Chapter 15

Introduction to management accounting

‘Jones was loyal to his staff, and diplomatic, but clearly had been bewildered by what he found when he arrived. “Well, we've only just got an audited balance sheet [statement of financial position] for 1998,” he said, “We just don't have any contemporary operating or financial data on which to make management decisions in this airline at the moment. It's the old garbage-in, garbage-out syndrome.” ’

Graham Jones commenting on the Greek airline company, Olympic Airlines

Source: Matthew Gwyther, Icarus Descending, Management Today, January 2000, pp. 52–3.

Learning Outcomes

After completing this chapter you should be able to:

- Explain the nature and importance of management accounting.

- Outline the relationship between financial accounting and management accounting.

- Explain the main branches of cost accounting and decision making.

- Discuss cost minimisation and revenue maximisation.

- Understand some of the major terms used in management accounting.

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

Chapter Summary

- Management accounting is the provision of accounting information to management to help with costing, with planning, control and performance and with decision making.

- Whereas the main focus of financial accounting is external, management accounting is internally focused.

- Management accounting has its origins in costing; however, nowadays costing is less important as new areas such as strategic management accounting develop.

- Management accounting can be broadly divided into cost accounting (costing; planning, control and performance) and decision making (short-term and long-term).

- Costing consists of recovering costs for pricing and for the valuation of inventory.

- Planning, control and performance are concerned with planning and controlling future costs using budgeting and standard costing as well as evaluating performance.

- Decision making involves short-term decision making, strategic management accounting, capital budgeting and sources of finance.

- Traditionally, management accounting has been criticised for focusing on minimising costs rather than maximising revenue.

- Increasingly, management accounting is making use of digital technology and sophisticated software applications.

Management Accounting

Why do you think management accounting is so called?

Management accounting is a relatively new term and has been in widespread use only since the 1950s. The term combines management and accounting. It suggests that accountants have a managerial role within the company. They are, in effect, more than just a functional specialist group. The term management accounting has come, therefore, to represent all the management and accounting activities carried out by accountants within a business. This involves not only costing, and planning, control and performance, but also managerial decision making.

Introduction

Management accounting is concerned with the internal accounting within a business. Essentially, it is the provision of both financial and non-financial information to managers so that they can manage costs and make decisions. In many ways, therefore, management accounting is less straightforward than financial accounting. Management accounting varies markedly from business to business and management accountants, in effect, carry around a toolkit of techniques, their ‘tools of the trade’. The purpose of this section is to try to explain these techniques and to fit them into an overall picture of management accounting.

Context

The management accountant works within a business. The focus of management accounting is thus internal rather than external. In this book, we simplify the formal definition (see Definition 15.1 on the next page) and take the purpose of management accounting as being to provide managers with accounting information in order to help with costing, with planning, control and performance and with decision making. As the formal, official definition shows, management accounting concerns business strategy, planning and control, decision making, efficient resource usage, performance improvement, safeguarding assets, corporate governance and internal control.

Management Accounting

Working definition

The provision of financial and non-financial information to management for costing, for planning, control and performance, and for decision making.

Formal definition

‘Management accounting is the application of the principles of accounting and financial management to create, protect, preserve and increase value so as to deliver that value to the stakeholders of for-profit and not-for-profit enterprises, in the public and private sectors. Management accounting is an integral part of management. It requires the identification, generation, presentation, interpretation and use of information relevant to:

- Inform strategic decisions and formulate business strategy;

- Plan long, medium and short-run operations;

- Determine capital structure and fund that structure;

- Design reward strategies for executives and shareholders;

- Inform operational decisions;

- Control operations and ensure the efficient use of resources;

- Measure and report financial and non-financial performance to management and other stakeholders;

- Implement corporate governance procedures, risk management and internal controls.’

Source: Chartered Institute of Management Accountants (2005), Official Terminology. Reproduced by Permission of Elsevier.

