Answers to End of Chapter Questions for Lecturers

These suggested answers are for the end of chapter questions that appear in black in the book. Answers to questions in blue are in the appendix section of the book for students to access.

Chapter 1: Discussion Answers

The answers below provide some outline points for discussion.

SECTION A: FINANCIAL ACCOUNTING: THE TECHNIQUES

Chapter 2: Discussion Answers

The answers below provide some outline points for discussion.

Chapter 2: Numerical Answers

| A1 | See Book Appendix for Answer. |

| A2 | Priya Patel |

Chapter 3: Discussion Answers

The answers below provide some outline points for discussion.

Chapter 3: Numerical Answers

Chapter 4: Discussion Answers

The answers below provide some outline points for discussion.

Chapter 4: Numerical Answers

| A1, A2 See Book Appendix for Answers. | |

| A3 | Mary Scott

|

| A4 | We have the following scenarios:

|

Chapter 5: Discussion Answers

The answers below provide some outline points for discussion.

Chapter 5: Numerical Answers

| A1, A2 See Book Appendix for Answers. | |

| A3 | Jill Jenkins |

| A4 | Janet Richards

|

Chapter 6: Discussion Answers

The answers below provide some outline points for discussion.

| A1 | See Book Appendix for Answer. |

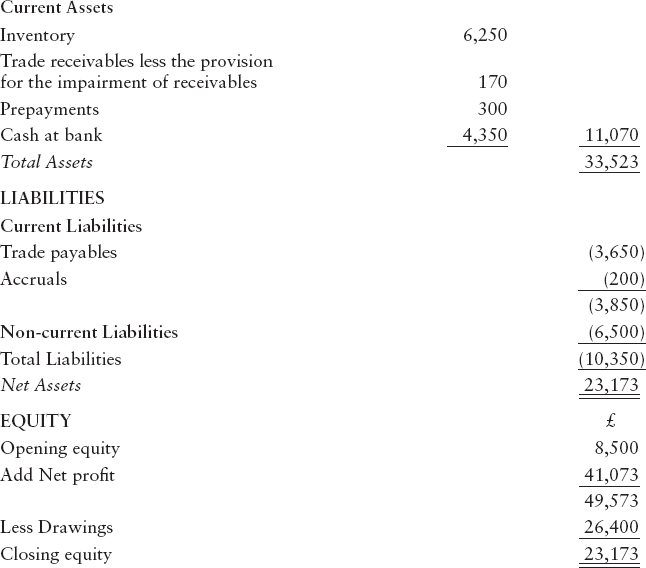

| A2 | Profit is indeed a linking figure. The net profit figure from the income statement links to the profit figure recorded under equity in the statement of financial position. In both the income statement and statement of financial position the profit is the balancing item. There are two ways of looking at profit. From the income statement perspective, profit is income less expenses. It is thus a residual figure. However, from the statement of financial position perspective it is the difference between opening and closing capital (i.e., opening and closing net assets). There is thus a potential clash (which is still unresolved by accountants) as to whether profit is a residual performance figure or the difference in net assets. |

| A3 | The trial balance is an outcome of the double-entry process. Double-entry dictates that for every debit there is an equal and opposite credit, the trial balance thus balances. However, the double-entry process does not capture all the relevant financial information. There are, for example, bills unpaid at the year end (i.e., expenses incurred, but not yet paid) or amounts prepaid (i.e., next year's expenses paid this year). These have to be matched to the current year. In addition, closing inventory may need to be taken into account. Finally, there is a need to provide for depreciation and doubtful debts. In all cases, to arrive at a true and fair view of financial performance we need to adjust for these items. The five main items we adjust for are closing inventory, accruals, prepayments, depreciation, and bad and doubtful debts. |

Chapter 6: Numerical Answers

| A1–A7 See Book Appendix for Answers. | |

| A8 | M. Atisse |

| A9 | C. Analetto |

| A10 | M. Angelo

|

| A11 | S. Eurat |

| A12 | R. Odin

|

| A13 | D. Urer |

| A14 | B. Ruegel |

Chapter 7: Discussion Answers

The answers below provide some outline points for discussion.

Chapter 7: Numerical Answers

Chapter 8: Discussion Answers

The answers below provide some outline points for discussion.

Chapter 8: Numerical Answers

| A1, A2 See Book Appendix for Answers. | |

| A3 | Picasso and Partners

|

| A4 | See Book Appendix for Answer. |

| A5 | B. Ridge Ltd

|

| A6 | See Book Appendix for Answer. |

| A7 | Brain

|

| A8 | See Book Appendix for Answer. |

Chapter 9: Discussion Answers

The answers below provide some outline points for discussion.

Chapter 9: Numerical Answers

| A1–A4 See Book Appendix for Answers. | |

| A5 | N.O. Hope Plc

Notes:

|

| A6 | Alpha and Beta Industries

We can perform our analysis in two stages: profitability and liquidity. For profitability, there is no doubt that on the two key measures, return on capital employed and net profit, Beta far outstrips Alpha. In both cases, Beta is twice as profitable as Alpha. Beta's dividend is also covered four times as opposed to Alpha's two. For liquidity, Alpha is stronger than Beta. However, even so, Beta's short-term solvency is not under threat. With a quick ratio of 1.3, Beta can still pay off its trade payables with ease. All things being equal, therefore, we would expect the share price of Beta, fuelled by its profitability, to be the highest. The higher P/E ratio may reflect the higher share price of Beta which has risen in anticipation of more steeply rising profits. |

| A7 | See Book Appendix for Answer. |

| A8 | Turn-a-Screw and Fix-it-Quick

The ratios below are calculated from the accounts. There is insufficient data for average values for return on capital employed and the efficiency ratios, the year end figure is therefore taken from the statement of financial position data. This is indicated by a single asterisk. Except where indicated, all calculations are in £000s.

