the value at

, the value at ![]() of a cash-flow

of a cash-flow ![]() known at

known at ![]() (

(![]() -measurable) and paid at

-measurable) and paid at ![]() being

being ![]() . For this reason, zero-coupon bond prices are also called discount factors. Evidently,

. For this reason, zero-coupon bond prices are also called discount factors. Evidently, ![]() .

.

The collection ![]() of discount factors of all maturities

of discount factors of all maturities ![]() at time

at time ![]() is called the discount curve at

is called the discount curve at ![]() . The discount curve is part of the market state at

. The discount curve is part of the market state at ![]() . Discount factors are market primitives and may be part of samples in a scenario. What discount maturities

. Discount factors are market primitives and may be part of samples in a scenario. What discount maturities ![]() are included in what samples depends on the product and its cash-flows. In general, a cash-flow doesn't depend on the whole collection of discount factors

are included in what samples depends on the product and its cash-flows. In general, a cash-flow doesn't depend on the whole collection of discount factors ![]() on an event date

on an event date ![]() , but on a smaller number of discounts of a specific set of maturities

, but on a smaller number of discounts of a specific set of maturities ![]() . The set

. The set ![]() of discount maturities in the sample

of discount maturities in the sample ![]() is part of the product-specific definition of the scenario.

is part of the product-specific definition of the scenario.

Finally, the discount curve can be expressed in price units, discount factors, or in rate units,

is called discount rate of maturity ![]() . The quantity:

. The quantity:

is called instantaneous forward rate (IFR).2 It follows immediately that:

and the short rate at time ![]() is defined as

is defined as ![]() .

.

Linear transactions

A forward contract with strike ![]() and maturity

and maturity ![]() on an underlying asset

on an underlying asset ![]() is a financial product paying a unique cash-flow

is a financial product paying a unique cash-flow ![]() at date

at date ![]() . Its timeline is the singleton

. Its timeline is the singleton ![]() and the time

and the time ![]() sample is the scalar

sample is the scalar ![]() .

.

On a date ![]() , the unique strike

, the unique strike ![]() such that the value of the corresponding forward contract is 0 is called the forward price of

such that the value of the corresponding forward contract is 0 is called the forward price of ![]() and denoted

and denoted ![]() . Forward prices

. Forward prices ![]() are part of the market state at time

are part of the market state at time ![]() , and it is best, in order to accommodate a wide range of products and models, to consider forwards as market primitives and parts of samples in the scenario. In this case, we don't need spot prices in the samples, since

, and it is best, in order to accommodate a wide range of products and models, to consider forwards as market primitives and parts of samples in the scenario. In this case, we don't need spot prices in the samples, since ![]() .

.

What forwards of what maturities are part of the samples depends on the exact nature of the cash-flows, same as discount factors. For instance, a forward contract depends on the sample ![]() so in this case,

so in this case, ![]() .

.

In interest rate markets, a forward rate agreement (FRA) pays ![]() on date

on date ![]() ,3 where

,3 where ![]() is the Libor rate fixed at

is the Libor rate fixed at ![]() for maturity

for maturity ![]() . The FRA's timeline is the union of its fixing and payment dates

. The FRA's timeline is the union of its fixing and payment dates ![]() and its dependency is on the sample

and its dependency is on the sample ![]() on the fixing date

on the fixing date ![]() . Why

. Why ![]() is on the timeline without a sample will be clarified when we move on to pricing, and realize that we are missing “something” on the payment dates samples.

is on the timeline without a sample will be clarified when we move on to pricing, and realize that we are missing “something” on the payment dates samples.

On a date ![]() , the unique strike

, the unique strike ![]() such that the value of the corresponding FRA is 0 is called forward rate, or forward Libor, and denoted

such that the value of the corresponding FRA is 0 is called forward rate, or forward Libor, and denoted ![]() . We consider forward Libors as market primitives and part of samples in the scenario. Spot Libors are therefore not necessary, since

. We consider forward Libors as market primitives and part of samples in the scenario. Spot Libors are therefore not necessary, since ![]() .4

.4

What forward Libors of what start and end dates and what index are included in the samples is something specified from the nature of the cash-flows. For instance, a FRA of maturity ![]() on a 3m Libor (“3m” referring both to the Libor's duration and to its index) pays

on a 3m Libor (“3m” referring both to the Libor's duration and to its index) pays ![]() on time

on time ![]() . Its timeline is

. Its timeline is ![]() , and it is determined by the time

, and it is determined by the time ![]() sample

sample ![]() . It follows that

. It follows that ![]() , one Libor being defined, in addition to its fixing date, by two dates and an index.

, one Libor being defined, in addition to its fixing date, by two dates and an index.

Since the cash-flow is known at time ![]() and paid

and paid ![]() later, we can equivalently model this FRA as the cash-flow:

later, we can equivalently model this FRA as the cash-flow:

paid at time ![]() . We used the discount factor to convert an amount paid in 3m into an amount paid immediately. This allows to reduce the timeline to the singleton

. We used the discount factor to convert an amount paid in 3m into an amount paid immediately. This allows to reduce the timeline to the singleton ![]() but increases the sample to include the discount factor:

but increases the sample to include the discount factor: ![]() . In this case,

. In this case, ![]() and

and ![]() .

.

An interest rate swap (IRS) is a financial product that exchanges a fixed leg for a floating leg. The payment schedules of both legs share a common start date ![]() and end date

and end date ![]() but they typically have different periods

but they typically have different periods ![]() and

and ![]() , hence a different number of coupons

, hence a different number of coupons ![]() and

and ![]() . In a receiver swap, the fixed leg pays the coupons

. In a receiver swap, the fixed leg pays the coupons ![]() on dates

on dates ![]() and the floating leg pays the coupons

and the floating leg pays the coupons ![]() on dates

on dates ![]() . A payer swap pays the opposite coupons. The timeline of an IRS is the union of the fixed and floating schedules. The scenario that determines an IRS is the sequence of Libor fixings over the floating schedule.

. A payer swap pays the opposite coupons. The timeline of an IRS is the union of the fixed and floating schedules. The scenario that determines an IRS is the sequence of Libor fixings over the floating schedule.

