Chapter 16

Accounting Ratios

LEARNING OBJECTIVES

After studying this chapter, you would be able to understand

Meaning of Ratio and Ratio Analysis

Objective of Ratio Analysis

Advantages and Uses of Ratio Analysis

Limitations of Ratio Analysis

Classification of Ratios

Liquidity Ratios – Computations

Solvency Ratios – Computations

Profitability Ratios – Computations

Activity Ratios – Computations

Ratios

INTRODUCTION

Usually the accounting goal in preparing financial statements is to provide valuable information to its different types of users. They mainly concentrate on collecting financial data and preparing financial statements — Balance Sheet and Income Statement. These statements provide only certain figures for its components. In order to make the information more useful, these financial statements are analysed by applying different techniques. One such technique or tool employed for analysing financial statements is “Ratio Analysis”, the corner stone of financial analysis is the use of ratios. As ratios capture critical dimension of the economic performance of business entities, the study of ratio analysis has gained much importance now-a-days. Numbers depicted in financial statements are hard to understand out of context. For example, “Profit Rs 2,50,000” — shown in income statement cannot reveal the exact real meaning unless it is analysed with other items (components), that is, how much capital is employed to achieve this profit. Likewise, this may be analysed by comparing with other components — sales, total assets, selling expenses, administration expenses and so on. Role of ratio analysis is vital, in such scenario. A financial ratio is computed by dividing one number (component/item) by another number. For a set of financial statements, a number of ratios can be computed. Only such ratio analysis can help give true meaning to the numbers in the Balance Sheet as well as income statements. The basic financial ratios help us to put numbers in perspective. By relating one part of the financial statements to another, they facilitate to answer a number of questions. In this chapter, important ratios, namely Liquidity Ratios, Solvency Ratios, Activity Ratios and Profitability Ratios are dealt with in analysis of financial statements.

OBJECTIVE 1: MEANING OF RATIO ANALYSIS–A SYSTEMATIC USE OF RATIOS TO INTERPRET THE PERFORMANCE OF ENTITIES

1.1 Meaning of Ratio and Ratio Analysis

A “Ratio” is described as arithmetical expression of relationship between two related items. Here, items represent the various components that constitute the financial statements. As these components have cause and effect relationship, arithmetical relationship between such components attains much significance. Accounting Ratios are nothing but ratios that are compared on the basis of accounting information provided by financial statements.

Ratio Analysis is a tool or technique employed to analyse the financial statements. Ratio Analysis is a process of interpreting relationship between the components (item) of financial statements thereby extending a meaningful information about business entities. Ratio Analysis is an accounting tool utilised in analysis, interpreting the various items in financial statements and reporting in understandable terms to its users. Myers explained it as, “Ratio Analysis is a study of relationship among various financial factors in a business”.

Ratio Analysis is a systematic use of ratios to interpret the financial statements in order to determine the performance and financial condition of the business enterprises. The term Accounting Ratios refers to the numerical relationship between two components/items/variables of the financial statements. This relationship can be expressed as

- Proportion say, for example the relationship between two variables – current assets and current liabilities (assuming current assets of Rs 1,50,000 and current liabilities of Rs 50,000). Current assets/Current liabilities

= Rs 1,50,000/Rs 50,000 = 3:1.

The relationship between two variables is expressed in the ratio form as 3:1 (proportion of numbers).

- The relationship can be expressed in terms of percentage say, net profits are 20 percent of sales (assuming net profit of Rs 20,000 and sales of Rs 1,00,000).

Net Profit/Sale× 100 = Rs 20,000/Rs 1,00,000×100 = 20%

(or)

- The same relationship can be expressed in fraction:

Net Profit is 1/5th of Sale = 20,000/1,00,000 =1/5 (or) 0.2

(or)

- The relationship can be expressed in “a number of times” – say the relationship between two items, net sales and current assets (assuming net sales of current assets turnover ratio) = Net Sales/Current Assets = 1,00,000/20,000 is expressed in “a number of times” as 5.

These alternative methods of expressing variables which are related to each other (interdependent) are referred to as Ratio Analysis. Such analysis facilitates to make better decisions on the overall performance of business organisations.

1.2 Ratio Analysis

The main objectives are:

- To judge the earning capacity of enterprises

- To ascertain the financial position (liquidity and solvency) and

- To determine the operating efficiency of business entities.

One would be able to understand broad objectives from the advantages of Ratio Analysis.

OBJECTIVE 2: ADVANTAGES AND USES OF RATIO ANALYSIS

1. Effective Tool in Analysis of Financial Statements: Final accounts of any enterprise is analysed by means of ratios, thereby all of them – bankers, investors, creditors etc.,are in a position to understand the financial position of such enterprises.

2. Easy and Simple in Application: These ratios summarise briefly the results of detailed and complicated accounting computation.

3. Liquidity Position: Ratios are an effective tool in assessing the firm‘s ability to meet its short-term obligations. Liquidity Ratios play an important role.

4. Long-term Solvency: Ratio Analysis is useful in analysing the long-term financial strengthness of a business entity. Profitability Ratio‘s role is significant in determining such capacity of a firm.

5. Judging Operating Efficiency: Activity Ratios are very useful in assessing the operating efficiency of a business concern. Sales revenue mobilised by effective utilisation of assets –is best ascertained by using Activity Ratios.

6. Tools for Forecasting: Ratios are very much useful in planning, execution and forecasting of any business related activities. Trend Ratios facilitate these tasks.

7. Overall Profitability: The management of any business enterprise is interested in the overall capability, i.e. (i) ability to meet its short-term and long-term needs to its creditors (ii) to ensure a reasonable return to its owners and (iii) to secure optimum and effective utilisation of the assets of the firm. All the ratios play an effective role in assessing the overall profitability of a concern.

8. Diagnosis and Remedial Measures: Even though the overall profitability is said to be normal, these ratios act effectively in spotting out the weak spots in the business components and suggesting measures to be taken to plug the loop-holes.

9. Intra-firm Comparison: The performance of different units belonging to the same business firm can be easily compared with Ratio Analysis. In an unit of the same firm, progress can be motivated and slackness can be averted by such intra-firm comparisons.

10. Inter-firm Comparison: Comparison of a firm‘s performance with other business firms is called inter-firm comparison. Such comparison exposes a firm‘s position against its competitors. Adverse results will help to rectify and modify its planning to achieve the desired results in the industry.

11. Trend Analysis: To sail among the other industries, to know the direction of movement, this trend analysis can render the necessary assistance.

OBJECTIVE 3: LIMITATIONS OF RATIO ANALYSIS

1. Results not Reliable: Reliability of ratio and its analysis depends on the correctness of financial statements. So the results obtained on the basis of any defective financial statements may also be not reliable.

2. Difficulty in Comparison: Various firms may adopt different procedures for the various activities of the enterprise. Differences may be due to

- Method of inventory valuation (First-In-First-Out (FIFO), Last-In-First-Out (LIFO) etc.)

- Method of computing depreciation (WDV, Straight Line)

- Working life of assets estimation

- Amortisation of intangible assets (goodwill, patents)

- Capitalisation of certain items

- Treatment of extraordinary items etc.

- Different accounting period, procedures

Due to such variations among the industries, comparisons may not be easy, reliable and accurate.

3. Price Level Changes: Frequent changes in price level will affect the compatibility of ratios. At times of inflation, such comparison will not yield the desired results.

4. Different Concepts: There are always different opinions about accounting concepts and computation techniques of various ratios. This conceptual diversity affects the effectiveness of Ratio Analysis. Different meanings and different approaches affect comparison.

5. Not Qualitative Analysis: As Accounting Ratios are tools of quantitative analysis, qualitative factors are ignored or over-rided.

6. Window Dressing: Manipulation of values are always in practice by concealing the real facts. Ratios are affected by window dressing of figures.

7. Not a Standard Yardstick: There is no standard ratio in practice to compare any of the components of business enterprise. It is difficult to evolve a common standard ratio, which is acceptable by all and at all times.

8. Insignificant Factors: Even if the figures of a business entity are not really significant, Accounting Ratios are computed. Such ratios may not be of much use for any financial analyst.

9. Personal Bias: While preparing financial statements, personal judgment plays a crucial role and as such these ratios are also not free from this limitation. So, such conclusions based on personal bias will be a standard one.

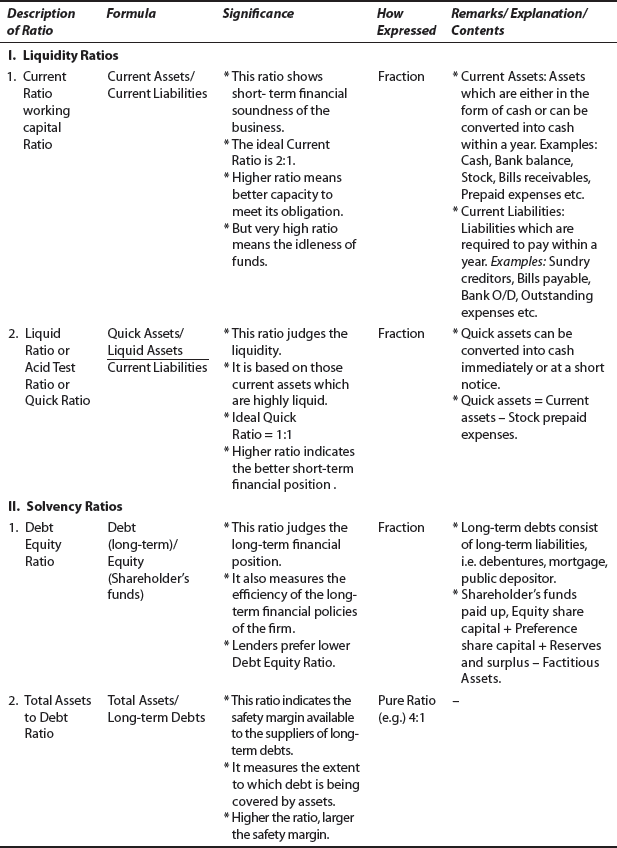

OBJECTIVE 4: CLASSIFICATION OF RATIOS OR TYPES OF RATIOS

Ratios may be classified as:

- Liquidity Ratios (Short-term solvency)

- Solvency Ratios

- Profitability Ratios

- Activity Ratios

OBJECTIVE 5: LIQUIDITY RATIOS

These ratios measure the short-term solvency of a concern. These ratios measure the firm‘s ability to pay off current dues (i.e., repayable in a year). In other words, liquidity means the ability to meet short-term obligations. (A liquid asset is one that can very easily be converted in to assets.) Liquidity Ratios may further be classified as:

- Current Ratio

- Liquid Ratio

- Absolute Liquid Ratio

5.1 Current Ratio – Relationship of Current Assets to Current Liabilities

- The relationship of current assets to current liabilities is termed as “Current Ratio”.