Brief comments: Turn-a Screw is the more profitable of the two companies. Both the return on capital employed and net profit ratios are significantly higher than Fix-it-Quick.

Brief comments: Both companies are very quick at collecting money from trade receivables (only about 14 days). However, they both take over four times as long to pay their trade payables. Turn-a-Screw's inventory turnover is slower than Fix-it-Quick's. Finally, the asset turnover ratio for both is comparatively low. (c) Liquidity Ratios

Brief comments: Neither company is particularly liquid. The current ratio is just over one for each, with current liabilities just being covered by current assets. However, the quick ratio is under 1. Therefore, if all current trade payables wanted their money at once, there would be insufficient trade receivables and cash.

Brief comments: Fix-it-Quick is slightly more highly geared than Turn-a-Screw. However, in both cases almost one pound in three comes from third party borrowing. (e) Investment Ratios

†Calculations in pence. Brief comments: Both companies have comparable dividend yields, price earnings and dividend cover. However, the earnings per share of Turn-a-Screw is significantly higher. Turn-a-Screw also has a much higher interest cover. Overall Comment: There are many similarities between the two companies. However, Turn-a-Screw is relatively more profitable and looks a better investment. |

| A9 | Report on Sunbright Enterprises Plc Financial Performance

1.0 Terms of Reference Mr Pocket has requested a report on the financial results of Sunbright Enterprises, using appropriate ratio analysis. 2.0 Introduction The income statements and statements of financial position of Sunbright Enterprises were used to calculate three profitability ratios, four efficiency ratios, two liquidity ratios, a gearing ratio and five investment ratios. The calculations underpinning these ratios are presented in the Appendix. In calculating these ratios, it is assumed that there have been no major changes in accounting policies. The main results are discussed below. 3.0 Profitability Over the last five years there has been a sharp decline in all three ratios. Return on capital employed has slumped from 29.6% in 2008 to 9.4% in 2012. Gross profit and net profit have similarly fallen from 40% to 25%, and from 8.1% to 3.3%, respectively. The business appears to be in great difficulty. 4.0 Efficiency The trade receivables and trade payables collection periods have both increased. However, whereas trade receivables are taking marginally more time to pay (increase from 20.6 to 23.9 days), trade payables are now having to wait much longer. This may be indicative of the cash flow problems the business appears to have. The inventory turnover ratio has declined markedly from 49.7 times to 26.7 times. However, inventory is still turned over twice per month. The asset turnover has gradually fallen from 3 times in 2006 to 1.95 times in 2011. This shows that the business is being run less efficiently. 5.0 Liquidity The current ratio has steadily declined. In 2008, there were twice as many assets as liabilities (1.94). But now there are barely enough assets to cover liabilities (1.00). Given the steady downward trend in liquidity, this situation is alarming. In addition, the quick ratio is declining rapidly. There has been a particularly sharp decline over the last year. Should short-term trade payables demand payment at once, Sunbright Enterprises will not have the resources to cope. 6.0 Gearing The gearing ratio has declined steadily from 33% in 2008 to 28% in 2012. This is positive. In other words, out of every £1, 28 pence has been borrowed. This is reasonably low. Sunbright Enterprises could, therefore, solve its short-term liquidity problems by borrowing. 7.0 Investment The dividend cover and interest cover ratios have slumped from a coverage of 4.8 and 17.1 times in 2008 to 1.3 times and 5.4 times in 2012, respectively. However, perhaps in an effort to bolster confidence, the dividend has been increased so that dividend yield has actually increased from 9%to 12.3%. This is generally better than one could get in the building society. Earnings per share (EPS) reflect the general slump in profitability. EPS has fallen sharply from 48.4 pence to 14.7 pence. Perhaps surprisingly the share price has not dropped as rapidly as one might expect. Therefore, the price/earnings ratio has held up surprisingly well at 6.5. 8.0 Recommendations and Conclusions Sunbright Enterprises is struggling. Its profitability is falling rapidly and it has liquidity problems. While it is paying a high dividend, it is a very risky investment. A short-term solution to liquidity problems would be to borrow using loan capital. However, there appear to be deeper structural problems. In my view, the share price is still artificially high and I would not invest. Appendix: Calculation of Ratios The ratios below are calculated from the accounts. For the efficiency ratios and ROCE, where available, the average of two years is taken for years 2008–2012. For 2008, only one year's data is available. This is indicated by an asterisk. Except where indicated calculations are in £000s.

2 Efficiency Ratios 3 Liquidity Ratios

4 Gearing

5 Investment Ratios

†calculation in pence |

SECTION B: FINANCIAL ACCOUNTING: THE CONTEXT

These suggested answers are for the end of chapter questions that appear in black in the book.

Answers to questions in blue are in the appendix section of the book for students to access.