The fixed coupon ![]() such that the value of the swap is 0 on a date

such that the value of the swap is 0 on a date ![]() is called “par swap rate,” or sometimes “forward swap rate.” Par swap rates are not market primitives; we will see shortly that they are expressed in a simple, universal, and model-independent manner from forward Libors and discount factors.

is called “par swap rate,” or sometimes “forward swap rate.” Par swap rates are not market primitives; we will see shortly that they are expressed in a simple, universal, and model-independent manner from forward Libors and discount factors.

Forward contracts, FRAs, and IRS are all examples of a particular type of financial products called linear products. Linear products are defined as schedules of linear cash-flows. Linear cash-flows are often defined as linear functions of the scenario, although this definition is approximate and in some cases incorrect. The definition of linear cash-flows is related to valuation, as we will see shortly.

European options

Traditionally, European options are those that depend on a single observation of an underlying market variable on a single event date. We go with this definition for now, although it is somewhat blurry in our context. We will correctly define European products later, when we move on to valuation.

For now, a cash-flow ![]() is called European if it depends on a single observation, on a single event date, of a single market variable:

is called European if it depends on a single observation, on a single event date, of a single market variable: ![]() where

where ![]() is a scalar market variable. The timeline of a European cash-flow is a singleton

is a scalar market variable. The timeline of a European cash-flow is a singleton ![]() , called “maturity,” “expiry,” or “exercise date” depending on the product. The cash-flow is a function (not a functional)

, called “maturity,” “expiry,” or “exercise date” depending on the product. The cash-flow is a function (not a functional) ![]() of the scalar

of the scalar ![]() .

.

When ![]() , the cash-flow is a European call. When

, the cash-flow is a European call. When ![]() , it is a European put. More generally, any smooth function

, it is a European put. More generally, any smooth function ![]() can be written as:

can be written as:

This is known as Carr-Madan's formula [28] and shows that all European cash-flows are combinations of calls and puts. Carr-Madan's formula is demonstrated with simple calculus and remains valid when ![]() is discontinuous, as long as derivatives are read in the distributional sense of Laurent Schwartz.

is discontinuous, as long as derivatives are read in the distributional sense of Laurent Schwartz.

A European call (respectively put) on a Libor is called a caplet (floorlet). A succession of caplets (floorlets) over a floating schedule is called a cap (floor).

A cash-settled swaption pays a single cash-flow on its exercise date ![]() :

:

for a payer swaption, or replace the right-hand side with ![]() for a receiver swaption, where

for a receiver swaption, where ![]() is the par swap rate on the exercise date. A swaption's cash-flow is a function of the par swap rate, which is not a market primitive, but an aggregate of a number of discount factors and forward Libors as we will see shortly. A swaption may therefore appear not stricto sensu European.5 We will revisit swaptions shortly.

is the par swap rate on the exercise date. A swaption's cash-flow is a function of the par swap rate, which is not a market primitive, but an aggregate of a number of discount factors and forward Libors as we will see shortly. A swaption may therefore appear not stricto sensu European.5 We will revisit swaptions shortly.

A financial product is called European if all its cash-flows are European (European products may also include multiple European cash-flows on the same date, on different underlying variables). All the linear products we introduced previously are European products. Nonlinear European products are called European options.

Path-dependent exotics

Cash-flows that are not linear or European depend on multidimensional samples on multiple event dates, in a nonlinear manner. Products that involve such cash-flows are collectively known as exotics. Cash-flows that depend nonlinearly on multidimensional samples are called “basket options.” Those depending on multiple samples prior to their payment dates are called “path-dependent.” When a party holds the contractual right to cancel, redefine, or alter cash-flows in any way, the product is said to be “callable” or “early exerciseable.” Those categories are not mutually exclusive.

The timeline of path-dependent cash-flows includes, by definition, multiple event dates. A textbook example is a barrier option6 on some underlying asset ![]() . A barrier delivers the cash-flow of a European call or put at maturity, but only when the underlying asset price remained below (up and out) or above (down and out) a predefined level called barrier and denoted

. A barrier delivers the cash-flow of a European call or put at maturity, but only when the underlying asset price remained below (up and out) or above (down and out) a predefined level called barrier and denoted ![]() , at all times before maturity. The cash-flow of an up-and-out call, for example, is:

, at all times before maturity. The cash-flow of an up-and-out call, for example, is:

where ![]() . Its timeline is therefore the continuous interval

. Its timeline is therefore the continuous interval ![]() and it is a functional of the continuous scenario

and it is a functional of the continuous scenario ![]() . Many other variations exist, like knock-in barriers, which pay only if the barrier was breached, American digitals, which pay a different amount depending on whether the barrier was breached or not, double barriers (those with a down barrier and an up barrier, sometimes called corridors), and all the imaginable combinations of these.

. Many other variations exist, like knock-in barriers, which pay only if the barrier was breached, American digitals, which pay a different amount depending on whether the barrier was breached or not, double barriers (those with a down barrier and an up barrier, sometimes called corridors), and all the imaginable combinations of these.

One important variation for Monte-Carlo simulations is the discretely monitored barrier. In this case, the payment is subject to not breaching (knock-out) or breaching (knock-in) the barrier over a discrete timeline, irrespective of what happens in between the observation dates. The timeline is the discrete union of the monitoring schedule with the fixing and payment dates of the cash-flow. The scenario is the spot price on the event dates in the timeline.

American options and cancellable products

Moving on to callable products, we introduce the two most common types of early exerciseable transactions, American options and cancellable products.

American options are those exerciseable at any time ![]() before maturity

before maturity ![]() into a cash-flow

into a cash-flow ![]() for an American call or

for an American call or ![]() for an American put. The party who holds the right to exercise does so on the first occasion when the exercise cash-flow exceeds the continuation value of the option (the value immediately after if not exercised). An American option's payment schedule and its timeline are therefore both the continuous interval

for an American put. The party who holds the right to exercise does so on the first occasion when the exercise cash-flow exceeds the continuation value of the option (the value immediately after if not exercised). An American option's payment schedule and its timeline are therefore both the continuous interval ![]() and its cash-flows are defined by:

and its cash-flows are defined by:

where ![]() tracks whether the option is still alive and

tracks whether the option is still alive and ![]() defines the exercise cash-flow. We have a product which cash-flow at

defines the exercise cash-flow. We have a product which cash-flow at ![]() depends on the product's value on and before

depends on the product's value on and before ![]() . We have seen that the product's value at time

. We have seen that the product's value at time ![]() is the sum of the values at

is the sum of the values at ![]() of all the cash-flows paid after

of all the cash-flows paid after ![]() . Hence, values depend on cash-flows and cash-flows depend on values. In addition, the continuation value

. Hence, values depend on cash-flows and cash-flows depend on values. In addition, the continuation value ![]() depends not only on the state of the market at

depends not only on the state of the market at ![]() , but also on the option pricing model.

