Chapter 12

Accounting for Hire - Purchase and Installment

LEARNING OBJECTIVES

After studying this chapter, you will be able to understand

Meaning of Hire-Purchase System

Meaning of the Terms Associated with Hire-Purchase System

Meaning and Contents of Hire-Purchase Agreement

Salient Features of Hire-Purchase System

The Components of Total Hire-Purchase Price and the Process of Calculation and Allocation of Their Different Situations

The Rule 78

The Accounting Treatment – Methods of Recording Transactions in the Books of Hire Purchase and Hire Vendor

The Meaning of Default and Repossession and the Accounting Treatment: Full Repossession and Partial Repossession

The Format of Hire-Purchase Sales Register and the Method of Usage

The Methods of Ascertaining Profit/Loss Made on Hire-Purchase Transactions Under Debtors Method (System) and Stock and Debtors Method (System)

Meaning of Installment System and Salient Features of Installment System

The Differences Between Hire-Purchase System and Installment-Purchase System

The Accounting for Installment Purchase Under “Interest Suspense Method”

The Concepts of Leasing, Salient Features of Lease, Advantages of Lease and Disadvantages of Leasing

Types of Lease and Salient Features of Accounting Standard (AS)–19 Relating to Financial Lease and Operating Lease

INTRODUCTION

One’s needs are many and varied, but resources to achieve such wants are scanty and scarce. In an era of electronic world, markets are flooded with so many articles with utility values. They induce the customers to purchase for their daily use in life. But resources (money) to acquire them are not within the reach of common man. Understanding this psychological concept of humanity, trading institutions (trading with goods and dealing on money matters) exploit the situation by adopting a technique or device to sell the goods under easy terms and conditions for those buyers who have no or minimum amount of money. Such a system is known as Hire-Purchase System and Installment System.

Under such scheme, one may come across with so many attractive captions – interest free loan; no hidden cost; no margin money; low EMI rates and so on. One has to understand, Is it really interest free? Are they selling products without profit? What is margin amount? How installment amounts are calculated? What will be the consequence of default in installment payment? Is there any statutory law to govern such system? How do the purchaser and buyer enter into an agreement? How accounting treatment is carried on with respect to buyer and seller? Is there any difference between Hire-Purchase System and Installment System? Answers to such questions and other related activities pertaining to this system form the major part of this chapter.

OBJECTIVE 1: DEFINITION OF HIRE-PURCHASE SYSTEM

Hire-Purchase System is defined as, “A system whereby the owner of the goods lets them on hire for periodic payments by the hirer upon an agreement that when a certain number of payments have been completed, the absolute property in the goods will pass to the hirer, but so that the hirer may return the goods at any time without any obligation to pay any balance of rent accruing after return; until the conditions have been fulfilled the property remains in the owner”.

1.1 Explanation of Important Terms

To understand this fully the following terms should be understood prior we proceed further:

- Hirer: A “Hirer” means a person who obtains or has obtained possession of the goods from an owner under a Hire-Purchase Agreement.

- Owner (or) hire vendor: Hire vendor means a person who delivers or has delivered the possession of goods to the hirer under a Hire-Purchase Agreement.

- Down payment (or) Option amount (or) Initial payment or Deposit: All the terms denote the same meaning that the sum of money paid by the hirer at the time of taking possession of the property (goods), i.e. at the time of entering into a Hire-Purchase Agreement.

- Hire: It means the sum payable periodically by the hirer under a Hire-Purchase Agreement.

- Cash Price: It means the total amount as price payable at the time of purchase. It is composed of cost to the owner PLUS profit margin.

- Net Cash Price: It means the cash price of the goods comprised in a Hire-Purchase Agreement LESS any deposit.

- Cash Price Installment: Cash Price Installment = Net Cash Price × Hire-Purchase Installment / Hire-Purchase Price.

- Hire-Purchase Price: It can be understood easily in the form of equation:

Hire-Purchase Price = Cost Price + Profit Margin + Interest on Outstanding Balance. - Hire-Purchase Charges: It means the difference between hire-purchase price and net cash price as stated in the Hire-Purchase Agreement. It is also called as “Interest”.

- Hire-Purchase Agreement: Hire-Purchase Agreement means an agreement under which the goods are let on hire. The hirer has an option to purchase them in accordance with the terms of the agreement. It includes an agreement under which

- possession of goods is delivered by the owner to a person who pays the agreed amount in periodical installments,

- the property in goods is to pass to such person on payment of such person has right to terminate the agreement at any time before the property so passes,

- such person has right to terminate the agreement at any time before the property so passes.

1.2 Contents of Hire-Purchase Agreement

As per Section 4 of the Hire-Purchase Act 1972, every Hire-Purchase Agreement should consist the following contents:

- The hire-purchase price of the goods.

- The cash price of the goods.

- The date of commencement of agreement.

- The number of installments by which the hire purchase is to be paid, the amount of each of those installments, the date upon which it is payable, the person to whom and the place where it is payable.

Now, going back to the definition part again, at this stage we will be able to know the salient features of Hire-Purchase System, which we can infer from the definition stated and the meaning and explanation of some specific terms explained so far.

1.3 Salient Features of Hire-Purchase System

Salient features of Hire-Purchase System,

- Hire-Purchase System is governed by Hire-Purchase Act 1972

- It is an agreement of hiring

- It is an agreement between Hirer and Hire Vendor

- Terms and conditions between the parties are entered and recorded in a document called Hire-Purchase Agreement.

- Cash price of goods is paid in installment on agreed terms.

- The title to goods passes on last payment

- The Hire Vendor (Seller) can take possession of goods if Hirer fails to pay installment

- The Hirer is not responsible for risk of loss of goods, till the ownership is transferred.

- The Hirer cannot mortgage, hire or sell or pledge the goods

- The Hirer has got a right to terminate the agreement at any time before the property so passes.

OBJECTIVE 2: PROCESS OF CALCULATION AND ALLOCATION OF INTEREST

Under Hire-Purchase System (sold or purchases), the price quoted is more than what it ought to be when such sale or purchase is on cash (one single payment in cash at the time of sale or purchase).

In accounting procedure, the excess of total hire-purchase price over cash price denotes the payment for interest. To put it in a simple form of equation: Interest = Total Hire-Purchase Price – Total Cash Price. In the real sense, the total hire price consists of two components: (1) Payments towards cash price – this is treated as purchase of asset – hence, this component, in the accounting concept, is treated as capital item and so Capital Expenditure. (2) The second component, i.e. interest is a financial gain or loss – for seller it is gain and for buyer it is loss. In such case, it is of revenue nature, it has to be recorded in Profit and Loss Account only.

Hence, the necessity arises to separate the two. After separation, it will then be allocated between revenue and capital.

This process of calculation and allocation involves a tricky task as it attracts many different situations which we will discuss in the forthcoming illustrations.

2.1 Situation 1

Provided: Rate of interest, total cash price and hire purchase are provided.

Requirement: Allocation of installment money between interest and cash price.

Illustration: 1

Mrs. Renu purchased a washing machine from a retailer. On Jan 1, 2005 paying immediately Rs 10,000 and agreeing to pay three installments of Rs 10,000 each on 31 Dec every year. The cash price of washing machine is Rs 37,250 and vendors charge interest at 5% p.a. Calculate the amount of interest paid by Mrs. Renu to the retailer every year.

Solution

Here, cash price and rate of interest are given. We have to compute interest amount paid every year.

|

|

Rs |

Step 1: |

Total Cash Price (Given) |

37,250 |

Step 2: |

Less: Down Payment (Cash) |

10,000 |

|

|

27,250 |

Step 3: |

Add: *Interest on Rs 27,250 @ 5% |

1,363 |

|

|

28,613 |

Step 4: |

Less: First hire-purchase Installment |

10,000 |

|

|

18,613 |

Step 5: |

Add: *Interest on Rs 18,613 @ 5% |

930 |

|

|

19,543 |

Step 6: |

Less: Second year Installment |

10,000 |

|

|

9,543 |

Step 7: |

Add: +Interest (Balancing amount) (Rs 10,000 – Rs 9,543) |

457 |

|

|

10,000 |

Step 8: |

Less: Third hire-purchase Installment |

10,000 |

|

|

Nil |

* Interest is calculated on the outstanding cash price and not calculated on outstanding installment amount.

+ For the third year (final year), interest is ascertained by the difference between the last installment to be paid and cash price remaining unpaid. Here, last installment amount is Rs 10,000. Cash price remaining unpaid is Rs 9543, the difference being Rs 457 is taken as interest. This practice is being followed normally.

The above method of calculation of interest may be done through a table, which is also explained now.

2.2 Situation 2

Provided: Rate of interest and installment

Required: Total Cash Price.

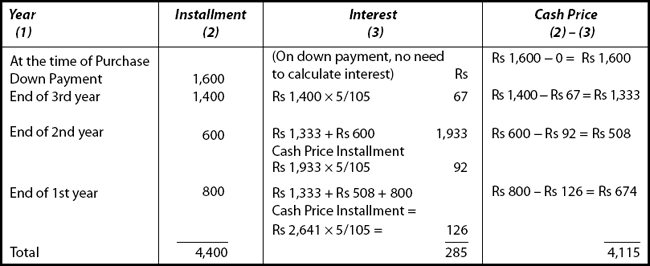

Illustration: 2

Mr. Raj purchased a DVD player on Jan 1, 2006 on Hire-Purchase System for Rs 4,400. As per terms, he is required to pay Rs 1,600 down, Rs 800 at the end of first year; Rs 600 at the end of second year and Rs 1,400 at the end of third year interest is charged at 5% p.a.

You are required to calculate the total cash price of the DVD player and interest paid with each Installment.

(C.A. Adapted and Modified)

Solution

Note

- In such a question (Situation 2), where total cash price is not given, interest is calculated from the last year which is third year here. First interest rate is calculated for 3rd year, then for 2nd year and only finally for 1st year. (For easy understanding, it is shown in the following table also in that manner – professionals may excuse for such a reversed presentation).

- As the installments shown in the problem include interest, the rate of interest has to be modified from “on Cash to Installment”, for which the following method is adopted:

Rs

Let Cash Price Installment Outstanding (Assumption)

100

Then interest @ 5% on Rs 100 for 1 year

5

Installment paid at the end of 1st year

105

∴ Interest on Installment paid 5/105

- First, interest paid for the 3rd year is to be calculated. Here, for Rs 1,400 × 5/105 (as per note: 2) = Rs 66.66 (it may be rounded off to the nearest rupee) = Rs 67.

Cash price paid will be Rs 1,400 – Rs 67 = Rs 1,333.

Then for computing interest for the 2nd year : This cash price amount has to be added to the second installment amount (i.e., Rs 1,333 + Rs 600) on which interest is calculated as Rs 1,933 × 5/105 = Rs 92.04 = Rs 92

Cash Price = Rs 600 – Rs 92 = Rs 508

Finally for computing interest for first year: The cash prices for the 3rd year, 2nd year are added together to the first installment. Here (Rs 1,333 + Rs 508) + Rs 800 = Rs 2,641. On which @ 5/105 to be worked out

Interest = 2,641 × 5/105 = Rs 125.76

(or) Rs 126 Cash Price = 800 – 126 = 674

This is shown in the following tabular column:

|

Total Cash Price |

= |

Rs 4,115 |

|

Total Interest Paid |

= |

Rs 285 |

|

Hire-Purchase Price |

= |

Rs 4,400 |

2.3 Situation 3

Provided: Total Cash Price and Installments

Required: Rate of Interest.

Illustration: 3

A mobile phone, cash price of which is Rs 3,600 is sold on Hire-Purchase System for Rs 4,000 payable in four quarterly installments of Rs 1,000 each. The first payment is made at the end of the first quarter. You are required to compute the calculation of interest.

Solution

First, compute the total interest

Total Interest |

= Total Installment Price – Total Cash Price |

|

= Rs 4,000 – Rs 3,600 |

|

= Rs 400 |

This is divided in the ratio of outstanding balance of installment price = Rs 400

i.e., Rs 4,000 + Rs 3,000 + Rs 2,000 + Rs 1,000 = Rs 10,000

= Rs 400/Rs 10,000 = 40/100 or 20/50 or 2/5

1st Quarter = Rs 4,000 × 2/5 = Rs 1,600

2nd Quarter = Rs 3,000 × 2/5 = Rs 1,200

3rd Quarter = Rs 2,000 × 2/5 = Rs 800

4th Quarter = Rs 1,000 × 2/5 = Rs 400

Table Showing Calculation of Interest

Note: “Proportion of interest” is to be calculated in advance, and the figures can be obtained directly through the table, as shown above.