Chapter 10: Discussion Answers

The answers below provide some outline points for discussion.

| A1, A2 See Book Appendix for Answers. | |

| A3 | The regulatory framework has evolved over time. It fulfils a need. The need is to provide a level playing field to balance the needs of the various parties interested in financial reporting. The preparers’ self-interest is to prepare accounts which put themselves in a good light. By contrast, the users (for example, the shareholders) require information that provides a ‘true and fair view’ of the company. Finally, the auditors, given the flexibility of accounting, want some guidelines on how the accounts should be prepared. They can then use these guidelines to stand up against the managers, if necessary. The regulatory framework thus provides a set of rules that all interested parties can turn to for guidance. The regulatory framework is thus the ‘referee’ of the accounting world, aiming to see fair play. |

| A4 | Mandatory information is information that the companies must provide, for example, a statement of financial position or an income statement. However, many companies provide extra financial and non-financial information. This is for several reasons. First, if all other companies are providing this information they may feel that this information is the ‘norm’. An example of this is the chairman's statement – a report by the chairman of a company on the year's activities. Although not a mandatory requirement, all companies traditionally provide this statement. Second, the disclosure of voluntary information may signal to users that the company has nothing to hide and, therefore, is a good investment. Third, the provision of voluntary information may signal that the company is progressive and a leader in financial communication. |

| A5 | A conceptual framework is a theoretical basis for accounting. Essentially, it is the development of a coherent and consistent set of accounting principles which underlie the preparation and presentation of financial statements. Various bodies, such as the Financial Accounting Standards Board in the US, the Accounting Standards Board in the UK and the International Accounting Standards Board, have attempted to develop a conceptual framework.

If a conceptual framework were to be successfully developed then it would be possible to set accounting statements with reference to the conceptual framework and to use it to solve accounting problems. Unfortunately, the development of the conceptual framework has been dogged by controversy. Critics argue it has been largely unsuccessful. While it has produced the ‘decision-making model’ (i.e., the objective of accounting is to provide users with information so that they can make economic decisions), there is still no agreement on an appropriate measurement model. |

Chapter 11: Discussion Answers

The answers below provide some outline points for discussion.

| A1, A2 See Book Appendix for Answers. | |

| A3 | A capital maintenance concept is a way of maintaining the capital of a business. Capital can be viewed in two ways: financial capital and physical capital. Financial capital is primarily the maintenance of the net assets of the business. This can be measured in nominal pounds (i.e., historical cost, not adjusted for inflation) or in inflation-adjusted pounds (i.e., current purchasing pounds). Physical capital, by contrast, stresses the operating capacity of the business. It is associated with a current cost measurement system and with monitoring the operating capacity of a business in real terms. This could be replacement cost, realisable value, fair value or present value. |

| A4 | UK accounting is governed by the ‘true and fair view’ concept. For UK companies, historical cost, it is believed, does not give a realistic view of the current value of property, plant and equipment in the statement of financial position. Many companies revalue their property, plant and equipment so that they more closely approximate to current market value. The initial impact of revaluing property, plant and equipment is to increase the property, plant and equipment figure in the statement of financial position and to increase the equity of the company. The ongoing impact, however, is to reduce profit. This is because depreciation is based on the revalued amount of the property, plant and equipment which is usually higher than historical cost.

For example, suppose the historical cost of property, plant and equipment was £100,000 and the property, plant and equipment were depreciated over 10 years, with a profit of £20,000. Profit after depreciation would then be the profit of £20,000 less the depreciation of £10,000 (£100,000 ÷ 10), equals £10,000. However, if property, plant and equipment were revalued, say to £150,000, depreciation would rise to £15,000 and profit after depreciation would fall to £5,000 (£20,000 profit less £15,000, i.e., £150,000 ÷ 10). The practice of revaluing property, plant and equipment is not universal internationally, because very few countries revalue their property, plant and equipment. Some countries, like the US, prefer to adopt unmodified historical cost accounting when accounting for property, plant and equipment. Revaluations are, however, permitted under IFRS. |

Chapter 12: Discussion Answers

The answers below provide some outline points for discussion.

| A1, A2 See Book Appendix for Answers. | |

| A3 | A choice of the six most important sections of the annual report is very subjective. In other words, students can choose any six as long as the choice can be sensibly defended. This is fine. My choice is given below. However, this is not definitive!

(i) Income Statement This gives the annual financial performance. This is of key importance in determining how the company has performed and is the key factor influencing the share price of a public limited company. (ii) Statement of Financial Position Although it does not provide a market valuation of the company, it does allow one to judge the liquidity and the gearing. (iii) Statement of Cash Flows Cash is king. So this statement allows a good assessment of how well the company is generating cash and how cash-rich it is. (iv) Chairman's Statement Provides the company's view of events in a narrative, story-like fashion. Users must be careful to look for bias, but it does provide a quick, relatively understandable overview. (v) Business Review Provides a stylised and structured look at the year's activities. Essential, in order to gain an overview of the company. (vi) Historical Summary Puts the results in a historical context. Enables trends over time to be established. |

| A4 | Companies prepare group accounts because they reflect economic reality. Most major international companies operate as groups. These groups comprise many companies. Some group companies are subsidiaries (i.e., where greater than 50% of the shares are held by the parent company) and some are associates (i.e., where between 20% and 50% of shares are held by the parent company). In order to arrive at a realistic view of corporate performance the total results of the group must be considered. Group accounts do this by combining the income statements and statements of financial position of the individual companies. |

| A5 | Impression management is the process whereby individuals attempt to influence the opinions of others in their favour. For example, candidates at interview may attempt to impress the interviewers by stressing their good points or omitting/downplaying their bad points. Impression management is thus a natural expression of the fact that we are all human and wish to give a favourable impression of ourselves. In the case of the annual report, there is usually a temptation for managers to try to set the agenda. First, they may wish to look good in the eyes of the shareholders or with the general public. Second, their jobs and remuneration may depend on convincing the shareholders that they are doing a good job. Their pay may, for example, be performance related. Bigger profits may mean bigger bonuses. There is thus an incentive to indulge in creative accounting. |

Chapter 13: Discussion Answers

The answers below provide some outline points for discussion.