- Short-term financial position is assessed by computing this ratio.

- Current Ratio serves also as an indicator to assess short-term obligations of a concern.

- This is calculated at a particular date and NOT for a particular PERIOD.

- The ratio is computed as: Current Ratio = Current Assets/Current Liabilities.

- Current Assets: The assets, which are in the form of cash or cash equivalents or can be converted into cash in a short time are current assets. These are

- Current Liabilities: Liabilities, which are repayable in short time. These are:

- Sundry creditors

- Bills payable

- Overdraft (Bank/Bills)

- Short-term loans

- Outstanding expenses

- Provision for Tax

- Unclaimed Dividend

- Any enterprise should have a reasonable Current Ratio, satisfactory level is 2:1. A higher ratio indicates poor investment policy, and a lower ratio reveals lack of liquidity and shortage of working capital.

- The excess of current assets over current liabilities is known as working capital.

Computation of Current Ratio

Illustration: 1

From the following, compute Current Ratio.

|

|

Rs |

|

Stock |

36,500 |

|

Sundry Debtors |

63,500 |

|

Cash-in-hand and Cash in Bank |

10,000 |

|

Bills Receivable |

9,000 |

|

Short-term Investments |

30,000 |

|

Prepaid Expenses |

1,000 |

|

Bank Overdraft |

20,000 |

|

Sundry Creditors |

25,000 |

|

Bills Payable |

16,000 |

|

Outstanding Expenses |

14,000 |

Solution

Step 1: |

Students have to classify and list out the Current Assets. They are: Stock, Sundry Debtors, Cash-in-hand/Bank, Bills Receivable, Short-term Investments, Prepaid Expenses. |

Step 2: |

Value of all these Current Assets have to be added and total value of Current Assets is calculated. |

Step 3: |

Now, Current Liabilities have to be sorted out. They are: Bank Overdraft, Sundry Creditors, Bills Payable and Outstanding Expenses. |

Step 4: |

Value of all these Current Liabilities have to be added together and total value of Current Liabilities is arrived at. |

Step 5: |

Current Assets/Current Liabilities = Current Ratio |

(a)Total value computed as in Step 2 and Step 4 to be taken into account.

|

Here, value of Current Assets |

= |

Rs 1,50,000 |

|

Current Liabilities |

= |

Rs 75,000 |

|

Current Ratio |

= |

Rs 1,50,000/Rs 75,000 |

|

|

= |

2:1 |

Step 6: |

Conclusion: Current Ratio is at normal level. |

Computation of Current Ratio from Balance Sheet

Illustration: 2

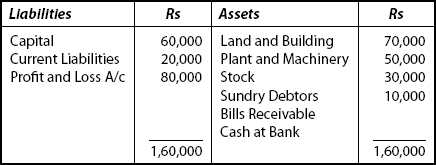

From this Balance Sheet of Prasadh and Co. Ltd, compute the Current Ratio.

Balance Sheet as on Mar 31, 2006

Solution

Step 1: |

Total value of all Current Assets have to be calculated first. |

Step 2: |

Here, if Balance Sheet is given, students have to pick up from the assets side, items belonging to current assets. |

Step 3: |

Here, except Fixed Assets, all the other items, that is, Stock, Debtors and Cash are Current Assets. Its total value = Rs 12,000 + Rs 7,500 + Rs 10,500 = Rs 30,000/- |

Step 4: |

Next step is to pick up the Current Liabilities alone from the Liabilities side of the Balance Sheet. Here Bank Overdraft and Creditors are Current Liabilities. Its total value = Rs 7000 +Rs 8000 = Rs 15,000 |

Step 5: |

Current Ratio: Current Assets/Current Liabilities |

Step 6: |

Conclusion: The Current Ratio is at normal level. |

Current Ratio from Working Capital

Illustration: 3

From the following, calculate the Current Ratio.

|

|

|

Rs |

|

Liquid Assets |

: |

40,000 |

|

Stock |

: |

30,000 |

|

Prepaid Expenses |

: |

10,000 |

|

Debtors |

: |

20,000 |

|

Working Capital |

: |

75,000 |

Solution

Here, working capital is given.

Step 1: So, students have to find out the value of Current Liabilities by using the formula:

(As Working Capital |

= |

Current Assets – Current Liabilities) |

Current Liabilities |

= |

Current Assets – Working Capital |

Value of Current Assets |

= |

Liquid Assets × Stock Debtors × Prepaid Expenses |

|

= |

Rs 40,000 × Rs 30,000 × Rs 20,000 × Rs 10,000 = Rs 1,00,000 |

= |

Current Assets — Working Capital |

|

|

= |

Rs 1,00,000−Rs 75,000 (given) |

|

= |

Rs 25,000 |

Step 3: Current Ratio |

= |

Current Assets/Current Liabilities |

|

= |

1,00,000/25,000 |

|

= |

4:1 |

Step 4: |

Conclusion: Current Ratio is at a higher level. It indicates poor investment policy of the concern, as huge amount of assets lie idle. |

Current Ratio from Capital Employed

Illustration: 4

A company has Total Assets of Rs 3,00,000, Fixed Assets: Rs 1,50,000, Capital Employed: Rs 2,70,000. Calculate the Current Ratio.

Solution

Step 1: Total assets and fixed assets are given. So Current Assets have to be worked out.

Current Assets |

= |

Total Assets − Fixed Assets |

|

= |

Rs 3,00,000 − Rs 1,50,000 |

|

= |

Rs 1,50,000 |

Step 2: From the value of capital employed and total assets, Current Liabilities have to be computed.

Current Liabilities |

= |

Total Assets − Capital Employed |

|

= |

Rs 3,00,000 − Rs 2,70,000 |

|

= |

Rs 30,000 |

Step 3: Current Ratio |

= |

Current Assets/Current Liabilities |

|

= |

1,50,000/30,000 |

|

= |

5:1 |

Step 4: Conclusion: Current Ratio is 5:1. It is above normal level.

Current Ratio from Debts

Illustration: 5

Calculate Current Ratio from the following:

|

|

Rs |

Working Capital |

: |

80,000 |

Total Debt |

: |

60,000 |

Long-term Debt |

: |

40,000 |

Solution

Step 1: Value of current liabilities is to be calculated first, if these datas alone are given.

Current Liabilities |

= |

Total Debt − Long-term Debt |

(i.e., Short-term Debt) |

||

|

= |

Rs 60,000 − Rs 40,000 |

|

= |

Rs 20,000 |

Step 2: Next step is to find the value of Current Assets.

Current Assets |

= |

Working Capital + Current Liabilities |

|

= |

Rs 80,000 + Rs 20,000 |

|

= |

Rs 1,00,000 |

= |

Current Assets/Current Liabilities |

|

|

= |

1,00,000/20,000 |

|

= |

5:1 |

Step 4: Current Ratio is at a higher level.

Treatment of Value of Goods Purchased

Illustration: 6

A company has Current Assets of Rs 2,50,000 and Current Liabilities Rs 1,50,000. Afterwards it purchased goods for Rs 50,000 on credit. Calculate Current Ratio after the purchase.

Solution

Note: Value of Current Assets and Current Liabilities, value of goods purchased are given.

* Value of goods purchased is on credit.

Important: So, it comes under both Current Assets and Current Liabilities.

* So, this value has to be added with liabilities and assets.

So Current Assets |

= |

Rs 2,50,000 + Rs 50,000 |

Current Liabilities |

= |

Rs 1,50,000 + Rs 50,000 |

Current Ratio |

= |

3,00,000/2,00,000 |

|

= |

3:2 |

Treatment of Creditors

Illustration: 7

Current Liabilities of a company are Rs 2,00,000/-, Current Ratio = 2.5:1. After this, it paid to X, a creditor of Rs 50,000. Calculate Current Ratio after payment to the creditor.

Solution

Step 1: |

Current Ratio and Current Liabilities are given. From this, Current Assets have to be calculated. |

Current Ratio |

= |

Current Assets/Current Liabilities |

Current Assets |

= |

Current Ratio × Current Liabilities |

|

= |

2.5 × Rs 2,00,000 |

|

= |

Rs 5,00,000 |

Step 2: |

Payment of Rs 50,000 is given to the creditor. This has to be adjusted on both Current Assets and Current Liabilities. |

So, after payment

Current Assets = Rs 5,00,000 − Rs 50,000 = Rs 4,50,000

Current Liabilities = Rs 2,00,000 − Rs 50,000 = Rs 1,50,000

Step 3: Current Ratio |

= |

4,50,000/1,50,000 |

|

= |

3:1 |

Treatment of Value of Current Assets

Illustration: 8

The ratio of Current Assets to Current Liabilities is 3:1, value being Rs 3,00,000 and Rs 1,00,000 respectively. The accountant of that firm is firm to maintain Current Ratio at 2:1 by acquiring Current Assets on credit being standard levels. You are required to assist him by suggesting the amount of Current Assets to be bought.

Step 1: Let the value of Current Assets to be required be = X (assumed)

Step 2: Current Ratio |

= |

Current Assets /Current Liabilities |

|

|

|

|

= |

(1,00,000 + X) 2 = (3,00,000 + X) 1 |

|

= |

2,00,000 + 2X = 3,00,000 + X |

2X − X |

= |

3,00,000 − 2,00,000 |

X |

= |

1,00,000 |

Current Assets to be acquired to maintain 2:1 Current Ratio = Rs 1,00,000.

5.2 Liquid Ratio or Quick Ratio or Acid Test Ratio

- Liquid Ratio is a relationship of liquid assets with current liabilities.

