Chapter 10

The Nature of Depreciation

LEARNING OBJECTIVES

After studying this chapter, you will be able to

Define Depreciation

Know the Characteristic Features of “Depreciation”

Understand the Accounting Concept of Depreciation

Know the Salient Features of Depreciation

Understand the Causes of Depreciation

Know the Need for Depreciation

Understand the Factors that Affect Depreciation

To Calculate Depreciation for the Period for Which Depreciation is to be Charged Depending on Different Types of Problems

Understand Methods of Accounting Entries for Recording Depreciation

Understand Methods of Providing (Allocating) Depreciation

Understand the Meaning, Formula, Merits, Demerits and Applicability of Straight Line Method

Calculate the Rate and Amount of Depreciation Under Straight Line Method

Understand the Meaning, Formula, Merits, Demerits and Suitability of Written Down Value Method

Distinguish Between Straight Line Method and Written Down Value Method

Compute Machinery Account and Ascertain Profit/Sale on Asset

Understand the Accounting Treatment for Creating Provision for Depreciation and Accumulated Depreciation

Understand the Procedure for Change in the Method of Depreciation as per Accounting Standard (AS) – 6

Complete and Prepare Machinery Account, When There is a Change in the Method of Depreciation

Understand the Concept of Annuity Method and Accounting Treatment Under This Method

Understand the Main Features of Sinking Fund Method

Differentiate Annuity Method and Sinking Fund Method

Understand the Sum-of-the-Years’-Digits Method

Choose a Method of Depreciation

Answer: Is Depreciation a Source of (Income) Funds?

Understand the Meaning, Objectives, Examples of Accounting Treatment and Disclosure Relating the “Provisions”

Understand the Meaning and Objectives of “Reasons” and to Distinguish Between “Provision” and “Reserve”

Understand Different Types of Reserves and Their Meanings

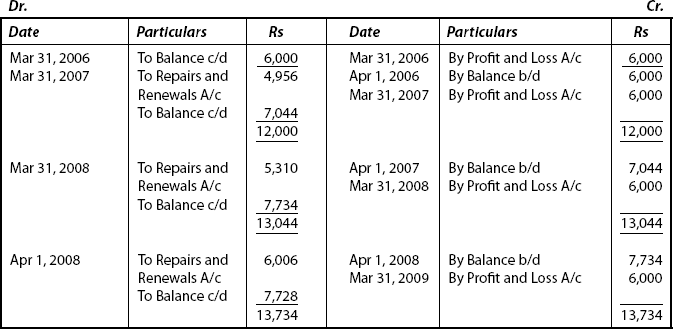

Understand the Term “Provision for Repairs and Renewals” and Its Accounting Treatment

Understand the Salient Features of Accounting Standard (AS) – 6

Introduction

To understand “what depreciation means” we have to expose the intricacies inherent in this word by way of the following detailed facts associated with the term. Every going concern acquires different types of assets broadly categorized into Fixed Assets and Current Assets. It is a fact that fixed assets are generally used for a longer period (i.e., more than one accounting period) and they are not for resale without using in the business activities). Despite the fact that fixed assets have longer life, they cannot be held perpetually in a concern. Fixed assets will have to loose their value over a period of time. At this stage one may say that the fall in value or quality of fixed assets may be connected with the term “Depreciation.” But the word Depreciation denotes many more factors.

OBJECTIVE 1: DEFINITION OF DEPRECIATION

According to the Institute of Chartered Accountants of India, “Depreciation is a measure of the wearing out or other loss of value of a depreciable asset arising from use, time or obsolescence. Depreciation is allocated so as to charge a fair proportion of the cost in each accounting period during the Expected Useful Life of the Asset. Depreciation includes amortization”. This is the Accounting Standard (AS) – 6.

According to the Institute of Chartered Accounts of England, “Depreciation represents that part of the cost of a fixed asset to its owner which is not recoverable when the asset is finally out of use by him. Provision against this loss of capital is an integral cost of conducting the business during the effective commercial life of the asset and is not dependent on the amount of profit earned”.

A careful analysis of the definition throws light on its character and extends its coverage by inclusion of some more terms like obsolescence, depletion and amortization.

OBJECTIVE 2: CHARACTERISTIC FEATURES OF “DEPRECIATION”

First, we shall look into its characteristic features:

- “Loss of value of depreciable asset” is an important phrase in the definition that explodes its character. Loss of value means fall in value – book value is reduced (its cost minus depreciation) – such a fall or reduction or decrease in value of fixed assets may be termed as “Deprecation”.

- It is a fall or decrease in the book value of depreciable fixed assets.

- It is related to tangible fixed assets.

- The fall in book value of asset is due to constant use of such asset in business activities.

- The fall or loss of value or reduction in book value of tangible depreciable fixed assets is gradual, continuous and permanent.

- As the definition covers “depletion, obsolescence, amortization” – explanation of these terms will also throw some light – what deprecation means really.

- Depletion: This term is used in relation to natural resources like oil wells, deposits in mines, quarries and so on. It indicates exhaustion of natural resources. Such assets value will be reduced due to constant use and such reduction in the value of assets is referred to as “Depletion”.

- Obsolescence: This term refers to the decline in economic value of assets. This may be due to invention of new techniques or equipment, market decline, change in fashion, inadequacy of existing fixed asset to meet increased demand and so on.

- Amortization: This term refers to loss of economic value of intangible assets such as patents, trademarks, goodwill and copyrights. Some of them have limited period of life. So they have to be written off and removed from the list of assets. The process of writing off of intangible assets is called amortization.

OBJECTIVE 3: ACCOUNTING CONCEPT OF DEPRECIATION

According to American Institute of Certified Public Accountants. “Depreciation Accounting is a system of accounting which aims to distribute cost or the basic value of tangible capital assets loss salvage, if any, over the estimated useful life of the unit (which may be group of assets) in a systematic and rational manner. It is a process of allocation and not of valuation.

- Depreciation accounting is the process of allocating the cost of the fixed tangible assets, less its salvage value over its serviceable life.

- Depreciation is an expense that is to be charged against the revenues of different years over the asset is to be used.

- It is immaterial whether the business makes profit or loss.

- The amount to be allocated each year should be systematic and rational.

- Deprecation accounting does not refer to the decline in value of current assets resulting from obsolescence.

- Depreciation is not the process of valuation, even if the market value of an asset increases, depreciation is to be recorded.

On the basis of above discussion (i.e., based on definition of depreciation and meaning of depreciation accounting) the following salient features come into light on “Depreciation.”

OBJECTIVE 4: SALIENT FEATURES

- Depreciation is gradual but continues fall in the book value of fixed assets.

- Deprecation is caused due to depletion, obsolescence and amortization of fixed assets.

- Deprecation is related to tangible fixed assets.

- Deprecation is not connected with current assets.

- Depreciation in accounting is a process of allocating the cost (as an expense) in each of the accounting period in which the asset is used.

- Depreciation has no relationship with the market value of assets.

- Deprecation cost is not an exact amount, it is to be estimated.

- Depreciation is a charge against the profits.

- Total deprecation cannot exceed its depreciable value (cost − scrap value) or original cost in case the scrap value is nil.

OBJECTIVE 5: THE CAUSES OF DEPRECIATION

The causes for the decline in the usefulness of asset may be due to physical and functional factors.

5.1 Physical Features

Physical loss of an asset is due to

- Wear and Tear: When the fixed assets are put into constant use, due to wear and tear, they may be rendered useless in course of time. Wear and tear may be due to friction, breakage and corrosion.

- Passage of time: Assets are affected when they are exposed to forces of nature – wind, rain, snow, heat of the sun, etc. – and with the passage of time the value of asset may get diminished even if they are not put in use.

- At times, natural calamities like earthquake, tsunami and factors like fire, flood and events of accident may cause the decline in the value of assets.

5.2 Functional Factors

- Inadequacy: It may not be able to match the demand – if the demand expands, its value is declined.

- Obsolescence: New inventions and technological advancement may be the cause of the decline.

- Depletion: Exhaustion of natural resources.

- Expiry of legal rights relating to copyright, patent, leases and so on. will also be a factor.

OBJECTIVE 6: NEED FOR DEPRECIATION

The need for charging a reasonable amount of depreciation arises for the following purpose or objectives.

1. True Results of Operations: It is necessary to charge the depreciation against income in each accounting period. Otherwise, the result of operations will not be fair and true.

2. True and Fair View of Financial Position: In the absence of depreciation charge, assets have to be shown at their original cost every year in the final accounts. In order to show true and fair final position, assets will have to be shown at cost less depreciation.

3. Proper Cost of the Product: Depreciation forms part of production like other expenses. In the absence of depreciation charge, cost records may not reveal true account of cost of production. To ascertain the proper cost of the product, it is imperate to provide for prescribed depreciation.

4. Funds for Replacements of Assets: A portion of profit is to be set aside in the form of depreciation every year which facilitates the task of replacement of assets at the end of its life. Without any additional financial burden, assets can be replaced in such accumulated depreciation provisions.

5. Legal Requirements: Legal requirements can be complied with, (as in case of companies) by way of charging depreciation on assets.

6. Allocation of Cost of Fixed Assets: The main objective of depreciation accounting is to allocate the cost of fixed asset to respective accounting periods which benefit from the use of the asset which can be achieved by charging depreciation.

7. Impact on Tax-Liability: Rate of depreciation is influenced by the tax-laws and thereby helps the tax liability to a certain extent.

OBJECTIVE 7: FACTORS AFFECTING AMOUNT OF DEPRECIATION

The amount of annual deprecation is based on the following factors:

1. Historical Cost: The cost includes all costs incurred in acquiring the depreciable fixed assets on its acquisition, installation and commissioning (e.g., invoice price, legal charges, freight, transport and so on.)

2. Estimated Useful Life: This depends on the intensity of use, standard of maintenance and the replacement policy of the management.

3. Estimated Residual Value (Scrap Value) (Salvage Value): The salvage value means the estimated amount that may be recovered on its sale or exchange for a new asset at the end of its useful service life.