In essence, costing concerns (1) setting a price for a product or service so that a profit is made and (2) arriving at a correct valuation for inventory. Planning, control and performance involve planning and controlling future costs using budgeting and standard costing as well as performance evaluation. Decision making involves managers solving problems using various problem-solving techniques.

Problem Solving

Can you think of five problems the management accountant may need to solve?

The list is potentially endless. However, here are ten.

- What products or services should be sold?

- How much should be sold?

- Should a product be made in-house or bought in?

- Should the firm continue manufacturing the product?

- At what level of production will a profit be made?

- Which products or services are most profitable?

- How can the firm minimise its working capital?

- How can the firm maximise revenue?

- Which areas should the firm diversify into?

- Should new finance be raised via debt or equity?

Relationship with Financial Accounting

The orientation of management accounting is completely different to that of financial accounting. As Figure 15.1 shows, financial accounting is concerned with providing information (such as the statement of financial position and income statement) to shareholders about past events. Management accountants will also be interested in such information, often on a monthly basis.

However, management accountants will also require a broader range of internal management information for costing, for planning, control and performance, and for decision making. Importantly, whereas financial accounting works within a statutory context, management accounting does not. Management accounting is thus much more varied and customised than financial accounting.

Financial accounting, in fact, has influenced the development of management accounting. Management accounting emerged much later than financial accounting. Indeed, early management accountants were primarily cost accountants.

Armstrong and Jones (1992) argue that management accountants have been involved in a ‘collective mobility’ project where cost accountants have redefined themselves as management accountants dealing with wider management accounting and strategic management issues. In part, this has been an attempt to move away from costing, which was perceived as low status, and to emulate the Institute of Chartered Accountants in England and Wales, which was considered as high status.

Perhaps because of its comparatively humble origins, management accounting has often been seen as subservient to financial accounting. Johnson and Kaplan (1987) argued in Relevance Lost that most management accounting practices had been developed by 1925 and that since then there has been comparatively little innovation. Under this view, management accounting has major problems. In particular, product costing is distorted, decision-making information becomes unreliable and management accounting reflects external reporting requirements rather than modern management needs.

Opinions differ on the current relevance of management accounting. However, it is true that management accounting has struggled to adapt to changes in the business environment. In particular, it has been relatively slow to adapt to the decline of manufacturing industry and the rise of the service economy in the UK and US (see Figure 15.2). These difficulties are likely to be exacerbated by the rise of knowledge-based companies. Management accounting is also struggling to adapt to globalisation and technological change. As we will see, however, new management techniques have arisen (such as activity-based costing, strategic management accounting and just-in-time stock valuation) which seek to address the criticisms of management accounting.

Overview

The diversity of management accounting makes if difficult to separate out individual strands. However, this book broadly splits management accounting into two.

1. Cost Accounting. This involves:

(i) Costing (recovering costs as a basis for pricing and for inventory valuation), and

(ii) Planning, control and performance (i.e., planning and controlling future costs using budgeting and standard costing).

Cost accounting is a common term used to embrace both costing, and planning, control and performance. Definition 15.2 shows two formal definitions of cost accounting. The first is by the Institute of Cost and Management Accountants (ICMA), the predecessor body of the author of the second definition, the Chartered Institute of Management Accountants (CIMA) in 2005. It is interesting to see that the definition has widened considerably over time. In particular, the more recent CIMA definition now explicitly mentions budgeting and standard costing.

Cost Accounting

Working definition

The determination of actual and standard costs, budgeting and standard costing.

Formal definition

- ‘The classification, recording and appropriate allocation of expenditure in order to determine the total cost of products or services.’

This earlier definition by ICMA is a good description of cost recovery.

- ‘Gathering of cost information and its attachment to cost objects, the establishment of budgets, standard costs and actual costs of operations, processes, activities or products; and the analysis of variances, profitability or the social use of funds. The use of the term “costing” is not recommended except with a qualifying adjective, e.g. standard costing.’

This CIMA (2005) definition embraces both cost accounting, and planning, control and performance.

Source: Chartered Institute of Management Accountants (2005), Official Terminology. Reproduced by Permission of Elsevier.

