Chapter 8

Charting Different Time Periods

IN THIS CHAPTER

![]() Changing a variety of charts to different time periods

Changing a variety of charts to different time periods

![]() Looking at hourly, daily, weekly, and monthly charts

Looking at hourly, daily, weekly, and monthly charts

![]() Examining multiple time periods and closing prices

Examining multiple time periods and closing prices

Looking at different time periods on charts is a lot easier with computing power. At a touch of a button, you can change everything. Chartists often look at different time periods to evaluate a stock, and great charting software helps with that analysis.

Using charting software, you can display differences for a selected period. The most common period for StockCharts.com clients is a daily period. (Most traders or investors check their portfolio when they get home from work, which probably makes daily charts the most popular.) When chartists refer to daily candlestick charts (see Chapter 4), each candle provides the information for the opening trade of the day, the high of the day, the low of the day, and the close of the day. Then the computer stacks these candles beside each other to create a chart. The chart may contain a year of candles (called the range), but each candle is showing the price action for one day, so the chart is called a daily chart. The period reflects how much time is in each candle, not the number of candles on the chart. As we discuss in Chapter 5 on bar charts, information can differ depending on the chart you select. Area and line charts (see Chapters 6 and 7) provide more of a summary than the detail you find in candlestick and bar charts.

In this chapter, we show you different chart formats in different time periods, and we provide pointers on when to use each type of time period.

Converting Candlestick Charts to Different Periods

You can use a candlestick type of chart (introduced in Chapter 4) to display different periods. In the following sections, we take a look at how the time period of a candlestick chart impacts the visual you will see. We use Amazon (AMZN) for June and early July 2017 to show how the periods you use to make up your chart can impact what you see.

60-minute to daily candle display

Figure 8-1 shows a 60-minute candle chart for the trading of Amazon on June 29 and the same date reflected by a single daily candle. The intraday candle closing levels don’t seem very important when the day is over. Both views show a down day. The intraday candles open and close information isn’t required to build the daily candle (but we still point out the closing price with a dotted line in Figure 8-1). Other than the high and the low of the day, the intraday candle information is dropped in the daily candle. But if you were day-trading, that 60-minute display would help you make entry and exit decisions.

Chart courtesy of StockCharts.com

FIGURE 8-1: Comparing 60-minute candles to one daily candle.

Daily to weekly candle display

The same information can be shown for the days of the week or the whole week. This information starts on the first working day of the week, so it may start on Tuesday if there’s a holiday on Monday. If so, the weekly candle will include only four days. If Friday is a holiday, then the candle will use Monday’s open and Thursday’s close. The chart shows what happened for that week between the two weekends. Figure 8-2 shows the transition of information from a daily chart to a weekly candle for Amazon from June 26 to July 3, 2017; notice that the high and low of the week are included in the weekly display.

Chart courtesy of StockCharts.com

FIGURE 8-2: Comparing five daily candles to one week.

Note: If the week crosses over the month end on a Wednesday, the weekly candle ignores the month-end information. The weekly candle won’t have any information specific to the monthly close.

Daily to monthly candle display

Monthly candles are different from daily and weekly candles. They use the start date of the first trading day of the month and end with the last trading day of the month for each calendar month. It doesn’t matter what day of the week these candles start or finish on.

In Figure 8-3, June starts mid-week. The monthly candle selects the June 1 market open price to start the month. When you compare daily, weekly, and monthly candles, the highest closing price for the day or the week may not show as an important level on the monthly chart. June 5 is the highest daily closing price for Amazon in the month, but the solid monthly candle ignores that information.

Chart courtesy of StockCharts.com

FIGURE 8-3: Comparing daily candles to one month.

Weekly to monthly candle display

It is difficult to compare a weekly chart to a monthly chart. If the start and the end of the month fall mid-week, finding the open, high, low, and close levels for the month on a weekly chart is impossible. Unless the market closed on a Friday for month-end at the highest level in the month, these levels will be different on the weekly and the monthly charts. Figure 8-4 shows why the charts have different values.