2.4 Situation 4

Provided: Installments only

Required: Cash Price and Rate of Interest

Illustration: 4

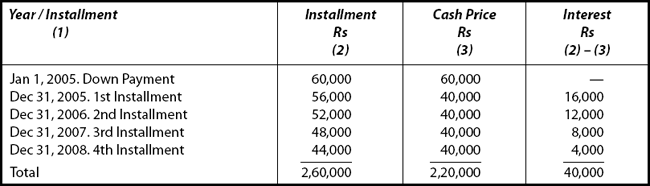

Gopal purchased a car on Jan 1, 2005 on hire-purchase paying Rs 60,000 cash down and balance in four annual installments of Rs 56,000, Rs 52,000, Rs 48,000 and Rs 44,000, each installment comprising equal amount of cash price, at the end of each accounting period. You are required to calculate total cash price, and amount of interest in each installment.

Solution

As neither cash price nor rate of interest is provided, from the only figure available (i.e) installment, it can be inferred that the difference in installments is due to “interest”. And all payments towards cash price to be equal (assumption). The rate of interest is uniform.

|

Let Cash Price (paid at each time be) |

= x (Assumption) |

|

Let Interest be |

= i (Assumption) |

Hence,

For the fourth year |

x + i |

= |

Rs 44,000 |

(1) |

For the third year |

x + 2i |

= |

Rs 48,000 |

(2) |

For the second year |

x + 3i |

= |

Rs 52,000 |

(3) |

For the first year |

x + 4i |

= |

Rs 56,000 |

(4) |

Subtract (4) − (3) = |

(x + 4i) |

= |

56,000 |

|

|

(x + 3i) |

= |

52,000 |

|

|

i |

= |

Rs 4,000 |

(5) |

(i.e.) Interest is Rs 4,000 |

|

|

|

|

Substitute the value of i (Eq. 5) in Eq. (1)

|

x + i |

= |

Rs 44,000 |

|

|

x + Rs 4,000 |

= |

Rs 44,000 |

|

|

x |

= |

Rs 44,000 – Rs 4,000 |

= Rs 40,000 |

Based on these values, hire-purchase price is allocated into cash price and interest as shown in the table below:

Table Showing Allocation of Cash Price and Interest

|

Total Cash Price |

= |

Rs 2,20,000 |

|

Hire-purchase price |

= |

Rs 2,60,000 |

|

∴ Total Interest |

= |

Rs 40,000 |

2.5 Situation 5

Provided: Rate of Interest and Installments

Required: Total Cash Price using Annuity Table

- Annuity means a series of equal payments at fixed intervals.

From the annuity table, the present value of annuity for the number of years at a certain rate of interest is found out.

- Present value means total unpaid cash price.

Annuity means the periodical installments of Re 1 each spread over a number of years at a given rate of interest.

Note: If the given installments are unequal, present values of each future installment is found out separately and is multiplied by such values and all are added to determine cash price (total).

Illustration: 5

Mr. X purchases a flat on Hire-Purchase System paying Rs 2,00,000 annually for 10 years. The rate of interest is 5% p.a. Calculate the cash price of flats by using annuity tables.

Solution

Reference to annuity tables shows the present value of Re 1 for 10 years as: 7.7217

(This factor is generally shown in the question it self)

|

Total Cash Value |

= |

Rs 2,00,000 × 10 |

|

|

= |

Rs 20,00,000 |

|

Present value of Re 1 for 10 years @ 5% |

= |

7.7217 |

|

Then present value of Rs 20,00,000 |

= |

Rs 20,00,000 × 7.7217/10 |

|

|

= |

Rs 14,43,400 |

Total cash price, rate of interest and installments are known.

Interest can be calculated as shown in Illustration 1.

2.6 Situation 6

Provided: Cash Price and Rate of Interest

Required: Installments and Total Hire-Purchase Price

Illustration: 6

- The cash price of a machine is Rs 3,00,000

- Rs 1,20,000 is to be paid on signing the agreement

- The balance is to be paid in annual Installments of Rs 60,000 with interest

- Interest chargeable on outstanding balance is 10% p.a.

Solution

Interest is calculated on the total outstanding cash price in a usual manner.

The interest calculated is added to the given installment

|

|

Rs |

Step 1: |

Total Cash Price |

3,00,000 |

Step 2: |

Less: Down payment |

1,20,000 |

|

|

1,80,000 |

Step 3: |

Add: Interest @ 10% on 1,80,000 |

18,000 |

|

|

1,98,000 |

Step 4: |

Less: 1st year installment |

|

|

Rs 60,000 + Rs 18,000 |

78,000 |

|

(Installment)(interest) |

1,20,000 |

Step 5: |

Add: Interest @10% on Rs 1,20,000 |

12,000 |

|

|

1,32,000 |

Step 6: |

Less: 2nd Hire Purchase Installment |

72,000 |

|

(60,000 + 12,000) |

60,000 |

Step 7: |

Add: Interest @ 10% on Rs 60,000 |

6,000 |

|

|

66,000 |

Step 8: |

Less: 3rd Hire Purchase Installment |

66,000 |

|

|

Nil |

Total Hire-Purchase Price = Down Payment + 1st Hire Purchase Installment + 2nd Hire Purchase Installment + 3rd Hire Purchase Installment

= Rs 1,20,000 + Rs 78,000 + Rs 72,000 + Rs 66,000

= Rs 3,36,000

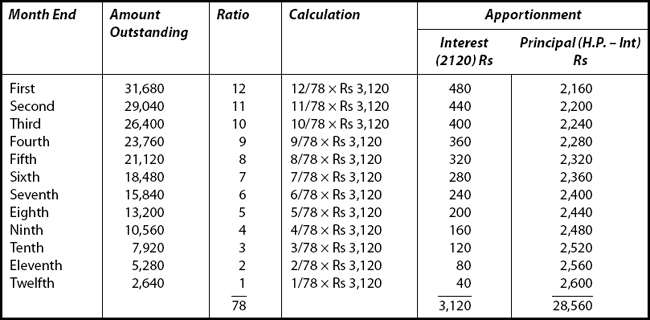

2.7 Rule 78

In case, cash price and hire-purchase price are given and calculation of interest for each installment is required, this procedure, i.e. Rule 78 will be of much use.

To apportion each installment between revenue and capital (i.e., interest and cash price), this rule is applied.

In case, if the installments are paid monthly at regular intervals for 1 year, then the total of series beginning from 1 and progressing by 1 can be calculated by applying the formula:

Suppose there are 12 monthly installments, the total number from 1 to 12 = 12(12+1)/2 = 78.

Illustration: 7

Mr. X buys a moped, the cash price of which is Rs 28,560 on a hire purchase basis paying the 12 monthly installments of Rs 2,640. No down payment was made. You are required to allocate each installment between revenue and capital.

Solution

|

Hire-Purchase Price |

= Rs 2,640 × 12 = Rs 31,680 |

|

Total Interest |

= Rs 31,680 – Rs 28,560 |

|

|

Apportionment of this interest (revenue) Rs 3,120 and price (capital) Rs 28,560 is done in the following way by using Rule 78.

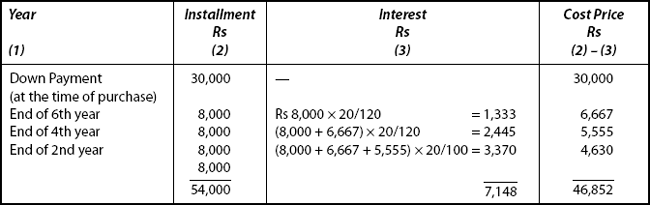

Illustration: 8

Parul purchased a software system on Hire-Purchase System. She pays Rs 30,000 and Rs 8,000 at the end of 2nd year, 4th year and 6th year. Interest is charged by the vendor at 2 yearly rest on the unpaid balance. Calculate interest paid with each installment.

Solution

Note: 2 yearly rest means simple interest at the end of 2 years.

(If it is given as yearly rest – every year interest has to be added – compounded)

In this question, this means that Rs 100 @ 10% p.a. (simple interest) at the end of 2 years = 100 × 10/100 × 2 = Rs 20, and the Rs 100 will become Rs 120 at the end of 2 years. As already discussed in Illustration 2, interest will be calculated first for the 6th year, and then for the 4th year and finally for the 2nd year.

Here, the difference is that the calculation is done only 2 years once and not yearly as per the direction given in the question.

Multiplying factor is 20/120 to convert cash price to Installment price.

Calculation:

For the 6th year |

= Rs 8,000 × 20/120 |

= Rs 1,333 |

For the 4th year |

= Rs (8,000 + 6,667) × 20/120 |

= Rs 2,445 |

For the 2nd year |

= Rs (8,000 + 6,667 + 5,555) × 20/100 |

= Rs 3,370 |

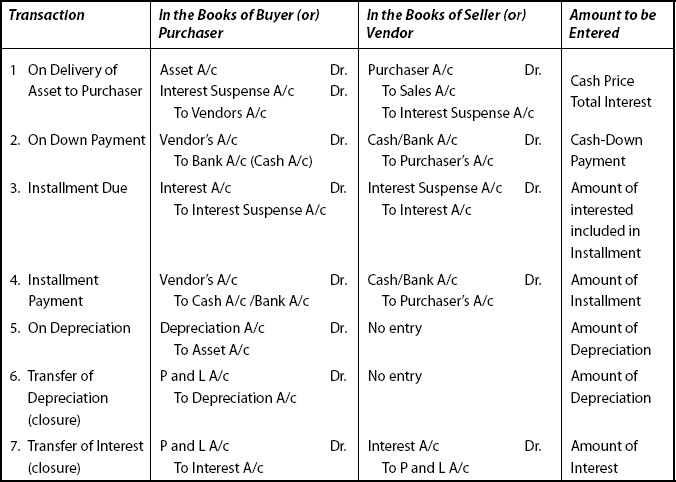

OBJECTIVE 3: ACCOUNTING TREATMENT

Books of buyer (or) Hire purchaser legally speaking, the hire purchaser may not be treated as the owner of goods purchased till the last due (installment) is paid by him. But in accounting treatment this view is ignored and the hire purchase is treated as other ordinary purchase transaction. Only thing the accountants emphasize is to add the term “Hire Purchase” to assets purchased under Hire-Purchase System, to distinguish from the assets purchased by full payment of cash.

There are two methods of recording transactions in the books of buyer (or) hire purchaser.

In the first method.

The Asset Account is debited with the cash price included in each installment. The down payment is fully towards cash price (the main drawback of this method is that assets will not appear in the Balance Sheet at proper value).

In the second method –

At the time of signing contract, the Asset Account is debited with total cash price further, when the first installment becomes due, the treatment differs. For all the other items of transaction, accounting treatment is more or less similar.

Under the first method, vendor’s account shows nil balance after every payment.

Whereas under the second method the vendor’s account will be a running account and becomes nil only after the last payment.

The accounting entries are shown for both the methods in the tabular form as below:

3.1 Journal Entries in the Books of the Buyer (or) Hire Purchase

Note

- Whenever installment amount becomes due, Transactions 3, 4, 5, 6 and 7 are to be repeated.

- In case, installments are not annual, then 6 and 7 are to be recorded once (i.e.) at the time of closing the books.

- However, in this book, only the second method is used most widely. The first method here is discussed purely from academic interest only as far as this book is concerned.

- Regarding depreciation, students are asked to provide depreciation on the assets purchased under Hire-Purchase System in the same way as other assets bought for “Cash or Credit” (ignore the controversy on depreciation whether depreciation is to be charged or not). As such, depreciation must be provided on the full cash price.

3.2 Accounting Treatment in the Books of Hire Vendor

- On signing the Hire-Purchase Agreement:

Hire-Purchaser’s Account

Dr.

To Hire-Purchase Sales Account

Amount → Cash Price of Goods.

(Note: Hire-Purchase Sales Account is closed by transferring to Trading Account)

- For receipt of Down Payment:

Cash / Bank Account

Dr.

To Hire-Purchaser’s Account

Amount → Down Payment amount

- For Installments becoming Due:

Hire-Purchaser’s Account

Dr.

To Interest on Hire-Purchase Sales Account

Amount → Interest amount on relevant Installment

- For Receipt of Installment:

Cash / Bank Account

Dr.

To Hire-Purchaser’s Account

Amount → Hire-Purchase Price Installment

- For transfer of Interest

Interest on Hire-Purchase Sale Account

Dr.

