CHAPTER

9

Oracle Fusion Accounting Hub

Oracle Fusion Accounting Hub (FAH) is used for accounting transformation, which is a process to convert events into journal entries. The accounting transformation involves a diverse set of source systems and applications ranging from investment banking, core banking systems, premium and claim management systems for insurance, asset management, retail, healthcare, telecoms, and so on. For a large organization, you will find that each of these source systems may sometimes have its own local accounting engine. This can cause duplication of accounting rules across various different systems. The cost of making changes to accounting rules across many systems is usually very high. Oracle Fusion Accounting Hub allows organizations to define their accounting rules in a single place.

Oracle Fusion Accounting Hub Overview

The typical source systems in an enterprise come from various different vendors ranging from different time periods when those platforms were developed. These legacy systems also have diversified processes of accounting transformation with very little centralized governance. The manual adjustments are usually made in spreadsheets or are isolated in each source system with limited audit capabilities. In many cases, these changes are not visible to the governance and accounting teams, and therefore, when something changes in the source systems, it is hard to know who made the changes or why. The Oracle Fusion Accounting Hub provides a configurable and auditable rule-based accounting engine that can be used to create accounting for these systems. These accounting systems can be generated for multiple reporting bases such as US GAAP, UK GAAP, IFRS, AIFRS, and other reporting standards.

Fusion Accounting Hub provides easy-to-use screens for configuring the accounting rules in one central place within the organization. The accounting generated from Fusion Accounting Hub is natively integrated with Fusion General Ledger for reporting at the Chart of Account level. But sometimes organizations require operational reporting, which requires dimensions that are more granular than Chart of Account segments. To facilitate this, Oracle Fusion Accounting Hub allows you to track balances at the sub-Chart of Accounts level, also known as supporting references. For example, an insurance company might want to know their liabilities at the insurance product level, or an investment bank may wish to know their exposure to counterparty. FAH allows you to define supporting references that are the Chart of Accounts equivalent but at subledger level. This allows tracking the balances at a much finer grain than Chart of Accounts.

Components of Fusion Accounting Hub

In prior releases of Oracle ERP, for example, in Oracle EBS R12 version, the term “Financial Accounting Hub” used the same engine as that of Subledger Accounting R12. When implemented in Financial Services, it is called the Financial Accounting Hub. The results from Financial Accounting Hub would then be posted into another Oracle General Ledger module in R12.

