Appendix A

Quick Start Guide

To achieve greatness, start where you are, use what you have, do what you can.1

—Arthur Ashe, former American world number 1 ranked professional tennis player and the only black man ever to win the singles title at Wimbledon, the U.S. Open, and the Australian Open

What Is the Wallet Allocation Rule?

At its core, the Wallet Allocation Rule stipulates that a customer's share of wallet is expected to equal 1 minus the inverse of a customer's rank of the firm/brand relative to the competitors the customer uses.

This simple formula would be all we need if all customers used exactly two firms/brands in a category. But because many customers use one or more than two, we need to weight this based on the number of firms/brands used to make them comparable. This weight equals 2 divided by the number of firms/brands used by a customer.

Mathematically, the formula we use to do this is as follows:

where:

| Rank | = | the relative position that a customer assigns to a brand in comparison to other brands also used by the customer in the category |

| Number of brands | = | the total number of brands used in the category by the customer |

To use the Wallet Allocation Rule to predict share of wallet, follow these steps:

- Establish the firms/brands in a product category that customers use.

- Ask an overall satisfaction/loyalty question to gauge performance for each firm/brand a customer uses.

- Assign a performance rank for each firm/brand for each customer (e.g., the highest rated firm/brand based on the overall satisfaction/loyalty question used would be ranked 1, the next highest 2, etc.).

- Calculate a customer-level Wallet Allocation Score (i.e., the customer's predicted share of wallet) using the rank and number of brands used by the customer.

- If you want to calculate firm/brand level scores, simply average the Wallet Allocation Scores for each firm's/brand's customers.

The ramifications of the Wallet Allocation Rule are profound. Using this simple formula, managers can easily and strongly link their customer metrics with share of wallet. These findings also point to the need for a new approach for identifying opportunities designed to enhance the customer experience and share of wallet simultaneously.

Using the Wallet Allocation Rule Formula: A Simple Example

Don't let the math worry you. Using the Wallet Allocation Rule is a very simple process.

The chart that follows shows the satisfaction ratings for three financial institutions used by customers John, Jane, Mary, and Tom (1 = completely dissatisfied, 10 = completely satisfied).

Figure A.1 Customers' Satisfaction Levels for Brands X, Y, and Z

The next chart shows the ranks of the three financial institutions based on the satisfaction scores provided by John, Jane, Mary, and Tom. In the case of a tie, as was the case for Tom with Brand Y and Brand Z, assign each a rank for the average of the two places they would have occupied had they not been tied. For example, if two brands are tied for second place, had they not been tied one brand would be in second, the other in third. The average of second and third is 2.5—that is, (2 + 3) / 2.

Brands not used are treated as missing and are not assigned a rank, as was the case for Jane with Brand Y.

Figure A.2 Relative “Ranked” Satisfaction Levels for Brands X, Y, and Z

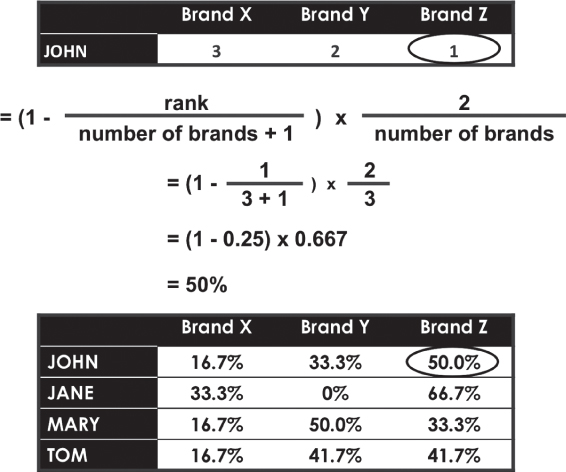

To arrive at a brand's share of wallet for a given customer, plug the brand's rank and the number of brands used by the customer into the Wallet Allocation Rule formula. For example, calculating John's share for Brand Z would be done as shown in Figure A.3.

Figure A.3 Brand-Level Share of Wallet

Wallet Allocation Rule Strategy

The Wallet Allocation Rule comes with several important strategic implications. First and foremost, managers cannot evaluate their firms without taking competition into account. Although this sounds obvious, the reality is that managers typically evaluate their firm's performance based on customer perceptions of their firm only. As a result, the target objectives used to evaluate and compensate managers are almost never based on changing the perceived rank of the firm vis-à-vis competition. Rather, they are based on achieving a particular score for the firm.

It is rank, however, that actually matters! Every manager knows that it is better to be number one than number two. But the Wallet Allocation Rule makes it very easy for managers to determine the financial implications of that. The difference between first and second is typically quite large. Making that jump can have a tremendous financial impact.

The Wallet Allocation Rule also makes clear that it is not enough to be tied for first place. Parity hurts! There must be a reason for customers to prefer your firm. Otherwise, you evenly divide your customers' share of wallet with your closest competitors.

It is important to remember, however, that although rank is imperative, it isn't the only thing that matters. The number of competitors that your customers use has a significant impact on share of wallet. Being first in a field of three is much better than being first in a field of six. That's because every brand used by a customer gets some percentage of his or her wallet. So the more brands used, the lower the potential share of wallet available for everyone.

These strategic issues have practical implications for how we identify opportunities for improving share of wallet. The traditional approach for identifying opportunities can be thought of as trying to find the answer to the question, “What can we do to make you happier?” Whether it is analyzing customers' open-ended survey responses, or deriving importance through statistical analysis, the focus is virtually always on improving satisfaction with what the firm/brand currently offers.