To Profi t and Loss Account

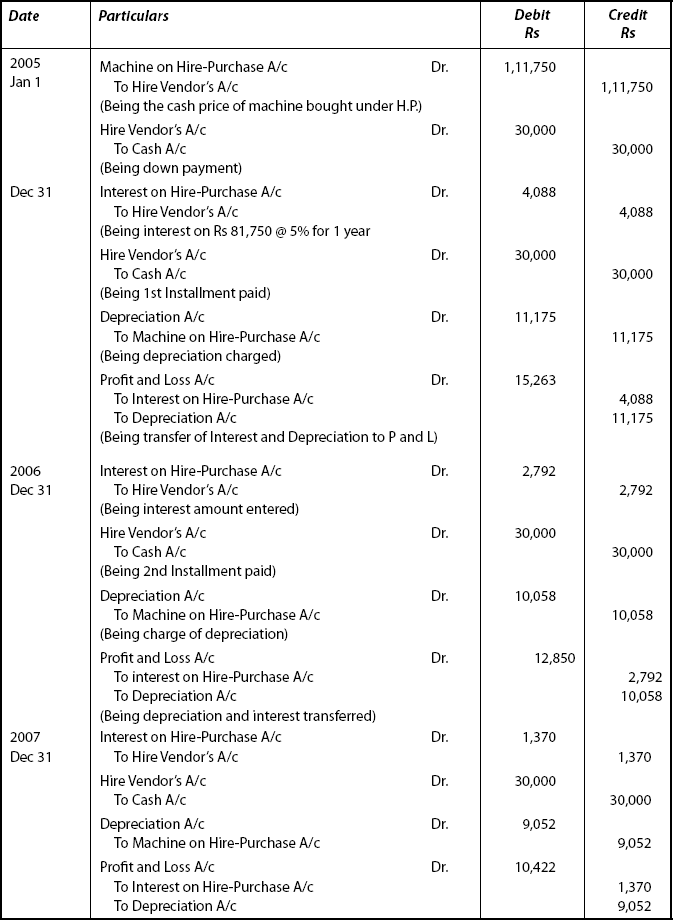

Illustration: 9

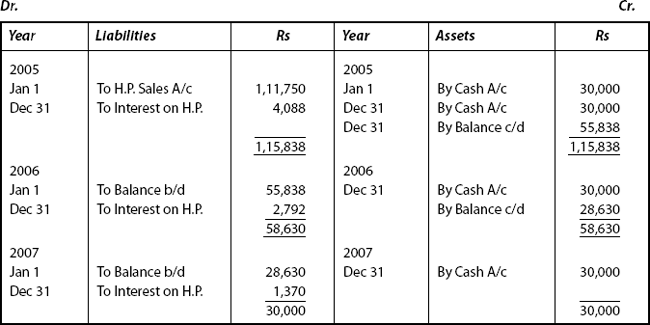

On Jan 1, 2005, Rukmani Ltd bought a machine on Hire-Purchase System. The cash price of the machine was Rs 1,11,750 and payment was to be made Rs 30,000 on signing the agreement and the balance in three installments of Rs 30,000 each, at the end of each year. The rate of interest charged by the vendor is 5% p.a. The depreciation is calculated at 10% annually on the diminishing balance of the asset. Make Journal entries in the books of Rukmani Ltd and the Vendor, recording the necessary transactions for three years.

(M. Com – Bharathidasan University Adapted)

Solution

Computation of Interest |

Rs |

Step 1: Cash Price |

1,11,750 |

Step 2: Less: Down Payment |

30,000 |

|

81,750 |

Step 3:Add: Interest @ 5% on Rs 81,750 for 1 year |

4,088 |

|

85,838 |

Step 4: Less 1st Hire-Purchase Price Installment: |

30,000 |

|

55,838 |

Step 5:Add: Interest @ 5% on Rs 55,838 for 1 year |

2,792 |

|

58,630 |

Step 6: Less: 2nd Hire-Purchase Price Installment |

30,000 |

|

28,630 |

Step 7:Add: Interest |

1,370 |

(Balancing figure Rs 30,000 – Rs 28,630) |

30,000 |

Step 8: Less: 3rd Hire-Purchase Price Installment |

30,000 |

|

Nil |

Computation of Depreciation (WDV)

|

|

Rs |

|

Cost of Machine |

1,11,750 |

|

Less: Depreciation @ 10% for 2005 |

11,175 |

|

|

1,00,575 |

|

Less: Depreciation @ 10% for 2006 |

10,058 |

|

|

90,517 |

|

Less: Depreciation @ 10% for 2007 |

90,52 |

|

|

81,465 |

Journal Entries (In the Books of Rukmani Ltd)

(In the Books of Hire Vendor) Journal Entries

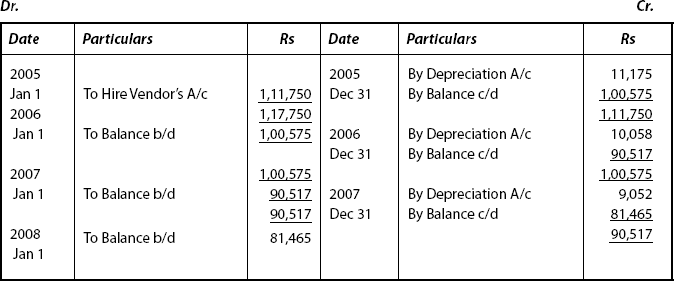

Now we have to prepare the necessary Ledger Accounts.

In the Books of Rukmani Ltd Machine on Hire-Purchase Account

Hire Vendor’ s Account

Balance Sheet as on ….

In the Books of Hire Vendor Rukmani Ltd

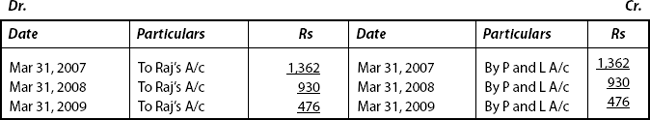

Illustration: 10

On Apr 1, 2006, Mr. Sathyam purchased a machine on hire purchase from Mr. Raj. The hire-purchase price was Rs 40,000. Payable Rs 10,000 as down payment and three annual installments of Rs 10,000 each; the first annual installment being payable on Mar 31, 2007. Mr. Raj charged interest @ 5% p.a.

Mr. Sathyan charged depreciation @ 10% p.a. on diminishing balances of the machine.

You are required to

- Compute the cash price of the machine

- Prepare Interest Account

- Prepare machinery on Hire-Purchase Account

- Prepare the account of Mr. Raj

- Prepare Depreciation Account.

For three consecutive accounting years in Mr. Sathyam’s ledger books.

Solution

Step 1

Computation of interest |

Rs |

|

(i) If interest is Rs 5 Cash Price |

5/105 |

|

(ii) Interest on 3rd Installment |

476 |

Rs 10,000 5/105 |

(iii) Cash Price of 3rd Installment |

9,524 |

(Rs 10,000 – Rs 476) |

(iv) Interest on 2nd Installment |

930 |

(Rs 10,000 + Rs 9,524) × 5/105 |

(v) Cash Price of 2nd Installment |

9,070 |

(Rs 10,000 – Rs 930) |

(vi) Interest on 1st Installment |

1,362 |

(Rs 10,000 – Rs 9070 + Rs 9524) × 5/105 |

(vii) Cash Price on 1st Installment |

8,638 |

(Rs 10,000 – Rs 1,362) |

Computation of Total Cash Price of the machine

|

|

Rs |

|

Down Payment |

10,000 |

|

Cash Price of 1st Installment |

8,638 |

|

Cash Price of 2nd Installment |

9,070 |

|

Cash Price of 3rd Installment |

9,524 |

|

Total Cash Price of the machine |

37,232 |

Step 3

Total Interest |

Rs |

(Rs 1,362 + Rs 930 + Rs 476) Rs 2,768 (or) H.P. Price: |

40,000 |

Less: Cash Price: |

37,232 |

|

2,768 |

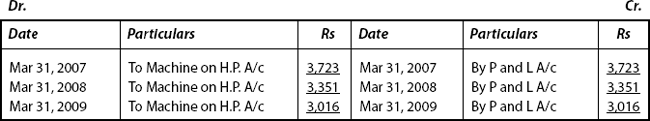

Step 4

Calculation of Depreciation |

Rs |

Cash Price of the machine |

37,232 |

Less: Depreciation @ 10% for (ending Mar 31, 2007) 1st year |

3,723 |

|

33,509 |

Less: Depreciation @ 10% for (ending Mar 31, 2008) 2nd year |

3,351 |

|

30,158 |

Less: Depreciation @ 10% for (ending Mar 31, 2009) 3nd Year |

3,016 |

|

27,142 |

Step 5

In the Books of Mr. Satyan Machine on Hire-Purchase Account

Interest Account

Step 7

Raj’s Account

Step 8

Depreciation Account

Illustration: 11

X Ltd purchased a mini van on Jan 1, 2006 from Sun and Co on Hire-Purchase System. It was agreed upon to make payment as under:

|

|

|

Rs |

|

Jan 1, 2006 |

On signing agreement |

20,700 |

|

Dec 31, 2006 |

At the end of first year |

39,930 |

|

Dec 31, 2007 |

At the end of second year |

39,930 |

|

Dec 31, 2008 |

At the end of third year |

39,930 |

|

|

Total Hire-Purchase Price |

1,40,490 |

Nothing more was payable after 3rd installment. All the installments are duly paid by X Ltd. Interest was reckoned @ 10% p.a.

Depreciation was charged at the rate of 10% p.a.

X Ltd closes its books on 31st Dec every year.

Prepare the following accounts in the books of X Ltd upto Dec 31, 2008

- Sun and Co. Account

- Mini Van Account

- Interest Account

I.C.W.A (Inter) - Modified

Solution

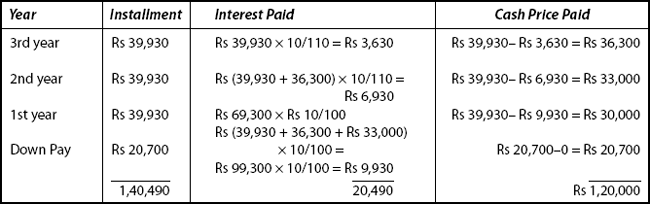

Step 1: First Interest is to be calculated

Step 2

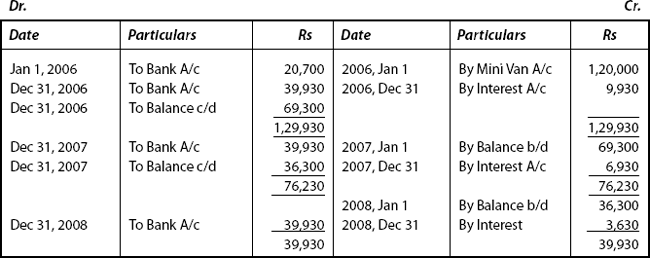

In the Ledger of X Ltd, Sun and Co. Account

Step 3

Interest Account

Mini Van Account

Illustration: 12

On Jan 1, 2006, Narayana purchased a machine from Star and Co on Hire-Purchase System. The hire-purchase price was settled at Rs 1,20,000 payable as to Rs 30,000 on Jan 1, 2006 and Rs 30,000 at the end of three successive year.

Interest was charged at the rate of 5% p.a. The asset was to be depreciated in the books of Narayana @ 10% p.a. on Reducing Installment Method. Given the present value of an annuity of Re 1 p.a. @ 5% interest is 2.7232.

You are required to prepare

(i) Star and Co Account and (ii) Machine Account in the books of Narayana.

Solution

In the Books of Narayana

Step 1: |

First cash price of the machine is to be calculated. |

Rs |

|

If the rule of annuity is Re 1, its present value at 5% p.a. |

2.7232 |

|

For the value of Rs 30,000, the present value will be |

30,000 × 2.7232 |

|

|

81,696 |

|

Add: Cash Down (Down Payment) |

30,000 |

|

Total Cash Price |

1,11,696 |

Step 2: |

Total Interest = Rs 1,20,000 – Rs 1,11,696 = Rs 8,304 |

Step 3: |

Interest is to be calculated |

Rs |

i) |

Total Cash Price |

1,11,696 |

ii) |

Less: Down Payment, 81,696 |

30,000 |

|

|

81,696 |

iii) |

Add: Interest @ 5% on Rs 81,696 |

4,084 |

|

|

85,780 |

iv) |

Less: 1st Hire-Purchase Price Installment |

30,000 |

|

|

55,780 |

v) |

Add: Interest @ 5% on Rs 55,780 |

2,790 |

|

|

58,570 |

vi) |

Less: 2nd Hire-Purchase Price Installment |

30,000 |

|

|

28,570 |

vii) |

Add: Interest (Balance Figure: 30,000 – 28,570) |

1,430 |

|

or |

|

|

(Rs 8,304 – Rs 4,084 – Rs 2,790) |

|

viii) |

Less: 3rd Hire-Purchase Installment |

30,000 |

|

|

30,000 |

|

|

Nil |

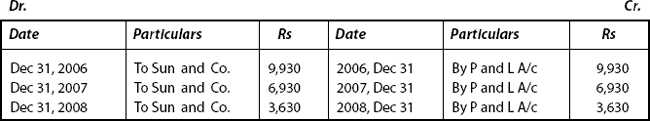

Star & Co Account

Machine on Hire-Purchase Accounts

OBJECTIVE 4: DEFAULT AND REPOSSESSION

When the hirer (hire purchaser) fails to pay the installments in time, then it amounts to default. In such cases, the owner (vendor) takes back the possession of goods which is referred to as “Repossession”. The amount already paid by the hirer is also forfeited.