, but also on the option pricing model.

American options therefore involve an undesirable coupling between the product and the model and a recursive relationship between values and cash-flows.

Cancellable products are those where a party has the right to cancel all the subsequent cash-flows on a set of exercise dates. A cancellable product's timeline is the union of the timeline of its non-callable counterpart with the exercise dates. When the non-callable product pays the cash-flows ![]() on times

on times ![]() , the callable product's cash-flows are defined with:

, the callable product's cash-flows are defined with:

where ![]() is 1 before cancellation and 0 thereafter, hence

is 1 before cancellation and 0 thereafter, hence ![]() and

and ![]() is updated on exercise dates

is updated on exercise dates ![]() with:

with:

where ![]() is the time

is the time ![]() value of all subsequent cancellable cash-flows. Again, cash-flows depend on future values in a recursive manner, and the definition of the cash-flows depends on the model. This is a defining characteristic of callable products; it is what makes them special and the reason why they require special modeling.

value of all subsequent cancellable cash-flows. Again, cash-flows depend on future values in a recursive manner, and the definition of the cash-flows depends on the model. This is a defining characteristic of callable products; it is what makes them special and the reason why they require special modeling.

In the somewhat simplified case of a cancelable product with one exercise date, sometimes called “one-time callable,” the cash-flows are the cash-flows of the non-callable counterpart before the exercise date ![]() , and:

, and:

after the exercise date, so the cash-flows are still dependent on a future value, but this is the future value of the non-callable counterpart, not the value of the callable product itself. The recursive relationship is gone, but the dependency on a future value and a model remains.

For instance, a physically settled swaption is the right to enter the underlying swap, or, equivalently, the right to cancel its cash-flows. It is therefore a one-time callable swap, which pays the cash-flows of the underlying swap, provided its present value on the exercise date ![]() is positive:

is positive:

We will see shortly that ![]() is an explicit function

is an explicit function ![]() of the forward Libors

of the forward Libors ![]() on the exercise date with maturities the start and end dates on the floating schedule, and the discount factors

on the exercise date with maturities the start and end dates on the floating schedule, and the discount factors ![]() to the payment dates of both legs. It follows that:

to the payment dates of both legs. It follows that:

All these discounts and forward Libors are therefore included in the swaption's sample on the exercise date: ![]() ,

, ![]() , and:

, and:

so:

Seen from this angle, the swaption is no longer a callable product, but fits the definition of path-dependent products. We will see shortly that we can also consider it a European option that delivers the present value of the underlying swap on the exercise date.

Turning callables into path-dependents

Callable products are therefore those whose cash-flows depend on the future values of themselves, and/or the future values of financial products other than primary market variables. How algorithms deal with them depends on the algorithm. We will see shortly that finite difference methods (FDM) cope with callable features in a native and natural manner. On the contrary, Monte-Carlo naturally handles path dependency, but doesn't know future transaction values and cannot handle callable features. In order to price a callable transaction with Monte-Carlo, we must first transform the transaction into an equivalent path-dependent, like we just did for a swaption.

In general, unlike for the swaption, we don't have an analytic expression of the future values, so we must somehow estimate them as a function of the market:

where ![]() is called a proxy function and the sample

is called a proxy function and the sample ![]() is the set of market variables on

is the set of market variables on ![]() it accepts as arguments, which must be included in the scenario in order to use the proxy.7 Using proxies, the cash-flows of the American option simplify into:

it accepts as arguments, which must be included in the scenario in order to use the proxy.7 Using proxies, the cash-flows of the American option simplify into:

and the cash-flows of an early cancellable transaction simplify into:

In both cases, the explicit dependency on future values vanished and the modified cash-flows fit the definition of classic path-dependents. The injection of proxies effectively turns callables into path-dependents.

It is also noticeable that proxies only appear in exercise indicators. On an exercise date, the set of sample values that cause early exercise is called the exercise region. The border of the exercise region is called the exercise boundary. The problem of finding effective proxies boils down to the estimation of exercise boundaries.

In the context of FDM, exercise boundaries are directly estimated on the FDM grid, as we will see shortly. In the context of Monte-Carlo, proxies are estimated by regression over pre-simulations, with an algorithm known as the least squares method or LSM, pioneered by Carriere in [13] and Longstaff and Schwartz in [14]. Proxies obtained with LSM are called regression proxies. The LSM algorithm is the established best practice for pricing callables with Monte-Carlo since the early 2000s. We briefly introduce it in the next chapter.

CVA

Finally, it is important to understand that counterparty value adjustment (CVA), along with most other value adjustments (xVA) and other bank-wise regulatory calculations, can be modeled as a financial product. This is crucial, because it follows that the models we develop for financial products are also suitable for these calculations. CVA is a real option a bank gives away whenever it trades with a defaultable counterparty. If the counterparty defaults on a future date ![]() when the net sum of all ongoing transactions with that counterparty (called netting set)

when the net sum of all ongoing transactions with that counterparty (called netting set) ![]() is positive, the bank loses the positive value of the netting set. This is a one-way street, hence, really an option: if

is positive, the bank loses the positive value of the netting set. This is a one-way street, hence, really an option: if ![]() , the liquidator will insist that the bank refunds its value. CVA is therefore a zero-strike put, contingent to default, on the entire netting set, consisting itself in thousands of transactions, each one of which is a financial product in its own right, perhaps exotic or hybrid. The difficulty of computing CVA in a practical manner, and in reasonable time, is directly related to the high dimension of the “underlying” netting set.

, the liquidator will insist that the bank refunds its value. CVA is therefore a zero-strike put, contingent to default, on the entire netting set, consisting itself in thousands of transactions, each one of which is a financial product in its own right, perhaps exotic or hybrid. The difficulty of computing CVA in a practical manner, and in reasonable time, is directly related to the high dimension of the “underlying” netting set.