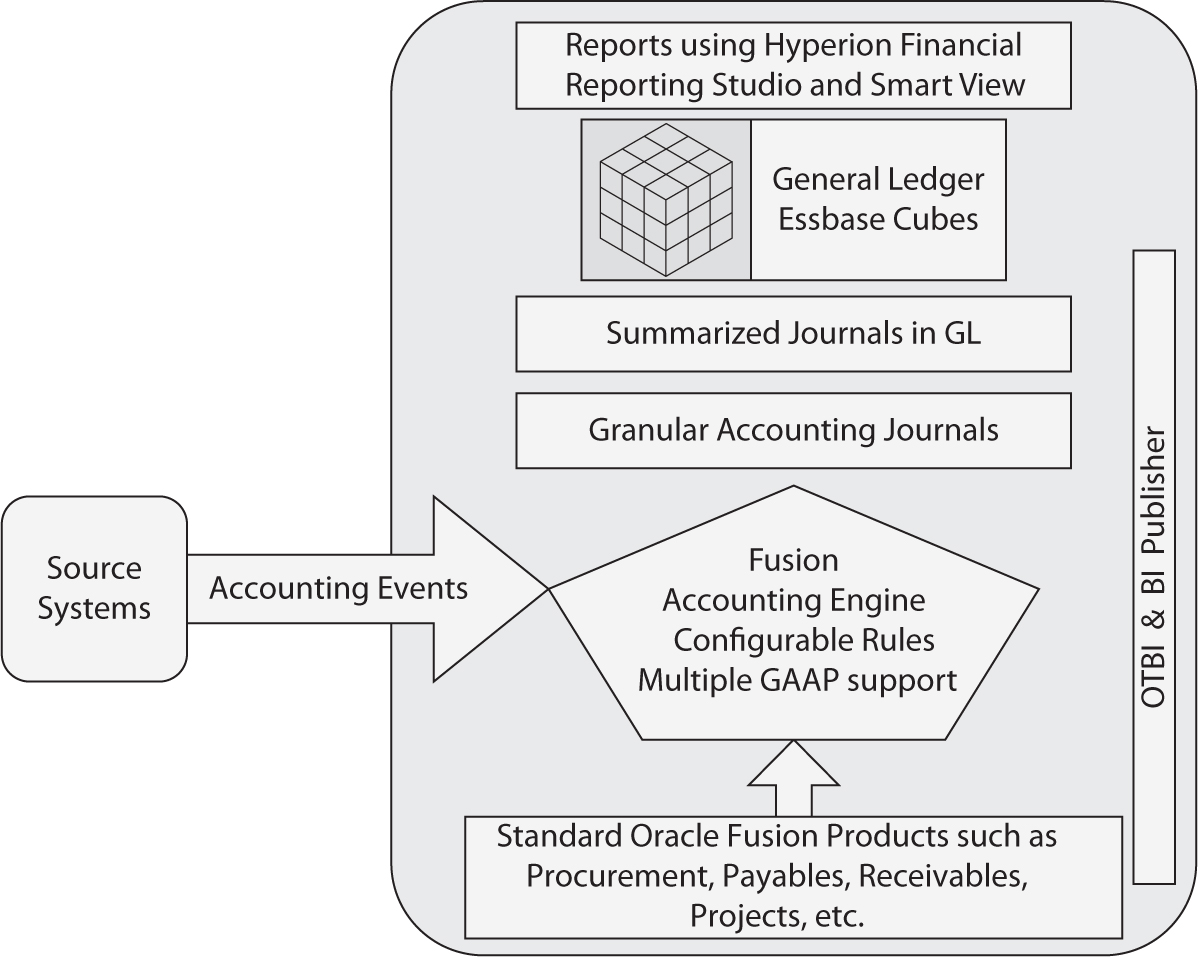

In Fusion Applications, Oracle has dropped the term Financial Accounting Hub and instead it is now called Fusion Accounting Hub, but it is also sometimes referred to as Fusion Financial Accounting Hub. The term Fusion Accounting Hub is more generic in nature, and can be implemented for any type of industry, not just financial services. Fusion Accounting Hub now is the overarching umbrella above and over Oracle Fusion General Ledger. In this chapter every reference to FAH indicates Fusion Accounting Hub, as opposed to R12’s Financial Accounting Hub. Figure 9-1 shows the key components of Fusion Accounting Hub. The various components of Fusion Accounting Hub are described in the following sections.

FIGURE 9-1. Fusion Accounting Hub components

Oracle Fusion Accounting Transformation Engine

The accounting rules engine in FAH provides an accounting transformation engine for the source transactions. It allows you to create journal entries and transfers reference information from diverse systems into Oracle General Ledger. The accounting transformation engine is also referred to as Fusion Subledger Accounting Engine.

Oracle Fusion General Ledger (GL)

Fusion GL provides journal entry import and creation, real-time balances from Essbase Cubes, accounting controls and data security, and period close functionality. Fusion GL also contains intercompany balancing, an allocation manager for the definition of allocation rules using complex formulas, automatic generation of allocation journals, enhanced journal approval, and year-end process management.

Oracle Fusion Financial Reporting

Oracle Fusion Accounting Hub leverages the Hyperion Financial Reporting Studio for analytic reporting on the Chart of Accounts. Further, it has BI Publisher technology to generate reports in various formats. In addition to BI Publisher, the Oracle Business Intelligence Enterprise Edition (OBIEE) comes pre-integrated with Fusion Applications, and FAH provides various out-of-the-box ad hoc reports using Oracle Transactional Business Intelligence (OTBI).

Approach for Fusion Accounting Hub Implementation

To implement Fusion Accounting Hub, it is important to understand the underlying transactional data that must be accounted for. The rules defined in FAH generate the journal entries for the transactions from external source systems. In other words, the Oracle Fusion Accounting Hub provides a solution to convert transactional data into accounting journal entries.