There are two possibilities:

- When the vendor (owner–seller) takes back the possession of goods entirely, it is referred to as “Full Repossession”.

- When the vendor takes back the possession of only some of the goods sold to hire purchaser, this is called as “Partial Repossession”.

4.1 Full Repossession

Accounting Treatment

| Books of Hire Purchaser | Books of Hire Vendor |

|---|---|

(1) All entries except the entry for payment of installment are recorded as usual (as discussed earlier in this chapter) up to the date of default. Entries for interest and depreciation are entered. For non-payment of installment (default) no entry is recorded. |

(1) All entries except the entry for the receipt of installment (default) are entered as usual. |

(2) The hire purchaser closes the account of vendor by debiting his account and crediting his account and crediting Asset Account (with the amount outstanding). |

(2) Vendor closes Purchaser’s Account by debiting the Goods Repossessed Account (or Goods Returned Account’ a new A/c) and crediting the Purchaser’s Account |

(3) The balance left (if any) in the Asset Account is transferred to P and L A/c and closed thereby. |

(3) The newly created account, Goods Returned Account is debited with expenses incurred on repair of goods and credited with actual resale price (cash) The balance (profit or loss) in this account is transferred to P and L A/c and closed. |

Illustration: 13

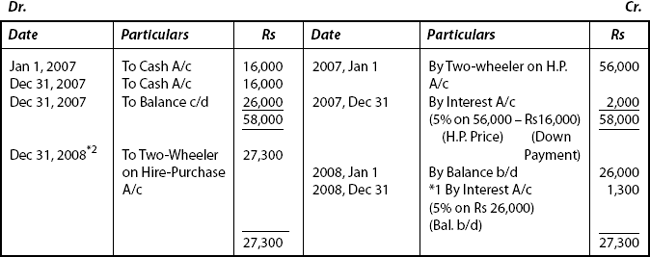

Mr. Antony purchased a two wheeler from Surya Scooters, Delhi for Rs 56,000 on Jan 1, 2007; payment to be made as Rs 16,000 down and three installments of Rs 16,000 at the end of each year. Rate of interest is charged @ 5% p.a. Mr Antony depreciates the two wheeler @ 10% p.a. on Straight Line Method. Mr. Antony paid the first installment but he could not pay the second installment with the result the Surya Scooters took back the possession of the two wheeler. The Surya Scooters had to spend Rs 750 on repairs and sold it for Rs 29,750. You are required to open the necessary ledger accounts in the books of both the purchaser and vendor.

Solution

(A) In the books of Mr. Antony

Surya Scooters Account

Two-wheeler on Hire-Purchase Account

|

Total Loss = *1 Interest Payable |

|

|

|

For the year 2008 |

= |

Rs 1,300 |

|

*3 Profi t and Loss A/c |

= |

Rs 17,500 |

|

Total Loss incurred to Antony |

= |

Rs 18,800 |

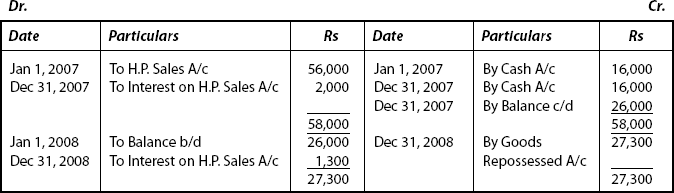

(B) In the books of Surya Scooters

Mr. Antony’s Account

Goods Repossessed Account or Goods Returned Account

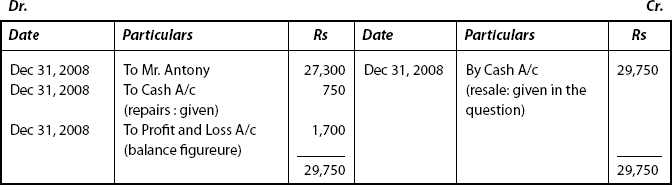

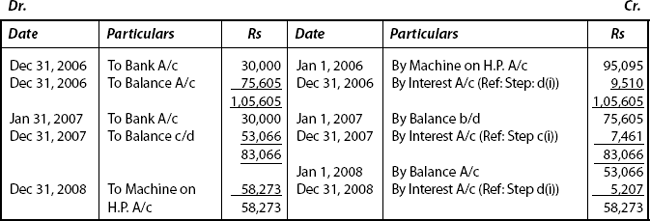

On Jan 1, 2006, Mr. Rahman acquired a machine on Hire-Purchase System from Crescent Ltd agreeing to pay four annual installments of Rs 30,000 each payable at the end of each year. There is no down payment. Interest is charged @ 10% p.a. and is included in the annual installments. Mr. Rahman paid the first and second installments but could not pay the third due on Dec 31, 2008, thereby the vendor repossessed the machine Mr. Rahman provides depreciation @ 10% p.a. on the machine under written down value method.

Show the Crescent Ltd Account and the Machine Account in the books of Mr. Rahman.

(B.com (Hons)—Modified)

Solution

Step 1:

- First, cash price installment is calculated and from this total cash price is calculated.

- As usual, service cash price is not provided in the question, by applying the rate, interest is calculated and then respective installment price is calculated.

- Let cash price installment be 100 (assumed)

Add: Interest @10% p.a. 10 (given)

Hire Purchase Installment 110

∴ Interest on hire purchase Installment =10/110

- Interest is calculated from the last (i.e.) 4th installment first then in the order of 3rd, 2nd and 1st installments.

- Interest on 4th Hire Purchase Installment

-

Installment Amount

Rs 30,000 (Given)

Interest

Rs 30,000 × 10/110 = Rs 2,727

∴ 4th Cash Price Installment

Rs 30,000 − Rs 2,727

Rs 27,273

Rs

- Interest on 3rd Hire Purchase Installment

(i)

Installment Amount

57,273

(Rs 30,000 + Rs 27,273)

(ii)

Interest = Rs 57,273×10/100 = Rs 5,207

(iii)

3rd Cash Price Installment = Rs 30,000 − Rs 5,207 = 24,793

24,793

- Interest on 2nd Hire Purchase Installment

(i)

Installment Amount

(Rs 30,000 + Rs 27,273 + Rs 24,793)

82,066

∴ 2nd Cash Price Installment

30,000 − Rs 7,461

22,539

22,539

- Interest on 1st Hire Purchase Installment

- Installment Amount

(Rs 30,000 + Rs 27,273 + Rs 24,793 + Rs 22,539) = Rs 1,04,605

∴ Interest =Rs 1,04,605×10/110 = Rs 9,510

- 1st Cash Price Installment − Rs 30,000 − Rs 9,510 20,490

(The above working may be depicted in the table format also)

Hence, Total Cash Price

=

4th inst.

= 27,273

3rd inst.

= 24, 793

2nd inst.

= 22,539

1st inst.

= 20,490

Total

95,095*1

- Installment Amount

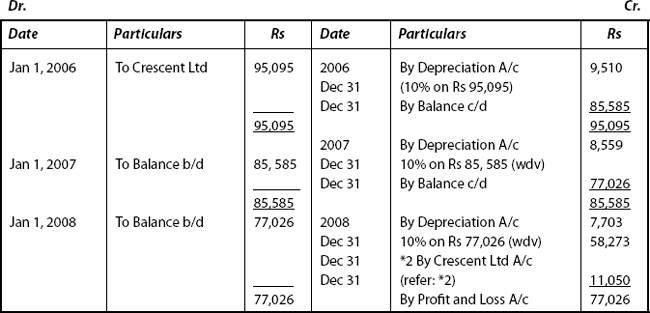

In the Books of Mr. Rahman Crescent Ltd

Step 3

Machine on Hire-Purchase Account

Illustration: 15

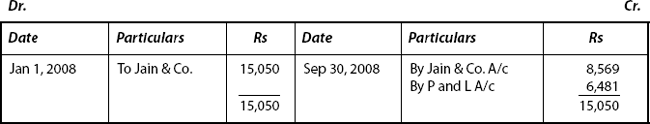

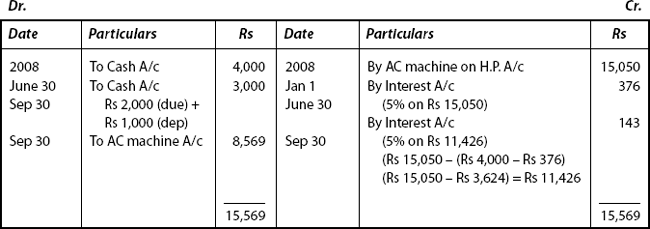

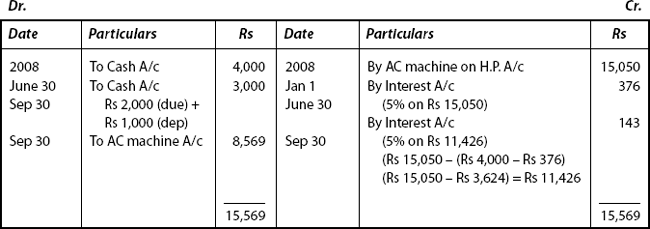

On Jan 1, 2008, Shekar purchased an air conditioner on Hire-Purchase System from Jain & Co. agreeing to pay four semi-annual installments of Rs 4,000 each commencing on June 30, 2008. The cash price of the item was Rs 15,050 and an interest of 5% p.a. was chargeable. On Sep 30, 2008, Shekar expresses his inability to continue and Jain & Co seized the air conditioner. It was agreed that Shekar would pay the due proportion of the installment up to the date of seizure and also a further sum of Rs 1,000 towards depreciation. At the time of repossession, Jain & Co. valued the air conditioner at Rs 7,500 Jain & Co after incurring Rs 1,000 towards reconditioning and sold it for Rs 9,000 on Oct 15, 2008. Show the Ledger Accounts in the Books of Shekar and Jain & Co.

Solution

Step 1

In the Books of Shekar, AC Machine on Hire-Purchase Account

Step 2

Jain & Co. Account

Step 3

In the Books of Jain & Co., Shekar Account

Goods Possessed Account

4.2 Partial Repossession

Instead of taking back all the items sold, the hire vendor may leave some of the items of goods with the hire purchaser. The hire vendor takes possession of only part of asset-back leaving the remaining part with the hire purchaser. This is referred to as “Partial Repossession”.

4.3 Accounting Treatment

Accounting entries are similar to those in the first case (Full Repossession). The additional points to be noted under this are:

- Both hire purchaser and hire vendor do not close the account of vendor and purchaser in their respective books. An additional entry has to be passed with the agreed value of the asset taken away by the vendor (usually, the agreed value will be provided in the question itself).

- The hire purchaser computes the value of asset still left with him by applying normal rate of depreciation. He keeps the Asset Account open. This account shows the balance of those assets which were left with the purchaser by the vendor.

- The balance c/d to the Credit side of the Asset Account shows the depreciated value of the asset left with the purchaser.

- The difference in the Asset Account is to be transferred to Profit and Loss Account.

- The difference arises because it has been credited with the following items:

- Normal depreciation

- The Hire-Vendor’s Account (with the agreed value of the assets taken back)

- Balance c/d (with the value of asset still left with buyer)

Illustration: 16

On Jan 1, 2008, Delhi Travels Ltd purchased from Punjab Motors five luxury cars costing Rs 5,00,000 each on the Hire-Purchase System. The payment was to be made as follows: 10% of cash price down, 25% of cash price at the end of four subsequent half years. The payment due on Dec 31, 2008 could not be paid and hence the cars were seized by the vendor. After negotiation, the Delhi Travels Ltd was allowed to keep three cars on the condition that the value of the other two cars would be adjusted against the amount due, the cars being valued at cost less 25% depreciation. Delhi Travels Ltd closes its Books on 30th June each year and the depreciation is charged at 15% p.a. on cars on the original cost. The Punjab Motors spent Rs 1,00,000 on getting the cars back on road with its original condition and sold for Rs 9,00,000. Show the various accounts in the Books of both the parties.