In its simplest form, an uncollateralized CVA, defined in a discrete manner and without recursion, is modeled as a financial product that pays, over an exposure schedule ![]() , where

, where ![]() and

and ![]() , the payment date of the last cash-flow in the netting set, the cash-flows:

, the payment date of the last cash-flow in the netting set, the cash-flows:

where ![]() is the proportion defaulted between

is the proportion defaulted between ![]() and

and ![]() .8

.8

The cash-flows of a CVA therefore depend on the future values of the netting set, so everything we said about callable products applies to CVA, too.9 In addition, CVA cannot be valued with FDM due to its high dimension, so proxies are necessary there, too.10

In addition, CVA depends on credit, so the scenarios must be enlarged to incorporate credit variables and credit events, something we are not doing in this publication. The future values of the netting set typically depend on a vast number of market variables from different asset classes: stocks, rates, currencies, etc. CVA is therefore a hybrid option, which valuation necessitates a hybrid model (essentially, an assembly of multiple models driving the different underlying markets, brought together and made consistent and arbitrage-free; see [7]).

Due to the dimension of the model and the size of the market samples, Monte-Carlo is the only practical means of pricing CVA. To generate high-dimensional market samples in reasonable time may be challenging; see [7]. The netting set's timeline, which is the union of the timelines of all the transactions, is typically dense, further slowing down evaluation, unless compression techniques, introduced in [30] and [11], are implemented. A reasonably fast generation of scenarios is not enough. To evaluate the large number of cash-flows in the netting set in every scenario is another bottleneck. Our publication dedicated to scripting [11] covers general, efficient means of representing and manipulating cash-flows, which helps with the aggregation and compression of the cash-flows, as well as a fast evaluation over the generated scenarios.

It follows that even though CVA may be seen as another financial product and evaluated in a hybrid platform, it remains that its size raises specific problems when we wish to price it in a practical manner and in reasonable time. Although this publication covers major ground for the efficient management of CVA, including generic simulation, parallelism, and AAD, it does not cover all the pieces, in particular, the representation and manipulation of cash-flows, the application of regression proxies, and some important algorithms specifically designed for the acceleration of xVA and explained in [31].

4.2 THE ARBITRAGE PRICING THEORY

Having defined financial products in an abstract manner suitable for the development of generic libraries, and having explored in detail the key notions of cash-flow, timeline, scenario, and sample,11 we are ready to discuss their valuation. Valuation is permitted by the keystone theorem of modern finance, underlying financial theory and practice for almost 50 years, established by Harrisson, Kreps, and Pliska in [32] and [33], following the ground-breaking work of Black and Scholes in [22].

The Asset Pricing Theorem

We state the fundamental asset pricing theorem here, referring to the original articles or textbooks for demonstrations. In the absence of arbitrage, and in complete markets (both of which we assume in all that follows):

- Financial cash-flows can be replicated by self-financing strategies.

A self-financing strategy is a dynamic trading strategy over a time interval, without injection or withdrawal of cash or assets (hence, self financing), that consists in holding, at time

, the underlying assets

, the underlying assets  that constitute the market, of prices

that constitute the market, of prices  , in the amounts

, in the amounts  .

.A self-financing strategy is specified by the vector process

. The vector

. The vector  , the amounts of assets held at time

, the amounts of assets held at time  , must be

, must be  -measurable, which means that they are determined at time

-measurable, which means that they are determined at time  , from the state of the market on a before

, from the state of the market on a before  , but not after.12

, but not after.12It follows from this definition that the value series of a self-financing strategy is an adapted process satisfying:

with

. One trivial, yet important, self-financing strategy is leave

. One trivial, yet important, self-financing strategy is leave  compounding at the short rate

compounding at the short rate  on a bank account. This strategy is traditionally called “bank account,” and its value, denoted

on a bank account. This strategy is traditionally called “bank account,” and its value, denoted  , is of course:

, is of course:

What the theorem says is that for any financial cash-flow

(defined as a

(defined as a  -measurable variable) paid at time

-measurable variable) paid at time  , there exists a self-financing strategy such that the value of the strategy replicates the cash-flow at time

, there exists a self-financing strategy such that the value of the strategy replicates the cash-flow at time  with probability 1:13

with probability 1:13

The amounts of assets

held in the replication strategy are called replication coefficients, hedge coefficients, or just “deltas.”

held in the replication strategy are called replication coefficients, hedge coefficients, or just “deltas.”The value of the cash flow at a time

is the value of the replicating strategy.

is the value of the replicating strategy. - There exists a unique probability measure, equivalent to the “real” probability measure,14 denoted

and called risk-neutral measure, such that the discounted values

and called risk-neutral measure, such that the discounted values  of all financial cash-flows are martingales under

of all financial cash-flows are martingales under  :

for any

:

for any

.

.

One consequence is that the value processes

of all cash-flows have a drift equal to

of all cash-flows have a drift equal to  under

under  .15 It is also the case for financial products, in between the payment of cash-flows (the value of a product dropping by the cash-flow on a payment date).

.15 It is also the case for financial products, in between the payment of cash-flows (the value of a product dropping by the cash-flow on a payment date).Another consequence is the fundamental pricing formula:

- The value

is a function of the market state on and before

is a function of the market state on and before  , including the current values

, including the current values  of the underlying assets in the current market. The replication strategy, the amounts of underlying assets to trade at time

of the underlying assets in the current market. The replication strategy, the amounts of underlying assets to trade at time  to replicate a cash-flow

to replicate a cash-flow  , are the derivative sensitivities of

, are the derivative sensitivities of  to these underlying prices:

to these underlying prices:

- More generally, the drift of the value process of any self-financing strategy under

is

is  , and conversely, any adapted process

, and conversely, any adapted process  with drift

with drift  , under

, under  is the value process of a self-financing strategy, and therefore, the price series of a tradable asset.

is the value process of a self-financing strategy, and therefore, the price series of a tradable asset.

This theorem guarantees that the market risk of financial products can be covered with trading strategies, justifies the universal practice of measuring risk by taking derivatives of transaction values to current market prices, and provides a general pricing formula for all financial products.

Later work precised, confirmed, and extended this fundamental theorem. For instance, it was no earlier than 2009 that it was finally demonstrated, indisputably and in the most general case, that derivative sensitivities effectively always correspond to hedge coefficients. The demonstration is due to Dupire, who had to develop a new branch of stochastic mathematics, called “stochastic functional calculus,” to obtain this result [34].