2. Decision Making. This involves:

(i) Short-term decision making i.e., operational or day-to-day decision making (such as break-even analysis, contribution analysis and the efficient management of working capital), and

(ii) Long-term decision making i.e., strategic decision-making (such as strategic management accounting, capital budgeting, and management of sources of long-term finance).

It is important, however, to appreciate that, in practice, this split although useful is somewhat arbitrary. For example, short-term decision making could be seen as a part of cost accounting as it is based on marginal costing (i.e., it excludes fixed costs).

These two major areas are shown in Figure 15.3 on the next page. The major areas shown in Figure 15.3 are discussed briefly below and then more fully discussed in the chapters that follow. Key terms that underpin management accounting are introduced. These new terms are highlighted in bold in the text and a full definition is then provided in Definitions 15.3 and 15.4 which follow the same order as in the text. These terms are more fully discussed later in the book.

Cost Accounting

Costing (Chapter 16)

Costing has its origins in manufacturing industry. The basic idea underpinning costing is cost recovery (i.e. the need to recover all the costs of making a product into the price of the final product). Broadly, cost recovery is achieved using a technique called total absorption costing. Total absorption costing seeks to recover both direct costs and indirect costs into a product or service. This form of costing thus seeks to establish the total costs of a product so that they can be recovered in the final selling price. As well as costing for pricing, costing is used for inventory valuation. In this case, either absorption costing or marginal costing is used. However, it should be remembered that for inventory valuation for financial reporting purposes inventories are usually valued using absorption costing.

Different industries will have different costing systems. For example, medicinal tablets will necessitate batch processing, while shipbuilding uses contract costing. A more modern technique called activity-based costing is sometimes used.

Planning, Control and Performance (Chapters 17 and 18)

Planning, control and performance aims to control current costs and plan for the control of future costs as well as evaluating performance. Two essential management control systems (i.e. systems that provide information for managerial planning, control and performance evaluation) are budgeting and standard costing.

- Budgeting (Chapter 17). Budgeting involves setting future targets. Actual results are then compared with these budgeted results. Any differences will be investigated. Budgets may be used as part of responsibility accounting. In such systems, a distinction is often made between controllable costs and uncontrollable costs.

- Standard costing (Chapter 18) is a standardised version of budgeting. Standard costing involves using preset costs for direct labour, direct materials and overheads. Actual costs are then compared with the standard costs. Any variances are then investigated.

The Basic Building Blocks of Management Accounting: Some Key Cost Accounting Terms

i. Costing

Cost. A cost is simply an item of expenditure (planned or actually incurred).

Total absorption costing. This form of costing is used to recover all the costs (both direct and indirect) incurred by a company into the price of the final product or service.

Direct costs. Direct costs are those costs that can be directly identified and attributed to a product or service, for example, the amount of direct labour that is incurred making a product. Sometimes these costs are called product costs.

Indirect costs. Indirect costs are those costs that cannot be directly identified and attributed to a product or service; examples are administrative, selling and distribution costs. These costs are totalled and then recovered into the product or service in an indirect way. For example, if there were £10,000 administrative costs and 10,000 products, each product might be allocated £1 of administrative costs. Indirect costs are often called overheads or period costs.

Absorption costing. Absorption costing is the form of costing used for valuing inventory for external financial reporting. It recovers the costs of all the overheads that can be directly attributed to a product or service. However, unlike marginal costing, which can sometimes be used for inventory valuation, it includes both fixed and variable production overheads.

Marginal costing. Marginal costing excludes fixed costs from the costing process. It focuses on sales, variable costs and contribution. Fixed costs are written off against contribution. It can be used for decision making or for valuing inventory. When valuing inventory only variable production overheads are included in the inventory valuation. (See Definition 15.4 for explanations of fixed costs, variable costs and contribution.) Marginal costing is called contribution analysis when used for decision making.

ii. Planning, Control and Performance Evaluation

Controllable costs. Costs that a manager can influence and that the manager can be held responsible for.