OBJECTIVE 8: DEPRECIATION ON ASSETS

Following alternatives may be adopted to charge depreciation on assets purchased during the year:

| Type | Period for which depreciation is to be charged |

|---|---|

(A) If the rate of depreciation is expressed as … % without the words of per annum (p.a.) |

|

(i) When date of purchase or sale is not given |

Depreciation is to be calculated for the full accounting period |

(ii) When date of purchase or sale is given |

Depreciation is to be computed on the basis of time factor unless the examination problem requires otherwise |

(B) If the rate of deprecation … % with the words p.a. is given (e.g. 12% p.a.) |

|

(i) If the date of the acquisition is given |

(i) Depreciation is charged for the period beginning with the date acquisition and ending with the date of closing period |

(ii) If the date of acquisition is NOT given |

(ii) Assumption I: Assume that the asset was purchased in the beginning and charge the depreciation for a full year Assumption II: Assume that the asset was purchased in the middle of the year and charge the depreciation for half of the year Assumption III: Assume that the asset was purchased at the end of the accounting period and no depreciation is to be charged [Students are asked to put a note in any such case.] |

OBJECTIVE 9: ACCOUNTING TREATMENT

Following are the two alternative methods of accounting entries for recording depreciation:

- By charging to asset account directly.

- By creating Provision for Depreciation/Accumulated Depreciation Account.

9.1 Method 1: By Charging to Asset Account Directly

This accounting procedure is applicable to all the methods of depreciation except Sinking Fund Method.

Under this method of recording depreciation, it is directly credited to the “respective asset account” with the result that the respective asset account appears in the Balance Sheet at its book value or cost value less depreciation for the accounting period.

9.2 Method 2: By Creating Provision for Depreciation

Under this method, the asset account is not at all affected by the depreciation amount. Asset appears in the books (Ledger and Balance Sheet) at its original cost until sold or discarded.

The amount stands in the credit side of the Provision for Depreciation Account depicts the total amount of depreciation accumulated to date. When the asset is sold, that accumulated amount in the Provision for Depreciation Account is transferred to the respective asset account and closed.

Difference between these two methods of accounting:

| Directly Charged to Asset A/c | Provision for Depreciation |

|---|---|

1 The asset is shown in the Balance Sheet at its cost or book value less depreciation relating to that accounting period. |

1 The asset always appears at its original cost in the Ledger and the Balance Sheet. |

2 Total amount of depreciation cannot be ascertained from a single Balance Sheet. |

2 Total amount of depreciation written off up to date can be ascertained even from the last single Balance Sheet. |

3 It is difficult to assess, whether the asset is new or old or when purchased, in the absence of any accounting information. |

3 It is very easy to find out the age of asset with the help of cost of asset and accumulated depreciation. |

Journal entries which will have to be passed under the method (charging direct to the asset):

- To record the purchase of asset:

Asset A/c

Dr.

To Cash/Bank A/c

(Being the Asset purchased.)

- To provide depreciation:

Depreciation A/c

Dr.

To Asset A/c

(Being the depreciation provided.)

- To close depreciation account:

Profit and Loss A/c

Dr.

To Depreciation A/c

(Being the Depreciation transferred to Profit and Loss A/c.)

- To record sale of asset:

Cash/Bank A/c

Dr.

To Asset A/c

(Being the asset sold.)

- To record profit/loss on sale:

- in case of profit:

Asset A/c

Dr.

To Profit and Loss A/c

(Being the transfer of profit on sale.)

- in case of loss:

Profit and Loss A/c

Dr.

To Asset A/c

(Being the transfer of loss on sale.)

- in case of profit:

OBJECTIVE 10: METHODS OF PROVIDING (ALLOCATING) DEPRECIATION

There are several methods of allocating depreciation. They are

- Straight Line Method

- Diminishing Balance Method

- Annuity Method

- Sinking Fund Method

- Insurance Policy Method

- Machine Hour Rate Method

- Units of Output or Production or Depletion Method

- Revaluation Method

- Sum-of-the-Years’-Digits Method

- Group Depreciation Method

The most commonly used methods are

- Straight Line Method

- Diminishing Balance Sheet

10.1 Straight Line Method: (or) Fixed (or) Equal Installment Method: Meaning, Formula, Merits, Demerits and Suitability

10.1.1 Meaning

Under this method:

- a fixed and equal amount (in the form of depreciation)

- according to a fixed percentage on original cost

- is written off each accounting year

- over the expected useful life of the asset

Under this method, the depreciation charge is not affected by the extent of the use of the asset, its age or efficiency.

10.1.2 Formula

- Amount of Depreciation = Original Cost − Residual value/Expected Useful Life of the Asset

- Rate of Depreciation = Amount of Depreciation/Original Cost × 100

While applying the formula, the following hints will be of much use to the students:

- Book Value (as on date of sale) = Original Cost − Total Depreciation (till date).

- Profit = Sale Proceeds − Book Value (as on date of sale).

- Loss = Book value (as on date of sale) − Sale Proceeds.

- In case of an exchange of asset,

Sale price is the amount at which the vendor agrees to acquire the old asset (trade in allowance). - In case of destruction of an insured asset, Sale price is the Claim admitted by the insurance company with the sale value if any.

10.1.3 Merits of this Method

- It is easy to comprehend and recognize by AS–6.

- It is easy to calculate the amount and rate of depreciation, and comparison is easy.

- The book value of the asset becomes zero or equal to its scrap value at the expiry of its useful life.

10.1.4 Demerits

- Total Charge − (Depreciation + Repairs + Renewals) does not commensurate with depreciation over the years. It is not in confirmity with the age of the asset.

- Interest on capital (invested in the asset) is ignored.

- It does not provide for the replacement of the asset on the expiry of its useful life.

10.1.5 Applicability

This method can yield rich dividends for those assets which have less repair charge and less chances of obsolescence. This method is suitable for patent, copyright, trademark, lease and so on.

Illustration: 1

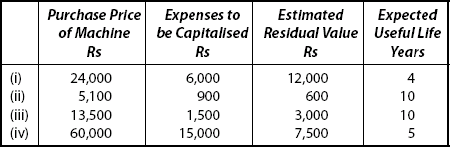

Calculate the rate of depreciation under Straight Line Method:

Purchase Price of Machine |

= |

Rs 4,00,000 |

Expenses to be Capitalized |

= |

Rs 2,00,000 |

Estimated Residual Value |

= |

Rs 2,00,000 |

Expected Useful Life |

= |

5 years |

Solution

Step 1: Calculation of Total Cost of Asset

Remember |

|

|

Total Cost of Asset = Purchase Price + Expenses to be Capitalized |

|

|

= |

Rs 4,00,000 + Rs 2,00,000 |

|

|

= |

Rs 6,00,000 |

Step 2: Calculation of amount of depreciation per year

Remember |

|

|

Amount of Deprecation |

|

|

= |

Total Cost of Asset – Estimated Scrap Value/Expected Useful Life |

|

|

= |

Rs 6,00,000 – Rs 2,00,000/5 years = Rs 4,00,000/5 |

|

|

= |

Rs 80,000 |

Step 3: Calculation of Rate of Depreciation

Remember |

|

|

Rate of Depreciation = Amount of Depreciation/Total Cost of Asset × 100 |

|

|

= |

Rs 80,000/ Rs 5,00,000 × 100 = 16%. |

Illustration: 2

A machine is purchased for Rs 4,00,000. Expenses incurred on it Rs 1,00,000. The residual value at the end of its expected useful life of 4 years is estimated at Rs 2,00,000. Calculate the amount of depreciation for the first year ending on Mar 31, 2009 if it is purchased on:

- Apr 1, 2008

- July 1, 2008

- Oct 1, 2008

- Jan 1, 2009

Solution

Step 1: Total cost of asset is to be calculated

|

|

(Total) Cost of Asset = Purchase Price + Expenses |

|

= |

Rs 4,00,000 + Rs 1,00,000 |

|

= |

Rs 5,00,000 |

Step 2: Amount of depreciation per year is calculated

Amount of Depreciation per year

|

= |

Total Cost of Asset – Estimated Residual Life/Expected Useful Life |

|

= |

Rs 5,00,000 – Rs 2,00,000/4 = Rs 75,000 per year |

Step 3: Amount of depreciation for the first year of purchase

Case (a): Date of purchase Apr 1, 2008

From Apr 1, 2008 to Mar 31, 2009: 12 months

∴ Amount of depreciation for 12 months, i.e. 1 year = Rs 75,000

(as per Step 2)

Case (b): Date of purchase: July 1, 2008

From July 1, 2008 to Mar 31, 2009 = 9 months

Amount of deprecation for 12 months = Rs 75,000

∴ Amount of depreciation for 9 months = Rs 75,000×9/12 = Rs 56,250

Case (c): Date of purchase = Oct 1, 2008

From Oct 1, 2008 to Mar 31, 2009 = 6 months

Amount of Depreciation for 6 months = 6/12×75,000 = Rs 37,500

Case (d): Date of purchase: Jan 1, 2009

From Jan 1, 2009 to Mar 31, 2009 = 3 months

Amount of Depreciation = 3/12 × 75,000 = Rs 18,750.

Illustration: 3

A machine is purchased for Rs 8,00,000. Expenses incurred on its cartage and installation Rs 1,00,000. Calculate the amount of depreciation @ 10% p.a. as per Straight Line Method for the first year ending on Mar 31, 2009, if the machine is purchased on

- Apr 1, 2008

- July 1, 2008

- Oct 1, 2008

- Jan 1, 2009

Solution

Step 1: Calculation of total cost of asset

Total Cost of Asset = Purchase Price + Expenses

|

= |

Rs 8,00,000 + Rs 1,00,000 |

|

= |

Rs 9,00,000 |

Step 2: Amount of depreciation

|

= |

Total Cost of Asset × Rate/100 × Period/12 months |

Case (a): Purchase is on Apr 1, 2008

Period = from Apr 1, 2008 to Mar 31, 2009 = 12 months

Amount of depreciation for 12 months = Rs 9,00,000 × 10/100 × 12/12

= Rs 90,000

Case (b): Purchase is on July 1, 2008

Period = from July 1, 2008 to Mar 31, 2009 = 9 months

Amount of depreciation for 9 months = Rs 9,00,000 × 10/100 × 9/12

= Rs 67,500

Case (c): Purchase is on Oct 1, 2008

Period = From Oct 1, 2008 to Mar 31, 2009 = 6 months

∴ Amount of depreciation for 6 months = Rs 9,00,000 × 10/100 × 6/12

= Rs 45,000

Case (d): Purchase is on Jan 1, 2009

Period = From Jan 1, 2009 to Mar 31, 2009 = 3 months

Amount of depreciation for 9 months = Rs 9,00,000 × 10/100 × 3/12

= Rs 22,500

Illustration: 4

A company purchased a second-hand machine on Apr 1, 2007 for Rs 1,50,000 and spent Rs 50,000 on its repairs. Depreciation is to be provided @ 10% as per Straight Line Method. The machine was sold for Rs 1,00,000. Accounting year is financial year. Calculate the profit/loss on sale of machine, on Mar 31, 2009.