After the analysis of the source system transactions, the integration into Fusion Accounting Hub begins by first defining and building the transaction object, which is a database representation of the source transactions. Next, we define journal rules to generate journal entries that consume those transactions. The implementation starts with a thorough analysis of the transactional system that must be integrated with the Oracle Fusion Accounting Hub. Therefore, it is of utmost importance to invest time in identification of the transactions that must be accounted for and the activities in the lifecycle of those transactions.

For example, in a mortgage management system, a bank can issue both fixed interest rate loans and variable rate loans. The lifecycle of each type of loan is different. There are different kinds of activities and events that occur during the lifecycle of these mortgages. For each type of mortgage loan, the implementers can identify the list of possible events and then decide with accountants the subset of events that have an accounting implication.

When working in Fusion implementations, it is very common to hear of the use of event-based terminology in Oracle Fusion Accounting Hub. Any activity in the source system that requires accounting can be classified as an accounting event. Event Class represents the classification of the transaction. For example, a Loan Type of Fixed Rate or Variable Rate is an event class. The Event Type represents the type of activity against the event class. For example, payment of a due amount is an event type. From experience, you will learn that the granularity of Event Class definition can vary from one implementation to another.

Accounting Rules are defined at the combination of Event Class and Event Type levels. For example, accounting for late payments and on-time scheduled payments will have a different accounting behavior in Fusion General Ledger. Typically, the accounting will be different for these so that a financial analyst can see from the GL Balances the late payments or the accrued payments by each period.

Minimal Data Requirement

To create accounting entries, you will always need Currency Code, Amount, and Accounting Date besides the Chart of Accounts. However, you will find that typically an organization will also have requirements to report on additional attributes such as Loan Broker, Loan Rate, and Number of Years for which the mortgage is fixed. These pieces of information are typically nice to have for operational Business Intelligence, but are not required for accounting and therefore can be captured via something known as supporting references.

Therefore, the bare minimum data required for accounting generation are accounting date, transaction currency, transaction amount, accounting amount, or currency conversion rate. Sometimes your accounting requirements can be complex, in which case you need more information than the minimal attributes. In fact, it is very common that you will need to handle additional transactional attributes to derive the GL code combination. To derive the account combination for a journal line, either the source system will send the account codes in the transaction feed, or you will derive the account codes from the transaction attributes. For example, a late payment will be accounted to Account Code 243933, whereas the scheduled payment will be accounted to 244600. When the source system sends account codes in the transaction feed to FAH, this is known as pass-through accounting.

As an implementer, it will be your responsibility to ask various questions to the business users, such as

1. What is the additional information they wish to see on the journal line besides the code combination?

2. Where should this additional information be displayed? In the journal line description or a dedicated field or in the reporting layer only?

3. What should be the description of the journal at the header level and at the line level?

4. How would you like to classify the journal entries in various groupings?

For example, in the case of mortgages, it is common that the business users will demand to see the following in the journal line:

![]() Bank branch name issuing the mortgage

Bank branch name issuing the mortgage

![]() Mortgage number

Mortgage number

![]() Interest rate

Interest rate

![]() Customer number/name

Customer number/name

The source system transactions are typically sent to Oracle Fusion Accounting Hub on a daily basis, with the accounting processes running every night. However, in some cases the business users might want to see the information almost in real time in Fusion General Ledger. Both these requirements can be met, but as an implementer, it is your responsibility to ask these questions of the business users.

The granularity of the journal lines in Fusion Accounting Hub can be the same as that in the source system, or it can be at a summarized level. The business needs will most often dictate the granularity requirements. You may find that some banks will want only the bank branch name to be captured in the journal line so that source transactions are summarized before being accounted. This will increase the processing speed in Fusion General Ledger, and storage requirements will be kept to a minimum. Even though disk space is considered to be cheap these days, the high volume of data produced by large organizations can lead to expensive annual storage costs, considering the costs of high-performing enterprise storage. Therefore, size considerations must be considered during the implementation phase.

Typical FAH Implementation Steps

The typical implementation steps are listed in the following sections.

Register Tables and Capture Accounting Event Data for Source Transactions Register tables and views for multiple data sources. These tables will receive the source system transactions that are meant to be accounted for by applying the accounting rules.