- This ratio is used to assess the firm‘s short-term liquidity. (Solvency)

- Liquid Assets = Current Assets – (Stock + Prepaid Expenses)

- This ratio is an indicator to assess the short-term debt paying capacity of a concern.

- This ratio is of high importance for Banks and other financial institutions.

- Liquid Ratio is computed as:

- Liquid Ratio = Liquid Assets/Current Liabilities

- Liquid Ratio of 1:1 is generally taken as a favourable one.

- A high Liquid Ratio indicates understocking.

- A low Liquid Ratio indicates overstocking.

Treatment of Liquid Assets

Illustration: 9

Calculate “Liquid Ratio” from the following:

|

|

Rs |

|

Current Liabilities |

80,000 |

|

Current Assets |

1,20,000 |

|

Stock |

30,000 |

|

Prepaid Expenses |

10,000 |

|

Sundry Debtors |

50,000 |

Solution

Step 1: First, Liquid Assets have to be calculated

-

Liquid Assets

=

Current Assets − (Stock + Prepaid Expenses)

=

Current Assets − (Stock + Prepaid Expenses)

=

Rs 1,20,000 − (Rs 30,000 + Rs 10,000)

=

Rs 1,20,000 − Rs 40,000

=

Rs 80,000

or

- It may also be deducted one by one from current assets, as

Current Assets – Stock – Prepaid Expenses. [Students may choose whichever is easier for them, either (i) or (ii).]

Step 2: Liquid Ratio |

= |

Liquid Assets/Current Liabilities |

|

= |

Rs 80,000/Rs 80,000 |

|

= |

1:1 |

Conclusion: Liquid Ratio is said to be at a normal and satisfactory level.

Computation of Current Ratio and Liquid Ratio

Illustration: 10

Sonali Ltd furnished the following information regarding its Current Assets and Current Liabilities:

|

Current Assets |

Rs |

|

Cash |

5,000 |

|

Sundry Debtors |

35,000 |

|

Bills Receivable |

10,000 |

|

Marketable Securities |

20,000 |

|

Prepaid Expenses |

8,000 |

|

Stock |

62,000 |

|

Total |

1,40,000 |

|

Current Liabilities |

|

|

Sundry Creditors |

40,000 |

|

Bills Payable |

25,000 |

|

Outstanding Expenses |

5,000 |

|

Total |

70,000 |

You are required to compute

- Current Ratio,

- Liquid Ratio,

- And as an accountant, pass your opinion on the result of these ratios.

Solution

Step 1: First Current Ratio is to be calculated.

Current Ratio |

= |

Current Assets/Current Liabilities |

|

= |

Rs l,40,000/Rs 70,000 = 2:1 |

Step 2: Liquid Ratio is to be calculated.

So, Liquid Assets have to be computed.

Liquid Assets |

= |

Current Assets − Stock − Prepaid Expenses |

|

= |

Rs 1,40,000 − Rs 62,000 − Rs 8,000 = Rs 70,000 |

Liquid Ratio |

= |

Liquid Assets/Current Liabilities |

|

= |

1:1 |

Opinion

- Current Ratio is 2:1 which is ideal one.

- Liquid Ratio is 1:1 which is also ideal.

So, the position of Sonali Ltd is said to be satisfactory and ideal, based on liquidity point of view.

Treatment of Value of Stock

Illustration: 11

Current Liabilities of a company: Rs 2,50,000

Current Ratio: 2:1

Liquid Ratio: 1:1

Compute the value of stock assuming there are no other current assets.

Step 1: First, value of Liquid Assets has to be calculated, as Liquid Ratio is given.

Liquid Ratio: 1:1 |

|

|

|

= |

Liquid Assets/Current Liabilities = 1/1 |

|

= |

Liquid Assets/Rs 2,50,000 = 1/1 |

| ∴ Liquid Assets | = |

Rs 2,50,000 |

Step 2: Value of Current Assets to be calculated, as Current Ratio is given.

Current Ratio |

= |

Current Assets/Current Liabilities = 2/1 |

|

= |

Current Assets/2,50,000 = 2/1 |

(Current Assets × 1) |

= |

(2 × 2,50,000) |

|

= |

Rs 5,00,000 |

Step 3: Value of stock is to be found out.

Value of Stock = Current Assets − Liquid Assets (Stock-in-trade)

Because, stock is the only current asset, as per the assumption given in the problem.

= Rs 5,00,000 – Rs 2,50,000

= Rs 2,50,000

Computation of Current Liabilities from Ratios

Illustration: 12

The Current Ratio of a company is 3:1 and Liquid Ratio is 1:1. Stock is Rs 5,00,000. Compute Current Liabilities.

Solution

Step 1: Since two various ratios are given, from that ratio, Current Liabilities is to be calculated.

Current Ratio |

= |

Current Assets/Current Liabilities |

|

= |

3/1 |

Liquid Ratio |

= |

Liquid Assets/Current Liabilities = 1/1 |

Current Assets − Liquid Assets |

= |

Stock |

3 − 1 |

= |

Stock |

2 |

= |

Stock |

Current Liabilities = 5,00,000/2 |

= |

Rs 2,50,000 |

Computation of Current Assets and Current Ratio

Illustration: 13

Total Current Liabilities of a company is Rs 3,00,000, Liquid Ratio is 4:1, Stock is Rs 3,00,000. Find the Current Assets and Current Ratio.

Solution

Step 1: Current Liabilities = Rs 3,00,000 (Given)

Liquid Ratio = 4:1 (Given)

Step 2: Liquid Ratio = Liquid Assets/Current Liabilities

= 4:1

That means Liquid Assets are 4 times as that of Current Liabilities

∴ Liquid Assets |

= |

4 × Rs 3,00,000 |

|

= |

Rs 12,00,000 |

= |

Liquid Assets + Stock |

|

|

= |

Rs 12,00,000 + Rs 3,00,000 |

|

= |

Rs 15,00,000 |

Step 4: Current Ratio |

= |

Current Assets/Current Liabilities |

|

= |

Rs l5,00,000/Rs 3,00,000 |

|

= |

5:1 |

Illustration: 14

Sharma Ltd has Liquid Ratio 2:1, stock is Rs 50,000. Total Current Liabilities is Rs 1,00,000. Compute Current Ratio.

Solution

Step 1: Liquid Ratio = 2:1 (Given)

Liquid Ratio = Liquid Assets/Current Liabilities = 2/1

This means that the value of Liquid Assets is twice as that of Current Liabilities.

Liquid Assets |

= |

2 – Rs 1,00,000 |

|

= |

Rs 2,00,000 |

Step 2: Value of Current Assets has to be calculated.

Current Assets |

= |

Liquid Assets + Stock |

|

= |

Rs 2,00,000 + Rs 50,000 |

|

= |

Rs 2,50,000 |

Step 3: Current Ratio |

= |

Current Assets/Current Liabilities |

|

= |

Rs 2,50,000/Rs 1,00,000 |

|

= |

2.5:1 |

Computation of Value of Stock

Illustration: 15

Liquid Ratio: 2:1; Current Assets: Rs 2,50,000; Current Liabilities: Rs 60,000. Compute the value of stock.

Solution

Step 1: Liquid Ratio = 2:1 (Given)

Liquid Ratio |

= |

Liquid Assets/Current Liabilities = 2/1 |

Liquid Assets |

= |

Current Liabilities × 2 |

|

= |

Rs 60,000 × 2 |

|

= |

Rs 1,20,000 |

Step 2: Value of stock |

= |

Current Assets − Liquid Assets |

|

= |

Rs 2,50,000 − Rs 1,20,000 |

|

= |

Rs 1,30,000 |

Relationship of Working Capital with Current Ratio and Liquid Ratio

Illustration: 16

Working capital of a limited company is Rs 1,20,000. Current Ratio is 3:1, Stock is Rs 60,000. Compute (a) Current Liabilities (b) Current Assets (c) Liquid Ratio

Solution

From Working Capital and Current Ratio, other values are computed as follows:

Step 1: Working Capital = Current Assets – Current Liabilities

Rs 1,20,000 = Current Assets − Current Liabilities

Step 2: Current Ratio = Current Assets/Current Liabilities = 3/1

Step 3: Assume Current Liabilities = X

Then, Current Assets = 3 × X (as ratio is = 3:1)

Step 4: Go to first step,

i.e., Current Assets – Current Liabilities |

= |

1,20,000 |

3X – X |

= |

1,20,000 |

2X |

= |

1,20,000 |

X |

= |

Rs 60,000 (Current Liabilities) |

Step 5: Current Assets |

= |

Rs 60,000 × 3 |

|

= |

Rs 1,80,000 |

Step 6: Liquid Assets |

= |

Current Assets − Stock |

|

= |

Rs 1,80,000 − Rs 60,000 |

|

= |

Rs 1,20,000 |

Step 7: Liquid Ratio |

= |

Liquid Assets/Current Liabilities |

|

= |

1,20,000/60,000 = 2/1 |

|

= |

2:1 |

5.3 Absolute Liquid Ratio – Relationship of Absolute Liquid Assets to Liquid Liabilities

The relationship of absolute liquid assets to liquid liabilities is termed as “Absolute Liquid Ratio”. It is calculated as:

Absolute Liquid Ratio = Absolute Liquid Assets/Liquid Liabilities

Absolute Liquid Assets = Cash, Bank and Short-term Investments.

Liquid Liabilities = Current Liabilities – Bank overdraft. Satisfactory level of ratio is 1:1.

Computation of Absolute Liquid Ratio

Illustration: 17

A limited company has Current Liabilities of Rs 1,00,000. It has Cash-in- hand Rs 5,000, Cash at Bank Rs 45,000, Short-term Investments Rs 50,000. Further Bank Overdraft is Rs 25,000. Compute Absolute Liquid Ratio.

Solution

Step 1: First, value of absolute Liquid Assets has to be calculated.

Absolute Liquid Assets |

= |

Cash + Bank + Short-term Investment |

|

= |

Rs 5,000 + Rs 45,000 + Rs 50,000 |

|

= |

Rs 1,00,000 |

Step 2: Value of Liquid Liabilities has to be calculated, now.