Solution

Step 1: Total Cost of Asset = Purchase Price + Expense

|

= |

Rs 1,50,000 + Rs 50,000 = Rs 2,00,000 |

Step 2: Depreciation

Period = from Apr 1, 2007 to Mar 31, 2009 = 24 months

Amount of Depreciation for 24 months

|

= |

Rs 2,00,000 × 10/100 × 24/12 |

|

= |

Rs 40,000 |

Step 3: Book value as on date of sale

(Step 1 – Step 2) = Rs 2,00,000 – Rs 40,000

= Rs 1,60,000

Step 4: Sale proceeds = Rs 1,00,000

Step 5: Book Value − Sale Proceeds

Rs 1,60,000 – Rs 1,00,000

= Rs 60,000 (Profit)

Hence, profit on Sale = Rs 60,000.

Illustration: 5

On Apr 1, 2006 X Ltd purchased a second-hand machine for Rs 1,60,000 and spent Rs 40,000 on its cartage and installation. The residual value at the end of its expected useful life of 4 years is estimated at Rs 80,000. On Sep 30, 2008. This machine is sold for Rs 1,00,000. Depreciation is to be provided according to Straight Line Method.

You are required to pass Journal entries in the books of X Ltd and prepare Machinery Account and Depreciation Account for the first three years assuming that the accounts are closed on Mar 31, each year.

Solution

Stage I First, rate of depreciation is calculated

- Total cost = Rs 1,60,000 + Rs 40,000 = Rs 2,00,000

- Amount of Depreciation per year = Total Cost – Estimated Residual value/Expected Useful Life

= Rs 2,00,000 – Rs 80,000/4 = Rs 30,000

- Rate of Depreciation = Amount of Depreciation/Total Cost of Asset × 100

= Rs 30,000/Rs 2,00,000 × 100 = 15%

Stage II Next, profit/loss on sale of asset is to be computed

Rs |

||

|---|---|---|

(i) |

Total Cost of Asset (Rs 1,600,000 + Rs 40,000) |

2,00,000 |

(ii) |

Less: Depreciation from the date of purchase to date of sale (Rs 2,00,000 × 15/100 × 30/12) |

75,000 |

(iii) |

Book value as on date of sale (i) – (ii) |

1,25,000 |

(iv) |

Less: Sale proceeds |

1,00,000 |

(v) |

Loss on Sale of Asset |

25,000 |

Note: Depreciation for the period from Mar 31, 2008 to date of sale of asset Sep 30, 2008 has to be computed.

Amount of depreciation for the period from Apr 1, 2008 to Sep 30, 2008

i.e. for 6 months = Rs 2,00,000 × 15/100 × 6/12

= Rs 15,000

Stage III Passing of Journal entries in the books of X Ltd

Journal of X Ltd

Machinery Account

Depreciation Account

10.2 Written Down Value Method (or) Diminishing Balance Method (or) Reducing Balance Method: Meaning, Formula, Merit, Demerit and Suitability

10.2.1 Meaning

The depreciation is calculated on the reducing balance (Asset Cost Less Depreciation) and not on original cost. Under this method, a fixed rate (percentage) is applied to the original cost in the first year and to the book value in subsequent years. The book value of the asset means the balance of asset cost but not yet depreciated. The deprecation is deducted from the cost of the asset and the balance is termed as Written Down Value (WDV). In the next year, the fixed rate is applied to the WDV and not to the original cost. Under this method, the rate of deprecation remains the same but the amount of depreciation goes down decreasing.

The WDV at the end of the estimated useful life of the asset will equal the estimated salvage value.

10.2.2 Formula: Rate of Depreciation (WDV Method)

R |

= |

|

R |

= |

Rate of depreciation in % |

N |

= |

Useful life of the asset |

S |

= |

Scrap value at the end of useful life of the asset |

C |

= |

Cost of the Asset. |

10.2.3 Merits

- Higher depreciation, charged in the earlier years of the asset (i.e., the machine in the most efficient condition result in increased production) is in conformity with larger revenues, is a practical approach.

- The obsolescence view is looked into as major part of depreciation is charged in the earlier years and in the end there will not be much difficult to replace assets.

- In later years, any machinery warrants higher maintenance and repair expenses and lower depreciation charge in later years ease the financial burden of the companies.

- As the asset will never be written off completely, the management can keep a track on the asset.

- All items, including additions are added together and depreciated on the same rate. As such recalculation need not be done.

- This method is recognized by AS–6 and recognized by tax authorities.

10.2.4 Demerits

- Under this method, the formula is a complicated one and more mathematical competence is needed.

- Interest on the amount invested in assets is ignored.

- It takes much time (i.e., more years) to write off the assets completely. As such early replacement of asset is not possible.

- Assets having a very short useful life, may affect the profit results, as (charged) depreciation rate is high in the earlier years.

- This method is neither based on the use of the asset nor distributed evenly throughout the useful life of the asset.

10.2.5 Suitability

This method is suitable where

- The amount of repair/renewable charges are high in later years.

- Obsolescence is more frequent.

10.2.6 Distinction Between Straight Line Method and Written Down Value Method

| Points of Distinction | Straight Line Method (SLM) | Written Down Value Method (WDV) |

|---|---|---|

1. Basis |

Depreciation is charged at a fixed rate on the original cost of the asset. |

Depreciation is charged at a fixed rate on original cost in the first year and on the WDV (Cost — Total Depreciation) in the subsequent years. |

2. Amount of Depreciation |

The amount of depreciation remains constant (same) throughout the life of asset. |

The amount of depreciation goes on decreasing from year to year. |

3. Effect on Net Profit |

Net Profit will be affected in later years since the maintenance charges may increase, depreciation being the same amount. |

Net Profit will not be affected in later years since the depreciation amount decreases. |

4. Formula and Calculation |

Easy to calculate depreciation as the formula is simple. |

Difficult to compute depreciation, as the formula requires mathematical skill |

5. Book Value |

At the end of useful life of the asset, book value is nil or equal to scrap value. |

The book value will never be zero or equal to scrap value. |

6. Suitability |

Suitable where (i) repair charges are less (i) obsolescence is less. |

Suitable where (i) repair charges are high (i) obsolescence is more frequent. |

7. Tax Authority’s Recognition |

This method is not recognised by Income Tax Authorities |

This method is recognised by Income Tax Authorities |

Illustration: 6

A machine was purchased on Apr 1, 2007 for Rs 50,000. The cost of installation and other expenses are Rs 3,000. Its scrap value at the end of its useful life will be Rs 5,000. Write up the Machine Account for the first two years under (i) WDV Method and (2) SLM charging 20% depreciation, assuming financial year is followed:

Solution

First, under SLM, amount of depreciation for a year (12 months) is calculated.

Annual Depreciation |

= |

Total Cost – Scrap value/Useful Life of Asset |

|

= |

Rs 50,000 + Rs 3,000 – Rs 5,000 |

|

= |

Rs 48,000 × 20/100 × 12/12 |

|

= |

Rs 9,600 |

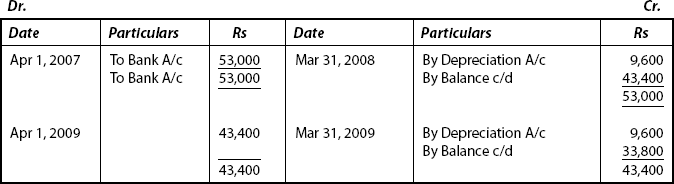

Machinery Account (Under Straight Line Method)

Machinery Account (Diminishing Balance Method)

Now, the differences between these two methods can be easily understood.

- The depreciation is charged on the original cost of the asset under Straight Line Method, whereas under WDV Method, even though it is charged on the original cost in the first year, in the subsequent years it is charged at WDV (Cost less Depreciation).

- The amount of depreciation remains the same, i.e. Rs 9,600 for every year under SLM, whereas it varies and decreases, i.e. Rs 10,600 in the first year and Rs 8,480 in the second year.

- Further the amount of depreciation is high in the first under WDV is Rs 10,600 compared to Rs 9,600 under SLM.

- Amount of depreciation is less even lesser than under SLM, i.e. Rs 8,480 under WDV Method, whereas it is Rs 9,600 under SLM.