Performance, however, is relative to competitive alternatives. Improving satisfaction is important because, at some point, increases in satisfaction make a brand more attractive to customers relative to competitors. But that is not enough. Managers also need to understand exactly why customers use each of the brands that they do. Customers have legitimate reasons for using multiple brands in a category. Therefore, efforts designed to improve share of wallet that do not address precisely why your customers also use your competitors are doomed.

One of the most common reasons customers use multiple brands is because they perceive there to be unique benefits associated with each brand they use. For example, credit union and retail bank managers often find that customers use one institution because of lower fees and another because of better Internet banking services. Therefore, reducing fees further for the fee-differentiated institution will not likely prove to be the best opportunity to improve share of deposits, even though low fees are the strongest driver of the institution's customers' satisfaction and loyalty. The competition is being used for another reason.

Another common reason that customers use multiple brands is structural barriers that distort demand. In other words, there is some market force that causes people to buy something other than their preferred brand. The most common of these is a lack of access. The more difficult a brand is to find, the more likely it is to be substituted. So improving customers' experience with the brand will have little impact on share of wallet until the barriers to purchasing it are removed.

Managers can gather this information as part of the Wallet Allocation Rule survey process. This process doesn't have to be complex. It can be as simple as asking customers something like the following:

- When choosing between brands, what tends to be the deciding factor in choosing one over the other?

- I choose [Brand 1] when…

- I choose [Brand 2] when…

With an understanding of why your customers use your brand as well as competitive brands, you can identify what it really takes to be the first choice of their customers. And because the Wallet Allocation Rule is tied to share of wallet, managers can prioritize their efforts by their potential impact on future revenues.

Identifying Opportunities for Improving Share of Wallet

Traditionally, managers have focused on understanding the “drivers of satisfaction” with their brand. The problem has been that these models tend to ignore competition and focus on changes in the absolute satisfaction score instead of shifts in the relative ranking of the brand vis-à-vis competition. As a result, although satisfaction scores may improve by focusing on the drivers uncovered in these models, share of wallet tends to show very little improvement.

To understand what drives changes in share of wallet, managers need to shift their focus from the “drivers of satisfaction” to the “drivers of rank.” As such, managers should work with their research teams to develop statistical models for identifying these drivers.

But managers do not need to wait on complex statistical models to begin using the Wallet Allocation Rule to identify opportunities. That is because at its core, improving your brand's rank means minimizing the reasons your customers have to use competitors. The following is an easy to follow six-step process that managers can use right away:

- Survey a statistically valid sample of your customers.

- Use the Wallet Allocation Rule to establish the share of wallet for each competitor used by your customers.

- Determine how many of your customers use each of the various competitors.

- Calculate the revenue going to each competitor from your customers.

- Identify the primary reasons your customers use your competitors.

- Prioritize opportunities by estimating the costs of addressing the reasons a specific competitor is used by your customers versus the potential financial return. (Don't forget to consider the cumulative impact for issues that span multiple competitors.)

An Example in the Credit Union Industry

Following is a simplified example of some of the information that managers could use from a Wallet Allocation Rule approach to guide their strategy. In this case, the example is set in the credit union market, but the methods are transferable to any industry sector in which customers tend to use multiple brands.

Managers first need to identify where they stand in the minds of their customers. Because the Wallet Allocation Rule uses ranks, it is recommended that credit union managers monitor the percentage of customers who consider the credit union their exclusive first choice (Figure A.4).

Figure A.4 Percentage of Customers Who Consider the Firm/Brand Their First Choice

The Wallet Allocation Rule also uses the number of competitors used by customers as a key component in the calculation of share (Figure A.5). As a result, managers need to understand how and with whom customers allocate their deposits.

Figure A.5 Percentage of a Firm's Customers Using Competitors

Credit union managers can then use this information to calculate the share of deposits going to their institutions and to their competitors. The advantage of knowing share of wallet (in this case, share of deposits) is that it is very easy to translate it into dollars. To understand which competitors represent the greatest threats and the greatest opportunities, managers need to establish how much money their customers are giving their competitors (Figure A.6).

Figure A.6 Money Going to Competitors from Your Brand's Customers

The next step is to identify exactly what drives first choice not only for your credit union but also for your competitors (Figure A.7). Customers have a logical reason for using each institution that they do. Winning back share requires minimizing the reasons customers have for using the competition.

Figure A.7 Primary Reasons Your Customers Use the Competition

In the case of this example, a low fee structure largely drives customers to choose the credit union as their first choice. Competitors, however, are competing on different aspects of coverage: Internet banking, ATM network, and branch locations. Examining first choice drivers through this lens of varied coverage allows managers to determine which competitors are easier and which are more difficult to address in the short term. In the case of this example, competing against Brand C will be more difficult in the short term because it requires that credit unions address the convenience of branch locations.

Knowing what drives customers to use the competition allows managers to focus on their greatest near-term opportunities—in this case either Internet banking or ATM network. Brand A, however, is doing a much better job of capturing customers' share of deposits. As a result, managers should first consider the feasibility of addressing Brand A's point of competitive advantage.

Conclusion

The key to growth is improved share of wallet. Although most managers instinctively know this to be true, the problem has always been how to do it. The Wallet Allocation Rule now makes it possible to understand what it really takes to be number one.