Create Accounting Rules Configure rules for various reporting bases such as US GAAP, UK GAAP, IFRS, AIFRS, and so on.

Generate Accounting Engine Technical Events Call the FAH technical APIs to raise technical events. These events reside in a table named XLA_EVENTS. One event will correspond to one journal per reporting basis in Fusion Accounting Hub.

Transfer and Post Create accounting by running Oracle Fusion account creation processes and transfer and post those accounting entries to Fusion General Ledger. It must be noted that journals are created in two places: first in Fusion Subledger Accounting, and then in Fusion General Ledger. The GL posting then updates the GL Chart of Account cubes in Essbase.

Report and Analyze Microsoft Excel-based Smart View technology can be used to interrogate the Essbase cubes. Further, users can build ad hoc financial reports using Hyperion Financial Studio, which reads the data from Essbase cubes. Additional reporting is possible using OTBI, and that is explained in Chapter 13.

System Implementation Steps in FAH

Implementing FAH is a mixture of technical and configuration work. Table 9-1 segregates the nature of the work for each key step in the implementation of FAH.

TABLE 9-1. Nature of Work for FAH Implementation

The data to be accounted is received in custom tables. Technical specialists in the implementation teams create these tables. It is a common practice to make the table designs and their structures agree. In almost every implementation a common data model is created to receive these transactions into staging. The high-level steps are listed in Table 9-2.

TABLE 9-2. Technical Objects Created to Support FAH Accounting Rules

Configure Accounting Rules

The purpose of the accounting rules is to build the journal lines. The high-level steps for accounting rule configuration are listed in Table 9-3.

TABLE 9-3. Configuration Steps in Fusion Accounting Hub

Figure 9-2 explains all the mandatory components used for configuration of Oracle FAH.

FIGURE 9-2. Mandatory components of Oracle FAH

As seen in Figure 9-2, it is the accounting method that gets attached to the ledger. You will create an accounting method for each reporting basis such as UK GAAP, US GAAP, or IFRS. Effectively, this allows your UK ledger to contain UK accounting behavior and your US ledger to contain US GAAP accounting behavior.

Raise Technical Events

The technical specialist must write a PL/SQL routine to execute the API named xla_events_pub_pkg.create_event. This will place the accounting event in the pending queue to be processed.

Process Accounting Events to Create Journals

You need to run a Create Accounting process to create journals. This process applies the accounting rules to the technical events and produces the journals that can be posted to Oracle General Ledger.

Steps to Implement Business Requirements for ACME

All insurance companies have an asset management division. The money collected from premiums gets invested into various investment instruments. In case of ACME US Insurance, they have outsourced their asset management to a third party. The third-party asset management company executes the trades for ACME US Insurance. These trades are sent to FAH every night for accounting. In this chapter we will take an example of a stock purchase event and account for it in Fusion General Ledger using the accounting rules.

In this chapter, we will create a configuration to process accounting events for stock purchase for the ACME US Insurance’s Asset Management division. You will learn the necessary components required to create and configure a journal. Although the configuration of FAH accounting rules can be done by FAADMIN or users with equivalent roles such as XXFA_FAH_ IMPLEMENTATION_CONSULTANT as shown in Appendix A, you must have access to the data role General Accountant ACME US Insurance Ledger in order to view the journals created by the accounting process.

Create Database Objects

In order to create the database objects, first your database administrators (DBAs) must create a custom schema for the database objects. The following steps can be executed by your DBA by connecting to the SYS schema. Your DBA will most likely create a dedicated tablespace for the user/schema being created.

Next, the staging table must be created as shown in the following example. In some organizations, you will use data modeling tools to create and manage these staging tables. It is also very common practice to use ETL tools that prepare data for FAH to process. But for this example, we will create the table manually as shown in the following example:

After creating the table in a custom schema, next create grant permissions to this table for FUSION schema and create database views, with subsequent grants to FUSION_RUNTIME:

Next, create a PL/SQL package in the FUSION schema. This PL/SQL package will be executed from the Enterprise Scheduler program, which will be registered later in this chapter. For simplicity we are using a package dedicated for trade accounting in this chapter. In a real-life implementation, you will write common FAH feed-processing utilities that can be used across all the incoming feeds. Further, you will create a common set of data models for all incoming feeds with error management integrated with the appropriate error exception management framework of your architecture.