The differences between these two methods can be illustrated in a better way as follows:

Illustration: 7

M/s Renu Sugars Ltd purchased a machine costing Rs 50,000 or Jan 1, 2004. The depreciation is to be charged @ 20% p.a. Write up the Machine Account for five years ending on Dec 31, 2008 under Straight Line Method and WDV Method:

Solution

Machine Account

Purchase of Assets (or Additions) and Depreciation

Illustration: 8

From the following information of Vas Ltd prepare Machinery Account for three years ending Mar 31, 2009, by providing depreciation @ 20% p.a. under Straight Line Method

| Date | Transactions | Rs |

|---|---|---|

Apr 1, 2006 |

Purchased a second hand machinery I |

1,20,000 |

Apr 1, 2006 |

Repairs on it |

30,000 |

Oct 1, 2006 |

Purchased a new machinery II |

3,00,000 |

Apr 1, 2007 |

Spent repairs on machine II |

3,000 |

Sep 30, 2008 |

Sold machinery I |

67,500 |

Sep 30, 2008 |

Purchased a new machinery III |

4,50,000 |

Solution

Step 1: Profit or Loss on Sale of Asset is calculated

|

|

Rs |

1. |

Total Cost of Asset (Rs 1,20,000 + Rs 30,000) |

1,50,000 |

2. |

Less: Depreciation on I from date of purchase to date of sale |

75,000 |

3. |

Book value as on date of sale (1–2) |

75,000 |

4. |

Less: Sale proceeds of Machine I |

67,500 |

5. |

Loss on sale (3–4) |

7,500 |

Step 2:

Machinery Account

Illustration: 9

From the following information of Ra & Co Ltd, prepare Machinery Account for three years ending Mar 31, 2009 by charging depreciation @ 20% p.a. applying WDV Method.

| Date | Transactions | Rs |

|---|---|---|

Apr 1, 2006 |

Purchased a second hand machinery I |

1,20,000 |

Apr 1, 2006 |

Spent for repairs |

30,000 |

Oct 1, 2006 |

Purchased a new machine II |

3,00,000 |

Apr 1, 2007 |

Spent for repairs on new machine II |

3,000 |

Sep 30, 2008 |

Sold machine I |

67,500 |

Sep 30, 2008 |

Purchased a new machine III |

4,50,000 |

Illustration figures are the same as that of the previous illustration but the Method of Deprecation differs here.

Solution

Step 1: Calculation of Profit/Loss on Sale of Machine:

| Rs | ||

|---|---|---|

1. |

Total Cost of Asset (Rs 1,20,000 + Rs 30,000) |

1,50,000 |

2. |

Less: Depreciation for 2006– 2007 (20% of Rs 1,50,000) |

30,000 |

3. |

Book value as on Apr 1, 2007 (1–2) |

1,20,000 |

4. |

Less: Depreciation for 2007–2008 (20% of Rs 1,20,000) |

24,000 |

5. |

Book value as on Apr 1, 2008 (3–4) |

96,000 |

6. |

Less: Depreciation upto date of sale from Apr 1, 2008 to Sep 30, 2008: 6 months 20% of Rs 96,000 for 6/12 |

9,600 |

7. |

Book value (6–7) as on Sep 30, 2008 |

86,400 |

8. |

Less: Sale proceeds |

67,500 |

9. |

Loss on Sale (7–8) |

18,900 |

Step 2:

Preparation of Machinery Account

Important Note: Amount spent on repairs on Apr 1, 2007 is of revenue nature and as such it is not debited to Machinery Account.

Note: There exists no difference in recording Journal entries under WDV. The procedure and accounting entries are similar to that of the procedure adopted under Straight Line Method.

Journal entries are same under both methods (i.e., Straight Line Method and Diminishing Value Method (WDV).

So this part is not repeated here.

Illustration: 10

On July 1, 2005, Shree Ltd purchased a second-hand machinery for Rs 40,000 and spent Rs 6,000 on re-conditioning and installing it. On Jan 1, 2006, the firm purchased machinery worth Rs 24,000. On June 30, 2007, (the machinery purchased on Jan 1, 2006) was sold for Rs 16,000. On July 1, 2007, another new machinery was purchased on installment basis, payment for which was to be made as follows:

June 30, 2008 |

Rs 10,000 |

July 1, 2008 |

Rs 12,000 |

June 30, 2009 |

Rs 11,000 |

Payments in 2008 and 2009 include interest of Rs 2,000 and Rs 1,000 respectively.

The company writes off depreciation @ 10% on original cost. The accounts are closed every year on Mar 31. Show the Machinery Account for three years ending Mar 31, 2008.

[B.Com (Hons) – Modified]

Solution

Note: As there is no specific instruction regarding the method of depreciation, Straight Line Method is followed.

Calculation of Depreciation: In order to avoid confusion, let the machinery purchased on July 1, 2005 be noted as Machine I (assumption), and the one purchased on Jan 1, 2006 as Machine II, and the other one purchased on July 1, 2007 as Machine III – for easy calculation of depreciation.

Step 1: For the year 2005–2006 (Apr 1, 2005 to Mar 31, 2006)

(i) Date of purchase July 1, 2005: Machine I |

Rs 40,000 |

Add: Expenses |

Rs 6,000 |

|

Rs 46,000 |

From July 1, 2005 to Mar 31, 2006: 9 months |

|

∴ Depreciation on Machine I = Rs 46,000 × 10/00 × 9/12 = Rs 3,450 |

|

|

|

(ii) Machine II was purchased on Jan 1, 2006 = Rs 24,000 |

|

From Jan 1, 2006 to Mar 31, 2006 = 3 months |

|

∴ Depreciation on Machine II = Rs 24,000 × 10/100 × 3/12 = Rs 600 |

|

Step 2: For the year 2006–2007 (From Apr 1, 2006 to Mar 31, 2007)

Note: There is no addition (purchase) or sale during this period. So depreciation has to be computed for 1 year for both the machines.

- Depreciation for Machine I

Rs 46,000 × 10/100 × 12/12 = Rs 4,600

- Depreciation for Machine II

Rs 24,000 × 10/100 × 12/12 = Rs 2,400

Step 3: For the year 2007–2008 (from Apr 1, 2007 to Mar 31, 2008)

- Depreciation for Machine II

This was sold on June 30, 2007

Depreciation for the period, i.e. from Apr 1, 2007 to June 30, 2007

∴ Depreciation = Rs 24,000 × 10/100 × 3/12 = Rs 600

- Depreciation for Machine I

(This means for a year.)

∴ Depreciation = Rs 46,000 × 10/100 × 12/12 = Rs 4,600

- On July 1, 2007, Machine III was purchased

Depreciation for the period from July 1, 2007 to Mar 31, 2008

= Rs 33,000 × 10/100 × 9/12

= Rs 2,475

Step 4: Note: Interest is not to be added to the cost of asset for depreciation calculation. At this stage, profit or loss on sale of machinery has to be computed.

|

|

Rs |

1. |

Original cost (as on date of purchase Jan 1, 2006) |

24,000 |

2. |

Less: Depreciation for this (Machine II) |

3,600 |

3. |

Book value (1–2) as on date of sale (June 30, 2007) |

20,400 |

Less: Sale proceeds |

16,000 |

|

5. |

Loss (3–4) |

4,400 |

Hence, there is a loss of Rs 4,400 on the sale of Machine II.

Step 5: Now all these figures have to be transferred to “Machinery Account” which has to be prepared as follows:

Machinery Account

Important Note: Machine is brought under Hire-Purchases Scheme, payment by installment spreads over a number of years. But total cost (i.e., sum of all the installments) has to be taken into account for computing depreciation and at the same time excluding interest amount as already noted.

Illustration: 11

On Apr 1, 2006, Siva Ltd agreed to purchase a machine on hire-purchase basis from Dev Ltd. The cash price of the machine was Rs 6,00,000. The company was required to pay Rs 3,00,000 down and the balance in three annual installments of Rs 1,00,000 each plus interest @ 12% per annum. First installment was paid on Mar 31, 2007. Show Machine Account for all the three years in the books of Siva Ltd, which depreciated machine @ 15% per annum using Diminishing Balance Method. Assume the books of accounts are closed every year on Mar 31.

(C.S. Foundation – Modified)

Solution

Note: Asset is bought under hire purchase system and payment is made in installments. For calculating depreciation, installment is ignored and the total, i.e. cash price has to be taken into account. Interest need not be added to the cost of the asset.

Machinery Account

Illustration: 12

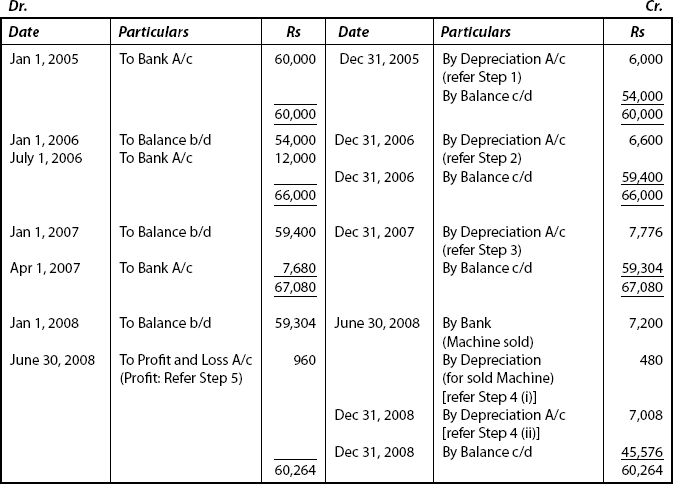

On Jan 1, 2005, a machine was purchased by Vasu Dev for Rs 60,000. On July 1, 2006 additions were made to the extent of Rs 12,000. On Apr 1, 2007, further additions were made to the extent of Rs 7,680. On June 30, 2008, a machine, the original value of which was Rs 9,600 on Jan 1, 2005, was sold for Rs 7,200. He closed books on Dec 31 every year.

Show the Machine Account for four years from 2005 to 2008 in the books of Vasu Dev, if depreciation is charged @ 10% under Original Cost Method.

B. Com (Hons) – Modified

Solution

Depreciation has to be calculated by Straight Line Method calculation.