Pricing with a numeraire

Another extension, extremely useful for analytic calculations and numerical implementations, including Monte-Carlo, was introduced in 1995 by El-Karoui, Geman, and Rochet [35]. The bank account ![]() is not the only choice of numeraire: any (strictly positive) self-financing strategy may be used as numeraire, including positive financial cash-flows and products, before payment.

is not the only choice of numeraire: any (strictly positive) self-financing strategy may be used as numeraire, including positive financial cash-flows and products, before payment.

For every such choice of a numeraire ![]() , there exists a unique probability measure

, there exists a unique probability measure ![]() , equivalent to

, equivalent to ![]() , such that all asset values (in between payments) in terms of

, such that all asset values (in between payments) in terms of ![]() are martingales under

are martingales under ![]() :

:

where ![]() . In particular, the value of a cash-flow

. In particular, the value of a cash-flow ![]() paid at time

paid at time ![]() satisfies:

satisfies:

and with ![]() without loss of generality:16

without loss of generality:16

Remembering that cash-flows are defined as functionals of scenarios:

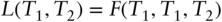

and that product values are the sum of the values of their cash-flow, it follows that the value ![]() of any financial product with cash-flows

of any financial product with cash-flows ![]() paid on dates

paid on dates ![]() satisfies:17

satisfies:17

We augment the definition of scenarios and samples18 to include the numeraire on payment dates, so that:

The functional ![]() of the scenario, including the numeraire on payment dates, is called payoff, and we get the classic result that the value of a financial product is its expected payoff:

of the scenario, including the numeraire on payment dates, is called payoff, and we get the classic result that the value of a financial product is its expected payoff:

Forward measures

Besides the bank account ![]() , a number of useful numeraires have been widely used in investment banks and universities to resolve analytic and numerical problems. We will see a few in this chapter, and demonstrate a simple change of numeraire in the code of Chapter 6.

, a number of useful numeraires have been widely used in investment banks and universities to resolve analytic and numerical problems. We will see a few in this chapter, and demonstrate a simple change of numeraire in the code of Chapter 6.

For now, we introduce a particularly useful family of numeraires: the zero-coupon bonds. A zero-coupon bond of maturity ![]() satisfies the criteria of a numeraire. The associated martingale measure is called forward measure for a reason that will be made apparent shortly. The

satisfies the criteria of a numeraire. The associated martingale measure is called forward measure for a reason that will be made apparent shortly. The ![]() forward measure is often denoted

forward measure is often denoted ![]() and expectations taken under this measure are denoted

and expectations taken under this measure are denoted ![]() .

.

One of the multiple benefits of forward measures is that they provide the means to price linear products directly and independently of a model.

Forward prices and forward contracts Let us revisit a forward contract of maturity ![]() and strike

and strike ![]() on an asset

on an asset ![]() , and price it under the

, and price it under the ![]() measure. From the fundamental pricing formula, we immediately get:

measure. From the fundamental pricing formula, we immediately get:

since ![]() . Solving for

. Solving for ![]() in the strike

in the strike ![]() to find the forward price

to find the forward price ![]() , we get:

, we get:

Forwards of maturity ![]() are expectations under the martingale measure associated with the zero-coupon bond of maturity

are expectations under the martingale measure associated with the zero-coupon bond of maturity ![]() , hence its name “forward measure.” It also follows that forwards of maturity

, hence its name “forward measure.” It also follows that forwards of maturity ![]() are martingales under

are martingales under ![]() , in particular:

, in particular:

These formulas are not particularly helpful for pricing, since today's forwards trade in the market. We know their prices. Where they are helpful is the other way around: the forwards that trade on the market today imply the means of forward-neutral measures.

Another trivial consequence is that the value of a forward contract is ![]() . Setting

. Setting ![]() , we get the time

, we get the time ![]() value of an asset delivered at time

value of an asset delivered at time ![]() :

:

Forward rates and FRAs The same can be said of FRAs in interest rate markets. A FRA over the period ![]() pays a cash-flow on date

pays a cash-flow on date ![]() , hence, we value it under

, hence, we value it under ![]() :

:

Solving ![]() in

in ![]() , we find that the forward Libor is the forward-neutral expectation of the Libor:

, we find that the forward Libor is the forward-neutral expectation of the Libor:

and a martingale under ![]() . Today's Libor curve implicitly defines the expected values of future Libors under the forward-neutral measures for their end dates. In addition, the value of a FRA is

. Today's Libor curve implicitly defines the expected values of future Libors under the forward-neutral measures for their end dates. In addition, the value of a FRA is ![]() . Setting

. Setting ![]() , we see that the time

, we see that the time ![]() value of a

value of a ![]() paid at

paid at ![]() is:

is:

Forward discount factors and instantaneous forward rates Consider now a product that delivers a zero-coupon bond of maturity ![]() at a time

at a time ![]() . Its value is obviously

. Its value is obviously ![]() . From the valuation formula under

. From the valuation formula under ![]() , we get:

, we get:

We know, now, that forward-neutral expectations are forwards. It follows that the forward price ![]() of maturity

of maturity ![]() of the zero-coupon bond of maturity

of the zero-coupon bond of maturity ![]() satisfies:

satisfies:

In addition, the value series ![]() of a forward discount factor of maturities

of a forward discount factor of maturities ![]() is a martingale under

is a martingale under ![]() . It follows that today's discount curve fixes the forward-neutral expectations of future discount factors.

. It follows that today's discount curve fixes the forward-neutral expectations of future discount factors.

The amount

is called forward discount rate, and effectively corresponds to the rate of a loan from ![]() to

to ![]() that may be locked at time

that may be locked at time ![]() by selling zero-coupon bonds of maturity

by selling zero-coupon bonds of maturity ![]() and buying zero-coupon bonds of maturity

and buying zero-coupon bonds of maturity ![]() for the same total price.

for the same total price.

Denoting ![]() and considering the limit case where

and considering the limit case where ![]() , we get the time

, we get the time ![]() instantaneous forward rate of maturity

instantaneous forward rate of maturity ![]() :

:

which we had defined before, only now we can see where this definition comes from and why the short (discount) rate is effectively ![]() .

.

Forward bank account Another example is the bank account ![]() .