Configure Fusion Accounting Hub

Table 9-4 lists the high-level steps required for the configuration of accounting rules. We will implement all the mandatory steps in order to process the journal.

TABLE 9-4. Business Rules for Chart of Account Derivation

Create GL Journal Source

In Setup And Maintenance, search and navigate to the task Manage Journal Sources. Click the + icon to create a new journal source with Name: Insurance Trades, Source Key: INSURANCE_TRADES, Description: Insurance Trades, and leave the remaining fields as per the defaults.

Create FAH Configuration Implementation Project

Navigate to Setup And Maintenance and click Manage Implementation Projects. Click the Create icon to create a new project with the following details:

Name: XX_FAH_TRADE_ACCOUNTING

Code: XX_FAH_TRADE_ACCOUNTING

Description: XX FAH TRADE ACCOUNTING

Click Next and expand the offering Fusion Accounting Hub. Enable the check box for Fusion Accounting Hub and all its child offerings, which are Accounting Coexistence, Intercompany, and Intrastat Reporting. Click the Save And Open Project button. Here you will see all the task lists and tasks associated with Fusion Accounting Hub configuration.

Create the FAH Application

To create a new subledger application, perform the following steps in the Task Lists And Tasks screen:

1. Expand the Register Source System Applications Tasks List.

2. Click Select... to the right of Manage Subledger Application as shown in Figure 9-3.

FIGURE 9-3. Creating a new subledger application for accounting rule configuration

3. Click the circle for Create Subledger Application.

4. Select Create New in the drop-down list.

Use the following information for creating the subledger application: Subledger Application: XX_FAH_TRADE_APPLICATION, Short Name: XX_FAH_TRADE_APPLICATION, Description: XX_FAH_TRADE_APPLICATION, and Journal Source: Insurance Trades. Once this application has been created, all future configurations in FAH for this chapter will be within this application, unless you wish to switch the scope to become another application. After following these steps, a new subledger application named XX_FAH_TRADE_APPLICATION will have been created, with the scope in this project set to this application.

Create the FAH Event Model

In the Manage Subledger Application, click the Create Process Category button. A small window will pop up to create a process category. Enter a name and short name as XX_FAH_TRADE_PRC_CATEGORY and click the Save And Close button.

Create an event model within this process category. Click the + icon as shown in Figure 9-4. Within the event model, create an event class, giving it a name and short name of XX_FAH_TRADE_EVENT_CLASS. In this example, use a Default Journal Category of Miscellaneous. This is a seeded General Ledger category. You will be defining a new journal category for your real implementation project. Attach the database view XX_FAH_TRADES_V to this event class under the System Transaction Identifiers tab as shown in Figure 9-5. Again in the System Transaction Identifiers tab, click the + icon to add a new row for Identifier SOURCE_ID_INT_1 and select TRADE_NUMBER as the View Column. In the User Transaction Identifiers tab, click the + icon to add three records for the identifier and view column combination as shown in Figure 9-5. Map Traded Equity to EQUITY_NAME, Transaction Amount to TRADE_AMOUNT, and Accounting Date to TRADE_DATE.

FIGURE 9-4. Creating an event model for the subledger application

FIGURE 9-5. Creating an event model for the FAH Trade Accounting application

You will be creating an event type after the event class has been created. This event type will belong to the event class XX_FAH_TRADE_EVENT_CLASS. Select your event class and click the + sign to create the event type, with the name and short name of XX_FAH_PURCHASE_EQUITY.