Step 1: For the year 2005 (Jan 1, 2005 to Dec 31, 2005) that machine remains throughout the year

∴ Depreciation = Rs 60,000 × 10/100 × 12/12 = Rs 6,000

Step 2: For the year 2006: (From Jan 1, 2006 to Dec 31, 2006):

Before addition: |

Rs |

Depreciation = Rs 60,000 × 10/100 × 12/100 |

6,000 |

Addition on July 1, 2006 = (From July 1, 2006 to Dec 31, 2006) |

|

Depreciation = Rs 12,000 × 10/100 × 6/12 |

600 |

Total Depreciation for the year 2006 |

6,000 |

Step 3: For the year 2007:

|

Rs |

Before addition: (for 1 year) |

|

(i) Depreciation = Rs 60,000 × 10/100 × 12/12 |

6,000 |

(ii) Depreciation = Rs 12,000 × 10/100 × 12/12 |

1,200 |

Addition on Apr 1, 2007 (from Apr 1, 2007 to Dec 31, 2008) |

|

(iii) Depreciation = Rs 7,680 × 10/100 × 9/12 |

576 |

Total Depreciation for the year 2007 |

7,776 |

Step 4: For the year 2008:

(i) Sale on June 30, 2008 = (June 30, 2008 to Dec 31, 2008) |

Rs |

Rs 9,600 × 10/100 × 6/12 |

480 |

(ii) Balance (60,000 – 9,600) = 50,400 × 10/100 × 12/12 |

5,040 |

10% on Rs 12,000 machine for 1 year |

1,200 |

10% on Rs 7,680 machine for 1 year |

768 |

|

7,008 |

Step 5: Calculation of profit/loss on sale of machine:

|

|

Rs |

1. |

Cost of machine sold on June 30, 2008 |

9,600 |

2. |

Loss: Depreciation for 2005 |

960 |

3. |

Book value on Dec 31, 2005 |

8,640 |

4. |

Less: Depreciation for 2006 |

960 |

5. |

Book value on Dec 31, 2006 |

7,680 |

6. |

Less: Depreciation for 2007 |

960 |

7. |

Book value on Dec 31, 2007 |

6,720 |

8. |

Less: Depreciation upto June 30, 2008 only |

480 |

9. |

Book value on the date of sale |

6,240 |

10. |

Sale value on the date of sale |

7,200 |

11. |

Profit (10 – 9) (Rs 7,200 – Rs 6,240) |

960 |

Step 6: Preparation of Machinery Account:

Machinery Account

10.3 Provision for Depreciation/Accumulated Depreciation: Passing of Entries and Preparation of Accounts

Under this method of recording depreciation, depreciation is to be credited to Provision for Depreciation Account.

As a result, the asset account is not affected by the amount of depreciation. The respective asset appears in the books (Ledger and Balance Sheet) at its original cost value. However, the amount in the credit side of the Provision for Depreciation Account shows the total amount of depreciation accumulated to date (till sold or discarded).

Journal entries to be passed are:

- To Provide Depreciation

Depreciation A/c

Dr.

To Provision for Depreciation A/c

- To Close Depreciation Account:

Profit and Loss A/c

To Depreciation A/c

- Disposal of the (respective) Asset:

- For transfer of original cost of asset disposed off

Asset Disposal A/c

Dr.

To Asset A/c

- For transfer of accumulated depreciation

on asset disposed off

Provision for Depreciation A/c

Dr.

To Asset Disposal A/c

- For Sale proceeds:

Cash/Bank A/c

Dr.

To Asset Disposal A/c

- For transfer of balance in Asset Disposal Account:

- When Profit:

Asset Disposal A/c

Dr.

To Profit and Loss A/c

- When Loss:

Profit and Loss A/c

Dr.

To Asset Disposal A/c

- When Profit:

- For transfer of original cost of asset disposed off

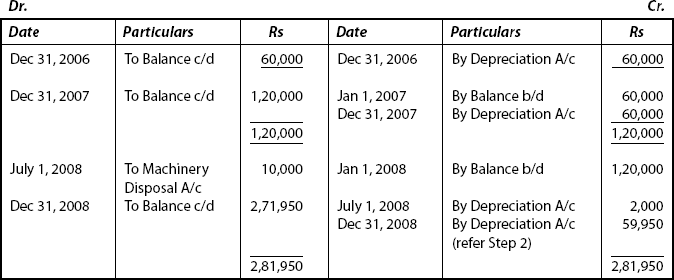

Illustration: 13

On Jan 1, 2006, Raj Ltd purchased a machinery for Rs 6,000,000. On July 1, 2008, a part of the machinery purchased on Jan 1, 2006 for Rs 40,000 was sold for Rs 22,500 and a new machinery at a cost of Rs 79,000 was purchased. The company has adopted the method of providing 1% p.a. depreciation on the original cost of the machinery. Prepare the necessary ledger accounts – Provision for Depreciation Account is maintained.

Solution

Step 1: Profit/loss on sale of machinery is to be calculated:

|

|

Rs |

1. |

Cost of Machinery (as on Jan 1, 2006) |

40,000 |

2. |

Less: Depreciation for the period from Jan 1, 2006 to July 1, 2008: 30 months Rs 40,000 × 10/100 × 30/12 |

10,000 |

3. |

Book value as on July 1, 2008 (1 – 2) |

30,000 |

4. |

Less: Sale proceeds |

22,500 |

| 5. | Loss on Sale (3 – 4) | 7,500 |

Step 2: Calculation of depreciation on machines (other than sold)

|

|

Rs |

1. |

On Machine I (Rs 6,00,000 – Rs 40,000) |

5,60,000 |

|

(Purchased) (Sold) |

|

|

Depreciation for 1 year: Rs 5,60,000 × 10/100 |

56,000 |

2. |

On new Machine II: |

|

|

Period from July 1, 2008 to Dec 31, 2008: 6 months |

|

|

Depreciation Rs 79,000 × 10/100 × 6/12 |

3,950 |

|

Total (for 2008) |

59,950 |

Step 3

Machinery Account

Step 4

Provision for Depreciation Account

Step 5

Machinery Disposal Account

10.4 Procedure for Change in the Method of Depreciation

Accounting Standard–6 of ICAI stipulates that the depreciation method selected should be applied consistently. It has to facilitate easy comparison of results of operation from period to period. AS–6 (Revised) permits change of method only from the back date (retrospectively) on existing machines.

In order to comply with any statutory requirements or Accounting Standards of ICAI, change from one method of depreciation to another method can be adopted.

In case, a change in the method of depreciation is needed, depreciation must be “Recalculated” from the date of asset coming into use.

Due to recalculation, Surplus (Excess) or Deficiency (Shortage) may be the outcome. Surplus is to be credited to Profit and Loss A/c (or Depreciation A/c) and Deficiency is to be debited to Profit and Loss A/c (or Depreciation).

This can be explained with the help of the following illustration.

Illustration: 14

On Jan 1, 2005 X Ltd purchased machinery costing Rs 75,000 and provided depreciation @ 10% p.a. on Straight Line Method basis. At the end of 2009, the company decided to change the method of depreciation from Straight Line Method to Diminishing Value Method, retrospectively, the rate of depreciation remains unchanged. Prepare the Machinery Account upto the year 2008.

Solution

Step 1: |

Calculation of total depreciation under old method: |

|

|

Period from Jan 1, 2005 to Dec 31, 2008: 36 months (3 years) |

Rs |

|

Depreciation = Rs 75,000 × 10/100 × 36/12 |

22,500 |

|

*1. Total depreciation under Straight Line Method |

18,000 |

Step 2: Calculation of total depreciation under new method:

|

(Diminishing Value Method) |

|

1. |

Cost of Machinery as on Jan 1, 2005 |

75,000 |

2. |

Less: Depreciation for 1 year (2005) |

7,500 |

|

(Rs 75,000 × 10/100 × 12/12) |

67,500 |

3. |

Book value on Jan 1, 2006 |

|

4. |

Less: Depreciation for 1 year (2006) |

|

|

(Rs 67,500 × 10/100 × 12/12) |

6,750 |

5. |

Book value on Jan 1, 2007 |

60,750 |

6. |

Less: Depreciation for 1 year (2007) |

|

|

(Rs 60,750 × 10/100 × 12/12) |

6,075 |

7. |

Book value on Jan 1, 2008 |

54,675 |

|

*2. Total depreciation under new method |

|

|

(Rs 7,500 + Rs 6,750 + Rs 6,075 |

20,325 |

Step 3: Calculation of the difference between the total depreciation under old method (Straight Line Method) and the total depreciation under new method (Diminishing Value Method).

|

|

Rs |

*1. |

Total Depreciation under SLM (Old Method) (refer Step 1) |

22,500 |

*2. |

Total Depreciation under WDV (New Method) (refer Step 2) |

20,325 |

3. |

Difference (Surplus or Excess) |

2,175 |

Step 4: Pass Journal entries.

|

Machinery A/c |

Dr. 2,175 |

|

|

To Profit and Loss A/c |

|

2,175 |

|

(Being the excess on the method of depreciation credited to Profit and Loss A/c) |

||

Step 5: Depreciation for the current accounting year

|

Rs 54,675 × 10/100 × 12/12 |

|

|

Book Value on Jan 1, 2008 |

|

|

(refer Step 2) |

Rs 5,468 |

|

(rounded off to the nearest rupee) |

|

Step 6: Preparation of Machinery Account:

Machinery Account

Illustration: 15

Shree Ltd purchased on Jan 1, 2004, certain machinery for Rs 97,000 and spent Rs 3,000 on its execution. On July 1, 2004 additional machinery costing Rs 50,000 was purchased. On July 1, 2006, the machinery purchased on Jan 1, 2004 was auctioned for Rs 50,000 and on the same date a new machinery was purchased at a cost of Rs 75,000. Depreciation was provided annually on Dec 31 @ 10% p.a. on the original cost. No depreciation need be charged during the year of sale of machinery for that part of the year when the machine was used. In 2008, however, the company has changed the method of depreciation to WDV Method @ 15% p.a. from the Straight Line Method. Show the machinery account for the period from 2004 to 2008.

[B.com (Hons) – Modified]

Solution

Let the machine purchased on Jan 1, 2004 be called as Machine I, additional machinery on July 1, 2004 be Machine II and the new machinery purchased on July 1, 2006 be Machine III for computing depreciation without any confusion.