Uncontrollable costs. Costs that a manager cannot influence and that the manager cannot be held responsible for.

Standard costs. Standard costs are individual cost elements (such as direct materials, direct labour and variable overheads) which are estimated in advance. Normally, the quantity and the price of each cost element are estimated separately. Actual costs are then compared with standard costs to determine variances.

Variances. Variances are the difference between the budgeted costs and the actual costs in both budgeting and standard costing. These variances are then investigated by management.

Decision Making

Decision making involves choosing between alternatives. When making a choice it is essential to consider only those costs that are relevant to the actual decision, i.e., relevant costs.

Short-Term Decisions (Chapter 19)

In many ways, distinguishing between short-term, operational decisions and long-term strategic decisions is somewhat arbitrary. It is, however, an essential managerial task as Soundbite 15.1 shows. It provides a useful basic distinction. Short-term decisions are dealt with in Chapter 19 and the first part of Chapter 22. Long-term decisions are covered in Chapters 20–21 and in the second half of Chapter 22.

Short and Long-term Planning

‘The real issue for most businesses is being able to juggle the link between the short and long-term effectively.’

Source: Gillian Lees, Building World-class Businesses for the Long Term, Global Accountant, September/October 2011, p. 26.

The Basic Building Blocks of Management Accounting: Some Key Decision-Making Terms

Short-Term Decisions

Fixed costs. Fixed costs are those costs that will not vary with production or revenue (for example, insurance) in an accounting period. They will not, therefore, be affected by short-term decisions such as whether or not production is increased.

Variable costs. Variable costs, however, will vary with production and revenue (for example, the metered cost of electricity). Short-term decision making is primarily concerned with variable costs. Revenue less variable costs gives contribution, a useful concept in short-term decision making.

Break-even analysis. Break-even analysis involves calculating the point at which a product makes neither a profit nor a loss. Fixed costs are divided by the contribution per unit (i.e., revenue less variable costs divided by number of products). This gives the break-even point.

Contribution analysis. When there is more than one product, this technique is useful in determining which product is the most profitable. It compares the relative contribution of each product. This can also be called cost-volume-profit analysis.

Long-Term Decisions

Discounted cash flow. Discounted cash flow discounts the future expected cash inflows and outflows of a potential project back to their present value today. Decisions can then be made on whether or not to go ahead with the project.

Businesses face many short-term decisions. Essentially, decision making is about choice. Businesses need to make numerous decisions. For example, should a business make a product itself or buy in the product? Should a business continue making or providing a product or service? At what price will a product break even (i.e., make neither a profit nor a loss)? These decisions are solved using various problem-solving techniques such as break-even analysis and contribution analysis. In such short-term decisions, it is essential to distinguish between fixed costs and variable costs.

A key aspect of short-term decision making is contribution. Contribution is sales less variable costs. In other words, fixed costs are excluded. Contribution is at the heart of two common management accounting techniques: break-even analysis and contribution analysis. This area of management accounting is sometimes called cost-volume-profit analysis.

Cost Behaviour

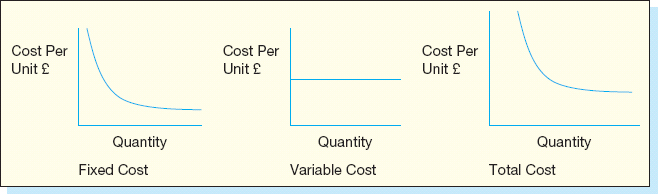

A key aspect of costing and a prerequisite of effective decision making is the determination of how costs vary with activity. In essence, as Definition 15.4 shows, at its simplest there are fixed costs and variable costs. Where costs do not increase with increasing activity, for example depreciation or insurance, they are fixed costs. Where they do change with increased activity they are variable costs. In some cases, however, the costs for a certain activity may be partly fixed and partly variable. For example, where there is a fixed charge for electricity and then payment is per unit. In this case, we have semi-variable costs. These costs are shown diagrammatically in Figure 15.4. Fixed costs may also be stepped, in other words, at a certain activity level, they may increase.