Liquid Liabilities |

= |

Current Liabilities − Bank Overdraft |

|

= |

Rs 1,00,000 − Rs 25,000 |

|

= |

Rs 75,000 |

Step 3: Absolute Liquid Ratio |

= |

Absolute Liquid Assets/Liquid Liabilities |

|

= |

Rs 1,00,000/Rs 75,000 |

|

= |

1 : 0.75 |

OBJECTIVE 6: SOLVENCY RATIOS (LONG-TERM SOLVENCY)

- Solvency Ratios deals with entity’s ability to meet its long-term obligations.

- Solvency refers to the firm’s ability to meet its long-term indebtedness.

- The following are important Solvency Ratios:

- Debt Equity Ratio

- Total Assets to Debt Ratio

- Proprietary Ratio

6.1 Debt Equity Ratio

6.1.1 Debt Equity Ratio – Relationship between Debt and Equity

- This ratio is computed to ascertain the soundness of the long-term financial position of the concern.

- This ratio indicates the proportion between debt (external equities) and the equity (internal equities).

- Debt Long-term loans: Debentures, long-term loans from Banks and financial institutions. Equity: Shareholder’s funds: Equity Share capital, Preference share capital, Reserves and surplus loss, Losses and fictitious assets (e.g.: Preliminary expenses).

- This ratio is calculated as:

Debt Equity Ratio = Debt (Long-term Loans)/Equity (Shareholder’s Funds)

- If it is 2:1, then the concern is said to be at a satisfactory level.

- A higher ratio than this normal level, i.e. 2:1 then the concern is facing a risky financial position, where as a lower ratio indicates safer financial position.

- It also indicates the extent to which the concern depends upon outsiders for its existence.

Computation of Debt Equity Ratio

Illustration: 18

From the following, compute Debt Equity Ratio:

|

Equity Share Capital |

1,00,000 |

|

General Reserve |

80,000 |

|

6¼% Debentures |

75,000 |

|

Current Liabilities |

90,000 |

|

Preliminary Expenses |

30,000 |

Solution

Debt Equity Ratio = Debt/Equity

Step 1: Debt = Rs 75,000

(∴ Debentures only here)

Step 2: Equity |

= |

Equity Share Capital + General Reserve − Preliminary Expenses |

|

= |

Rs 1,00,000 + 80,000 − Rs 30,000 |

|

= |

Rs 1,50,000 |

Step 3: Debt Equity Ratio |

= |

Rs 75,000/Rs 1,50,000 |

|

= |

1:2 |

6.2 Total Assets to Debt Ratio

6.2.1 Total Assets to Debts Ratio – Relationship between Total Assets and Debt

The components of this ratio:

(i) Total Assets and (ii) Debt

- Total Assets: This include both Fixed and Current Assets. But this does not include fictitious assets as preliminary expenses, underwriting commission discount on issue of shares/debentures etc. and debit balance of Profit and Loss A/c.

- Debts: Long-term debts, which usually gets matured after 1 year. This includes bonds, debentures and other loans from financial institution.

- Total Assets to Debt Ratio = Total Assets/Long-term Debts

- Normal level is said to be at 2:1 ratio.

- A higher ratio indicates higher security to lenders.

- A low ratio indicates a risky financial position.

Computation of Total Assets to Debt Ratio

Illustration 19

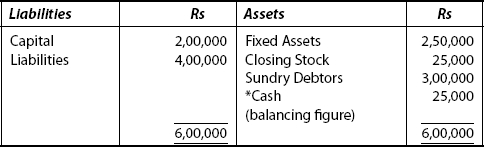

Following is the Balance Sheet of a company as on Mar 31, 2006:

You are required to compute Total Assets to Debt Ratio.

Solution

Step 1: Total Assets = Rs 5,00,000

Step 2: Debt (Long term) = Rs 2,00,000 (Debentures only)

Step 3: Total Assets to Debt Ratio |

= |

Total Assets/Long-term Debt |

|

= |

Rs 5,00,000/Rs 2,00,000 |

|

= |

5:2 |

6.3 Proprietary Ratio

6.3.1 Proprietary Ratio – Relationship between Proprietor’s Funds and Total Assets

- This ratio establishes the relationship between Proprietor’s funds and total tangible assets.

- This ratio reflects the general financial position of a concern.

- This is computed as:

Proprietor’s Funds Proprietary Ratio = (Shareholder’s Fund)/Total Assets

- Proprietor’s Funds: Share capital, Reserves and surplus (loss to be deducted, payment to others not included)

- Tangible Assets: Good will, Preliminary expenses etc.

- Normal level = 100

- A high level indicates safety to creditors.

- A low (usually < 50) level assets the (investors) creditors.

From the following, calculate Proprietary Ratio:

| Rs | |

|---|---|

Equity Share Capital |

1,00,000 |

reference Share Capital |

30,000 |

Reserves and Surplus |

20,000 |

Debentures |

2,00,000 |

Sundry Creditors |

50,000 |

|

3,00,000 |

Fixed Assets |

2,00,000 |

Current Assets |

30,000 |

Investments |

70,000 |

|

3,00,000 |

Solution

- Shareholder’s Funds: Rs 1,00,000 + Rs 30,000 + Rs 20,000= Rs 1,50,000 (excluding debentures and creditors)

- Total Assets = Rs 3,00,000

- Proprietary Ratio = Rs l,50,000/Rs 3,00,000 = 1/2 = 0.5 or 5:1 (or) 0.5 × 100 = 50%

Computation of Proprietary Ratio from Balance Sheet

Illustration: 21

Balance Sheet of Dabar Ltd as on Mar 31, 2006 is given. From this, compute (a) Debt Equity Ratio, (b) Proprietary Ratio and (c) Total Assets to Debt Ratio

Solution

(a) Value of Debentures = Rs 5,00,000 |

||

Shareholder’s Funds (Equity) |

= |

Equity Share Capital + General Reserve |

|

= |

Rs 12,00,000 + Rs 8,00,000 (Debentures) |

Debt Equity Ratio |

= |

Long-term Debts/Shareholder’s Funds |

|

= |

Rs 5,00,000/Rs 20,00,000=0.25:1 |

(b) Proprietary Ratio |

= |

Shareholder’s Funds/Total Assets |

|

= |

Rs 20,00,000/Rs 40,00,000 = 0.5:1 or 0.5% = 50% |

(c) Total Assets to Debt Ratio |

= |

Total Assets/Long-term Debt |

|

= |

Rs 40,00,000/Rs 5,00,000 |

|

= |

8:1 |

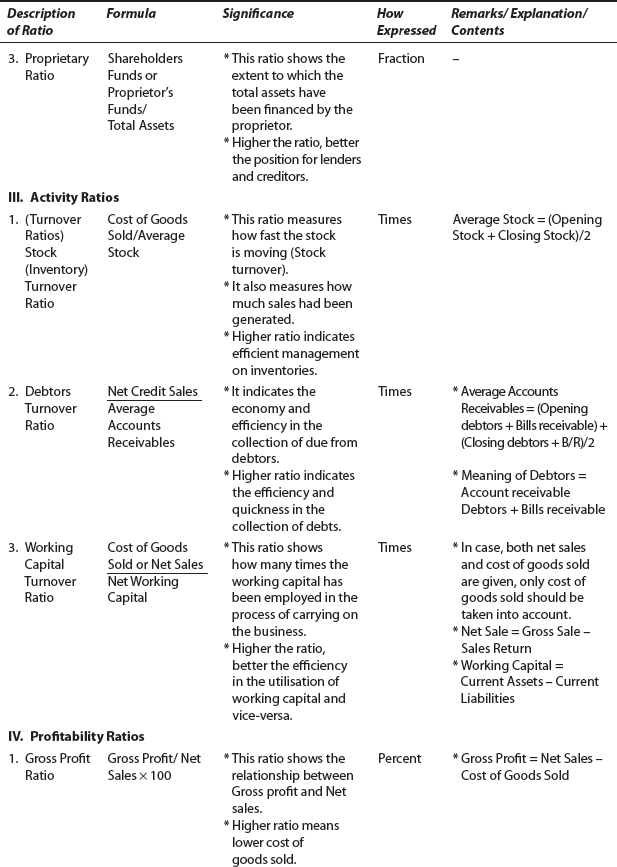

OBJECTIVE 7: PROFITABILITY RATIOS

- Efficiency of a concern is measured by profitability.

- Profit as compared to the capital employed indicates profitability of a concern.

- Some important Profitability Ratios are: Gross Profit Ratio, Net Profit Ratio, Operating Profit Ratio and Operating Ratio.

7.1 Gross Profit Ratio

7.1.1 Gross Profit Ratio – Relationship of Gross Profit to Sales

- The relationship of gross profit to sales is termed as Gross Profit Ratio.

- This ratio is calculated as:

Gross Profit Ratio = Gross Profit/Net Sales × 100

- Gross Profit is taken from Trading Account of an enterprise.

Gross Profit

=

Sales − Cost of Goods Sold

Cost of Goods Sold

=

Opening Stock × Purchases − Closing Stock (or)

=

Sales − Gross Profit

Net Sales

=

Gross Sales (Cash Sale × Credit Sale) − Sales Returns

- This ratio is a good indicator to maintain the correct selling price and efficiency of trading activities.

- It may also be compared to previous years, which will assist the management to take vital policies.

Illustration: 22

From the following, calculate Gross Profit Ratio.

|

|

Rs |

|

Cash Sales |

50,000 |

|

Credit Sales |

60,000 |

|

Sales Return |

10,000 |

|

Gross Profit |

50,000 |

Solution

Step 1: Value of Net Sales to be computed.