Step 1: Calculation of total depreciation for Machine II, under both the methods worked out as:

| Machine II | Straight Line Method Rs (10%) |

Written Down Method Rs (15%) |

|

|---|---|---|---|

|

Cost as on July 1, 2004 |

50,000 |

50,000 |

|

(Addition) |

|

|

Less: |

Depreciation for the period |

|

|

|

From July 1, 2004 to Dec 31, 2004 |

2,500 |

3,750 |

|

for six months: (year 2004) |

|

|

|

Book value on Dec 31, 2004 |

47,500 |

46,250 |

Less: |

Depreciation for 1 year (2005) |

5,000 |

6,938 |

|

Book value on Dec 31, 2005 |

42,500 |

39,312 |

Less: |

Depreciation for 1 year (2006) |

5,000 |

5,897 |

|

Book value on Dec 31, 2006 |

37,500 |

33,415 |

Less: |

Depreciation for 1 year (2007) |

5,000 |

5,012 |

|

Book value on Dec 31, 2007 |

32,500 |

28,403 |

|

Total Depreciation |

17,500 |

21,597 |

| Machine III | Straight Line Method Rs (10%) |

Written Down Method Rs (15%) |

|

|---|---|---|---|

|

Cost (as on July 1, 2006) |

75,000 |

75,000 |

Less: |

Depreciation from July 1, 2006 to |

|

|

|

Dec 31, 2006: 6 months |

3,750 |

5,625 |

|

Book value on Dec 31, 2006 |

71,250 |

69,375 |

Less: |

Depreciation for 1 year (2007) |

7,500 |

10,406 |

|

Book value on Dec 31, 2007 |

63,750 |

58,969 |

|

Total Depreciation |

11,250 |

16,031 |

Step3: Computation of Surplus or Deficiency:

|

Total depreciation on Machine II and III: |

Rs |

(i) |

Under WDV Method |

|

|

(Rs 21,597 + Rs 16,031) |

37,628 |

(ii) |

Under Straight Line Method |

|

|

(Rs 17,500 + Rs 11,250) |

28,750 |

|

Difference between (i) and (ii) (Excess) |

8,878 |

Step4: Computation of Depreciation for 2008

|

Book value of both machines (II and III) |

|

|

(WDV: Ref Step 2) |

96,250 |

|

(Rs 63,750 + Rs 32,500) |

|

Less: |

Difference (Excess) |

8,878 |

|

|

87,372 |

Less: |

15% Depreciation |

13,106 |

|

(under WDV) |

74,266 |

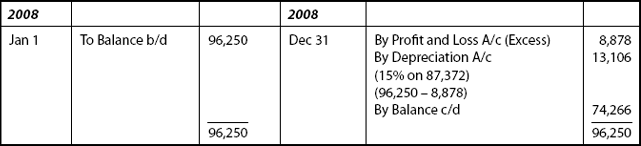

Machinery Account

As per AS–6, the change in the method of depreciation must be effective with retrospective effect on the existing machine. The position will be as:

* Calculation of loss on sale: |

Rs |

||

|

Cost |

= |

1,00,000 |

Less: |

Depreciation |

= |

20,000 |

|

|

|

80,000 |

Less: |

Sale proceeds |

= |

50,000 |

|

Loss |

= |

30,000 |

Illustration: 16

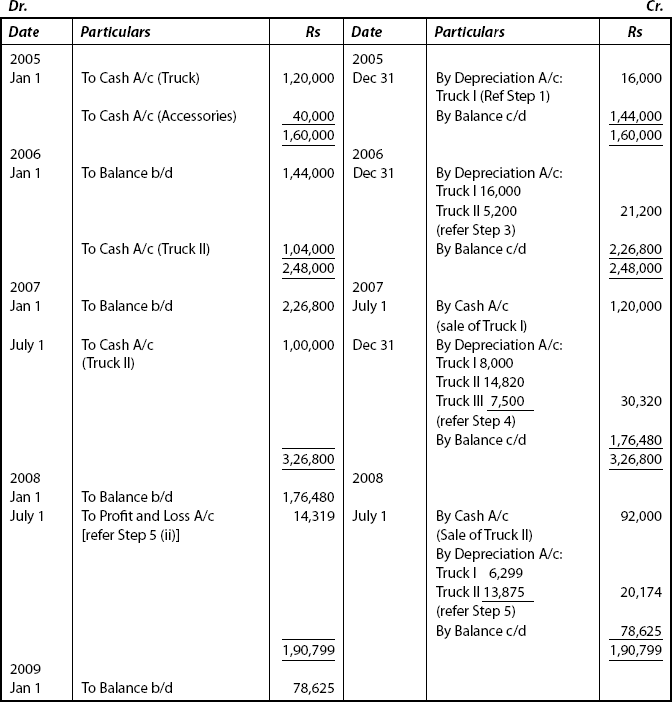

X Ltd bought a truck on Jan 1, 2005 for Rs 1,20,000 and a sum of Rs 40,000 was spent for various accessories on July 1, 2006 another vehicle was purchased for Rs 1,04,000. On July 1, 2007, the first truck was sold for Rs 1,20,000. On the same date another truck was purchased for Rs 1,00,000. On July 1, 2008 the second vehicle was sold for Rs 92,000. Rate of depreciation was 10% p.a. on the original cost annually on Dec 31. In 2007, the method of depreciation was changed to Diminishing Value Method, on the balance existing on Dec 31, 2007, the rate being 15% p.a. Prepare Truck Account for 2005, 2006, 2007 and 2008.

B.Com (Hons.) – Modified

Solution

Step 1: Accounting Standard–6, stipulates that change in method and rate should take place with retrospective effect.

But in this problem, instructions are given accordingly the change in method and rate will have to take place from Dec 31, 2007.

Step 2: Calculation of depreciation for 2005:

Cost as on Jan 1, 2005 (Rs 1,20,000 + Rs 40,000) = Rs 1,60,000

Period: (from Jan 1, 2005 to Dec 31, 2005): 1 year

Depreciation for 2005 = Rs 1,60,000 × 10/100 × 1 = Rs 16,000

Step 3: Calculation of depreciation for 2006:

- Truck I: period = 1 year (Jan 1, 2006 to Dec 31, 2006)

Depreciation for Truck I for 2006 = Rs 16,000

- Truck II: Cost as on July 1, 2006: Rs 1,04,000

Period (from July 1, 2006 to Dec 31, 2006) = 6 months

Depreciation for Truck II for 2006 = Rs 5,200

(Rs 1,04,000 × 10/100 × 6/12)

Step 4: Calculation of depreciation for 2007

Note:

- Rate has to be changed from 10% to 15%.

- Method has to be changed from Straight Line Method to Diminishing Value Method.

- For Truck II

Book Value as on Jan 1, 2007 = Rs 98,800

(Rs 1,04,000 – Rs 5,200)

↓

(Depreciation for 2006)

Period: from Jan 1, 2007 to Dec 31, 2007 = 1 year

Depreciation for 2007 = Rs 14,820

(Rs 98,800 × 15/100 × 12/12)

- For Truck III

Cost as on July 1, 2007: Rs 1,00,000

Period from July 1, 2007 to Dec 31, 2007: ½ year

Depreciation for 2007 = Rs 7,500

(Rs 1,00,000 × 15/100 × ½)

- For Truck II

Step 5: Depreciation for the year 2008:

- For Truck II:

Book value on Jan 1, 2007: Rs 98,800

Less: Depreciation for 2007: Rs 14,820

Book value on Jan 1, 2008: Rs 83,980

Depreciation (Jan 1, 2008 to July 1, 2008) = Rs 83,980 × 15/100 × 6/2 = Rs 6,299

- At this stage itself Profit/Loss on sale may be computed.

Rs 1.

Depreciated value of Truck II date of sale (July 1, 2008)

77,681

(Rs 83,980–Rs 6,299)

2.

Sale proceeds

92,000

Profit (Rs 92,000–Rs 77, 681)

14,319

(2–1)

- For Truck III

Book value cost as on July 1, 2007

1,00,000

Period from July 1, 2008 to Dec 31, 2007 = 6/12 years

Depreciation 1,00,000 × 15/100 × 6/12 (2007)

7,500

Book value as on Jan 1, 2008

92,500

Less: Depreciation @ 15% for 1 year (for 2008)

13,875

Book value as on Jan 1, 2009

78,625

Step 6

Truck Account

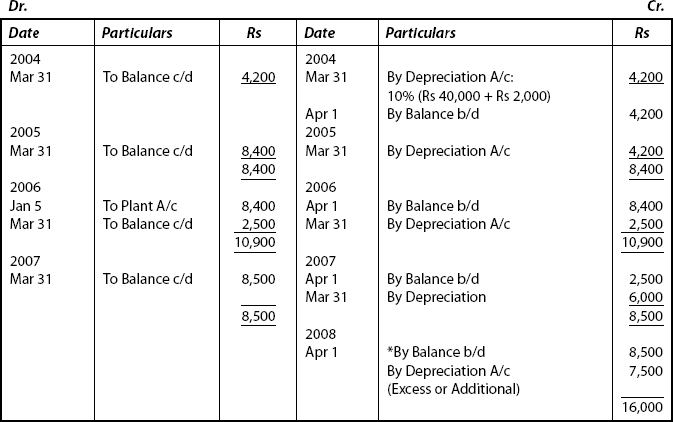

Illustration: 17

On Apr 1, 2004, a new plant was purchased for Rs 40,000 and a further sum of Rs 2,000 was spent on its installation. On Oct 1, 2006 another plant was acquired for Rs 25,000. Due to fire on Jan 5, 2007 the first plant was totally destroyed and was sold for Rs 1,000 only. On Jan 20, 2008 a second hand plant was purchased for Rs 30,000 and a further sum of Rs 5,000 was spent for bringing the same to use on Mar 15, 2008. Depreciation has been provided @ 10% p.a. on straight line basis. It was a practice to provide depreciation for full year on all acquisitions made at any time during any year and to ignore depreciation on any item sold or disposed of during the year. None of the assets were measured. The accounts are closed annually to Mar 31. It is now decided to follow the rate at 20% p.a. on Diminishing Balance Method with retrospective effect in respect of the existing items of plant and to make necessary adjustment entry on Apr 1, 2008.