| A1, A2 See Book Appendix for Answers. | |

| A3 | The group likely to be strongly in favour is the managers. Managers like creative accounting because it enables them to serve their own interests. They can use the flexibility within accounts, for example, to smooth profits, flatter profits or manage gearing. Existing shareholders may also support creative accounting. This is because often the managerial strategies, such as profit smoothing, will keep the share price high. This will benefit them. Regulators, by contrast, are likely to be against creative accounting. This is because it undermines the idea of a true and fair view. If creative accounting takes hold it will destroy the credibility of accounting. In short, bad accounting will drive out good accounting. Other users (such as employees, the tax authorities, banks or the government) are also likely to want neutral and unbiased information. They, too, will be against creative accounting. |

| A4 | Managers may well be interested principally in short-term remuneration and long-term job security. Remuneration may consist, in part, of profit-related bonuses or share incentives (such as profit-related shares or share options). The short-term interests of the managers are, therefore, best served by managerial strategies such as profit maximisation or profit smoothing. The managers’ longer-term interests may also involve a strong share price to stop unwelcome take-overs. |

| A5 | In many ways, creative accounting is an unwanted consequence of the flexibility within accounting and the short-term pressures upon management to meet the expectations of the stock market. As long as these pressures remain, creative accounting is likely to remain. It is unlikely, in my view, that creative accounting will ever be stopped by regulation. As new regulations emerge, then creative accountants will find ways around them. Regulation will probably make creative accounting schemes more complex; however, it is unlikely to stop them completely. |

| A6 | One possible revised income statement might look as follows:

Notes:

|

Chapter 14: Discussion Answers

The answers below provide some outline points for discussion. However, they should not be taken as exhaustive or prescriptive. International accounting is a topic that is very fluid and open to interpretation.

| A1 | The world is becoming global. Trade and investment are international. It is rare nowadays for leading national companies not to trade overseas. For example, British multinationals, such as British Petroleum, have subsidiaries overseas, while overseas companies, such as Exxon, have subsidiaries in the UK. There is thus a need to study accounting in a wider context. If trade and investment are worldwide, then the study of accounting must also be international. It is, for example, important to realise that if we used US Generally Accepted Accounting Principles (GAAP) we would arrive at a different figure for profit and net assets than if we used UK GAAP. It is also important to appreciate that the European Union and the International Accounting Standards Board are now important forces in world accounting. They shape accounting, theory and practice, in the UK. There is also little doubt that their influence is likely to grow in the future. Finally, a study of international accounting allows the special features of one's own country's accounting (such as the periodic revaluation of property, plant and equipment in the UK) to be identified. Studying the accounting practices of other countries may also show how accounting in one's own country can be improved. |

| A2, A3 See Book Appendix for Answers. | |

| A4 | It is always thought-provoking, but extremely difficult, to rank the divergent forces in order of importance. There is no one right answer. Taking the UK, in my opinion, perhaps one could rank the divergent forces as follows:

|

| A5 | If we take the divergent forces individually.

Culture and spheres of influence are not very relevant here. So overall, the answer is yes! |

| A6 | The divergent forces are those that make accounting in each country different. They cause accounting to reflect each country's individual circumstances. However, the need for comparability across countries appears to be ever more insistent. International trade and investment increasingly cause pressures for convergence. Multinational companies, the International Organisation of Securities Commissions (IOSCO), international investment institutions, and international accounting firms are all pressing for convergence. At the European level, these pressures are reflected in the activities of the European Commission, particularly in the implementation of the Fourth and Seventh Directives. At the international level, the International Accounting Standards Board (IASB) in conjunction with IOSCO is working for a set of international standards. Moreover, the European Union has backed the use of International Accounting Standards. Certainly, for large multinational companies these pressures for convergence seem unstoppable. However, at the moment domestically-listed companies and smaller non-listed companies, partnerships and sole traders are likely to continue using national Generally Accepted Accounting Practices. In the UK, however, the UK's Accounting Standards Board is now recommending that publicly accountable entities adopt IFRS. |

SECTION C: MANAGEMENT ACCOUNTING

These suggested answers are for the end of chapter questions that appear in black in the book.

Answers to questions in blue are in the appendix section of the book for students to access.

Chapter 15: Discussion Answers

| A1 | See Book Appendix for Answer. |

| A2 | The costing image has traditionally been associated in the UK with manufacturing industry. There are several reasons why management accountants may have wanted to lose this image. First, in the UK, manufacturing industry has always been looked down on compared with the professional classes and the landed gentry. Costing being associated with manufacturing has thus been tarnished. Second, costing has always been seen as a relatively low-grade profession. It is routine and involves little judgement. Third, management accounting, particularly strategic management accounting, has a much wider focus compared with costing. Whatever the reason, management accountants have steadily moved away from their costing origins. This is reflected in the successive names of their Institute:

|

| A3 |

(a) Direct costs are those costs (such as direct materials or direct labour) that can be directly charged to a product or service. They represent a key element in the overall cost of a product or service. (b) Indirect costs (often called period costs) are those costs such as production overheads, selling and distribution costs or administrative costs that cannot directly be charged to a product or service. They are more difficult to recover into the cost of a product or service than direct costs. (c) Fixed costs are overheads that do not vary with the level of production or revenue. When making short-term operational decisions (such as making more or less of a product) these costs will not vary. They are, therefore, irrelevant to the decision. (d) Variable costs are overheads that do vary with the level of production or revenue. They should, therefore, be taken into account when making a short-term operational decision. They are relevant to the decision. (e) Standard costs are costs of a product or service that are estimated in advance. When the actual cost of the product is known it is compared with the standard cost. Any differences are known as variances and can be investigated. |

| A4 | The toolkit analogy is a good one. The management accountant faces many problems. They range from at what price to sell a particular product to whether or not to diversify internationally. These diverse problems cannot all be solved through the use of one standard technique. There are, in effect, numerous techniques. In costing, for example, there are a range of techniques that apply absorption costing, such as job costing, batch costing, or process costing. In short-run decision making, there is break-even analysis, and contribution analysis. Meanwhile, in long-term decision making, there is capital budgeting. |

| A5 | The concern of management accountants with costs has led to them being seen primarily as cost cutters. Cost cutting makes the business more efficient. If revenue remains the same, reducing costs will boost profit. However, essentially it is a negative strategy. A more positive strategy is to expand and boost revenues through more sales. This is revenue maximisation. Revenue maximisation might involve entering new markets, or exploiting new products or existing customer databases. The aim is to expand revenue and thus create more profits. It does not matter if costs increase as long as revenue rises faster. |

| A6 | See Book Appendix for Answer. |

Chapter 16: Discussion Answers

The answers below provide some outline points for discussion.