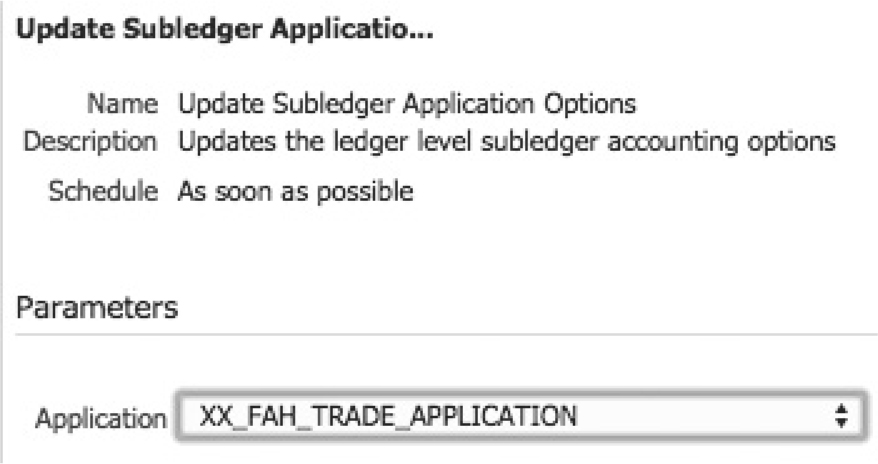

Now that your event model has been created, you can submit the next task to run a process named Update Subledger Accounting Options. In the parameters, select Application XX_FAH_TRADE_APPLICATION as shown in Figure 9-6 and click Submit. Navigate to the Scheduled Process window and ensure that the submitted process has succeeded.

FIGURE 9-6. Running the Update Subledger Application Options process

Next, navigate to the Manage Subledger Application Transaction Objects task and create an entry in the Transaction Objects region with XX_FAH_TRADES_V as the Object Name and Header as the Object Type. Click the Save And Close button, and then submit the task Create And Assign Sources with the parameter Subledger Application configured as XX_FAH_TRADE_APPLICATION. At this stage you must ensure that the submitted process has been successful, as shown in the status field of Figure 9-7. You must not proceed with further configuration of accounting rules unless this process has been successful.

FIGURE 9-7. Create And Assign Subledger Sources screen showing results

Navigate to the task Manage Accounting Attributes and add the following accounting attributes: Entered Amount : TRADE_AMOUNT, Accounting Date : TRADE_DATE, Distribution Type : EVENT_TYPE, First Distribution Identifier : LINE_NUMBER, Entered Currency Code : TRADE_CURRENCY as shown in Figure 9-8. Click the Validate Assignments button.

FIGURE 9-8. Accounting attribute assignments

Configure Accounting Rules

A series of tasks must be performed to configure the accounting rules. These steps are highlighted in Figure 9-9.

FIGURE 9-9. Tasks for configuration of accounting rules

Click the Manage Account Rules task and click New. Create a new accounting rule with a name and short name of XX_FAH_COMPANY_SEGMENT. In Chart of Accounts, select ACME Insurance COA Instance, change Rule Type to Segment, and select Company as the segment from the drop-down list. In the Rules region, click the + icon and add a new row with Value Type Source, Value as COMPANY_NUMBER from the drop-down list, and click Validate. This will create an accounting rule for the company segment as shown in Figure 9-10.

FIGURE 9-10. The Create Account Rule screen for company segment

Define a mapping set to derive the Line of Business segment value. Using the mapping set, you can map a text value to a predefined value in the value set segment. In this case, we wish to map ACME Life Asset Management division, that is, ALAM, to 104. Navigate to the Mapping Set task and click New to create a new mapping set as shown in Figure 9-11. This value set will map the value in column BUSINESS_DIVISION to the Line of Business segment value.

FIGURE 9-11. Defining a mapping set for the Line of Business segment

Click Manage Account Rules and define a new rule named XX_FAH_LOB_SEGMENT, while attaching it to the mapping set created for the Line Of Business segment, as shown in Figure 9-12. Click Validate, and click the Save And Close button.

FIGURE 9-12. Attaching the mapping set to an account rule

Having created the accounting rules for Entity and Company, next create account rules for the Account, Cost Center, Intercompany, Location, and Spare segments as shown in Table 9-5. The account rules for these segments will be created with constant values. In a real implementation project you will use conditions, mapping sets, or source derivation to derive values for account segments.