You are required to prepare

- A Plant Account

- Provision for Depreciation A/c

B.Com (Hons.) – Modified

Solution

Here, all accounts, i.e. Provision for Depreciation, Sale of Asset and change in method with retrospective effect from part of the problem and one by one is to be prepared as follows:

Step 1: Preparation of Provision for Depreciation Account:

Provision for Depreciation Account

Step 2: Calculation of Depreciation under Diminishing Value Method

|

|

Rs |

1. |

Plant purchased on Oct 1, 2006 cost |

25,000 |

|

Less: Depreciation for (2006–2007): 1 year |

5,000 |

|

(Rs 25,000 × 20/100 × 1) |

|

|

Book value |

20,000 |

|

Less: Depreciation for (2007–2008): 1 year |

4,000 |

|

(Rs 20,000 × 20/100 × 1) |

______ |

|

Total Depreciation for this plant = Rs 5,000 + Rs 4,000 = Rs 9,000 |

|

2. |

Plant purchased (Jan 20, 2008) |

|

|

Cost |

35,000 |

|

(Rs 30,000 + Rs 5,000) |

|

|

Less: Depreciation for 2007 – 08 |

7,000 |

|

(Rs 35,000 × Rs 20/100 × 1) |

______ |

|

Depreciation for this second-hand plant |

7,000 |

|

Total provision for depreciation for both plants |

16,000 |

|

*Provision already made (SLM) |

8,500 |

|

Difference: Provision – Additional Depreciation Needed |

_____ |

Step 3

Plant Account

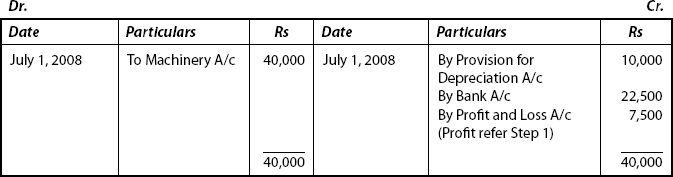

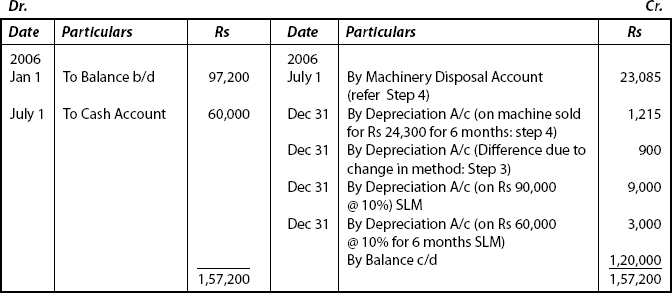

Illustration: 18

Machinery Account of Parul Ltd showed a debit balance of Rs 97,200 on Jan 1, 2006, depreciation @ 10% p.a. is charged. On July 1, 2006, a part of the machinery purchased for Rs 30,000 on Jan 1, 2004, was sold for Rs 21,000 and on the same date a new machinery was purchased for Rs 60,000. On Dec 31, 2006, the company decided to change the method of depreciation from WDV Method to Straight Line Method with effect from Jan 1, 2004, depreciation remaining at 10% p.a.

Prepare necessary ledger accounts.

Solution

In case, sale or disposal of a part of the asset occurs, new account – Asset Disposal Account may be prepared. As such, book value of the sold or discarded asset may be transferred to Asset Disposal Account.

Step 1: As debit balance of Machinery Account is given in the question, cost price on that date has to be computed as:

|

|

Rs |

Let the original cost on Jan 1, 2004 be taken as |

100 |

|

Then, |

Less: Depreciation @ 10% for 2004 |

10 |

|

WDV on Jan 1, 2005 will be |

90 |

|

Less: Depreciation @ 10% for 2005 |

9 |

|

WDV on Jan 1, 2006 |

81 |

If WDV is Rs 81, original cost will be Rs 100. |

|

|

[Original cost for Rs 97,200 = 100/81 × Rs 97,200 |

|

|

|

= Rs 1,20,000 |

1,20,000 |

|

Rs |

Step 2: Less: Machinery sold on July 1, 2006 |

30,000 |

(cost as on July 1, 2004) |

|

Cost of machinery in hand |

90,000 |

(on July 1, 2004) |

|

Add: Cost of machinery purchased |

60,000 |

(on July 1, 2006) |

|

Acquisition cost of machinery still in hand |

_______ |

Step 3: Depreciation on machinery at SLM for |

|

2004 and 2005 @ 10% on Rs 90,000 |

18,000 |

(Rs 9000 + Rs 9000) |

|

Less: Depreciation already charged @ 10% |

|

on WDV on Rs 90,000 for 2004 = Rs 9,000 |

|

and on Rs 81,000 for 2005 = Rs 8,100 |

17,100 |

(Rs 9,000 + Rs 8,100) |

|

Difference due to change in method |

___ |

Step 4: Calculation of WDV of machinery to be transferred to new account – Machinery Disposal Account:

|

|

|

Rs |

Original Cost |

30,000 |

||

|

Less: |

Depreciation for 2004 |

3,000 |

|

|

|

27,000 |

|

Less: |

Depreciation for 2005 |

2,700 |

|

|

|

______ |

|

Less: |

Depreciation upto July 1, 2006 for 6 months |

1,215 |

|

|

|

______ |

Step 5

Machinery Account

Note: No specific instructions are given in the question. Accordingly, change in method of depreciation is applicable at the end of accounting period, i.e. for the year 2006 only.

Step 6

Machinery Disposal Account

10.5 Annuity Method: Meaning and Features

- The different methods of computing depreciation fail to take into account the “interest on capital” invested in fixed assets.

- This system rectifies this factor.

- Under this system, interest is to be calculated at a specified rate on the opening of the asset account and added to the book value every year and credited to interest account.

- Journal entry:

Asset Account Dr.

To Interest A/c

- Simultaneously, a fixed amount is to be charged as a depreciation expense on a straight line basis.

- The underlying factor under this system is that the amount of depreciation to be charged every year must be so calculated as to reduce that asset together with interest accumulated thereon to its salvage value at the end of the useful life of the asset.

This can be best explained by way of an illustration as follows:

Illustration: 19

X takes a lease of land for Rs 1,00,000. The annual depreciation is charged on the basis of Annuity Method presuming the rate of interest at 6% p.a. The annuity table shows that the annual amount necessary to write off Re 1 in 4 years at 6% p.a. is Rs 288591. Prepare the Lease Account.

Solution

To write off Re 1 together with interest at 6% over 4 years = Re .288591

the annual charge (This is shown in the question itself.

Annuity Table shows all data.)

To write off Rs 1,00,000 plus interest, the annual charge = Rs 1,00,000 × .288591

Now, a table is to be prepared to show the amounts of interest and depreciation to be charged to Income Statement or Profit and Loss Account.

Table showing the amounts of interest and depreciation to be charged to Income Statement and Profit and Loss Account.

- Depreciation is to be Debited to Income Statement.

- Interest is to be Credited to Income Statement.

- Note from the table, Cost of the Asset Rs 1,00,000 plus interest Rs 15,436 = Total Depreciation Rs 1,15,436.

- From the table, you can note that the charge against profit Increases every year.

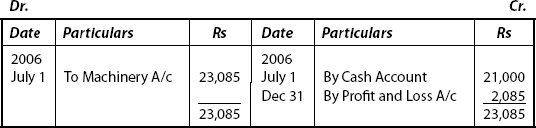

Lease Account

10.5.1 Advantages

- It involves accurate calculation.

- Interest is taken into account in this method, whereas all the other methods neglect this aspect.

10.5.2 Demerits

- Calculation will become more difficult in case of frequent additions of assets.

- Under this method, the amount of interest and depreciation are treated together, which may not yield good result.

10.5.3 Suitability

- It is suitable for large amounts of capital investments oriented business.

- This is most suitable for long-term leases.

10.6 Sinking Fund Method (or) Depreciation Fund Method: Meaning, Merits, Demerits and Suitability

10.6.1 Meaning

- The fund created to provide a definite amount at a certain future date for the specific purpose of replacement of asset at the end of its useful life may be termed as Sinking Fund.

- The procedure adopted to create such fund is referred to as “Sinking Fund Method” or “Depreciation Fund Method”

- Under this method, provision is made for the replacement of asset.

- This method requires the calculation of a basic sum of money which, if invested every year, would together with interest earned will be equal to the cost of asset.

Such amount which has to be set aside every year by way of depreciation is calculated by using Sinking Fund tables.

10.6.2 Merits

- This method not only provides depreciation, but also makes provision for replacement of asset at the end of its useful life.

- As separate sum of money is earmarked, there will not be any financial stress while replacement of assets.

10.6.3 Demerits

- Income is charged with the same amount of depreciation. Such a combination of depreciation and replacement may not yield the desired result.

- It ignores the proportionate amount to be spent for maintenance in later years of the assets.

10.6.4 Suitability

Suitable for concerns which aim to treasure some part of amount for futuristic activities:

10.6.5 Differences between Annuity Method and Sinking Fund Method

| Basis of Difference | Annuity Method | Sinking Fund Method |

|---|---|---|

1. Separate Fund Account |

Annual amount is not set aside as a separate fund account |

Annual amount is set aside as a separate fund account |

2. Charge of interest |

Interest is charged from the end of first year itself |

Interest is charged only at the end of second year |

3. End result |

The total depreciation is more than the depreciation cost of the asset (as interest is added to the cost of the asset) |

The total depreciation is less than the depreciable cost of the asset (as interest is deducted from the cost of the asset) |

4. Outside investment |

Funds are not invested in outside securities |

Funds set aside are invested in outside securities |

5. Realization of interest |

Interest is not actually realized |

Interest is actually realized, as it is received from investment in outside securities. |

6. Accounting treatment |

Interest is credited to Profit and Loss A/c by debiting to Asset account |

Interest is credited to Sinking Fund Account |

7. Effect on Profit and Loss Account |

As depreciation is fixed, interest is decreasing – effect on Profit and Loss A/c will result in a rise |

As depreciation and interest being uniform, there will be one effect on Profit and Loss Account |

10.6.6 Accounting Treatment for Sinking Fund Method

Stage I: |

At the end of First Year |

|

Step 1: |

(a) Find the amount of depreciation to be provided from the Sinking Fund tables. That has to be recorded at the end of the first accounting period as: |

|

|

Depreciation A/c |

Dr. |

|

To Sinking (Depreciation Account) |

|

Step 2: |

(b) The amount so transferred to Depreciation Fund is invested in outside securities (purchasing instruments) |

|

|

Depreciation (Sinking)Funds Investment Account |

Dr. |

|

To Bank A/c |

|

Stage II: |

At the end of second year and subsequent years (except last year) |

|

Step 1: |

(a) When interest is received on investments |

|

|

Bank A/c |

Dr. |

|

To Depreciation Fund A/c |

|

Step 2: |

(b) On setting aside the annual amount: |

|

|

(same as in stage 1 (a)) |

|

|

Depreciation A/c |

Dr. |

|

To Depreciation Fund A/c |

|

Step 3: |

(c) On investing the amount set aside (with interest) |

|

|

(same as in Stage 1 (b)) |

|

|

Depreciation Fund Investment A/c |

Dr. |

|

To Bank A/c |

|

(Note: Here the amount to be invested = Amount set aside + Amount of interest received on previous investments) |

||

Stage III: |

Last Year |

|

Step 1: |

(a) On sale of investments (realization of investment fund) |

|

|

Bank A/c |

Dr. |

|

To Depreciation Fund Investments A/c |

|

Step 2: |

(b) For transfer of profit/loss on realization of depreciation fund investments: |

|

|

(i) When Profit: |

|

|

Depreciation Fund Investment A/c |

Dr. |

|

To Depreciation Fund A/c |

|

|

(ii) When Loss: |

|

|

Depreciation Fund A/c |

Dr. |

|

To Depreciation Fund Investments A/c |

|

Step 3: |

(c) For sale of old asset (scrap) |

|

|

Bank A/c |

Dr. |

|

To asset A/c |

|

Stage V: Treatment in Balance Sheet

- Depreciation Fund Account appears on the Liabilities side of the Balance Sheet under the head “Reserves and Surplus” – till the asset is disposed off.