| A1 | See Book Appendix for Answer. |

| A2 | Traditional product costing was developed during the industrial revolution. Manufacturing industry was predominant. The factories were characterised by a huge capital investment in machinery and a large workforce. Traditional product costing is characterised by huge quantities of direct labour and direct material. Overheads were relatively small. So it made sense to recover these overheads using volume measures such as machine hours or labour hours.

Over the last generation, however, there has been a marked shift in the economic base of developed countries. Manufacturing industry is less dominated by direct labour. Service industries (such as those concerned with finance, marketing, transport, and the Internet), have grown in importance. These industries do not employ huge quantities of direct labour, do not manufacture products nor have large capital investments in machinery. Traditional product costing thus becomes less appropriate. In these industries, new methods of recovering overheads are needed. Thus, we have activity-based costing, which strives to recover overheads according to their relationship with activities, rather than volume-driven production measures. Activity-based costing identifies factors that influence cost and seeks to recover costs using these factors. |

| A3 | Overhead recovery is certainly the most difficult part of cost recovery. The recovery of direct expenses is relatively simple. As their name suggests, they can be directly traced to the product or service. However, with overheads the problem is more complex. First of all the total overheads must be ascertained. This will often involve estimating them in advance. The next stage is also difficult: allocating them in a meaningful way to goods or services. This is particularly true when there are many different overheads and multiple products. |

| A4 | A key problem in setting a price for a product or service is the potential mismatch between the costs of the product or service and the price that customers will pay for them. If market pricing is adopted the danger is that the costs of the product will exceed the market price. If cost-plus pricing is used then this may not be realistic given the market. Target costing seeks to square the circle. First, the market price is established. Second, a target cost price is established with reference to the market price. Third, the costs of making the product or service are re-engineered in order to meet the target cost. In essence, therefore, target costing does try to combine the best of market and cost-plus based pricing. |

| A5 | See Book Appendix for Answer. |

Chapter 16: Numerical Answers

| A1–A3 See Book Appendix for Answers. | |

| A4 | Flight

|

| A5 | Spicemeals Catering

|

| A6 | Supertab |

| A7 | Dodo Airways

We can solve this using the formula below. It should, however, be noted that there are many alternative permissible formulas.

|

| A8 | See Book Appendix for Answer. |

| A9 | Rugger

(ii) Activity-Based Costing

There is a big difference on the cost of the Conversion, which is a low-volume product. The Conversion costs are £165.15 using activity-based costing, but £144.60 using traditional cost recovery. In particular, inspections and stores requisitions are costly. This would make an important difference when setting a selling price. |

Chapter 17: Discussion Answers

The answers below provide some outline points for discussion.

| A1 | See Book Appendix for Answer. |

| A2 | ‘Cash is king’ This old adage stresses the importance of cash to a business. Cash is needed to pay for goods and services, to pay the wages, to pay for capital expenditure and to pay individuals. Without cash a business will go bankrupt, unable to pay its trade payables. Given the central role that cash and the generation of cash play in a business, the cash budget is a crucial forecasting device. It tells the business whether or not it has enough cash for the next period. If there is too much cash, the surplus can be invested. If too little, then borrowing can be arranged. The importance of the cash budget is demonstrated by a bank's insistence on a business cash forecast before it will lend money to a business. |

| A3 | Budgeting, at one time, was thought of as primarily a technical activity. It was a way of planning for the future. However, important behavioural consequences of budgets have been increasingly recognised. This is because budgets measure performance. The performance of a business reflects upon the individuals in the business. Therefore, it is in the individuals’ interest to manage the ‘budget’ in their favour. Individuals within a business will adopt budget management strategies. These include padding the budget at the budget-setting stage so that they create a buffer of ‘budgetary slack’. This enables them to meet budgetary targets without being under too much pressure. Alternatively, if performance against budget is the basis of an individual's bonus, individuals may have incentives to plan their expenditures in order to maximise their bonus. This is sometimes known as creative budgeting. |

| A4 | See Book Appendix for Answer. |

Chapter 17: Numerical Answers

| A1 | See Book Appendix for Answer. |

| A2 | John Rees

|

| A3, A4 See Book Appendix for Answers. | |

| A5 | T. Iger

|

| A6, A7 See Book Appendix for Answers. | |

| A8 | F. Ox

|

| A9 | Asia |

| A10 | Peter Jenkins

For the maximum bonus take all the revenue and all the discretionary costs in different quarters (for example, quarters 2 and 4).

Peter's bonus will thus be 10% of quarter 4's result (a profit of £95,500) and is, therefore, £9,550. For the minimum bonus spread the costs evenly.