Chart courtesy of StockCharts.com

FIGURE 8-4: Comparing weekly to monthly candles.

Converting Bar Charts to Different Periods

Bar charts (which we introduce in Chapter 5) have traits similar to those of candlestick charts when switching periods. Again, we use Amazon for the month of June and early July 2017 to show you the differences in the following sections.

60-minute to daily bar charts

Figure 8-5 shows a 60-minute bar chart compared to a one-day bar. The intraday chart highlights the previous day’s closing level with a dashed line. The chart conveys the same message as the candle chart in Figure 8-1. The 60-minute bars have a repetitive style, whereas the candle bodies appear to be more unique.

Chart courtesy of StockCharts.com

FIGURE 8-5: Comparing 60-minute bars to one daily bar.

Daily to weekly bar charts

Going from a daily bar chart to a weekly or monthly bar chart can work well. Figure 8-6 compares the daily chart to the weekly chart. Notice that the first day in June is included in the last week of May. Like the candlestick chart, it conveys the information between two weekends.

Chart courtesy of StockCharts.com

FIGURE 8-6: Comparing 24 daily bars to 5 weekly bars.

Weekly to monthly bar charts

The variance between weekly bars and monthly bars is the same as that shown on the candlestick charts in Figure 8-4. Looking at the charts with the same range setting, the weekly chart populates differently from the monthly chart because a month can start mid-week, so this cannot be an apples-to-apples comparison.

- The weekly chart on the left side of Figure 8-7 adds an extra week in the beginning of the chart, even though the dates requested are the same. So you can see that the chart on the left shows a price of 700 as the low, while the chart on the right has 725 as the low. You can see that a red circle highlights 725/700.

- The deep low on the monthly chart that looks all alone is different on the weekly chart as the price move back up happened in the following week.

- The price retracement at the top of the chart in June looks mild on the monthly chart, where price retraced most of May’s push higher and was almost back to the price from the beginning of May. On the weekly chart, the price looks a lot more volatile with lower lows, then higher lows, and a final week of lower lows.

Chart courtesy of StockCharts.com

FIGURE 8-7: Comparing weekly to monthly bars.

Converting Line and Area Charts to Different Periods

Moving to line charts (see Chapter 6) dramatically changes the information view by showing only the closing price. The closing price may be difficult to spot through the detail on the bar and candlestick charts that we discuss earlier in this chapter. You can spend a little time looking at each candle or bar to see the closing level, but the line chart in Figure 8-8 makes that level obvious. As area charts (see Chapter 7) shade the information under the line, the chart highs and lows are the same as those shown on a line chart.

Chart courtesy of StockCharts.com

FIGURE 8-8: Line and area (mountain) charts.

Intraday data disappears as the price labels are based on closing prices only, not intraday prices. By eliminating some of the detailed price information, the chart conveys a similar look. A line chart gives you a different view of weekly and monthly information as it removes the little wiggles from day to day.

Taking It One Day at a Time with Daily Charts

Looking at daily charts — the topic of this section — helps you understand the mood of the market each day. Markets can be affected by news from various sources, but when investors think things are improving generally, they can ignore a lot of bad news. When market participants are worried, the slightest bit of bad news can add angst, and investors may drop their resilience of holding a specific stock through tough markets.

Looking at the daily price movement in context

A daily chart gives you context for the current price and how it compares to recent history. This information is much more valuable than one day of information.

Figure 8-9 shows a one-year chart of Nike (NKE) using the bar chart format. The stock oscillated all year (from July 2016 to June 2017) in a range between $48 and $59. The right side of the chart is at the top end of the range, which makes the stock interesting now for everyone. Will it be able to move to the upside above the previous trading area, or will it fall back down into the range? If you own it, do you want to sell it and lock in your price near the high end of the range? If you don’t own it, do you want to buy it here?