Solution

Step 1: Value of cars taken away is calculated as:

|

|

Rs |

|

Cost of each car |

5,00,000 |

|

Cost of two cars |

5,00,000 × 2 = 10,00,000 |

|

Cost Price of two cars |

10,00,000 |

|

Less: Depreciation @ 25% on Rs 10,00,000 |

2,50,000 |

|

Value of cars at the time of seizure |

7,50,000 |

Step 2: |

Value of cars still left with the purchaser is calculated as: |

Rs |

|

Cost of three cars 3 × Rs 5,00,000 |

15,00,000 |

|

Less: Depreciation @ 15% on Rs 15,00,000 |

2,25,000 |

|

Value of cars left with the purchaser |

_______ |

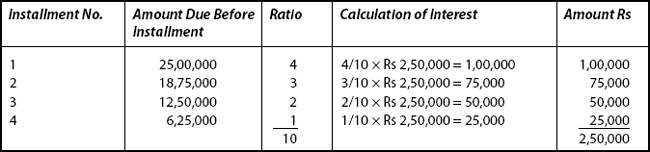

Step 3: Interest is calculated as:

|

Rate of interest is not provided |

||

|

Total Interest |

= |

Hire-Purchase Price – Cash Price |

|

|

= |

Rs 27,50,000 – Rs 25,00,000 |

|

|

= |

Rs 2,50,000 |

Step 4: Allocation of interest is made as follows:

Step 5

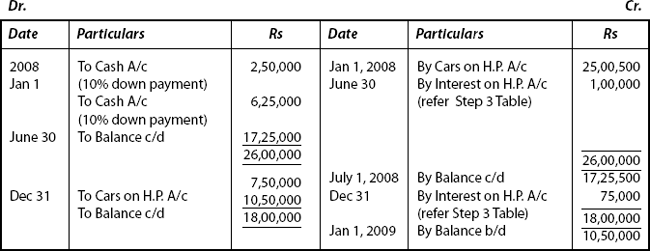

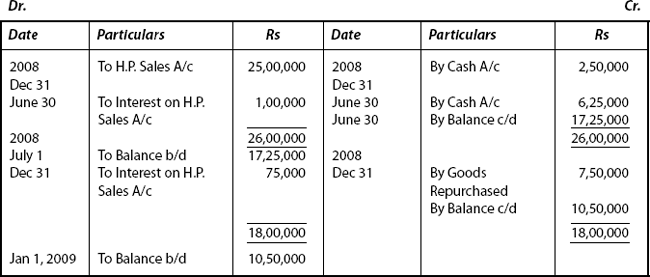

In the Books of Delhi Travels Ltd Cars on Hire-Purchase Account

Punjab Motor Account

Step 7

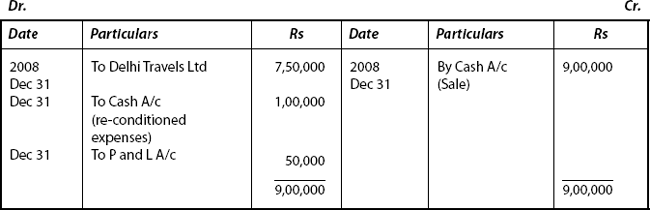

In the Books of Punjab Motors

Step 8

Goods Repossessed Account

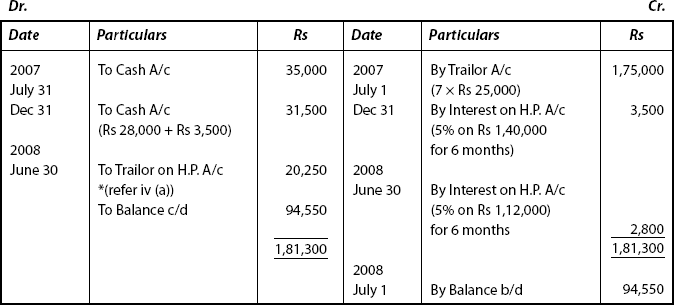

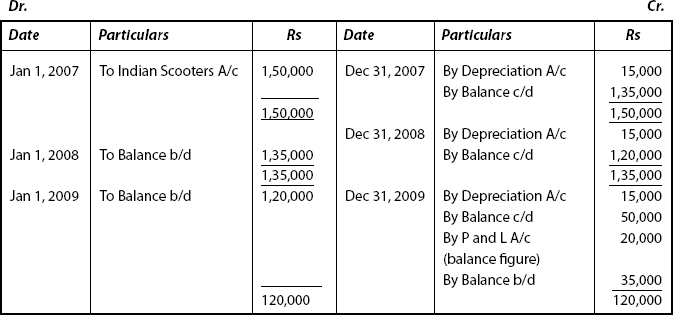

On July 1, 2007, Vas & Co. purchased 7 tractor trailors from the Good Luck Ltd. The cash purchase of each trailor was Rs 25,000. Vas & Co. was to pay 20% of the cash purchase price at the time of delivery and the balance in 5 half-yearly installments starting from Dec 31, 2007 with interest @ 5% p.a. On Vas & Co. failure to pay the installment due on June 30, 2008, it was agreed that Vas & Co. would return 3 trailors to the Good Luck Ltd and the remaining 4 would be retained by him. The Good Luck Ltd agreed to allow him a credit for the amount paid against 3 trailors less 25%. Show the relevant accounts in the Books of Vas & Co. assuming that his Books are closed in June every year and depreciation @ 20% is charged on tractor trailors.

B.Com (Hons) Delhi—Modified)

Solution

Step 1: Calculation of credit allowed and loss on return of 3 trailors

|

|

Rs |

(i) |

Total amount of principal amount paid against 7 trailors |

63,000 |

|

(Rs 35,000 + Rs 28,000) |

|

(ii) |

Total amount of principal amount paid against 3 trailors |

27,000 |

|

(Rs 63,000 × 3/7) |

|

(iii) |

Credit allowed by Good Luck Ltd |

20,250 |

|

(Rs 27,000 – 25% of Rs 27,000) |

|

|

(Rs 27,000 – Rs 6,750) |

|

(iv) |

Loss on return of 3 trailors: |

|

|

(a) Book value of 3 trailors returned |

60,000 |

|

[(Rs 25,000 × 3) – 20% of 75,000] |

|

|

(Rs 75,000 – Rs 15,000) |

|

|

Less: Credit allowed |

20,250* |

|

(Step iii) |

|

|

(b) Hence loss on return of 3 trailors |

39,750 |

Step 2

In the Books of Vas & Co., Good Luck Ltd Account

Tractor Trailor Hire-Purchase Account

Illustration: 18

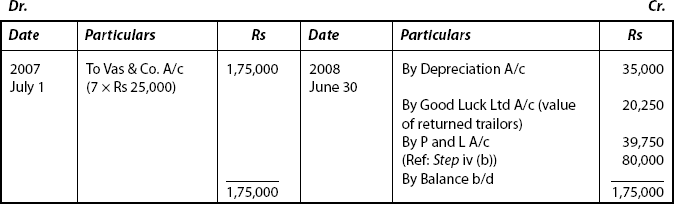

India Scooters Ltd sold 3 scooters for a total cash sale price of Rs 1,50,000 or hire purchase basis to Dev Agencies on Jan 1, 2007. The terms of agreement provided for Rs 45,000 as cash down and the balance of cash price in three equal installments together with interest @ 10% p.a. compounded annually. The installment on were payable as per the following schedule: 1st installment on Dec 31, 2008; 2nd installment on Dec 31, 2009 and 3rd installment on Dec 31, 2010. Dev Agencies paid 1st installment on time but failed to pay thereafter (on his failure to pay the second installment, India Scooters Ltd repossessed 2 scooters and valued them at 50% of cash price). Dev Agencies charged 10% p.a. depreciation on Straight Line Method. Prepare necessary Ledger Accounts in the Books of Dev Agencies for the year 2007 to 2009.

Solution

Step 1: Calculation of Interest

|

|

Rs |

|

Total Cash Price |

1,50,000 |

|

Less: Down Payment |

45,000 |

|

|

1,05,000 |

|

Add: 10% interest for 2007 |

10,500 |

|

|

1,15,500 |

|

Add: 10% interest for 2008 |

11,550 |

|

|

1,27,050 |

|

Less: 1st Installment on Dec 31, 2008: |

57,050 |

|

(Rs 35,000 + Rs 10,500 + Rs 11,550) |

|

|

(Installment) (Interest) (Interest) |

_____ |

|

(2007) (2008) |

70,000 |

|

Add: 10% interest for 2009 |

7,000 |

|

|

77,000 |

Step 2: Value of Scooters (on Dec 31, 2009)

|

Cash Price of Scooter |

50,000 |

|

Less: Depreciation @ 10% for 2007 (S.L.M): |

5,000 |

|

|

45,000 |

|

Less: Depreciation @ 10% for 2008 (S.L.M): |

5,000 |

|

|

40,000 |

|

Less: Depreciation @ 10% for 2009 (S.L.M): |

5,000 |

|

|

35,000 |

In the Books of Dev Agencies, Scooters on Hire-Purchase Account

Step 4

India Scooters Ltd Account

At times, a business firm sells goods both on cash price basis and hire-purchase price basis simultaneously. When goods sold on hire purchase are (i) of small sales value and (2) number of customers is large, calculation of profit or loss of hire purchase is an arduous task. It is cumbersome to maintain a large number of books of account under such circumstances.

A format of Hire-Purchase Sales Register is shown here, in order to understand how much time and labor will be required to maintain such books for each and every item sold, to ascertain the net results of operations.

OBJECTIVE 5: FORMAT OF HIRE-PURCHASE SALES REGISTER FOR THE YEAR ENDED

5.1. The following information is extracted from such hire-purchase sales registered to ascertain profit / loss hire purchase transactions:

5.1.1 |

Cost Price of Goods sold on Hire Purchase: |

|

Cost Price = No. of units sold on H.P. × Cost Price per unit |

5.1.2 |

Hire-Purchase Price: |

|

Hire-Purchase Price = No. of units sold on H.P. × Hire-Purchase Price per unit. |

5.1.3 |

Total Cash received from Hire Purchase Customers = |

|

Cash received = Cash Down Payment + Amount of installment received. |

5.1.4 |

Total installment due but unpaid: |

|

Due but unpaid = Amount of installment which became due but not received during the accounting period. |

5.1.5 |

Total installment not yet Due: |

|

Not yet due = Amount of Installments which became due but not received during the accounting period. (Stock still with customers) |

In order to avoid such cumbersome process of accounting, a new method popularly known as Hire-Purchase Trading Account is being adopted now, to ascertain profit/loss made on hire purchase transactions, preferably of small value goods.

OBJECTIVE 6: METHODS OF ASCERTAINING PROFIT

To ascertain profit or loss made on hire purchase transactions the following methods can be adopted:

- Debtors Method (System)

- Stock and Debtors Method (System)

6.1 Debtors Method

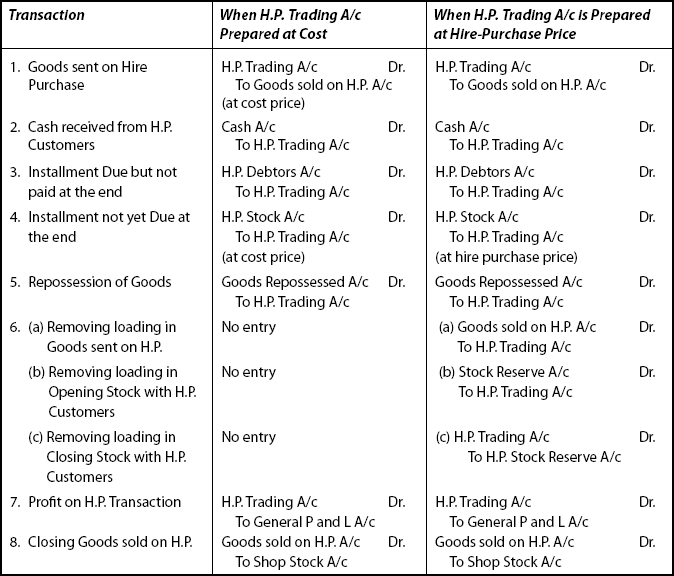

Under this method, a Hire-Purchase Trading Account is prepared to ascertain profit or loss on hire purchase transactions.

The accounting entries in the Hire-Purchase Trading Account may be made either at cost or at hire-purchase price (selling price).

(For loss: Reverse the above entry for both methods)

Formats of Hire-Purchase Trading Account(At Cost)

Load is calculated as: (Load → Mark Up → Profit Margin → denotes same meaning)

Load = H.P. Price of (Opening stock or Closing Stock or Goods sold on H.P.)