Peter's bonus is nil because he has failed to make a profit of more than £8,000 in any quarter. He will, therefore, try to adopt the first scenario, even if it has dire consequences for the firm. |

| A11 | See Book Appendix for Answers. |

Chapter 18: Discussion Answers

| A1 | See Book Appendix for Answer. |

| A2 | Standard costing is very good at breaking down the individual elements of a product or service into easily ascertainable amounts. This enables the standard quantities to be compared with the actual quantities, and the standard prices to be compared with the actual prices. Therefore, it enables quite detailed variances for both price and quantity to be established. This enables detailed monitoring to be carried out. Variances can be tracked to individual managers who are responsible for them.

This is fine, in theory. However, in practice, individuals often feel threatened by such detailed monitoring. This is particularly true if the original standards have not been set very accurately or without consultation. If the original standards are too lax, individual employees may not need to try too hard to meet the standards. If the original standards are too harsh, then the individual employees may consistently miss the targets and become demotivated. |

| A3 | Standard costing performs both functions. Essentially, standard costing is about closely monitoring the individual elements of a product or service. Standard costs set down predetermined standards for price and quantity. Variances from these standards are then investigated. In this way, costs are controlled. Human behaviour is also controlled since managers will be responsible for keeping to the predetermined targets. Standard costing may also be about motivation, if the targets set are attainable with effort. This may motivate employees to achieve them. However, there is the danger that employees may find standards constricting and the standards may then be demotivational. It is hard to state universally whether standard costing is more about control than motivation because both coexist. |

| A4 | The initial standard-setting process is indeed the key to the successful operation of standards. Initial standards can be ideal (i.e., attainable in an ideal world), attainable (i.e., reached with effort), or normal (i.e., normally attained). The best for motivational purposes are probably the attainable standards. To ensure a fair set of standards it is essential that standards are agreed by all parties and not imposed. Employees who are expected to meet the standards should discuss the standards with the managers and industrial engineers who set them. If there is agreement at the start of the process that the standards are fair and realistic, then this will ensure that the employees are not alienated. If they feel alienated at the start, then there is every danger they will become resentful and demotivated by the standards. |

| A5 | See Book Appendix for Answer. |

Chapter 18: Numerical Answers

| A1 | See Book Appendix for Answer.

*The sales price variance is £3,200 unfav. The overall cost variances are direct materials variance £9,200 fav., labour cost variance £11,960 fav., £320 unfavourable variable overheads cost variance, and £2,000 unfav., fixed overheads variance. **Remember, fixed costs remain unchanged whatever the level of activity, we do not, therefore, flex them.

Note this is simply the flexed profit (£36,160) less the original budget (£26,500) = £9,660 Fav. (iv) Sales variances 3,500 more widgets were sold than anticipated causing the sales quantity variance. However, each widget sold for £0.20 less than anticipated creating the adverse sales price variance. Material cost. We paid £9,200 less than expected. This may be due to more competitive prices or decreased quantity used. We need more information on this. Labour cost. We paid £11,960 less than expected. Either we paid less per hour or we used fewer hours than expected. We need more information. Variable overheads. This was £320 Unfavourable. We either incurred more overheads or recovered more into our products. We need to look at how we recovered variable overheads. Fixed overheads These were £2,000 more than expected. We need to know why. |

| A3, A4 See Book Appendix for Answers. | |

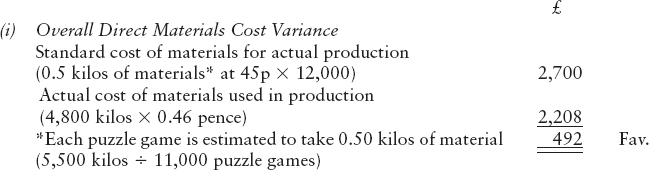

| A5 | Toycare |

| A6 | See Book Appendix for Answer. |

| A7 | Special Manufactures |

| A8 | See Book Appendix for Answer. |

| A9 | Supersonic

(iv) The actual profit for Supersonic is £125,500 (£686,500 − £561,000) more than budgeted. Supersonic has actually sold 4,000 assembly mountings less than anticipated, creating an unfavourable sales quantity variance of £31,950. By contrast, there is a favourable sales price variance of £91,200 as each assembly mounting has sold for £20.00 not £18.80. On the cost variances, there is an unfavourable direct materials price variance (£15,000) as the sheets are more expensive than anticipated. However, less sheets were used than anticipated, possibly because they were of better quality. There is thus a favourable quantity variance of £84,000. The labour price variance of £25,500 is favourable since Supersonic paid £7.50 per hour rather than the budgeted £8.00. However, perhaps because an inferior quality of labour was used, the number of hours increased creating an unfavourable quantity variance of £28,000. For variable overheads, less overheads than anticipated were incurred creating a favourable price variance of £4,900. As more labour hours were used, more overheads were recovered into the product causing an unfavourable quantity variance. Finally, fixed overheads were more than anticipated. |

Chapter 19: Discussion Answers

The answers below provide some outline points for discussion.

| A1 | See Book Appendix for Answer. |

| A2 | Contribution per unit is simply the selling price per unit less the variable cost per unit (direct materials, direct labour and variable overheads). It proves a useful concept because it enables us to compare directly the contributions made by different products or services. It also enables us to determine the break-even point and to carry out ‘what-if’ analyses. These are where we change the assumptions underlying the production and revenue models. For example, we might increase selling price or decrease production volume. What-if analysis is often done on computer spreadsheets and is a very powerful tool. |

| A3 | The strengths of break-even analysis are that it is relatively simple to carry out and relatively easy to understand. The problems lie in the implicit assumptions. For example, revenue is assumed to be linear (in other words, if we sell 10 units at £100, it is assumed we will sell 100 units for £1,000). In practice, many companies will reduce their price to sell more. In a similar way, variable costs may not necessarily be directly variable. If we purchase more direct material we may get it cheaper. Finally, fixed costs may vary over the medium term. |