TABLE 9-5. Account Rules for the Remaining Segments

Navigate to the task Manage Journal Line Rules. This is where the credit and the debit entries will be created. Create a new Journal Line Rule named XX_FAH_TRADE_RULE_CR as shown in Figure 9-13. Ensure that the side is Credit and the Accounting Attribute Group is Entered Currency in the Accounting Attribute Assignments tab. Follow the exact same steps to create a Debit Journal Line Rule named XX_FAH_TRADE_RULE_DR. You can click Action | Duplicate to duplicate the Journal Line Rule that can be amended further.

FIGURE 9-13. Creating a Credit Journal Line rule

To create a Journal Entry Rule Set, go to the task Manage Subledger Journal Entry Rule Sets and create a rule set named XX_FAH_TRADE_RULE_SET. Select Event Class XX_FAH_TRADE_EVENT_CLASS for this rule set, with Event Type value All. Assign ACME Insurance COA Instance to this rule set. In the Journal Lines region, click the + sign to attach the Journal Line Rules for Credit and the Debit side that were created in the previous step.

In the Segment Rules region for the Credit Journal Line Rule XX_FAH_TRADE_RULE_CR, assign XX_FAH_COMPANY_SEGMENT to Company, XX_FAH_LOB_SEGMENT to LOB, XX_FAH_CC_SEGMENT to Cost Centre, XX_FAH_ACC_SEG_CR to Account, XX_FAH_IC_SEGMENT to Intercompany, XX_FAH_LOCATION to Location, and XX_FAH_SPARE to Spare. Similarly, for the Debit Journal Line Rule XX_FAH_TRADE_RULE_DR, replicate the same segment rules as that for Credit, but change the Account segment rule to XX_FAH_ACC_SEG_DR. These steps are shown in Figure 9-14. Click Actions and activate the Journal Line Rule Set.

FIGURE 9-14. Journal Line Rule Set

Navigate to the task Manage Standard Accruals, select the Standard Accrual accounting method, and click Actions | Duplicate to create a new accounting method named XX_FAH_ACME_INSURANCE_ACCRUAL. Add the Event Class, Event Type, and Rule Set as shown in Figure 9-15, and activate this accounting method.

FIGURE 9-15. Creating an accounting method for the rule set

After the accounting method has been activated, it can be assigned to the primary ledger ACME US Insurance Ledger. Navigate to the task Specify Ledger Options under Manage Primary Ledgers for ACME US Insurance Ledger, and change the accounting method from Standard Accrual to XX_FAH_ACME_INSURANCE_ACCRUAL as shown in Figure 9-16. This completes the configuration of accounting rules required to implement ACME’s requirement.

FIGURE 9-16. Changing the accounting method of the ledger to use new accounting rules

Create a System Event and Import Journals

A technical specialist will create a new enterprise scheduler job to process the trades so that accounting can be generated as per your accounting rules. To create this job, go to the task Define Custom Enterprise Scheduler Jobs For Ledger And Related Applications and create a PL/SQL type job as shown in Figure 9-17.

FIGURE 9-17. Creating an enterprise scheduler job to create system events for trades

After inserting the records into the staging table XX_FAH_TRADES_STG, run this scheduler job, and it should create the events in a table named XLA_EVENTS. Your technical specialist should be able to verify this by querying on this table.

After the event creation, submit a standard enterprise scheduler job called Create Accounting as shown in Figure 9-18.

FIGURE 9-18. Submitting a Create Accounting job

The Create Accounting process will spawn the journal import program as shown in Figure 9-19.

FIGURE 9-19. The journal import process finally creates the journals from the trading system.

Summary

In this chapter you have seen the end-to-end implementation process to create accounting for transactions taking place in third-party systems. Although the examples in this chapter perform accounting for investment trades, similar principles can be applied to any other type of system. The example in this chapter creates both a debit and credit side automatically for a single trade event in asset management. However, in some implementations the source system may have its own built-in General Ledger. In those cases, you can implement pass-through accounting so that for each source system transaction line, a corresponding journal line is created in Fusion Accounting Hub.

In this chapter, you have also seen that Fusion Accounting Hub requires teamwork between a business analyst and a technical specialist.

At the time of writing this book, the Fusion Accounting Hub is only available for on-premise or Oracle Private cloud up to Release 9. Oracle may make Fusion Accounting Hub available on public cloud in its future releases.