- Stock out on hire: Stock out on hire at cost means stock with the customers

Stock out on hire = Amount of installments not due – Profit margin

At the ending of the accounting period, it is valued as:

Stock out on hire = Cost × Amount of installments not yet due/Total amount of installment including deposit.

- Cost of Goods sold on hire purchase is worked out as follows:

Opening Stock at the shop:

-------

Add: Purchases during the year

-------

Less: Closing stock at the shop

-------

Cost of Goods sold

*****

- Goods sold on Hire Purchase:

Opening Stock at the shop:

-------

Add: Purchases during the year

-------

Less: Closing stock at the shop

-------

Add: Load on Mark Up

-------

Cost of Goods sold

*****

Illustration: 19

The following details relate to a dealer in pressure cooker who disposes off them on Hire-Purchase System. Assuming his gross profit on sales to be 20% and there were no opening or closing creditors for goods or expenses, prepare H.P. Trading Account for the year ended Mar 31, 2009:

|

|

Rs |

Apr 1, 2008: |

Stock out on hire at H.P. Price |

80,000 |

|

Stock on hand at shop at cost |

10,000 |

|

Installments over due, customers still paying |

6,000 |

Mar 31, 2009: |

Stock out on hire at H.P. Price |

92,000 |

|

Stock on hand at Cost |

14,000 |

|

Installments over due, customers still paying |

10,000 |

|

Cash purchases during the year |

1,20,000 |

|

Credit purchase during the year |

16,000 |

|

Cash (installments) received during the year |

1,60,000 |

|

Hire Purchase expenses paid during the year |

14,800 |

Solution

Study the Proforma and transfer these figure to the account as:

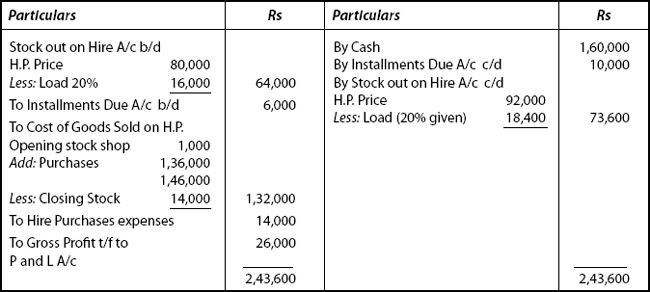

Hire-Purchase Trading Account(At Cost)

Illustration: 20

Renu sells goods on hire purchase basis at a profit of 50% on Cost. Following particulars are relating to the business during the year 2008

|

Rs |

Hire Purchase Stock at (selling price) as Jan 1, 2008 |

18,000 |

Installments Due on Jan 1, 2008 |

10,000 |

Goods sold on H.P. during the year (at selling price) |

1,74,000 |

Cash received from H.P. Customers during the year |

1,20,000 |

Goods repossessed (installments due Rs 4,000) as valued |

1,000 |

Hire purchase stock (at selling price) as on Dec 31, 208 |

60,000 |

Installments Due on Dec 31, 2008 |

18,000 |

Prepare the Hire-Purchase Trading Account, the Profit earned for 2008 |

|

(B.Com (Hons) – Delhi – Modified)

Solution

* Figures are shown at selling price (i.e.) H.P. Price. So remember the format for preparing Trading A/c (at selling price), draw and transfer the transactions to it.

* In the question, “sold at profit of 50% on cost” is provided.

50% on Cost= 1/2 on Cost

1/2 on Cost = 1/3 on sale

Load is calculated at 1/3 of Stock.

In the Books of Renu, Hire-Purchase Trading Account (At Selling Price) for 2008

Illustration: 21

PVR Ltd sells product on hire purchase terms, the price being cost plus 33?% and provides you the following particulars for the year ended Mar 31, 2009:

|

Apr 1, 2008 |

Mar 31,2009 |

|

Rs |

Rs |

Stock out on Hire |

2,00,000 |

2,30,000 |

Stock out shop |

25,000 |

35,000 |

Installments due but customers still paying |

15,000 |

25,000 |

Prepare Hire-Purchase Trading Account |

||

If Goods sold on hire purchases amounted to Rs 4,00,000 |

||

If Goods purchased during the year amounted to Rs 4,00,000 |

||

Solution

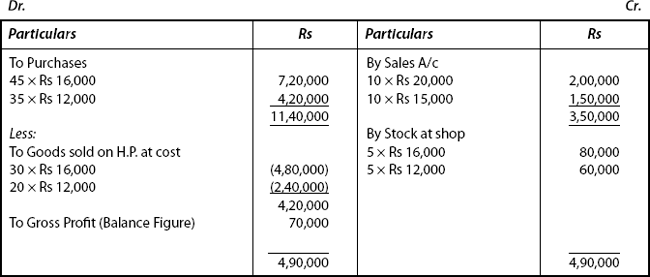

Case (i)

Hire-Purchase Trading Account

Shop Stock Account

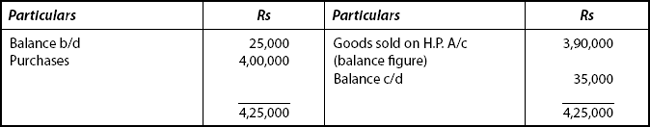

Goods Sold on H.P. Account

Memorandum H.P. Debtors Account

Memorandum H.P. Stock A/c

Case (ii)

Hire-Purchase Trading Account

Goods Sold on H.P. A/c

Memorandum H.P. Stock A/c

Memorandum H.P. Debtors A/c

6.1.1 Calculation of Missing Figure

Generally, one of the following items may be missing in the given question:

- Stock in the beginning

- Purchases

- Installments due in the beginning

- Installments due at the end

- Cash received from customers

- Stock at the end

First, it is essential to compute such missing figure and only then Hire-Purchase Trading Account may be prepared.

6.1.2 Accounting Procedure to Trace Missing Figures

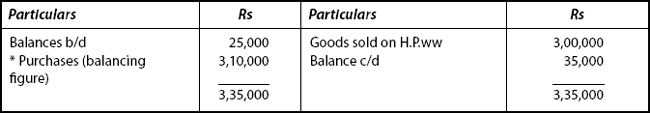

Step 1: The following three accounts are to be prepared strictly in the order:

|

(Refered to as) |

(A) Stock in the Shop Account |

The First Account |

(or) |

|

Shop Stock Account |

|

[always at Cost Price] |

|

(B) Stock on Hire |

The Second Account |

(or) Stock with the Customer’s A/c (or) |

|

Installments NOT DUE A/c |

|

[always at Hire-Purchase Price] |

|

(C) Installments DUE A/c |

The Third Account |

Note: Sometimes these three accounts are prepared in the reverse order from C to B and then to A, respectively.

Step 2: Draw the ledger format for all the three A, B and C accounts in the order.

- Opening Balances: All opening balances are to be entered on the debit side of the respective accounts as: To Balance b/d.

- Closing Balances: Closing balances are to be entered on the credit side of the respective accounts as: By Balance c/d.

- Purchases: Debit side of stock in the Shop A/c Cash.

- Cash Received from Customers: Credit side of Installment Due A/c.

- Goods sold during the year: Debit side of stock with the customer’s account.

(or)

To be transferred from the credit side of first account to debit side of second account.

- Begin with the account that has maximum entries.

Such a procedure enables to locate the missing figure relatively in easy manner.

Usually, the missing figure is arrived at as balancing figure.

Once it is ascertained, it is transferred to the next account in the order.

- When the figure is to be transferred from one account to another avccount that figure must be converted from Cost Price to Hire Price (Selling Price) 1 to 2, 2 to 3 --- order In case if the order is reversed from 3rd account to 2nd, price will have to be converted into Cost Price. This process of transfer takes place till the missing figure is arrived at.

- Installments due during the year (as against its opening or closing balance) appears in the credit side of the second account and debit side of the third account at the SAME FIGURE simultaneously.

Proforma of First Account (At Cost Price)

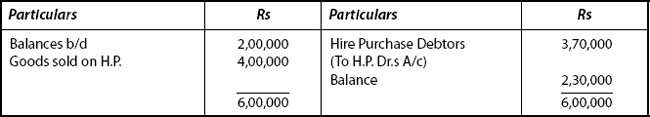

Second Account: Stock with Customer’s Account (At Hire-Purchase Price) Installments Not Due A/C

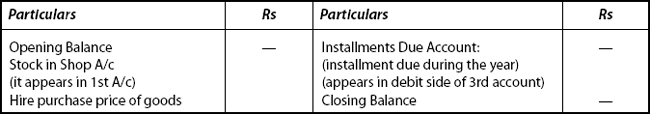

Third Account Installment Due Account

Illustration: 22

Shweta Traders sells some kitchen ware on hire purchase at cost plus 50%. Find out the profit for the year ending Mar 31, 2009 from the following particulars:

|

Apr 1, 2008 |

Mar 31, 2009 |

|

Rs |

Rs |

Stock with hire purchase customers at selling price |

13,500 |

|

Stock at shop at cost |

27,000 |

|

Installments Due |

7,500 |

|

Cash received from customers |

|

90,000 |

Goods repossessed (installments due Rs 3,000) value at |

|

750 |

Installments due, customers still paying |

|

13,500 |

Stock at shop at cost (excluding repossessed goods) |

|

30,000 |

Goods purchased during the year |

|

90,000 |

Solution

Main steps involved in solving this problem

- Calculation of missing figure

- Computation of Profit/Loss by preparing H.P. Trading Account.

Calculation of Missing Figure:

- Cost Plus 50%

Cost Plus ½ → 1/3 on sale

- Preparation of Accounts in the order

Stock in the Shop Account

Stock with the Customer’s Account

(Installments Not Due Account)

Installments Due Account

Missing Figure = Stock with the customers = Rs 45,000

(2) Calculation of Profit or Loss

Hire-Purchase Trading Account

For the Year Ending on Mar 31, 2009

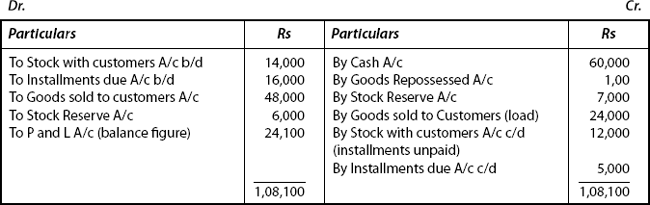

Mr. X sells goods at hire purchase price. Hire purchase is made of profit at 50% on hire purchase price (cost). Calculate profit from the information given below for the year 2008:

2008 |

|

Rs |

Jan 1 |

Installments due in the beginning |

16,000 |

Dec 31 |

Installments due during the year |

50,000 |

|

Cash received during the year |

60,000 |

|

Goods sold during the year |

48,000 |

|

Installments unpaid (not due) on 31 Dec |

12,000 |

|

Goods repossessed during the year (Amount Due Rs 1,000) |

100 |

Solution

1. Calculation of missing figure

Stock with the Customer’s Account

Amounts Not Due (not needed in this type)

Installment Due Account

Note: The figure of installments due during the year. It is shown at two places since it cancels the debit of customers’ account (who were debited when the goods were supplied) and gives a new debit to the new account opened for the customers from whom installments have become due upto the date of preparation of H.P. Trading A/c.

Calculation of Profit or Loss Hire-Purchase Trading Account

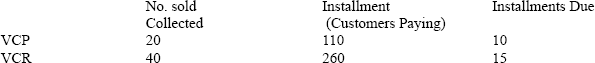

Illustration: 24

Rockcity Agencies started business on Apr 1, 2008. During the year ended Mar 31, 2009, they sold refrigerators and TV sets under two schemes: Cash Price Schemes (CPS) and Hire Price Systems (H.P.S).

Under the CPS, they priced the goods at cost plus 25% and collected it on delivery.

Under the HPS, the buyers were required to sign a H.P. Agreement to pay for the value of goods in 30 installments, the value being calculated at cash price plus 50%. The following are the details available at the end of Mar 31, 2009.

You are required to prepare

- Hire-Purchase Trading Account

- General Trading Account

Solution

Hire-Purchase Trading Account for the Year Ended Mar 31, 2009

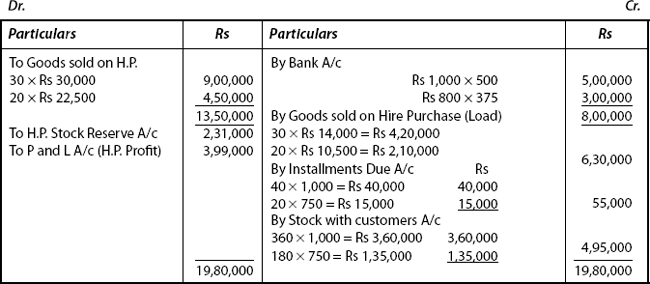

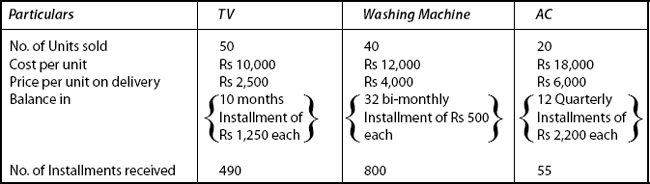

Illustration: 25

Krishna Traders sell on H.P. terms consumable durables. Details of its activities during 2008–2009 are as shown below:

Two washing machines on which only 6 installments in all and one air conditioner on which 3 installments were received, were repossessed as the customers defaulted in payment of subsequent installments. These were taken back at original cost less 30%.