Chart courtesy of StockCharts.com

FIGURE 8-9: Daily chart for one year.

On just about every chart, you will see emotional gaps between bars. These erratic movements are not the daily norm for NKE, but the chart in Figure 8-9 shows these gaps often enough as sudden 5 percent moves that affect your capital. Nike is a Dow 30 stock, which is chosen by the Dow Jones Company as one of 30 companies in the Dow Jones Industrial Average Index. This is a prestigious list of strong U.S. companies that changes infrequently.

Daily charts allow you to see these gaps, whereas the gap has to happen on Monday morning to see it on a weekly chart. This is one key advantage of looking at a daily bar or candlestick chart when you’re looking for critical price moves.

The daily chart shows the price moving between $48 and $59 over the period of one year. This sideways movement encompasses the whole chart. Strong stocks will start in the bottom left and go to the top right. Charts that are consolidating are hard to own because as an owner, you are in a range that is not generating new capital. Recognizing a consolidation range is helpful. If you like the stock for further gains, it gives you a chance to buy it somewhere in the range as the investing community has reached a balance.

Using a range of one year (or more) with a daily chart

There are some compelling reasons to look at a range of one year in a daily chart. You can see

- Consolidation ranges of a few months to one year

- Annual highs

- Annual lows

- The price trading range for the last year

- Breakouts to new 52-week highs (one-year highs)

- Breakdowns to new 52-week lows (one-year lows)

When a stock is moving to new one-year highs after not being at one-year highs for a long time, investors take notice that this is a changing point in time. For the first time in a year, investors are willing to pay the most they have for the company stock.

Figure 8-10 shows Nike (NKE) in October 2009 moving to a new high for the first time in a few years. The chart has three years of daily information plotted in a bar chart format. While the price is squished together, you can see the stock move above previous prices. In October 2009, the stock goes to a new one-year high. Four months later in February 2010, the stock moves to new all-time highs. A lot of stocks were still very weak after the financial crisis and not close to new all-time highs. Seeing a stock do very well while other stocks are still recovering suggests strength.

Chart courtesy of StockCharts.com

FIGURE 8-10: Daily chart showing a stock becoming a winner.

If you look at stocks as they move to new highs after moving sideways, you need to consider what the current shareholder is thinking. All the investors within the last year are happy to hold the stock as it starts climbing.

Owning Nike as it broke out to new highs was beneficial. Then the stock consolidated in the top right corner of Figure 8-10. Figure 8-11 shows what happened to Nike afterward. The stock continued to make new one-year highs for the next six years without making a new one-year low. The stock still had retracements of as much as 25 percent during the six-year run.

Chart courtesy of StockCharts.com

FIGURE 8-11: Daily chart showing a stock staying a winner.

The disadvantage of looking at a long-term chart using daily candles or bars is that you can no longer see the individual price points. Having multiple years on the chart using different time periods (weekly or monthly) enables you to see the information clearly, but you lose specific information like gaps.

Chart courtesy of StockCharts.com

FIGURE 8-12: A daily chart showing a stock staying a winner in line chart format.

Examining market capitalization with daily charts

You can calculate a company’s market capitalization by multiplying the total number of shares by the current price per share, which is called market cap in most financial reporting. Companies are typically compared based on their market cap. While there is no standard or minimum/maximum in the industry, a few companies that create market indexes have created some rough measures that change over time.

Rough rules of thumb are as follows:

- Large-cap: Greater than $10 billion

- Mid-cap: Between $2 billion and $10 billion

- Small-cap: Typically less than $2 billion

When an individual investor has a portfolio of large-cap stocks, the portfolio behaves similarly to the market index. A market index is designed by a company placing a group of stocks bundled together to get an idea of the total price action of the companies within the index. The S&P 500 ($SPX) is a market index of the top 500 large-cap U.S. companies. The Dow Jones Industrial Average ($INDU) is another.