Net Sales |

= |

Cash Sale + Credit Sale − Sales Return |

|

= |

Rs 50,000 + Rs 60,000 − Rs 10,000 |

|

= |

Rs 1,00,000 |

Step 2: Gross Profit = Rs 50,000 (Given)

Step 3: Gross Profit Ratio |

= |

Gross Profit/Net Sales × 100 |

|

= |

Rs 50,000/ Rs l,00,000 × 100 = 50% |

Illustration: 23

From the following data, compute Gross Profit Ratio.

| 2008 Rs | 2009 Rs | |

|---|---|---|

Sales |

2,00,000 |

2,40,000 |

Gross Profit |

50,000 |

80,000 |

Gross Profit Ratio = Gross Profit/Net Sales × 100 |

|

Year |

Year |

2008 |

2009 |

Gross Profit Ratio = Rs 50,000/Rs 2,00,000 × 100 |

= Rs 20,000/Rs 2,40,000 × 100 |

= 25% → |

= 33 1/3% |

Conclusion = Profit rose from 25% to 33 1/3% this year. |

|

Treatment of Cost of Goods Sold and Gross Profit (G.P.)

Illustration: 24

Sales of a company is Rs 7,20,000.

Gross Profit is 20% on cost. Compute Gross Profit Ratio.

Solution

Step 1: Cost of goods sold has to be calculated as:

Let the cost be |

= |

Rs 100 |

Then Sales |

= |

Rs 120 (100 + 20%) |

Cost of Goods Sold |

= |

100/120 × Rs 7,20,000 |

|

= |

Rs 6,00,000 |

Step 2: Next, Gross Profit has to be calculated.

Gross Profit |

= |

Sales − Cost of Goods Sold |

|

= |

Rs 7,20,000 − Rs 6,00,000 |

|

= |

Rs 1,20,000 |

Step 3: Gross Profit Ratio |

= |

Gross Profit/Net Sales × 100 |

|

= |

Rs 1,20,000/Rs 7,20,000 × 100 |

|

= |

16.66% |

7.2 Net Profit Ratio

7.1.2 Net Profit Ratio – The Relations hip of Net Profit to Net Sales

- The relationship of Net Profit to Net Sales is termed as “Net Profit Ratio”.

- Net Profit Ratio is calculated as

Net Profit Ratio = Net Profit/Net Sales ×100

- This ratio reflects the overall efficiency of a concern.

- This ratio also helps to determine operational efficiency of an enterprise.

- Higher the Net Profit Ratio, better the efficiency of a concern.

- At times, Net Profit Ratio is calculated either Profit Before Tax (P.B.T.) (or) Profit After Tax (P.A.T.), then Net Profit Ratios will be

P.B.T./Net Sales × 100 (or) P.A.T./Net Sales×100

- Net Profit is taken from P and L Account or to Gross profit less administration expenses, selling and distribution expenses, financial expenses, non-operating expenses and adding non-operating incomes.

Computation of Net Profit Ratio

Illustration: 25

Compute Net Profit Ratio from these.

Net Profit = Rs 75,000

Sales = Rs 3,00,000

Net Profit Ratio= Net Profit/Net Sales × 100

Illustration: 26

Gross Profit Ratio of a company is 20%. Its cash sales are Rs 5,00,000 and its credit sales are 80% of total sales. The indirect expenses are Rs 50,000. Calculate Net Profit Ratio.

Solution

Step 1: Total sales have to be computed.

Total Sales |

= |

Cash Sales + Credit Sales |

|

= |

Rs 5,00,000 + 80% of Total Sales |

| This means cash sales = 20% (100% − 80%) of Total Sales | ||

∴ Total Sales |

= |

Cash Sales ×100/20 |

|

= |

Rs 5,00,000 × 100/20 |

|

= |

Rs 25,00,000 |

Step 2: Next, value of Gross Profit is to be computed.

Gross Profit |

= |

Rs 25,00,000 × 20/100 |

|

= |

Rs 5,00,000 |

Step 3: Value of Net Profit is to be computed.

Net Profit |

= |

Gross Profit − Indirect Expenses |

|

= |

Rs 5,00,000 − Rs 50,000 |

|

= |

Rs 4,50,000 |

Step 4: Net Profit Ratio |

= |

Net Profit/Net Sales × 100 |

|

= |

Rs 4,50,000/Rs 25,00,000 × 100 |

|

= |

18% |

7.3 Operating Profit Ratio

7.3.1 Operating Profit Ratio – Relationship between Operating Profit and Net Sales

- This ratio measures the relationship between operating profit and net sales.

- This ratio helps in determining the operational efficiency of an enterprise.

- This ratio is calculated as:

Operating Profit Ratio = Operating Profit/Net Sales × 100

- Operating Profit = Net Profit+ Non-operating Expenses –Non-operating Income

Non-operating Expenses = Interest on Loan and Loss on sale of assets

Non-operating Income = Dividend, Interest received and Profit on sale of asset

Or - Operating Profit = Gross Profit –Operating Expenses

- Net Sales = Gross Sales = Cash Sales + Credit Sales – Sales Revenue

Computation of Operating Profit Ratio

Illustration: 27

Compute Operating Profit Ratio from the following:

|

|

Rs |

|

Net Profit |

6,00,000 |

|

Loss on Sale of Furniture |

20,000 |

|

Profit on Sale of Investments |

60,000 |

|

Rs |

|

|

Interest paid on Loan |

60,000 |

|

Interest from Investment |

40,000 |

|

Sales |

11,60,000 |

Solution

Step 1: Non-operating expenses have to be calculated.

Non-operating Expenses |

= |

Interest on Loan + Loss on Sale of Furniture |

|

= |

Rs 60,000 + Rs 20,000 |

|

= |

Rs 80,000 |

Step 2: Non-operating income to be computed.

Non-operating Income |

= |

Interest received from Investments + Profit on Sale of Investment |

|

= |

Rs 40,000 + Rs 60,000 |

|

= |

Rs 1,00,000 |

Step 3: Operating profit is to be computed.

Operating Profit |

= |

Net Profit + Non-operating Expenses − Non-operating Income |

|

= |

Rs 6,00,000 + 80,000 − 1,00,000 |

|

= |

Rs 5,80,000 |

Step 4: Operating Profit Ratio |

= |

Operating Profit/Net Sales × 100 |

|

= |

5,80,000/11,60,000 × 100 |

|

= |

50% |

Treatment of G.P. with Sales

Illustration: 28

Calculate Operating Profit Ratio if

Case (a) Net sales Rs 10,00,000, Gross profit 20%on Sales and Operating expenses Rs 20,000

Case (b) Net sales Rs 6,00,000, Gross profit 20% on Sales and Operating expenses Rs 20,000

Solution

Case (a): Operating Profit |

= |

Gross Profit—Operating Cost |

|

= |

Rs 2,00,000−Rs 20,000 |

|

= |

Rs 1,80,000 |

| Operating Profit Ratio | = |

Operating Profit/Net Sales × 100 |

|

= |

Rs 1,80,000/Rs 10,00,000 × 100 = 18% |

Case (b): Operating Profit |

= |

Gross Profit—Operating Expenses |

Gross Profit |

= |

20% of Sales |

|

= |

20/100 × Rs 6,00,000 |

|

= |

Rs 1,20,000 |

∴ Operating Profit |

= |

Rs 1,20,000−Rs 20,000 |

|

= |

Rs 1,00,000 |

Operating Profit Ratio |

= |

Operating Profit/Net Sales × 100 |

|

= |

Rs 1,00,000/Rs 6,00, 000 × 100 = 16.66% |

7.4 Operating Ratio

7.4.1 Operating Ratio – Relationship between Operating Cost and Net Sales

- This ratio establishes relationship between operating cost and net sales.

- This measures the operating efficiency of the enterprise.

- This ratio measures the amount of expenditure incurred in production, sales and distribution of output.

- Operating Ratio = Cost of Goods Sold + Operating Expenses/Net Sales × 100

or

Operating Ratio = Operating Cost/Net Sales × 100

- Cost of Goods Sold =Opening Stock + Purchases + Direct Expenses + Manufacturing Expenses – Closing Stock (or) Sales – Gross Profit

- Operating Expenses = Administrative Expenses + Selling and Distribution Expenses

- Operating Ratio and Net Profit Ratio are interrelated.

Operating Ratio + Net Profit Ratio = 100

Example: |

20% + 80% = 100 |

|

|

|

or |

|

40% + 60% = 100 |

|

|

|

or |

|

70% + 30% = 100 |

|

- Higher Operating Ratio indicates poor performance, so lower the better.

- It is an indicator to determine the cost content, and which element of cost has gone up.

Computation of Operating Ratio

Illustration: 29

From the following, compute Operating Ratio:

|

|

Rs |

|

Cost of Goods Sold |

4,50,000 |

|

Operating Expenses |

50,000 |

|

Sales |

10,60,000 |

|

Sales Returns |

60,000 |

Solution

Step 1: Add Cost of Goods Sold and Operating Expenses

= Rs 4,50,000 + Rs 50,000

= Rs 5,00,000

Step 2: Value of Net Sales has to be calculated.

Net Sales |

= |

Sales — Sales Return |

|

= |

Rs 10,60,000 − Rs 60,000 |

|

= |

Rs 10,00,000 |

Step 3: Operating Ratio is to be found out.

Operating Ratio |

= |

Cost of Goods Sold + Operating Expenses/Net Sales × 100 |

|

= |

Rs 5,00,000/Rs l0,00,000 × 100 |

|

= |

50% |

OBJECTIVE 8: ACTIVITY RATIOS

- Activity Ratios measure the effectiveness of entities.

- These ratios are also called as “Performance or Turnover Ratios”.

- These ratios measures the effectiveness of a business concern.

- It can also be known how effectively a concern utilises its resources, by using these ratios.

- The following are some important Activity Ratios:

8.1 Inventory Turnover Ratio

8.1.1 Inventory Turnover Ratio – Relationship between the Cost of Goods Sold and Average Inventory

- This ratio establishes relationship between the cost of goods sold (during a given period) and the average amount of inventory carried (during that period).

- This indicates whether stock has been efficiently used or not.

- The ratio is calculated as follows:

Inventory or Stock Turnover Ratio

= Cost of Goods Sold/Average Inventory (or) Stock

- Cost of Goods Sold = Opening Stock + Purchase + Direct Expenses – (Less) Closing Stock

or

Cost of Goods Sold =Sales– Gross Profit

Average Stock = (Opening Stock + Closing Stock)/2

Note: If information to calculate average stock is not given in the problem then students are expected to take the closing stock as average stock.