Prepare H.P. Trading A/c for the year ended Mar 31, 2009 at Cost Price.

Solution

Step 1:*1H.P. Sales

|

Rs |

Rs |

Down Payment T.V: (50 × Rs 2,500) |

1,25,000 |

|

Washing Machine: (40 × Rs 4,000) |

1,60,000 |

|

A.C = 20 × 6,000 |

1,20,000 |

4,05,000 |

Add: Installments Received: |

|

|

T.V = 490 × Rs 1,250 6,12,500 |

6,12,500 |

|

T.V = 490 × Rs 1,250 |

6,12,500 |

|

Washing Machine: 800 × Rs 500 |

4,00,000 |

|

A.C = 55 × Rs 2,200 |

1,21,000 |

11,33,500 |

|

|

15,38,500 |

|

|

Rs |

|

Cost of 2 Washing Machines: Rs 12,000 × 2 |

24,000 |

|

Cost of 1 A.C Machine: Rs 18,000 × |

18, 000 |

|

|

42,000 |

|

Less 30% of Cost |

12,600 |

|

Return Price |

29,400 |

Step 3: *3Stock at the end on H.P. at Cost:

|

|

Rs |

|

|

|

|

|

|

|

|

|

|

|

3,55,733 |

Step 4: Preparation of H. P. Trading Account

H. P. Trading Account

6.2 Stock and Debtors System

To ascertain profit or loss under Stock and Debtors System, another method of ascertaining profit or loss on hire-purchase transactions is “Stock and Debtors System”.

6.2.1 Under this method the following accounts are maintained

- Goods sold on Hire-Purchase Account

- Shops Stock Account

- Hire Purchase Debtors Account

- Hire Purchase Stock Account

- Hire Purchase Adjustment Account

- Stock Reserve Account

6.2.2 Accounting entries to be passed under this method

- On purchase of goods for shop stock

Shop Stock A/c

Dr.

To Purchase A/c

(At Cost Price)

- On goods sent (sold) on hire purchase

Hire Purchase Stock A/c

Dr.

(H.P. Price)

To Shop Stock A/c

(Cost Price)

To Hire Purchase Adjustment A/c (Load)

- Total installments which become due

Hire Purchase Debtors A/c

Dr.

(H.P.Price)

To H.P. Stock A/c

- Cash received from debtors

Cash A/c

Dr. (Down Payment + Installments received)

To H.P. Debtors A/c

- Repossession of goods on default

Repossessed Stock A/c

Dr. (Estimated Value)

H.P. Adjustment A/c

Dr. (Loss on Valuation)

To H.P. Debtors A/c

(Total Installments Due)

- Reserve on opening stock on hire purchase price

Stock Reserve A/c

Dr. (Load)

To H.P. Adjustment A/c

- Profit on H.P.

(reserve entry of No. 6)

- Profit on H.P.

H.P. Adjustment A/c

Dr.

To P and L A/c

- Loss on H.P.

(reverse entry of No.8)

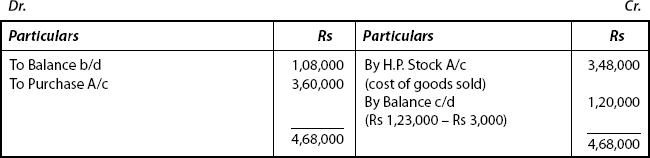

Illustration: 26

M/s Sona & Co sells goods on Hire-Purchase System at cost plus 50%. Prepare H.P. Debto Account, Shop Stock Account, Stock Account and H.P. Adjustment Account from the year ending Mar 31, 2009.

|

|

Rs |

Apr1, 2008 |

Stock with H.P. customers at selling price |

54,000 |

|

Stock at shop at cost |

1,08,000 |

|

Installments Overdue |

30,000 |

Mar 31, 2009 |

Cash received from customers |

3,60,000 |

|

Goods Repossessed (Installments due Rs 16,000) |

3,000 |

|

valued at Rs 3,000 which was included in the stock at the end; |

|

|

Goods purchased during the year |

3,60,000 |

|

Stock at shop at cost |

1,23,000 |

|

Installments Due |

54,000 |

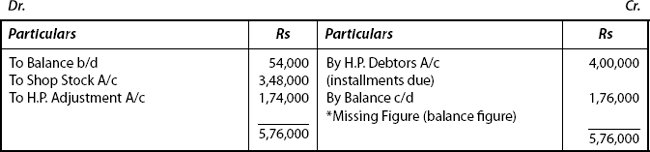

In the Books of M/S Sona & Co Shop at Stock Account

Hire-Purchase Stock Account

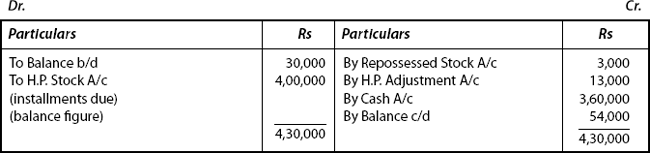

Hire-Purchase Debtors Account

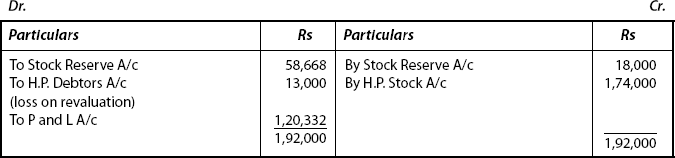

Stock Reserve Account

Hire Purchase Adjustment

Illustration: 27

Jaya Enterprises sold a washing machine to Leela on Hire-Purchase System on Apr 1, 2008 for Rs 18,400. Leela paid Rs 4,000 on the same date to receive the delivery of washing machine and agreed to pay the balance in 12 equal monthly installments; each installment becoming due on the last day of each month. Leela paid six installments in time but failed to pay the other installments. In Dec 2008, (before the monthly installment had become due) Jaya enterprises repossessed the washing machine. The repossessed washing machine was valued at Rs 7,000. Show the necessary ledger accounts in the books of Jaya Enterprises (under Stock and Debtors System).

B.Com (Hons.) – Modified

Solution

In the Books of Jaya Enterprises

First,

- Installment amount,

- Installments Due (H.P. Debtors)

- Installments NOT DUE (H.P. Stock) all have to be calculated

Step 1:

Step 2: |

Installment Due = (H.P. Debtors) |

|

|

Period from Apr 1, 2008 to Mar 31, 2009 = 12 months |

|

|

(a) (i.e.) Total installments |

12 |

|

(b) From Apr 1, 2008 to Sep 30, 2008 Installments were paid |

6 |

|

(c) *1 Installment Due + Installment Not Due |

6 |

|

c = (a−b) |

|

The date on which the asset was taken back repossessed = Dec 1, 2008

The period between the last installment paid and the date on which the asset was repossessed, i.e. from Sep 30, 2008 to Dec 1, 2008 = 2 months

*2 This is installments due (H.P. Debtors) = 2

Step 3: |

Installment Not Due |

|

|

*1 Installment Due + Installments Not Due |

6 |

|

Less: *2 Installments Due |

2 |

|

∴ Installments Not Due |

4 |

|

or |

|

Simply counting from Dec 1, 2008 to Mar 31, 2009 = 4

Step 4: Based on these values the following has to be calculated:

(i) H.P. Debtors Account = No. of Installments Due × Installment Amount |

|

= 2 × Rs 1,200 |

= 2,400 |

(ii) H.P. Stock Account |

= No. of Installments Not Due × Installment Amount |

= 4 × Rs 1,200 |

= Rs 4,800 |

(iii) Goods Repossessed |

= Rs 2,400 + Rs 4,800 = Rs 7,200 |

Step 5: Difference between the valution of repossessed assets and this (net effect on repossession – profit or loss)

(Rs 2,400 + Rs 4,800) − Rs 7,000

= Rs 7,200 − Rs 7,000 = Rs 200

(Profit)

Step 6

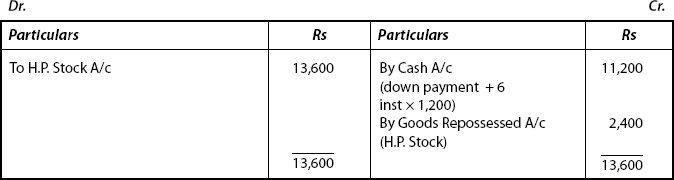

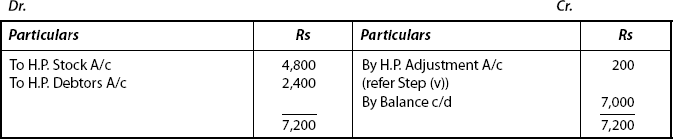

Hire-Purchase Stock Account

Step 7

Hire-Purchase Debtors Account

Step 8

Goods Repossessed Account

Illustration: 28

Thomas sells goods on hire purchase at cost Plus 60%. He provides the following information for the period ending Mar 31, 2009:

Apr 1, 2008 |

Rs |

Stock with hire purchase customers at selling price |

6,000 |

Stock at the shop at cost |

2,500 |

Installments overdue |

4,000 |

Mar 31, 2009 |

|

Total Installments that feel due during the year |

94,720 |

Cash received from customers (including down payments of Rs 7,720) |

87,720 |

Goods Repossessed (Installments due Rs 250) |

200 |

Stock at that shop at cost (Including goods repossessed Rs 200) |

1,000 |

Purchases |

60,000 |

Hire expenses |

1,700 |

Prepare the necessary Ledger Account to record the above transactions and compute the profits.

[B.Com (Hons) – Modified]

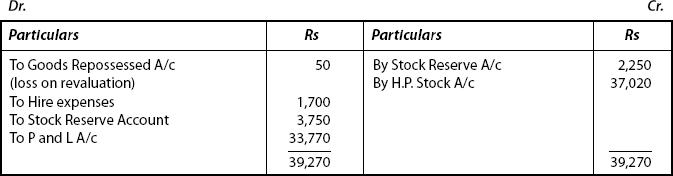

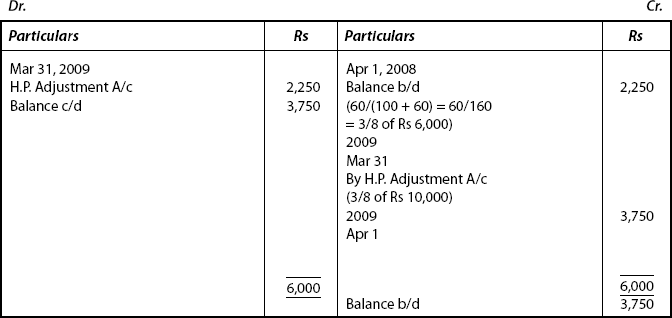

Solution

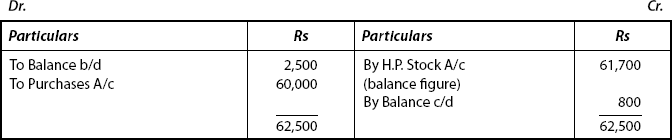

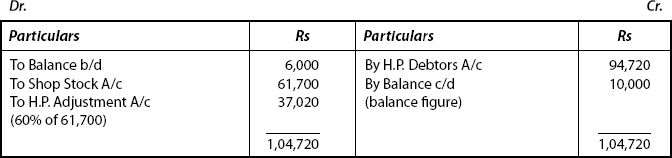

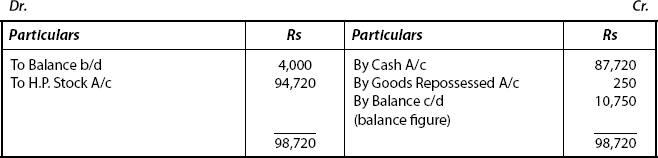

In the Books of Thomas Shop Stock Account

Hire Purchase Stock Account

Hire Purchase Debtors Account

Hire Purchase Adjustment A/c

Stock Reserve Account

Illustration: 29

Chennai Kitchen Mart sells goods both on cash and hire-purchase basis and records hire-purchase transactions on Stock and Debtors System, and closes its Books on Dec 31, every year.