- Depreciation Fund Investment Account appears on the Assets side of the Balance Sheet under the head “Investments” till realization of investments.

Illustration: 20

A machine costing Rs 10,00,000 is expected to have an estimated useful life of 4 years and scrap value of Rs 71,800 at the end of useful life. The Sinking Fund table shows that Re 0.215470803 invested at the end of each year at 10% compound interest will amount to Re.1 at the end of 4 years and Re.1 p.a. at 10% compound interest amount to Rs 4.641 in 4 years.

Calculate the amount of depreciation to be provided for.

Solution

Method I

Step 1:Cost of Machine – Scrap Value

Rs 10,00,000 – Rs 71,800

= Rs 9,28,200

Step 2: Rs 9,28,000 × 0.215470803

= Rs 1,99,999.9965

= Rs 2,00,000

Method II

Step 1: Cost – Scrap

Rs 10,00,000 – Rs 71,800

= Rs 9,28,200

Step 2: Rs 9,28,200 ÷ 4.641

= Rs 2,00,000

10.6.7 Calculation of the amount of Investments to be made

Case (a): When specific investments are to be made in multiples of same specific denomination (e.g. Rs 10; Rs 20 and so on) (will be given in the problem), then only that amount which is fully divisible by the given denomination will be invested.

Example: Suppose the amount available for investment is Rs 1,05,129.08 and the investments are to be made in the multiple of Rs 10, then only Rs 1,05,120 will be invested and the balance Rs 9.08 will be kept separately in Depreciation Fund Cash A/c. This will be adjusted at the end of the time of making investments during the next accounting period.

Case (b): When no specific instruction is given:

- In case of Non-cumulative Depreciation Fund: The amount of profit set aside has to be invested, i.e. Interest on Depreciation Fund Investments is credited to Profit and Loss A/c and interest is not reinvested.

- In case of Cumulative Depreciation Fund, interest + profit has to be invested, i.e. Interest on Depreciation Fund Investments is credited to Depreciation Account and interest is reinvested.

Case (c): In any case, no investment should be made in the last year.

Calculation of the amount of interest on depreciation fund investments:

Illustration: 21

From the following particulars calculate the amount of investments to be made and interest to be received by assuming investments are to be equal to entire profits set aside.

Profit to be set aside |

= Rs 60,000 |

Interest Rate |

= 10% |

Year of Realization of Investments |

= 4th year. |

Solution

Note: Entire profit is to be set aside. No specific instruction is given, i.e. amount available is to be made in multiple of specific amount. So, the entire amount is to be taken into account.

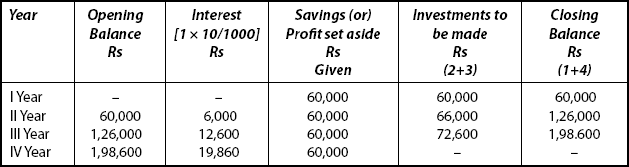

This can be best shown in the following table:

Table showing the calculation of the amount of investment to be made and interest to be received:

Note

- Generally, the closing balance at the end a year will be the opening balance of next year.

- Interest is calculated at the opening balance of the year, i.e. from the second year (Column = 2).

- Profit set aside is constant (Column = 3).

- Investments (entire) interest + Profit set aside are shown in column 4 (2 + 3).

- Closing balance represents the sum of opening balance and investments to be made in column 5 (1 + 4).

- No interest is computed for 1st year.

- No investment is made in the last year (IV year).

Illustration: 22

From the following figures calculate the amount of investment to be made and interest to be received (by considering investments to be made in the nearest multiple of Rs 100)

Profit to be set aside |

= Rs 41,602.89 |

Interest Rate |

= 10% |

Year of Realization of Investments |

= 4th year. |

Solution

Draw the columns as in previous illustration:

Note: In the illustration, investments are to be made in the nearest multiple of Rs 100, investment amount is worked out in multiples of 100 and the fraction is left out. Take the case if in II year – Profit to be set aside + Interest = Rs 41,602.89 + Rs 4,160 = Rs 45762.89. This is to be divided by 100:45,762.89/100.

(Rs 45,700 in full, i.e. multiple of 100 – 457 × 100) the fraction of Rs 62.89 is to be kept separately in Depreciation Fund Cash A/c and not to be shown in the account.

This is the difference to be noted by students.

Illustration: 23

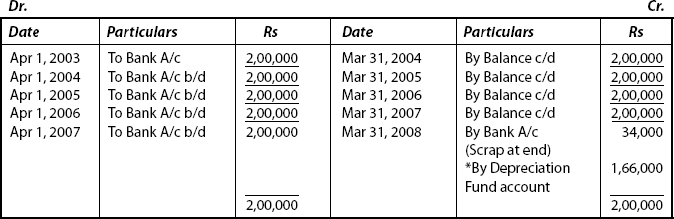

Vasant bought a machine on Apr 1, 2003 for a sum of Rs 2,00,000 having useful life of five years. It is estimated that the plant will have a scrap value of Rs 32,000. He decided to charge depreciation according to Depreciation Fund Method. Sinking Fund Table shows that Re. 0.180975, if invested yearly @ 5% p.a. produces Re. 1 at the end of five years. The depreciation fund investments are expected to earn interest @ 5% p.a. At the end of fifth year, the investments were sold for Rs 1,30,000 and the scrap realized Rs 34,000.

You are required to prepare Plant Account. Depreciation Fund Account and Depreciation Fund Investments Account for five year period.

B.Com (Hons) – Modified.

Solution

Step 1: Calculation of amount to be provided for depreciation fund every year:

(Remember Method I in Illustration 20)

Cost – Scrap |

= |

Rs 2,00,000 − Rs 32,000 |

|

= |

Rs 1,68,000 |

Multiply this by the figure from Sinking Fund Table |

||

|

= |

(Rs 1,68,000) × 0.180975 |

|

= |

Rs 30,403.60 |

|

= |

Rs 30,404 (rounded off) |

|

|

|

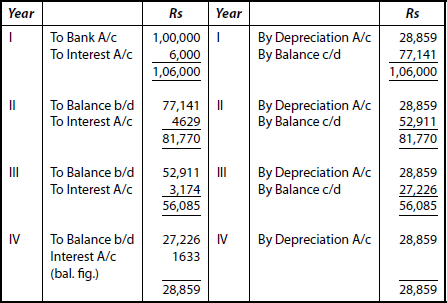

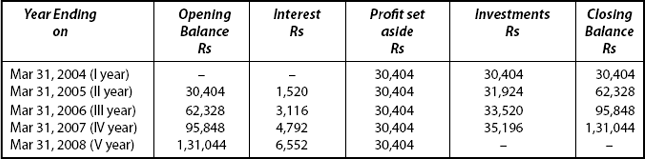

Step 2: Calculation of the amount of investments to be made and interest to be received for 5 years. Table showing investments to be made each year and interest to be received.

Step 3: Preparation of Depreciation Fund Account:

Depreciation Fund A/C

*To be transferred from Depreciation Fund Investment A/c.

**Plant A/c may be transferred from Plant A/c but it may be calculated simply: (Rs 2,00,000 (Cost) – Rs 34,000 (Scrap)) = Rs 1,66,000

Note: Interest is transferred from table column 3.

Step 4: Preparation of Depreciation Fund Investment A/c

Depreciation Fund Investment Account

Note: (1) Bank A/c → represents two components:

- Investment to be made

- Interest to be received.

To enter the figure for the years from 2005 to 2007, refer to the table Step 2 and directly transfer the figure under column “Investments to be made”.

Column 5: Students need not work out again thereby saving time.

(2) Bank A/c → For the year – (on credit side) 2008 represents the value of investments sold at the end of 5th year.

Step 5: Preparation of Plant Account

Plant Account

Step 6: Preparation of Depreciation Account

Depreciation Account

10.6.8 Sum-of-the-years’-digits method

- This method is simple and easier than WDV Method.

- This method is based on the assumption that loss of economic usefulness of an asset is high during the early years of an asset.

- When the asset is new, depreciation is charged more. Charge less depreciation when the assets get older.

- It will enable to suit matching of costs and revenues.

The depreciation is computed as follows:

Depreciable cost of an asset is Rs 1,00,000; useful life of that asset is 4 years. Calculate amount of depreciation to be provided for the period.

Solution

Useful Life of the Asset = 4 years

Sum-of-the-Years’-Digit = 1 + 2 + 3 + 4 = 10

I year = Depreciation = 4/10 × 1,00,000 = Rs 40,000

II year = Depreciation = 3/10 × 1,00,000 = Rs 30,000

III year = Depreciation = 2/10 × 1,00,000 = Rs 20,000

IV year = Depreciation = 1/10 × 1,00,000 = Rs 10,000

Under this method, more amount is charged in the I year, i.e. Rs 40,000 and less towards the end, i.e. Rs 10,000.