| A4 | See Book Appendix for Answer. |

Chapter 19: Numerical Answers

| A1 | See Book Appendix for Answer. | ||||||||

| A2 | Riskmore

It seems that all the divisions are making a positive contribution, except for miscellaneous. However, the car division is actually the most profitable. Certainly, Riskmore should consider shutting down the miscellaneous division and increase profits to £55,000 (contributions from Car [£55,000], Home [£35,000] and Personal [£15,000] = £105,000 less fixed costs of £50,000). Perhaps it should also focus even more on the car division. However, Riskmore should be careful that shutting the miscellaneous division will not have a knock-on effect on the other divisions. |

||||||||

| A3 | See Book Appendix for Answer. | ||||||||

| A4 | The Open Umbrella

The short way of doing this is by just dividing the contribution by the number of labour hours. Therefore, Kiosk 1 (£55 ÷ 35) = £1.57; Kiosk 2 (£115 ÷ 55) = £2.09 Alternatively, we could calculate in full.

To maximise contribution over 70 hours, fully open Kiosk 2 and use remaining hours for Kiosk 1. This is because there is a higher contribution for each labour hour for Kiosk 2.

Total contribution for both kiosks is therefore £138.50 (i.e., Kiosk 1 £23.55 plus Kiosk 2 £114.95). |

||||||||

| A5 | Globeco

We can calculate the overall contribution and then divide by the number of labour hours used.

(ii) Contribution per labour hour

(iii) Labour hour to make each unit

(iv) Therefore, to use the available 1,500 hours, we need to allocate them up to the maximum revenue in the order France, Germany, UK and US. This order reflects the order of decreasing contribution per labour hour and will give maximum total contribution. *This is calculated by deduction. So far for France, Germany and the UK we have used 1,375 hours. We have 125 hours left of the 1,500 hours available. Each product for the US takes 0.26 labour hours. Therefore, we can make 481 US board games. |

||||||||

| A6 | See Book Appendix for Answer. | ||||||||

| A7 | Colin Xiao

(i) Contribution per unit (i.e., sales less variable cost per unit) |

||||||||

| A8 | See Book Appendix for Answer. |

Chapter 20: Discussion Answers

The answers below provide some outline points for discussion.

| A1 | See Book Appendix for Answer. |

| A2 | Whether or not management accountants should involve themselves in strategic matters has provoked much debate. For the Chartered Institute of Management Accountants (CIMA), there seems little doubt. Strategic management accounting is a welcome development. It continues the long march of management accountants away from costing. The forerunner of the current management accountant was the cost clerk. Cost clerks had little status or authority. Gradually, the cost clerk evolved into the cost accountant. In turn, the management accountant replaced the cost accountant. Finally, it is the turn of the strategic management accountant. In each case, a wider redefinition of management accounting subsumed the earlier job. Thus, the management accountant performed costing duties as well as more high-level decision making. In the same way, CIMA appears to favour strategic management accounting subsuming the narrow management accounting role.

However, strategic management accounting is not without its critics. Some see it as a step too far. These critics fail to see the accounting input or the particular skills that management accountants can offer. They view strategic management accounting rather as a collection of techniques and ideas borrowed from other disciplines with little relevance to the day-to-day work of the management accountant. |

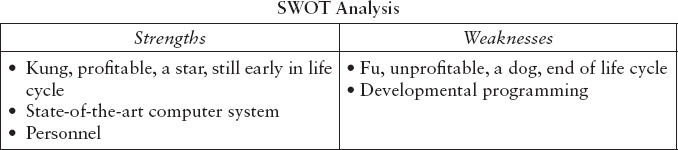

| A3 | Strengths and weaknesses of six techniques |

| A4 | There is not really an easy answer to this. Using internal resources such as expanding existing product ranges or markets is obviously a sure and steady way of building up the business. The advantage is that you build on existing strengths, but the disadvantage is that it can be quite slow. Internal growth is a reasonably conservative method of corporate expansion.

By contrast, external growth is a much faster way to expand. You effectively take over existing businesses and utilise their resources. However, taking over other businesses can be risky. It is important to evaluate them carefully so that, like any purchase, you know what you are buying. Although the potential gains of external growth are great, the risks can be high. This is especially true when expanding overseas. |

| A5 | See Book Appendix for Answer. |

Chapter 20: Numerical Answers

| A1, A2 See Book Appendix for Answers. | |

| A3 | Computeco |

| A4 | Regional Railway Company

|

| A5 | Feel Good

(i) You would target the following groups: age over 40 (particularly 60+); those living in the North and South (particularly the South); females; viewers of BBC; and readers of the Daily Mail. (ii) You would need more information about the interconnectedness of these groups. For instance, could we narrow down the target market to females over 40, living in the South? (iii) By targeting the Mail and Express we will maximise our target audience. It is not worth using television advertising, because the majority of the targeted customers watch BBC, which does not take advertising. |

Chapter 21: Discussion Answers

The answers below provide some outline points for discussion.

| A1 | See Book Appendix for Answer. |

| A2 | The problem with capital investment appraisal is that it involves looking into the future. The future is very difficult to predict. Therefore, it is very hard to forecast future cash flows. For example, market demand may vary or inflation may occur. Moreover, it is extremely difficult to accurately predict any future discount rate. For this reason, capital investment appraisal is often akin to crystal ball gazing. To remove the potential uncertainty, sensitivity analysis may be undertaken. This seeks to model future scenarios by varying the underlying assumptions of the potential alternative projects. |

| A3 | The five main capital appraisal techniques, with specific advantages and disadvantages are summarised below.