- Higher ratio indicates the unit functions on a comparatively low margin of profit. More sales are on with (that unit of investment in stocks) a rupee of investment in stocks.

- This ratio also helps to invest minimum in stock.

- It helps business enterprises to earn a reasonable margin of profits.

Computation of Inventory Turnover Ratio

Illustration: 30

From the following, compute Inventory Turnover Ratio.

|

|

Rs |

|

Cost of Sales |

9,00,000 |

|

Stock at the beginning of the year |

2,50,000 |

|

Stock at the end of the year |

3,50,000 |

Solution

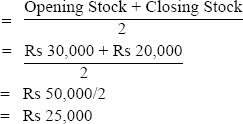

Step 1: First, average stock is to be calculated.

Average Stock

Step 2: Cost of Goods Sold = Cost of Sales = Rs 9,00,000

Step 3: Inventory Turnover Ratio = Rs 9,00,000/Rs 3,00,000 = 3 times

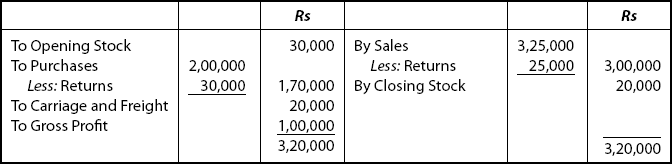

Computation of Stock Turnover Ratio from Trading A/c

Illustration: 31

Following is the Trading A/c of Jam Ltd. Compute Inventory Turnover Ratio.

Solution

Step 1: Cost of goods sold has to be calculated.

Cost of Goods Sold |

= |

Sales — Gross Profit |

|

= |

Rs 3,00,000 − Rs 1,00,000 |

|

= |

Rs 2,00,000 |

Step 2: Average stock is to be calculated.

Average Stock

Step 3: Stock Turnover Ratio |

= |

Cost of Goods Sold/Average Stock |

|

= |

Rs 2,00,000/Rs 25,000 = 8 times |

Treatment of Cost of Sales

Illustration: 32

From the following, calculate Stock Turnover Ratio.

Total Sales: Rs 10,00,000, Opening Stock: Rs 2,20,000 and Closing Stock: Rs 1,80,000.

Loss Ratio = 20%.

Solution

Step 1: From Sales, Cost of Sales is to be computed.

Sales = Rs 10,00,000

Gross Loss: 20%

20% of Sales (10,00,000) = Rs 2,00,000

∴ Cost of Sales |

= |

Sales + Gross Loss |

|

= |

Rs 10,00,000 + Rs 2,00,000 |

|

= |

Rs 12,00,000 |

Step 2: Average Stock has to be calculated.

Average Stock

Step 3: Inventory Turnover Ratio |

= |

Cost of Sales/Average Stock |

|

= |

Rs 12,00,000/Rs 2,00,000 = 6 times |

From the following, calculate Inventory Turnover Ratio.

|

Rs |

Opening Stock |

1,00,000 |

Purchases |

3,50,000 |

Sales |

5,00,000 |

Gross Profit Ratio |

20% on Sales |

Solution

Step 1: First, cost of sales has to be computed.

Cost of Sales |

= |

Sales − Gross Profit |

|

= |

Rs 5,00,000 − (20% of 5,00,000) |

|

= |

Rs 5,00,000 − Rs 1,00,000 |

|

= |

Rs 4,00,000 |

Step 2: Value of Closing Stock has to be calculated.

Closing Stock |

= |

Opening Stock + Purchases + Gross Profit − Sales |

|

= |

Rs 1,00,000 + Rs 3,50,000 + Rs 1,00,000 − Rs 5,00,000 |

|

= |

Rs 5,50,000 − Rs 5,00,000 |

|

= |

Rs 50,000 |

Step 3: Value of Average Stock

Step 4: Inventory Turnover Ratio |

= |

Cost of Goods Sold/Average Stock |

|

= |

Rs 4,00,000/Rs 75,000 |

|

= |

5.33 times |

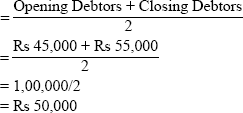

8.2 Debtors Turnover Ratio or Receivables Turnover Ratio

8.2.1 Debtors Turnover Ratio –Relationship between Net Credit Sales and Average Debtors

- This ratio indicates the relationship between net credit sales and average debtors or receivables in a year.

- This ratio is calculated as:

Debtors Turnover Ratio = Net Credit Sales/Average Accounts Receivable

- Accounts Receivable includes “Trade Debtors” and “Bills Receivables”.

- Average Debtors

- Doubtful debts are not deducted from total debtors.

- If details regarding opening and closing receivables and credit sales are not given in the problem, the Debtors Turnover Ratio =Total Sales/Accounts Receivable

- This ratio is calculated to determine the number of times the receivables are turned over in a period in relation to sales.

- It indicates how quickly debtors are converted into cash.

- A high ratio indicates the quickness of debts collected. Lower ratio would mean otherwise.

Debtors Turnover Ratio — Computation

Illustration: 34

The following data are taken from Shah Ltd.

|

Rs |

Total Sales for the year 2009 |

4,00,000 |

Cash Sales for the year 2009 |

1,00,000 |

Debtors as on Jan 1, 2009 |

45,000 |

Debtors as on Dec 31, 2009 |

55,000 |

Compute Debtors Turnover Ratio.

Solution

Step 1: First, Credit Sales have to be calculated.

Credit Sales |

= |

Total Sales − Cash Sales |

|

= |

Rs 4,00,000 − Rs 1,00,000 |

|

= |

Rs 3,00,000 |

Step 2: Next, average debtors have to be computed.

Average Debtors

Step 3: Finally,

Debtors Turnover Ratio |

= |

Credit Sales/Average Debtors |

|

= |

Rs 3,00,000/Rs 50,000 = 6 times |

8.3 Working Capital Turnover Ratio

8.3.1 Working Capital Turnover Ratio – Relationship between Sales and Working Capital

- This ratio indicates the efficiency of working capital of a concern.

- This also indicates if there is over trading.

- This ratio is calculated as:

- Working Capital Turnover Ratio = Sales/Working Capital

Working Capital = Current Assets − Current Liabilities

- This ratio is better than Stock Turnover Ratio.

- It measures the rate of working capital utilisation.

Illustration: 35

Compute Working Capital Turnover Ratio.

|

Rs |

Cost of Goods Sold |

2,80,000 |

Current Assets |

2,05,000 |

Current Liabilities |

1,65,000 |

Solution

First, working capital is to be calculated.

Working Capital |

= |

Current Assets — Current Liabilities |

|

= |

Rs 2,05,000 − Rs 1,65,000 |

|

= |

Rs 40,000 |

Note: As no sales figures are given, ratio is to be calculated on the basis of cost of sales.

So Working Capital Turnover Ratio |

= |

Cost of Sales/Net Working Capital |

|

= |

Rs 2,80,000/Rs 40,000 |

|

= |

7 times |

Computation of Working Capital Turnover Ratio from Balance Sheet

Illustration: 36

Following is the Balance Sheet of Chopra Ltd. Compute Working Capital Turnover Ratio.

Further Information

- Total Sales during the year = Rs 46,00,000

- Sales Returns during the year = Rs 6,00,000

Solution

Step 1: First, Net Sales (or) turnover is to be computed.

Net Sales |

= |

Total Sales − Sales Return |

|

= |

Rs 46,00,000 − Rs 6,00,00 |

|

= |

Rs 40,00,000 |

Step 2: Next, Current Assets have to be added.

Current Assets |

= |

Short-term Investment + Stock + Debtors + Bills Receivable + Cash at Bank + Cash-in-hand |

Current Assets |

= |

Rs 2,30,000 + Rs 1,80,000 + Rs 2,20,000 + Rs 1,10,000 + Rs 60,000 + Rs 1,00,000 |

|

= |

Rs 9,00,000 |

Step 3: Next, Current Liabilities should be added together.

Current Liabilities |

= |

Creditors + Bills Payable + Provision for Income Tax |

|

= |

Rs 2,80,000 + Rs 80,000 + Rs 40,000 |

|

= |

Rs 4,00,000 |

Step 4: Working Capital |

= |

Current Assets — Current Liabilities |

|

= |

Rs 9,00,000 − Rs 4,00,000 |

|

= |

Rs 5,00,000 |

Step 5: Finally,

Working Capital Turnover Ratio |

= |

Net Sales/Working Capital |

|

= |

Rs 40,00,000/Rs 5,00, 000 |

|

= |

8 times |

Notes

* Both Operating Profit Ratio and Operating Ratio are complementary to each other.

* If one such ratio is deducted from 100, the other ratio can easily be obtained.

* Post-mortem Analysis: Ratio Analysis is based on past records, i.e. what happened on a particular date. Nothing is revealed in the interim period. No facts about the future is disclosed.

* Not conclusive result: A single ratio cannot be relied upon to take decisive action. Inter-related and overall analysis of all the concerned ratios can only yield the desired result to some extent. Ratios obtained by a single ratio analysis is not reliable and conclusive.

OBJECTIVE 9: RATIOS: ADVANCED LEVEL

9.1 Turnover Ratio

The ratios to determine how quickly certain current assets are converted into cash are termed as Turnover Ratios.

Some important Turnover Ratios are:

- Inventory Turnover Ratio

- Debtors Turnover Ratio

- Creditors Turnover Ratio

9.1.1 Inventory Turnover Ratio

Formula = Inventory Turnover Ratio = Cost of Goods Sold/Average Inventory

Remember

Cost of Goods Sold = Sales – Gross Profit

Average Inventory

This ratio is expressed by………times.

High ratio indicates status of liquidity of a concern.

Low ratio indicates that the inventory stays for a long time in the warehouse, which is not advisable.

Computation of Inventory Turnover Ratio

Illustration: 37

A firm has sold goods worth Rs 4,00,000 with a gross profit margin of 25%. The stock at the beginning and at the end of the period are Rs 45,000 and Rs 55,000 respectively. Compute the Inventory Turnover Ratio.