. ![]() is a martingale under

is a martingale under ![]() , therefore:

, therefore:

Since forward-neutral expectations are forwards, it follows that ![]() is the forward value of the bank account

is the forward value of the bank account ![]() at time

at time ![]() for the maturity

for the maturity ![]() . In particular, we have today's value of bank account forwards of all maturities:

. In particular, we have today's value of bank account forwards of all maturities:

Interest rate swaps It immediately follows from what precedes that the value on an IRS (a receiver swap in this instance) is:

and, solving for ![]() in

in ![]() to get the par swap rate

to get the par swap rate ![]() , we get:

, we get:

This formula is universal and model independent, which implies that the par swap rate is a redundant market primitive, hence, not directly included in scenarios. The denominator is called the annuity of the fixed leg. The annuity is a combination of zero-coupon bonds, hence, a tradable asset, with time ![]() value:

value:

On the par swap rate formula, we recognize that ![]() is the value at time

is the value at time ![]() of the floating leg in terms of the annuity:

of the floating leg in terms of the annuity:

It follows that ![]() is a martingale under the martingale measure

is a martingale under the martingale measure ![]() associated with the annuity.

associated with the annuity.

Also note that the formula of the value of a (receiver, in this instance) IRS can be rearranged into:

Swaption pricing A physically settled payer swaption (right to enter the underlying payer swap) of strike ![]() on the exercise date

on the exercise date ![]() is the value, if positive, of the underlying swap on the exercise date:

is the value, if positive, of the underlying swap on the exercise date:

We can therefore price it under the annuity-neutral measure:

where the payoff is that of a standard put (for a payer swaption, it is a call) on the swap rate, which itself is a martingale. This is the theoretical basis for pricing swaptions under models like Black-Scholes [22] or SABR [36]. These established market practices therefore implicitly, and correctly, manage swaptions under the annuity-neutral measure. Assuming a constant volatility ![]() as in Black and Scholes's specification,

as in Black and Scholes's specification, ![]() is given by Black and Scholes' formula [22]. Assuming

is given by Black and Scholes' formula [22]. Assuming ![]() is a stochastic volatility martingale as in SABR's specification,

is a stochastic volatility martingale as in SABR's specification, ![]() is given by Hagan's formula [36].

is given by Hagan's formula [36].

Natural numeraires We demonstrated that forward prices ![]() , observed at

, observed at ![]() with maturity

with maturity ![]() , are martingales under the forward measure

, are martingales under the forward measure ![]() associated with the zero bond of maturity

associated with the zero bond of maturity ![]() , the maturity date of the forward. This zero bond and forward measure are respectively called the natural numeraire and the natural measure of the forward

, the maturity date of the forward. This zero bond and forward measure are respectively called the natural numeraire and the natural measure of the forward ![]() .

.

In particular, the spot price ![]() on time

on time ![]() coincides with its forward

coincides with its forward ![]() . Its natural numeraire is therefore the zero bond of maturity

. Its natural numeraire is therefore the zero bond of maturity ![]() , and its natural measure is

, and its natural measure is ![]() . Forwards are expectations of asset prices under their natural measure.

. Forwards are expectations of asset prices under their natural measure.

This is true of all asset prices. In particular, the forward price of the bank account ![]() on time

on time ![]() is its expectation under its natural measure

is its expectation under its natural measure ![]() .

.

The forward discount factor:

is a martingale under ![]() . Therefore:

. Therefore:

The natural measure of the discount factor ![]() , observed at time

, observed at time ![]() with maturity

with maturity ![]() , is therefore

, is therefore ![]() . The expectation of a discount factor under its natural measure is the corresponding forward discount factor observed today. Its natural numeraire is the zero bond of maturity

. The expectation of a discount factor under its natural measure is the corresponding forward discount factor observed today. Its natural numeraire is the zero bond of maturity ![]() .

.

A forward Libor ![]() observed at time

observed at time ![]() with maturities

with maturities ![]() is a martingale under its natural measure

is a martingale under its natural measure ![]() , associated with its natural numeraire, the zero bond of maturity

, associated with its natural numeraire, the zero bond of maturity ![]() . In particular, a spot Libor observed at

. In particular, a spot Libor observed at ![]() with maturity

with maturity ![]()

![]() coincides with the forward on the fixing date. It follows that the expectation of a Libor under its natural measure is the forward Libor. Its natural numeraire is the zero bond of maturity the Libor's payment date.

coincides with the forward on the fixing date. It follows that the expectation of a Libor under its natural measure is the forward Libor. Its natural numeraire is the zero bond of maturity the Libor's payment date.

Finally, we have seen that the par rate ![]() of a given swap, paid over the annuity

of a given swap, paid over the annuity ![]() of the swap's fixed leg, is a martingale under

of the swap's fixed leg, is a martingale under ![]() .

. ![]() is therefore the swap rate's natural measure, and the fixed leg's annuity

is therefore the swap rate's natural measure, and the fixed leg's annuity ![]() is its natural numeraire.

is its natural numeraire.

Every observation of a market variable ![]() fixed at time

fixed at time ![]() admits a natural measure, such that conditional expectations

admits a natural measure, such that conditional expectations ![]() of

of ![]() under the natural measure are, by definition, the forward values observed at time

under the natural measure are, by definition, the forward values observed at time ![]() of the cash-flow

of the cash-flow ![]() at time

at time ![]() . It follows that those forward values are martingales under

. It follows that those forward values are martingales under ![]() 's natural measure. The numeraire associated to the natural measure of an observation

's natural measure. The numeraire associated to the natural measure of an observation ![]() is called its natural numeraire. The notion of natural numeraire and measure depends on the nature of the market variables, and we have seen that prices, Libors, discounts, bank accounts, and swap rates define their natural measures in a different way. In addition, natural measures relate to observations: two observations on different dates of the same variable have different natural measures and numeraires.

is called its natural numeraire. The notion of natural numeraire and measure depends on the nature of the market variables, and we have seen that prices, Libors, discounts, bank accounts, and swap rates define their natural measures in a different way. In addition, natural measures relate to observations: two observations on different dates of the same variable have different natural measures and numeraires.

In economic terms, the observation of a market variable always expresses the value of an asset in terms of a unit. This unit is the observation's natural numeraire. The market price of an Apple share on 30 September 2025 expresses the value of a fraction of Apple in terms of 30/09/25 USD. Its natural numeraire is the USD denominated zero bond of maturity 30/09/25.