The behaviour of costs is important because it feeds through into cost per unit. Essentially, the more units you produce, the less fixed cost per unit. The more units you produce, however, does not affect your variable cost per unit which remains the same. Finally, total cost (i.e., fixed and variable costs together) will decline over the quantity produced. This cost behaviour is shown in Figure 15.5.

Strategic Management Accounting (Chapter 20)

Whereas costing represents the oldest branch of management accounting, strategic management accounting represents the newest. Strategic management accounting represents a response to criticisms that management accounting is outdated and lacking in innovation. Using strategic management accounting, the management accountant relates the activities of the firm to the wider external environment. Strategic management is thus concerned with the long-term strategic direction of the firm.

Strategic management accounting assesses the current position of the business through techniques such as PESTLEO analysis that seek to evaluate the external environment in which the company operates. It also uses techniques such as value chain analysis, product life cycle analysis and product portfolio analysis.

Strategic management accounting also appraises the current position of the company. Over time, a series of techniques has grown up such as SWOT analysis, the balanced scorecard and benchmarking. Finally, the strategic choice of the company is determined by either exploiting the internal strengths of a company (using, for example, data mining or customer profitability analysis) or by external diversification.

Cost Accounting and Management Accounting

A distinction is sometimes made between cost accounting and management accounting. What do you see as the essential difference?

Management accounting has its origins in cost accounting. However, gradually cost accounting and management accounting have been seen as distinct. Cost accounting is seen, at its narrowest, as focusing on cost collection and cost recovery and more widely as cost recovery and control. However, management accounting is viewed as a much broader term which not only encompasses cost accounting, but also involves decision making and, more recently, strategic management accounting. Cost accounting is thus typically portrayed as routine and low-level, whereas management accounting is seen as a higher-level activity.

Capital Investment Appraisal (Chapter 21)

Capital budgeting involves the financial evaluation of future projects. This evaluation is carried out by using various techniques such as payback, the accounting rate of return, net present value, the profitability index and the internal rate of return. Under net present value, the profitability index, and the internal rate of return, the technique of discounted cash flow analysis is used.

Sources of Finance (Chapter 22)

The topic of business finance is immense. The aspects covered in this book are the financing of the business in the short and the long term. This covers both the internal generation of funds and the raising of external finance. In the short term, the management of working capital involves the management accountant in a series of short-term decisions about the optimal level of inventory and trade receivables. This may use a series of techniques such as Materials Requirement Planning (MRP), Economic Order Quantity (EOQ) and Just-in-Time for optimising inventory. Meanwhile, debt factoring and invoice discounting can be used to reduce the cost of trade receivables. Long-term financing of the business involves the choice between internal financing through retained profits and external financing through either leasing, loans or share capital. Share capital is normally raised via a rights issue, a public issue or a placing. Finally, in Chapter 22, the rate and calculation of cost of capital is explained.

Short-Term vs Long-Term Decisions

What do you think are the essential differences between short-term and long-term decisions?

Short-term decisions are operational, day-to-day decisions which typically involve the firm's internal environment. For example, what quantity of a particular product should we make or what should be the price of a particular product.

By contrast, long-term decisions are strategic, non-operational decisions. These typically involve a firm's external environment. So, for example, they may involve the need to diversify or the need to make acquisitions and disposals. Alternatively, they might evaluate whether a long-term capital investment is worthwhile.

Cost Minimisation and Revenue Maximisation

The management accountant can make a business more efficient through cost minimisation or revenue maximisation. Cost minimisation attempts to reduce costs. However, as stated in Real-World View 15.1, this needs to be done in a controlled way. This may be achieved by tight budgetary control or cutting back on expenditure.

In order to have any chance of containing costs in a sustainable way you have to know what you're doing.… If you don't know your starting point, how will you know where you can make savings.

Source: Andrew Stone, Keep your eye on the big picture for savings, Daily Telegraph, Wednesday, August 2010, p. B12.