Solution

Step 1: Cost of Goods Sold = Sales – Gross Profit

Sales |

= |

Rs 4,00,000 (Given) |

Gross Profit (G.P.) |

= |

25% of Rs 4,00,000 |

|

= |

Rs 1,00,000 (Profit) |

|

= |

(Rs 4,00,000 – Rs 1,00, 000) = Rs 3,00,000 |

Step 2: Average Inventory = (Rs 45,000 + Rs 55,000)/2→(Stock in the beginning + Stock at the end)/2

Step 3: Inventory Turnover Ratio = Rs 3,00,000/Rs 50,000 =6 times

Step 4: Inventory Holding Period = 12 Months/Inventory Turnover Ratio

= 12/6 = 2 months

9.1.2 Debtors Turnover Ratio

Formula

Debtors Turnover Ratio |

= |

Net Credit Sales/Average Debtors |

Net Credit Sales |

= |

Gross Credit Sales – Sales Returns |

Average Debtors |

= |

|

Note: Debtors include Bills Receivable.

High ratio indicates short time lag between credit sales and cash collection. A low ratio shows the slackness in debt recovery.

Computation of Debtors Turnover Ratio

Illustration: 38

A firm has made credit sales of Rs 2,00,000 during the year. The outstanding amount of debtors at the beginning and at the end of the year were Rs 20,000 and Rs 30,000 respectively. What is the Debtors Turnover Ratio?

Solution

Formula

Debtors Turnover Ratio |

= |

Net Credit Sales/Average Debtors |

|

|

|

|

|

|

|

|

|

9.1.3 Creditors Turnover Ratio

It is a ratio between net credit purchases and the average amount of creditors outstanding during the year.

Formula

Creditors Turnover Ratio |

= |

Net Credit Purchases/Average Creditors |

Net Credit Purchases |

= |

Gross Credit Purchases – Returns |

|

|

|

Creditors include bills payable.

A low ratio shows the liberal credit policy.

A high ratio shows the speedy settlement of credit.

Computation of Creditors Turnover Ratio

Illustration: 39

A firm has made credit purchases of Rs 3,00,000. The amount payable to the creditors at the beginning and the end of the year is Rs 70,000 and Rs 80,000 respectively. Compute the Creditors Turnover Ratio.

Solution

Creditors Turnover Ratio |

= |

Net Credit Purchases/Average Creditors |

|

|

|

|

|

|

|

|

|

9.2 Cash Cycle – Combined Effect of Turnover Ratios

Cash cycle shows the inter-relationships of sales, collections from debtors and payment to creditors. It reveals the combined effect of all these Turnover Ratios.

Assume that in the above three illustrations, the data showed relate to a single and same firm, then cash cycle.

Inventory Holding Period |

= 2 months |

Add: Debtors Collection Period |

|

Less: Creditor s Payment Period |

|

Shorter the cash cycle,, better the liquidity status. |

|

[The liquidity position of a firm, now-a-days, at international level, is also examined in relation to its ability to meet projected daily expenditure from operations. Such ratios – Defensive Interval Ratio (a ratio between quick assets and projected daily cash recruitments), Cash Flow from operations ratios are not dealt with here.]

9.3 Leverage Ratios

The other category of financial ratios is also termed as Leverage Ratios or Capital Structure Ratios. A modern approach is to express Debt Equity Ratio in terms of the relative proportion of long-term debt and shareholder’s equity.

Debt Equity Ratio = Long-term Debt/Shareholder’s Equity

In this approach, Current Liabilities are excluded in long-term debt. So, by including the Current Liabilities in the debt structure, Debt Equity Ratio is computed differently as

Debt Equity Ratio = Total Debt/Shareholder’s Equity

The Debt Equity Ratio has wider implications, affecting the creditors, owners and even the firm itself. Do judicious combination of Creditors Funds and Owners Funds, that is, the proportion of debt in the financial structure plays a crucial role in determining financial status of a firm. Technically this is termed as Leverage or Trading on Equity %.

This is further inter-related to Coverage Ratios, which measure the firm’s ability to pay certain fixed charges. The Coverage Ratios measure the relation between what is normally available from operations of the firms and the claims of outsiders. Coverage Ratios –interest coverage, dividend coverage, total fixed charge coverage, total cash flow coverage, capital expenditure ratio, debt–service coverage ratio are not dealt with here.

9.4 Profitability Ratios

9.4.1 Profitability Ratios relating to Sales

We have discussed Profitability Ratios in the earlier part of the chapter. Now a slight advance step on Profitability Ratios is to be seen here. Profitability Ratios relating to sales is termed as Expense Ratio. There are different variants of Expense Ratios, depending upon the nature of expense. They are

- Cost of Goods Sold = Cost of Goods Sold/Net Sales × 100

- Operating Expenses Ratio = Administrative Expenses + Selling Expenses/Net Sales ×100

- Administrative Expenses Ratio = Administrative Expenses/Net Sales × 100

- Selling Expenses Ratio = Selling Expenses/Net Sales× 100

- Operating Ratio = Cost of Goods Sold + Operating Expenses/Net Sales × 100

- Financial Expenses Ratio=Financial Expenses/Net Sales × 100

Note: Expenses on taxes, dividends and extraordinary losses (theft, stock devasted by natural calamities) are not included.

Thus, specific Expenses Ratio for each of such items may be calculated. These Expense Ratios are interrelated with Profit Margin Ratio (G.P. Ratio, N.P. Ratio etc.). The Profitability Ratios based on sales (Expenses Ratio) is a very important tool for ana1ysing the operational efficiency – the profitability of a manufacturing concern.

9.4.2 Profitability Ratios relating to Investments

Return on Investment Ratio: Profitability Ratios relating to Investments, measures the relationship of the profit of the firm to its Investments. These ratios are termed as Return on Investments (ROI).

Return on Assets: (based on assets) measure the relationship between net profit assets. The net profit may be (a) net profits after taxes (b) net profits after taxes + interest and (c) net profits after taxes + interest – tax savings and the assets may be (a) total assets (b) fixed assets and (c) tangible assets. As such, there are different variants in computation of return on assets.

Formulae for computing different return on assets:

- Return on Assets (ROA) = Net Profit after Taxes/Average Total Assets × 100

- ROA = Net Profit after Taxes + Interest/Average Total Assets × 100

- ROA = Net Profit after Taxes + Interest/Average Tangible Assets × 100

- ROA = Net Profit after Taxes + Interest/Average Fixed Assets ×100

The above formulae can be substituted by the following to ascertain the operating performance of a business entity.

Return on Capital Employed (ROCE): Here the capital employed is the base to test the profitability of a concern, relating to sources of long-term funds.

As the concepts of profits and capital employed vary, ROCE also can be computed in various ways:

- ROCE = Earnings Before Interest and Taxes (EBIT) /Average Total Capital Employed + 100

- ROCE = Net Profit after Taxes + Interest – Tax advantage on Interest/Average Total Capital Employed ×100

- ROCE = Net Profit after Taxes + Interest – Tax advantage on Interest/Average Total Capital Employed – Average Intangible Assets × 100

ROCE, in total, assess the firm’s profitability, taking owners’ funds and lenders’ funds together.

9.4.3 Return on Shareholder’s Equity

Profit is based on return on shareholder’s equity and its different variants. Moving one step up, profitability of firm may be ascertained by computing Return on Shareholder’s Equity.

There are different variants of the Return on Shareholder’s equity. They are:

- Rate of return on:

- Total Shareholders’ Equity

- Equity of Ordinary Shares

- Earnings Per Share (EPS)

- Dividend Per Share (DPS)

- Dividend Payout Ratio (D/P Ratio)

- Dividend and Earnings Yield

- Price Earnings Ratio (P/E Ratio)

- Return on Investment (ROI) and (h) Computing of ROI Ratio

9.4.3.1a Return on Total Shareholders’ Equity: Return on Total Shareholders’ Equity = Net Profit after Taxes/ Average Total Shareholders’ Equity × 100

Total Shareholders’ Equity = Preference Share Capital + Ordinary Shareholders’ Equity (equity share capital + share premium +reserves and surplus – accumulated loss)

This ratio indicates how profitably the owners’ funds have been utilised by the business entities.

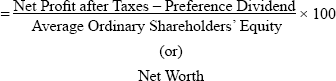

9.4.3.1b Rate of Return on Equity of Ordinary Shareholders: It is also called as Net Worth. This ratio measures the return on the total equity funds of ordinary shareholders.

Return on Equity Funds

This is the most essential and vital ratio for equity shareholders of a company. Since equity shareholders are real owners, this ratio plays a crucial and significant role in industries.

9.4.3.2 Earnings Per Share (EPS):This measures the extent of profit available to the equity shareholders. Profit is computed as per share basis.

Earnings Per Share = Net Profit (after taxes and dividend on performance shares)/No. of Ordinary Shares Outstanding × 100

These ratios can be analysed by (i) intra-firm results (past records) (ii) inter-firm comparisons and (iii) overall industry results.

Besides these,

- Cash Earnings Per Share,

- Book Value Per Share and

- Price to Book Value Shares

are also useful in analysing and predicting future returns from Stock.

9.4.3.3 Dividend Per Share (DPS):DPS = Dividend paid to ordinary shareholders/No. of Ordinary Shares Outstanding

DPS may be a better indicator than EPS, as it shows the distribution of net profit to ordinary shareholders.

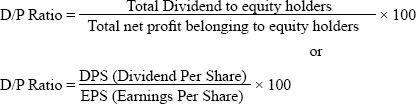

9.4.3.4 Dividend Payout Ratio (D/P Ratio):This ratio measures the proportion of dividends paid to earning available to shareholders.

From this, Retention Ratio is computed.

Retention Ratio = 100 − D/P Ratio

This is useful to measure how much is retained in the business from the net profits earned.

These two ratios, i.e. EPS and DPS are generally based on book value of shares (per share).

9.4.3.5 Earnings and Dividend Yield: Yield of a firm may also be expressed on the basis of market value of shares (per share). These are (i) Earnings Yield (ii) Dividend Yield

They are computed as:

- Earnings Yield = EPS/Market Value Per Share × 100

- Dividend Yield = DPS/Market Value Per Share × 100

9.4.3.6 Price Earnings Ratio (P/E Ratio):This ratio measures the amount that investors are willing to pay for each rupee of earnings.

- This ratio measures investors’ expectations and the market appraisal of the performance of a business entity.