In formal terms, the natural numeraire ![]() of an observation

of an observation ![]() is the numeraire such that under any complete and arbitrage-free probabilistic specification with correct initial values,

is the numeraire such that under any complete and arbitrage-free probabilistic specification with correct initial values, ![]() corresponds to the forward price observed at

corresponds to the forward price observed at ![]() of the cash-flow

of the cash-flow ![]() . This is rather abstract, but in practical terms, for a given observation of a market variable, it is generally quite clear what its natural numeraire and measure are. In particular, for the market variables that populate market samples:

. This is rather abstract, but in practical terms, for a given observation of a market variable, it is generally quite clear what its natural numeraire and measure are. In particular, for the market variables that populate market samples:

- The natural measure for a forward price

is

is  , including spot prices

, including spot prices  with natural measure

with natural measure  .

. - It directly follows that the natural measure for a discount factor

, or the bank account

, or the bank account  observed at

observed at  , is also

, is also  .

. - The natural measure for a forward Libor

is

is  , including spot Libors

, including spot Libors  with natural measure

with natural measure  .

.

Constant Maturity Swaps We computed the values of all the linear transactions introduced earlier: forward contracts, FRAs, IRS, without specifying a model, directly, as a function of the forward prices, forward rates, and discount factors trading on the current market. This is a defining characteristic of linear products: linear products are financial products whose value depends on the current market, independently of a model. It follows that today's value of linear products is the same in any arbitrage-free model that respects today's market. We just saw that forwards are expectations under natural measures, so we have a clean definition of linear products:

Linear products are those whose value depends on expectations, but not distributions. It follows that the value of any linear product is a linear combination of the present values of a number of forward contracts, hence the name “linear” products.

This (correct) definition of linear products conflicts with the (approximate but widely accepted) one of products where cash-flows are linear functions of scenarios. Consider a cash-flow ![]() , linear in the market variable

, linear in the market variable ![]() fixed on

fixed on ![]() . We now know that its value satisfies:

. We now know that its value satisfies:

When ![]() is

is ![]() 's natural measure,

's natural measure, ![]() is its forward, therefore:

is its forward, therefore:

and it follows that the cash-flow is indeed a linear one. When this is not the case, and ![]() 's natural measure

's natural measure ![]() :

:

The difference between the two expectations ![]() and

and ![]() is called convexity adjustment and can be calculated with Girsanov's theorem, but only under dynamic assumptions on the future behavior of

is called convexity adjustment and can be calculated with Girsanov's theorem, but only under dynamic assumptions on the future behavior of ![]() , in particular its volatility. It follows that the cash-flow is not a linear one, but a European one (because it depends on a single variable on a single date).

, in particular its volatility. It follows that the cash-flow is not a linear one, but a European one (because it depends on a single variable on a single date).

To see that clearly on an example, a Libor ![]() is a linear cash-flow when paid at

is a linear cash-flow when paid at ![]() . Its value is then:

. Its value is then:

as seen earlier. When paid at ![]() , its value is:

, its value is:

and:

Ignoring discount basis and assimilating:

the cash-flow ![]() paid at

paid at ![]() is equivalent to a

is equivalent to a ![]() payment, under the underlying Libor's natural numeraire, of:

payment, under the underlying Libor's natural numeraire, of:

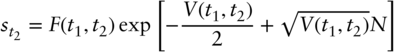

which clearly identifies the cash-flow as a nonlinear quadratic function of the underlying Libor. Its linearity was only apparent. It is actually a European cash-flow. Under a simple model a la Bachelier [37] with Gaussian first increments with annual standard deviation ![]() , its value is:

, its value is:

(where we skipped trivial calculation steps). In a more general, non-Gaussian context, we can statically replicate this cash-flow, like any European cash-flow written on a Libor, with combinations of caps and floors, by an application of Carr-Madan's formula.

This is the cash-flow of a well-known, actively traded financial product called “Libor in arrears.” More generally, an actively traded family of financial products, called constant maturity swaps or CMS, pay cash-flows linked to libor or swap rates, over schedules different than their natural numeraire, resulting in nonlinear products, which value depends on volatility and dynamic assumptions. Like Libor in arrears, swap-based CMS are statically replicated with combinations of swaptions, with techniques similar to Carr-Madan's, as explained in [38].

Nonlinear products, like swaptions or CMS, cannot be valued out of the underlying market alone. Their value depends on volatility assumptions, and more generally, dynamic assumptions of how the market is going to evolve. This is the purpose of derivatives models.

4.3 FINANCIAL MODELS

Having defined financial products in a general manner, we repeat the exercise for financial models. The asset pricing theory gave us the pricing formula for all financial products:

where the payoff function ![]() and the definition of the scenario (what market primitives, including numeraire, on what dates) are fully specified by the product.19 In order to apply this formula and produce prices, we must specify the distribution of

and the definition of the scenario (what market primitives, including numeraire, on what dates) are fully specified by the product.19 In order to apply this formula and produce prices, we must specify the distribution of ![]() under

under ![]() . This is the defining purpose of a model.

. This is the defining purpose of a model.

We call “model” a specification of the probability distribution of the scenario ![]() . This specification may either be direct, or implied from dynamic assumptions regarding future market behavior, in which case we say that the model is dynamic.

. This specification may either be direct, or implied from dynamic assumptions regarding future market behavior, in which case we say that the model is dynamic.

More precisely, the scenario:

is a collection of market samples ![]() on a collection of event dates, and each sample is itself a collection:

on a collection of event dates, and each sample is itself a collection:

of market variables on the event date ![]() . A sample may be a singleton, or a discrete, infinite, or continuous collection of market variables. Hence, the scenario

. A sample may be a singleton, or a discrete, infinite, or continuous collection of market variables. Hence, the scenario ![]() is a collection of market observations:

is a collection of market observations:

where the ![]() s are all the individual market variables on all the event dates. Different market variables on the same date are different

s are all the individual market variables on all the event dates. Different market variables on the same date are different ![]() s and the same market variable on different dates are also separate

s and the same market variable on different dates are also separate ![]() s. Each

s. Each ![]() belongs to one sample

belongs to one sample ![]() , and we denote

, and we denote ![]() its event date, also called observation date or fixing date. We now have a more precise definition of models.

its event date, also called observation date or fixing date. We now have a more precise definition of models.

The defining purpose of a model is to specify the joint distribution of the observations ![]() in the scenario

in the scenario ![]() .

.