Sales Maximisation

‘Legend tells of the traveller who went into a county store and found the shelves lined with bags of salt. “You must sell a lot of salt,” said the traveller, “Nah,” said the storekeeper. “I can't sell no salt at all. But the feller who sells me salt – boy, can he sell salt”.’

Martin Mayer (1974), The Bankers

Source: The Executive's Book of Quotations (1994), p. 255. Oxford University Press.

Some authors argue strongly that management accounting needs to refocus on revenue maximisation. In part, revenue maximisation is achieved through the new focus on strategic management accounting which looks outwards to the external environment rather than inwards. Substantial opportunities arise to adopt new techniques such as customer database mining. This latter technique looks at customer databases and seeks to extract from them customer data which will expand the business's revenue.

Management accountants have often been criticised for being overly concerned with cost cutting (see, for example, Lesley Jackson, H.P. Bulmer Holding plc's UK Finance Director, in Real-World View 15.2).

Cost Minimisation

Jackson's time as general commercial manager gave her the opportunity to look at a business from a different angle. She says it made her a better accountant.

‘A lot of accountants tend to look at cost minimalisation and low risk. They tend to have a more conservative mindset. I became slightly more maverick in this sense,’ she says.

It was this broader outlook on business and varied skills-sets that gave Jackson the edge over other candidates for the role at Bulmers.

Source: Michelle Perry, Brewing up a Profit, Accountancy Age, 3 May 2001, p. 20.

Use of Computers and Impact of Digital Technology

The theory and practice of management accounting is shown in the next seven chapters. In practice, for most of the techniques shown, a dedicated computer program would be used. Alternatively, a spreadsheet could be set up so as to handle the calculations. These programs enable complicated and often complex real-life situations to be modelled. However, it is essential to be able to appreciate which figures should be input into the computer. As Peter Williams states:

‘While it may be possible for any company with a PC to produce a set of management information using relatively low-cost accounting software, there is no guarantee that the output will be true and fair.’ (Accountancy Age, 2 March 2000, p. 23)

Digital technology affects all businesses. Management accounting changes and adapts to this as Alnoor Bhimani shows in Real-World View 15.3.

Levels of Digital Impact on Economic Activities

Novel products and new services emerge at a pace that closely matches the rate of technological advances. The use of digital technologies hastens the rate of innovation and the speed at which new product offerings evolve. The advent of digitization has given rise to information goods such as e-books, digital music recordings, and mobile messaging platforms among others. Information-intensive services such as web-based airline bookings and car rental reservation systems and Internet-based courier-tracking facilities are now common-place. They provide benefits to consumers (value-makers) who guide the activities of firms (value-makers), which, in turn, seek to benefit commercially from these innovations. For many industries, digitization as part of technological offerings and processes underpin the extent of value creation and the basis of exchange. Management accounting information can be useful in value creation monitoring and reporting and to align changes in the types of costs incurred with revenues generated within increasingly digitized contexts.

Source: A. Bhimani, (2006), ‘Management Accounting and Digitization,’ Contemporary Issues in Management Accounting, Oxford University Press.

There are many sophisticated IT systems that have grown up over recent years which help management run their businesses. Enterprise Resource Planning Systems (ERPS) are one of the most well-known. These cover a whole range of integrated programmes covering both financial accounting and management accounting functions. The basic transactional data is entered once and then is available for use by employees, including management accountants, across the company.

Art not a Science

It must be remembered that management accounting is an art not a science. Much of management accounting is involved in looking to the future. As such, it deals with the inherent uncertainty that the future inevitably brings. Key activities, such as costing, budgeting and capital investment appraisal involve forecasts and estimates. In many cases, managers will run multiple versions of their estimates to see how sensitive their estimates are to changes to basic parameters such as volume or price. This is often known as sensitivity analysis.