- As investors on firm’s performance is assessed, this is very useful to the investors.

- Further advanced concepts such as Return on Equity (ROE), Growth Rates, Internal Growth Rate (IGR) and Sustainable Growth Rates (SGR) are not dealt with here.

9.4.3.7 Return on Investment (ROI):This ratio measures the relationship of profit with capital employed.

Formula:

- This ratio is expressed in percentage.

- This is useful to ascertain how much income the use of Rs 100 of Capital generates.

- This ratio measures how efficiently the sources entrusted to the business are used.

- This ratio also ascertains the efficiency of different units within a business concern.

9.4.3.8 Computation of ROI Ratio: Capital employed is to be computed, first. For this, any of the following methods can be adopted.

Method 1: Sum of (1) Share Capital (includes preference and equity) (2) Reserves and (3) Long-term loans has to be done.

From this total, the following items have to be deducted: (1) Fictious Assets (e.g. preliminary expenses) and (2) Non-operating assets.

Net result will be the Capital employed.

Method 2: Capital employed will be ascertained by adding all the fixed assets (less depreciation) and the working capital of a concern.

Illustration: 40

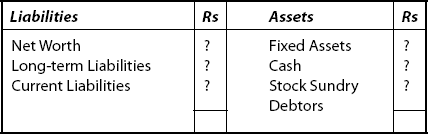

Following is the Balance Sheet of Raj Ltd as on Mar 31, 2009: Compute ROI:

Solution

Step 1: Profit before interest has to be computed.

|

Rs |

|---|---|

Profit (as shown in the question) |

4,00,000 |

Add: Interest (10% on Rs 10,00,000) |

1,00,000 |

Profit before interest |

5,00,00 |

Step 2: Capital employed is to be computed.

Method 1:Fixed Assets (Net) |

25,00,000 |

Add: Working Capital |

|

Current Assets –Current Liabilities |

5,00,000 |

(Rs 15,00,000 – Rs 10,00,000) |

|

Capital Employed |

________ |

This can be ascertained by another way. |

|

Method 2: Share Capital |

10,00,000 |

Add: (Reserves + Profits) |

|

Rs 7,00,000 + Rs 4,00,000 |

11,00,000 |

|

21,00,000 |

Add: Loans |

10,00,000 |

|

31,00,000 |

Less: Underwriting Commission |

1,00,000 |

Capital Employed |

30,00,000 |

Step 3: → ROI |

= |

Profit before Interest/Capital Employed × 100 |

|

= |

Rs 5,00,000/Rs 30,00,000 × 100 |

|

= |

16.66% |

Calculation of Capital Employed

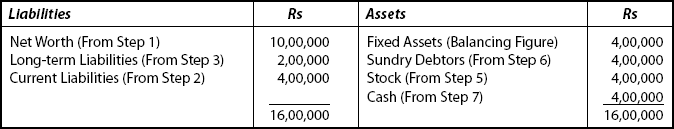

Illustration: 41

The Balance Sheet of X Ltd as on Mar 31, 2009.

Additional Information

Net profit for the year was Rs 1,00,000 after charging interest of Rs 20,000 on secured term loan, but before tax.

Calculate Return on Capital Employed for the year.

Solution

[Note: As Net profit and interest are shown in additional information they may straight away be taken for the computation of the Profit Before Interest (PBI).

Step 1: Here profit is shown after charging interest. So profit is added to interest here to arrive at Profit Before Interest.

Therefore, Profit Before Interest = Rs 1,00,000 + Rs 20,000 = Rs 1,20,000

Step 2: Capital Employed is now calculated.

Method 1: Fixed Assets

(Rs 1,00,000 + Rs 1,00,000 + Rs 1,77,500 + Rs 37,500 + Rs 25,000) |

= |

Rs 4,40,000 |

Add → Working Capital (C.A.. C.L.) |

= |

Rs 60,000 |

(Rs 4,70,000 – Rs 4,10,000) |

|

__________ |

Method 2

|

Rs |

Share Capital |

2,50,000 |

Preference Share Capital |

1,00,000 |

Add: Reserves and Surplus |

1,25,000 |

Add: Long-term Loan |

1,50,000 |

|

6,25,000 |

Less: Miscellaneous Expenditure |

25,000 |

|

6,00,000 |

Less: Investment |

1,00,000 |

Capital Employed |

5,00,000 |

Step 3: Return on Capital Employed: PBI/Capital Employed × l00

= 1,20,000/5,00,000 × 100 = 24%

Note: Investments not taken into account here assuming it is not exclusively for the business concern.

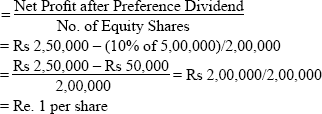

Computation of EPS

Illustration: 42:

Calculate the Earnings Per Share from the following data.

|

Rs |

Net Profit after Tax |

6,00,000 |

10% Preference Share Capital (Rs 10 each) |

10,00,000 |

Equity Share Capital (Rs 10 per share) |

10,00,000 |

Solution

|

Rs |

Preference Dividend: 10% of Rs 10,00,000 |

1,00,000 |

Number of Equity Shares |

10,00,000/10 |

|

1,00,000 |

Net Profit after Tax |

6,00,000 |

Substitute the figures in the equation or formula:

Earnings Per Share

Computation of DPS

Illustration: 43

Net Profit after interest and tax Rs 5,00,000. Profit distributed as dividend 50%. Equity Share Capital (25,000 equity shares Rs 100 per share) Rs 25,00,000. Calculate Dividend Per Share.

Solution

DPS |

= |

Profit distributed as Dividend/No. of Equity Shares |

|

= |

(50% of Rs 5,00,000)/25,000 = Rs 2,50,000/25,000 |

|

= |

Rs 10 |

DPS |

= |

Rs 10 per Share |

Illustration: 44

Earnings per share Rs 25. Market Price per share Rs 400. Calculate Price Earning Ratio.

Solution

Illustration: 45

The Capital of Vasanth Co. Ltd is as follows:

|

Rs |

10% Preference Share of Rs 10 each |

5,00,000 |

Equity Shares of Rs 10 each |

20,00,000 |

|

________ |

Further Information

|

Rs |

Profit after Tax |

2,50,000 |

Equity Dividend Paid |

1,00,000 |

Market price per Equity Share |

50 |

Calculate: (i) Earnings Per Share and (ii) Price Earning Ratio.

Solution

- EPS

P/E Ratio

=

Market Price per Share/Earning per Share

=

Rs 50/Re. 1 = 50 : 1

(Combining these two ratios, that is, EPS and P/E, market value of share in future may be computed, which means forecast.)

[Here Market Price per Share |

= |

EPS × P/E |

|

= |

1 × 50 = Rs 50] |

Illustration: 46

|

Rs |

Equity Share Capital (Rs 10 per Share) |

25,00,000 |

Reserves and Surplus |

2,50,000 |

Secured Loan (15%) |

12,50,000 |

10% Unsecured Loan |

6,25,000 |

Fixed Assets |

15,00,000 |

10% Investments |

2,50,000 |

Operating Profit |

12,50,000 |

Income Tax Rate |

50% |

Market Price per Share |

50 |

Calculate Price Earning Ratio (P/E) |

|

Solution

Step 1: First, EPS has to be ascertained.

Rs |

|

Operating Profit |

12,50,000 |

Less:

|

2,50,000 |

Profit before Tax |

10,00,000 |

Less: Income Tax 50% |

5,00,000 |

Profit after Tax |

5,00,000 |

Step 2: No. of Equity Shares

= Rs 25,00,000/Rs 10 = 2,50,000 shares

Step 3: EPS = Profit after Tax/No. of Equity Shares

= Rs 5,00,000/2,50,000 = Rs 2

Step 4: Calculation of P/E Ratio

|

P/E Ratio |

= |

Market Price per Share/EPS |

|

|

|

|

SOLVED PROBLEMS FOR PROFESSIONAL COURSES – COMPREHENSIVE

Construction of Trading and Profit A/c

Illustration: 47

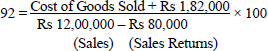

You are given the following information for the year 2008–09 from the books of a firm engaged in trading operations.

Average monthly sales for the year amounted to Rs 30,000

Goods are sold at cost plus 25%

Stock-in-trade on Mar 31,2009: Rs 29,000

Stock Turnover Ratio: 10

Operating Ratio: 85% Turnover

Depreciation charged on fixed assets for the year: Rs 10,000

Non-operating income for the year consisted of Bank Interest Rs 1,500 and Dividends received from investments Rs 2,500.

Non-operating expenses amounted to Rs 2,500 towards the sale of fixed assets.

You are required to construct the Trading and Profit and Loss Account of the firm for the year ended Mar 31, 2009.

(ICWA Inter – Modified)

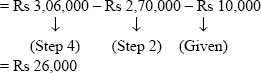

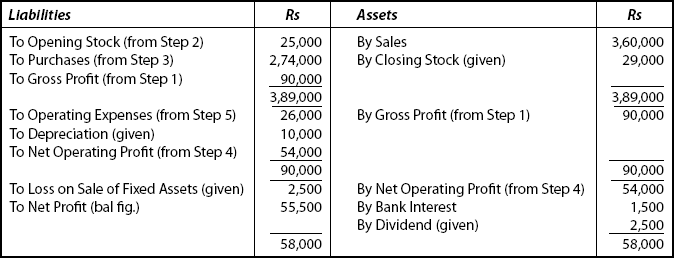

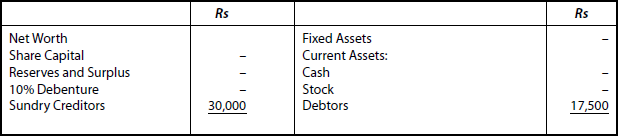

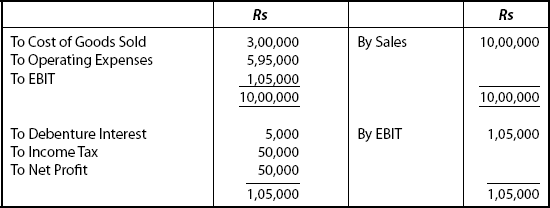

Solution