|

| A4 | Time is money because you can earn money by investing it over time. Or to put it another way £100 today is not the same as £100 in five years’ time. Time, therefore, has a monetary value. To establish this you need to know the appropriate cost of capital. For example, if a company can borrow capital at 10% per year, £100 now is worth £110 in a year's time! The difficulty with estimating cost of capital is that it is largely determined by interest rates. These, in turn, depend on economic factors. These are difficult to predict accurately. |

| A5 | See Book Appendix for Answer. |

Chapter 21: Numerical Answers

| A1–A3 See Book Appendix for Answers. | |

| A4 | Choosewell

*Cash flows are simply cash inflows less cash outflows. Profit is cash flow less depreciation, which is £7,500 per year (initial capital outlay £30,000 ÷ 4 years) for Ready, and £3,750 per year (initial capital outlay £15,000 ÷ 4 years) for Steady and Go. Therefore, for Ready year 1 profit is £12,000 cash flow less £7,500 depreciation = £4,500.

Here we calculate when the cumulative cash flows cover the initial capital outlay. Ready is the best project under this criterion. (ii) Accounting rate of return

Using this criterion we would choose Steady and Go as they have higher returns. (iii) Net present value

Ready has a NPV of £3,451 which is less than the combined NPVs of Steady and Go of £4,745 (£2,302 and £2,443). We would, therefore, choose to invest our £30,000 in Steady and Go. (iv) Profitability index

This shows that Steady and Go have a higher profitability index. We would invest in them. (v) Internal rate of return (IRR) Choose a 20% discount rate to arrive at a negative NPV.

Calculate IRR, using formula:

Therefore, as Choosewell's cost of capital is 9%, which is less than these rates, we could undertake all the projects if funds were not limited at £30,000. As we have to choose either Ready or Steady and Go, we would choose Steady and Go as they have the highest IRRs. Overall, we would probably choose Steady and Go because they were best using accounting rate of return, net present value, profitability index and IRR. If we were just looking for a very quick return we might choose Ready as it has marginally the best payback period. |

| A5 | Manpool

(i) Deciding which stadium and which rate using net present value The Superbowl stadium makes the best returns. Manpool should build it as long as it can borrow funds at 5% or 8%, but not at 10 %. (ii) Internal rate of return (IRR) We can calculate the IRR by looking for discount rates that give a positive and negative NPV. For both Bowl and Superbowl, 5% gives a positive NPV, while 10% gives a negative NPV. Then, we use the formula (in £000s):

Therefore, if borrowing money at 5% (option (a)), both stadiums would be financially viable. However, if we could borrow money at 8% (option (b)) we should only consider Superbowl. Under option (c) borrowing at 10 %, we should build neither stadium. Overall, Superbowl looks the best project as it has the highest IRR and better NPVs. |

| A6 | Myopia

Calculate cash flows and accounting profit before interest and taxation.

(i) Payback When do the cumulative cash outflows reach £700,000? After four years cash flows are £632,844. Therefore it is 4 years + (£67,156/£157,139) = 4.43 years (ii) Accounting rate of return

*Note, we exclude the final cash inflow from our calculations.

The NPV is £62,597 at 10% so we can go ahead with the project. (iv) Profitability Index

Using Myopia's cost of capital, we have:

Its profitability index is, therefore, 1.09. The project can be accepted. (v) Internal rate of return (IRR). To calculate the IRR, we need discount rates which give positive and negative NPVs. We use the formula:

Therefore, as Myopia has a cost of capital of 10% it would be worthwhile undertaking the project. |

Chapter 22: Discussion Answers

The answers below provide some outline points for discussion.

| A1 | See Book Appendix for Answer. |

| A2 | Working capital is, in essence, the short-term, operational capital of a firm. It consists of current assets (inventory, trade receivables and cash) less current liabilities (trade payables). A company may use certain management techniques to use its working capital as efficiently as possible. It may also raise short-term finance. We will look at the individual elements of working capital separately: cash, trade receivables and inventory. Cash is essential to a firm's survival. A company may, therefore, have a bank overdraft which will ensure that it can draw upon cash when needed. Alternatively a company may take out a bank loan. For trade receivables, a common management technique is the trade receivables’ collection model. This determines the optimal level of credit to ensure a firm's maximum contribution. A company may also raise money against its trade receivables by using debt factoring or invoice discounting. This involves borrowing money against future receipts from trade receivables. Finally, for inventory, a company may use the economic order quantity to minimise the costs of ordering inventory. Alternatively, a firm may attempt to minimise its stockholding through just-in-time inventory management. In certain circumstances, a firm may raise money against its inventory (e.g., by sale and leaseback). |

|

|

|

| A4 | The weighted average cost of capital (WACC) is the effective rate at which a company can finance its operations. The WACC is the average of the different rates of interest or dividend that a firm has to pay out. If a firm has two equal sources of funding, say £500,000 market value in equity (ordinary shares) and £500,000 market value in long-term loans with a rate of dividend of 15% and a rate of interest of 10%, respectively; the cost of capital would be 12.5%. This is the average of the cost of equity capital (15%) and the cost of debt capital (10%).

It is an important concept because when assessing future capital investment you need to take into account the weighted average cost of capital. It is futile to invest in a project with an investment return of 10%, when you must borrow money at 15% to fund it. Firms strive for an optimal cost of capital. |

| A5 | See Book Appendix for Answer. |

Chapter 22: Numerical Answers

| A1 | See Book Appendix for Answer. |

| A2 | Bookworm

|

| A3 | Winter Brollies

Thirty days credit, therefore, maximises contribution because the revised contribution of £98,833 is the highest. |

| A4 | See Book Appendix for Answer. |

| A5 | Nebula

|