Changing Nature of Management Accounting

Management accounting techniques are changing over time. Some of these changes are dictated by changes in the business environment such as the long-term decline in manufacturing industry and the rise of the service sector. Other factors involve the increasing use of information technology and the rise of e-commerce. Up-to-date information is often difficult to get, but Real-World View 15.4 gives a flavour of change.

Changes in Management Accounting Techniques

Source: J. Burns and H. Yazdifar, (2001), ‘Tricks or Treats?’ The role of management accounting is changing, Financial Management, March, as cited in R. Scapens (2006), Changing times: management accounting research and practice from a UK perspective in A. Bhimani, Contemporary Issues in Management Accounting, Oxford University Press, 2005.

They may also use techniques such as decision trees where you map all the options. You can then assign probabilities and amounts to these and calculate what you think is the optimal result.

Conclusion

Management accounting is the internal accounting function of a firm. It can be divided into cost accounting (costing; planning, control and performance) and decision making (short-term and long-term). In costing, the two main aspects are pricing and inventory valuation. In planning, control, and performance, budgeting and standard costing are used. Decision making has four main strands: short-term decision making; strategic management accounting; capital budgeting; and sources of finance. Management accountants are increasingly moving away from costing towards new areas such as strategic management accounting. In effect, this reflects the decline of manufacturing industry in developed countries.

Selected Reading

Armstrong, P. and Jones, C. (1992) The Decline of Operational Expertise in the Knowledge-base of Management Accounting: An examination of some post-war trends in the qualifying requirements of the Chartered Institute of Management Accountants, Management Accounting Research, Vol. 3, pp. 53–75.

An interesting look at how the management accounting profession has gradually changed over time. Originally concerned with costing, it now has a much wider focus.

Bhimani, A. (2005) Contemporary Issues in Management Accounting (Oxford University Press).

This book contains 18 chapters that give useful insights into many aspects of management accounting.

Drury, C. (2005) Management and Cost Accounting (Thomson Learning: London).

This is a comprehensive text on management and cost accounting. Once students have mastered the basics, this represents a good book for future reading.

Johnson, T. and Kaplan, R.S. (1987) Relevance Lost: The Rise and Fall of Management Accounting (Harvard University Press).

A benchmarking book which triggered a relook at management accounting. After this book a new management accounting emerged consisting of topics such as activity-based costing and strategic management accounting.

Kaplan, R.S. (1984), Yesterday's Accounting Undermines Production, Harvard Business Review, July/August, pp. 95–101.

This provides a good overview of the problems with traditional management accounting.

Discussion Questions

Discussion Questions

Questions with numbers in blue have answers at the back of the book.

| Q1 | What are the main branches of management accounting and what are their main functions? |

| Q2 | Why do you think that management accounting has been so keen to lose its costing image? |

| Q3 | What are the following types of cost and why are they important?

(a) Direct cost (b) Indirect cost (c) Fixed cost (d) Variable cost (e) Standard cost |

| Q4 | The management accountant has been described as a professional with a toolkit of techniques. How fair a description do you think this is? |

| Q5 | Why have management accountants been criticised for being cost minimisers and how might they be revenue maximisers? |

| Q6 | State whether the following statements are true or false. If false explain why.

(a) The two main branches of management accounting are cost accounting and decision making. (b) Total absorption costing is where all the overheads incurred by a company are recovered in the valuation of inventory. (c) The difference between absorption costing and marginal costing as a form of costing for inventory valuation is that absorption costing includes direct materials, direct labour and all production overheads. By contrast, marginal costing only includes direct materials, direct labour and all variable production overheads. Marginal costing, therefore, excludes fixed production overheads. (d) Strategic management accounting is concerned principally with short-term operational decisions. (e) Discounted cash flow discounts the future expected cash flows of a project back to their present-day monetary values. |

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

PAUSE FOR THOUGHT 15.1

PAUSE FOR THOUGHT 15.1 DEFINITION 15.1

DEFINITION 15.1

SOUNDBITE 15.1

SOUNDBITE 15.1

REAL-WORLD VIEW 15.1

REAL-WORLD VIEW 15.1