On Apr 1, 2008, it sold a mixie and microwave oven to Sheela: the other particulars are provided as:

| Particulars | Mixie | Micro Oven |

|---|---|---|

Cost Price |

Rs 4,500 |

Rs 8,000 |

Down Payment |

Rs 1,000 |

Rs 2,000 |

No. of Installments Payable |

10 |

8 |

Amount in each Installment |

Rs 500 |

Rs 1,000 |

Mode of Payment |

Monthly |

Bi-Monthly |

First Installment Due on |

May 1, 2008 |

June 1, 2008 |

Sheela paid all the installments due except for those due on Dec 1, 2008. It was decided that the Kitchen Mart would take back Micro Oven at an agreed price of Rs 5,500 and excess amount, if any, will be adjusted against the installment due on mixie. Oven repossessed was sold for Rs 6,000 after repair charges for which amounted to Rs 250.

Prepare necessary ledger accounts to record the above transactions and calculate the profits.

B. Com (Modified)

Solution

In the Books of Chennai Kitchen Mart

Hire-Purchase Stock Account

Hire-Purchase Debtors A/c

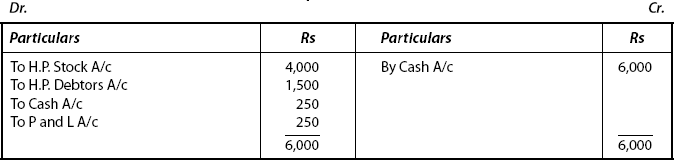

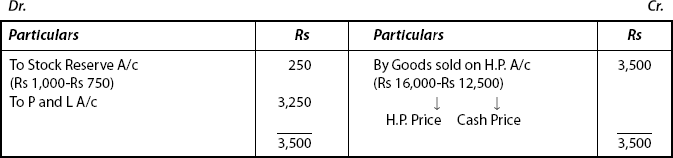

Goods Repossessed Account

Hire-Purchase Adjustment A/c

Working Notes |

Rs |

(i)Value of Goods repossessed |

5,500 |

Less: Installment not due on oven. |

4,000 (H.P. Stock Amount) |

Transfer to H.P. Debtors A/C |

1,500 (H.P. Debtors) |

(ii) Cash Price of mixie still in possession of Sheela:

(iii) The balance in the H.P. Stock Account shows the amount of installments NOT DUE on mixie still with Sheela.

OBJECTIVE 7: INSTALLMENT SYSTEM

This system also operates on the basis of an agreement, known as Installment Purchase Agreement. It means an agreement of sale from which we can infer the salient features of this system of sale:

Features of Installment System:

- Ownership of goods is passed on to the buyer immediately after entering into this agreement.

- The buyer in no way has got any right to terminate the contract unless the seller defaults.

- The seller cannot take back the goods (Repossession) if the buyer fails to pay installment. Remedy for the seller is only by way of legal action against the buyer to recover the installment due.

7.1 Purchase System

| Basis of Distinction | Hire-Purchase System | Installment Purchase System |

|---|---|---|

Basis of operation |

This system operates on the basis of Hire-Purchase Agreement |

This operates on the basis of installment Purchase Agreement |

Nature of Agreement |

This system is based on an agreement of hiring |

This is based on agreement of Sale |

Statutory Governance |

This is governed by the Hire Purchase Act, 1972 |

This is governed by the Sale of Goods Act, 1930 |

Parties entered into agreement |

The parties entered into agreement, under this system are called Hirer and Hire Vendor |

The parties concerned are called Buyer and Seller |

Ownership Rights |

The ownership (title to goods) passes onto the purchaser only on last payment of installment |

The ownership passes immediately after signing the agreement, although the price of goods will be paid in Installments. |

Return of Goods |

The purchaser may return goods |

The buyer cannot return goods unless, and until the seller defaults |

Repossession |

If the hirer makes default in installment payments, the vendor can take back the goods from the hirer. |

Even if there is any default in installment payment, the seller cannot take back from the buyer. |

Risk of Loss |

Risk of Loss of goods lie with the Vendor |

Risk of Loss of goods lie with the Buyer |

Right of Disposal |

Buyer cannot hire out, lease, mortgage, destroy, damage or transfer of goods. |

Buyer can have the right to dispose the goods (property) purchased under this system. |

Position relating to Installment |

The installment paid is treated as Hire chare for the use of goods. |

Installment paid is treated as part redemption of the value of goods (payments) |

Charges (other than Cash Price) |

Component other than Cash Price included in installment is called “Hire Charges”. |

Under this system, it is called “Interest”. |

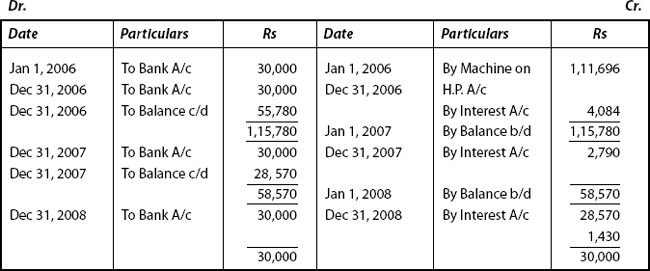

7.2 Accounting Treatment

Accounting for installment purchase is done on the basis of “Interest Suspense Method”.

Accordingly, the asset is debited (at its total cash price) and the seller is credited (with total amount payable to him). Then debit the “Interest Suspense Account” (with the difference between the total amount payable and the cash price).

Recording of entries in the books of buyer and seller and application of Interest Suspense Method

Accounting Entries

Notes:

- Entries relating to Transactions 3, 4 and 5 will have to be repeated for subsequent installments.

- Balance of “Interest Suspense Account” will have to be transferred to the Balance Sheet (Liabilities side), in case of Purchaser and to the assets side in the case of Buyer.

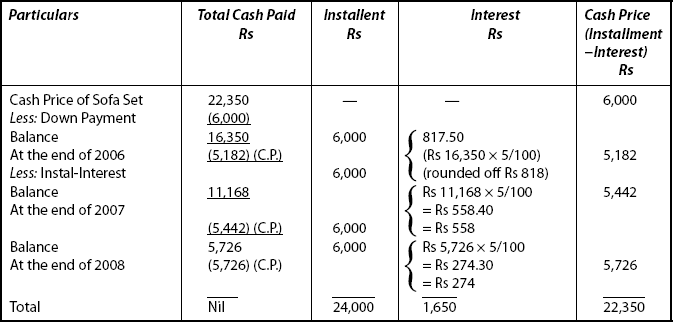

Illustration: 30

On Jan 1, 2006, Mr. Anand bought a sofa set from Ajay & Co on the installment system. The cash price of the sofa set was Rs 22,350 and the payment was to be made as follows:

- Rs 6,000 on signing the agreement

- Balance in three installments of Rs 6,000 each at the end of each year.

5% interest is charged by the suppliers per annum. Mr. Anand writes off 10% depreciation annually on the diminishing balance of the cash value. Make entries in the Books of both the parties.

Solution

Cash price of the sofa set and the no. of Installments and the amount of each installment are given in the question.

From these figures, first total interest is calculated and then for each year it has to be calculated, as the installment comprises the interest component also.

Total Interest |

= Total Installment Amount – Cash Price of Sofa Set |

|

=Rs 6,000 × 4 –Rs 22,350 |

|

=Rs 24,000 – Rs 22,350 |

|

= Rs 1,650 |

This amount has to be apportioned for each year as follows:

Table Showing Calculation of Interest and Cash Price

(Paise Rounded off to the nearest Rupee value)

Journal Entries in the Books of Anand

Journal Entries in the Books of Ajay & Co

Note:

- From these journal entries, all the necessary ledger accounts may be prepared with ease.

- Students should practice apportioning interest as shown in the format table.

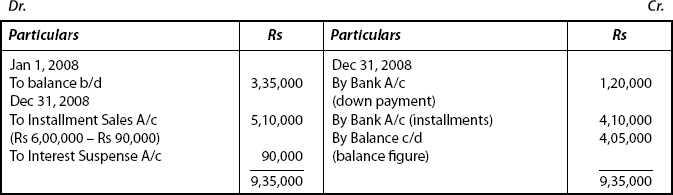

Illustration: 31

Joseph & Co. sells consumer durables under installment payment system under which 20% of the total dues are to be paid on delivery and the balance in eight equal quarterly installments commencing from the last date of the quarter in which the goods have been delivered. 15% of the total dues are attributed towards interest of which credit to revenue is taken as:

|

In the year of sale |

30% |

|

Next year |

50% |

|

The year after Next |

20% |

Total dues for goods sold and delivered during the last three years had been:

|

|

Rs |

|

2006 |

4,00,000 |

|

2007 |

5,00,000 |

|

2008 |

6,00,000 |

On Jan 1, 2008, Installment Debtors Account and Interest Suspense Account showed balances of Rs 3,35,000 (Dr.) Rs 64,500, respectively. The deliveries have been even throughout the year and all the installments have been collected on due date.

Prepare Installment Debtors Account, and Interest Suspense Account as they would appear in 2008.

Solution

Step 1: Installment falling in 3 years

Step 2: Table showing sales, down payment, interest, total amount of installments, ratio of total installments received for each year.

Step 3::

Installment Debtors Account

Step 4:

Interest Suspense A/c

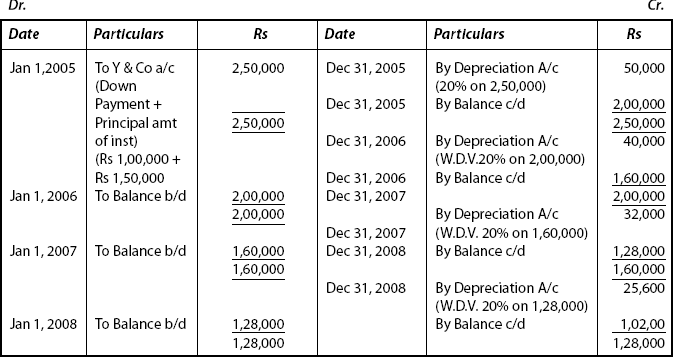

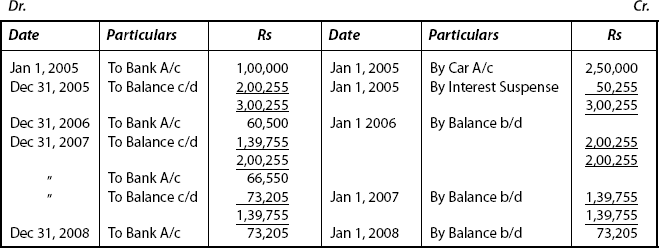

Illustration: 32

On Jan 1, 2005, X acquires a car form Y & Co on installment buying @ 10% p.a. interest, which is changeable yearly. X agrees to pay Y & Co. Rs 1,00,000 on Jan 1, 2005, Rs 60,500 on Dec 31, 2006; Rs 66,550 on Dec 31, 2007 and finally Rs 73, 205 on Dec 31, 2008. X duly discharges all these sums. X provides depreciation @ 20% p.a. on Diminishing Balance Method at the accounting date Dec 31, each year.

You are required to prepare the Car Account, Y & Co. A/c and Interest Suspense Accounts in the Books of X.

Solution

Step 1: First apportionment of cash price and periodic interest is to be calculated as below:

Step 2

Car Account

Step 3

Y & Co. Account

Step 4

Interest Suspense Account

OBJECTIVE 8: CONCEPTS OF OPERATING AND FINANCIAL LEASE

8.1 Meaning

The concept “Leasing” refers to the practice of using an asset for a fixed period at an agreed rental basis.

Leasing may be described as a contract between two parties – the Lessor and the Lessee – for the use of a “specific asset”, for a specific fixed period on agreed rental value basis.

8.2 Lessor

The owner of the specific asset is termed as Lessor. He may be an individual or association of persons, or a firm or a limited company.

8.3 Lessee

The person who is in need of the specific asset, for his use for a limited period, who in turn pay a quantum of amount for possessing and using that asset for a fixed time. Here too, the person may be an individual or association of persons or firm or a limited company.

8.4 Leasing Agreement

A document, comprising terms and conditions for entering into a contract between the Lessor and the Lessee, is called as Leasing Agreement.

8.5 Suitability

Leasing transaction is suitable for a business entity which requires only the use of (Capital) Fixed Assets and may not require ownership because a very huge amount is needed to acquire such high value assets. In such circumstances, such business entities can easily avail of this leasing transaction thereby they can use with very minimum amount by way of paying rental.

From the above discussion, we have come to know that the following parties are involved in a leasing transaction.

- The leasing company (lessor) which finances the transaction.