Note the separation of concerns: the payoff function ![]() and the definition of the scenario

and the definition of the scenario ![]() are specified by the product outside of any kind of model logic. The model specifies the probability distribution of

are specified by the product outside of any kind of model logic. The model specifies the probability distribution of ![]() outside of any cash-flow logic.20

outside of any cash-flow logic.20

A model is not free to specify any joint distribution for the ![]() s.

s. ![]() must respect its defining property that asset prices in terms of the numeraire are martingales; otherwise the model is arbitrageable, produces inconsistent prices, and is generally not acceptable. All common models introduced shortly are arbitrage-free. In addition, the model's specification of

must respect its defining property that asset prices in terms of the numeraire are martingales; otherwise the model is arbitrageable, produces inconsistent prices, and is generally not acceptable. All common models introduced shortly are arbitrage-free. In addition, the model's specification of ![]() must respect the current market prices. For instance, we have modeled underlying stocks, indices, and currencies as financial products. Their value under

must respect the current market prices. For instance, we have modeled underlying stocks, indices, and currencies as financial products. Their value under ![]() as financial products must correspond to their current market price. More generally, we have seen that the forward prices and rates, traded on today's market, fix expectations under forward-neutral measures, imposing a constraint on the model, called initial value conditions.

as financial products must correspond to their current market price. More generally, we have seen that the forward prices and rates, traded on today's market, fix expectations under forward-neutral measures, imposing a constraint on the model, called initial value conditions.

We shall review linear and European models, appropriate for the valuation of respectively linear and European transactions, before we discuss dynamic models, the most general class of models, those appropriate for the pricing of all products.

Linear models

Linear models refer to what we have been calling so far “today's market.” They contain all the underlying asset prices, including dividend and repo curves, all the discount and Libor curves, and other variables that define the current state of the market. They “know,” among other things, the forward prices ![]() and discount factors

and discount factors ![]() of all maturities

of all maturities ![]() , as well as forward Libors

, as well as forward Libors ![]() of all maturities

of all maturities ![]() and

and ![]() , for all Libor indices.

, for all Libor indices.

Linear markets achieve this capability by interpolation of the available market information: spots, futures, par swap rates, basis and currency swaps, and so forth. This is not as easy as it may sound, especially since the multiplication of basis and discount curves in 2008–2011. To properly construct a linear market is a sophisticated, challenging exercise that occupies some of the greatest minds in the industry. We refer to [39] for a review of linear markets, including a presentation of the difficulties and the sophisticated solutions implemented in modern systems.

Mathematically, linear markets, who know all forwards, define the expectations ![]() of the

of the ![]() s under their respective natural measures, but they know nothing else of their distribution

s under their respective natural measures, but they know nothing else of their distribution ![]() , because they have no knowledge of their future dynamics. This transpires in the notations: linear markets know all the

, because they have no knowledge of their future dynamics. This transpires in the notations: linear markets know all the ![]() for all maturities

for all maturities ![]() , but nothing of the

, but nothing of the ![]() when

when ![]() . Linear markets are initial value conditions. They are the modern counterpart of the “initial spot

. Linear markets are initial value conditions. They are the modern counterpart of the “initial spot ![]() ” found in traditional literature.

” found in traditional literature.

Why then do we call them linear models and discuss them in the model section here? We have defined a model by its ability to assign a probability distribution to a scenario. Linear models assign probability 1 to the forward scenario ![]() where every market variable

where every market variable ![]() lands, on its event date, on its forward value seen from today, which we have seen is its expectation under its natural measure

lands, on its event date, on its forward value seen from today, which we have seen is its expectation under its natural measure ![]() :

:

This “probability distribution” of the scenario obviously respects initial conditions, and is trivially arbitrage-free, the discounted price series of all assets being (constant) martingales between payments. This is actually the simplest possible arbitrage-free model consistent with today's market.

It follows that the price of any financial product defined by its payoff ![]() and scenario

and scenario ![]() in the linear model is:

in the linear model is:

which may explain why those models are called linear, although:

so the linearity of linear models is an approximate notion.

We priced a number of linear products in the linear model in Section 4.2, although we did not call it linear model at the time. The value in the linear model is called the intrinsic value of the product. For European options, this definition coincides with the traditional definition. For instance, for a European call, ![]() . Our definition extends the notion of intrinsic value to all financial products. The difference between the actual value and the intrinsic value is called time value:

. Our definition extends the notion of intrinsic value to all financial products. The difference between the actual value and the intrinsic value is called time value: ![]() . Linear products are those whose time value is zero.21 The intrinsic value prices the linear part of a product and is independent of volatility or dynamic assumptions. The time value prices the nonlinear part of a product and depends on volatility and other dynamic assumptions.

. Linear products are those whose time value is zero.21 The intrinsic value prices the linear part of a product and is independent of volatility or dynamic assumptions. The time value prices the nonlinear part of a product and depends on volatility and other dynamic assumptions.

From a practical point of view, pricing in a linear model is extremely fast, usually a fraction of a millisecond, because it takes a unique scenario. It is also very accurate because no numerical algorithm is involved. Linear models are suitable for Monte-Carlo simulations; in particular they fit the simulation model interface we build in Chapter 6, albeit in a trivial manner, since they generate only one scenario: the forward scenario ![]() . Generic, well-designed valuation systems price linear products (and the intrinsic value of other products, an interesting information in its own right) as a simulation in a single scenario.

. Generic, well-designed valuation systems price linear products (and the intrinsic value of other products, an interesting information in its own right) as a simulation in a single scenario.

More sophisticated models used for the valuation of nonlinear transactions can also price linear products, as a special case of options or exotics. Provided that the models respect today's market, the prices coincide with the linear model, but with lower speed and accuracy. Finally, note that those more sophisticated models coincide with linear models, not only for linear products, but for all products, when their volatility parameters are set to zero.22 Therefore linear models are also zero-volatility arbitrage-free dynamic models.

European models

Moving one step up to European models, we discuss those models appropriate for the pricing of European products, but not exotics.

We have seen that a European cash-flow of maturity ![]() is a combination of calls and puts on the same market variables, same maturity, and same payment date, as demonstrated by Carr-Madan's formula. It follows that a dynamic model is not necessary for the valuation of European cash-flows; all we need are the call prices

is a combination of calls and puts on the same market variables, same maturity, and same payment date, as demonstrated by Carr-Madan's formula. It follows that a dynamic model is not necessary for the valuation of European cash-flows; all we need are the call prices ![]() of all strikes

of all strikes ![]() for the maturity

for the maturity ![]() .23 European models, by definition, “know” these prices in the same way linear models “know” forward prices: by interpolation of available market data, in this case, the prices of calls and puts that trade on today's market.24