Because markets around the world are different and the United States has the largest market capitalization in the world, these large-cap groups are different sizes depending on the market you trade. Indexes for large-cap stocks are set up around the globe. Some of the most popular to watch include the following:

- United States: S&P 500

- Canada: TSX 60

- London: FTSE 100

- Australia: ASX 100

- India: The Nifty Fifty

These indexes represent the most stable companies. A portfolio of large-cap stocks with diversification across business sectors typically mimics the movement of these indexes.

Daily charts look different depending on the company’s market capitalization. Liquidity, the ability to get in and out of the market fast, also is impacted by a stock’s capitalization. The following sections take a look at the differences based on capitalization and liquidity.

Large-cap and high liquidity

Apple Inc. trades around 20 million to 30 million shares a day at $130/share. That means more than $2.6 billion moves every day in Apple shares. With that huge trading volume, the price moves smoothly by pennies each way throughout the day for the most part. Stocks that have high trading volumes are considered highly liquid. This liquidity is very important for large funds when they want to increase or reduce the size of their position by thousands of shares. The shares can still move up or down a lot in a day, but there are active buyers and sellers willing to own or sell at every penny move in each direction. This makes the stock more stable.

Figure 8-13 has the volume traded per day shown on the bottom of the daily chart. The higher the bar is at the bottom, the greater the volume.

Chart courtesy of StockCharts.com

FIGURE 8-13: High liquidity share volume.

Small-cap and low liquidity

If you pick a small-cap company like Handy and Harman (HNH), as shown in Figure 8-14, you see that it broke out to a new high in 2017. HNH trades an average of 17,000 shares a day. It is very difficult for an institution to accumulate enough shares to influence its large portfolio positively. Conversely, when it wants to sell the stock, there are very few buyers for the number of shares it wants to sell.

Chart courtesy of StockCharts.com

FIGURE 8-14: Low liquidity share volume.

While the price of the stock may move to new one-year highs, it is not nearly as liquid as Apple Inc. Large-cap, liquid stocks get large institutional investors buying large positions when they break to new highs. This is rarely true for small-cap companies.

Figure 8-14 shows the daily chart for Handy and Harman with relatively big volume as it moves to new highs, but the actual number of shares is still very small. For the first half of the month of May 2017, the stock traded less than 10,000 shares with no price movement for weeks. In February, it moved from a January 31 intraday high of $29.85 to $21.90. While the stock was dropping about 30 percent in three weeks, there was little to no buying interest.

This is the trademark of no liquidity. You are stuck holding the stock while it plummets. Handy and Harman may be a great company as it is breaking out to new highs later in the year. However, it will be hard to make money on the stock due to the lack of liquidity when you want to sell. If you can own a percentage of the daily float easily, it is probably worth avoiding. This is the type of stock a friend gives you a tip to buy. All stocks are easy to buy; they are harder to sell when you want to.

Embracing Short-Term Thinking with 60-Minute Charts

When you’ve made the decision to buy a stock, your next step is to look for the best entry point. Conversely, if you want to sell, you also want to look for the best exit point. Sixty-minute charts can make the decision easier for you. Volume is a key factor in these charts.

Highlighting intraday price action

The majority of the trading volume happens in the first 1.5 hours of the day and the last hour. The two highest-volume time slots for buying and selling during the day are also at the most important time frames for bar and candlestick charts, near the open and the close. The volume is not consistent throughout the day, and this trend is quite obvious on 60-minute charts (like the one in Figure 8-15).

Chart courtesy of StockCharts.com

FIGURE 8-15: Intraday price and volume.

Some other clues can show up on 60-minute charts. While it is not always obvious, the market may open down slightly during strong uptrends but end up closing higher. On a 60-minute chart, the opening would start below the previous close. This typically shakes unfamiliar traders who may be worried they are going to lose their gains. Stocks ebb and flow. They get momentum to go higher, and then they pull back slightly. It is important to understand this give-and-take during uptrends.

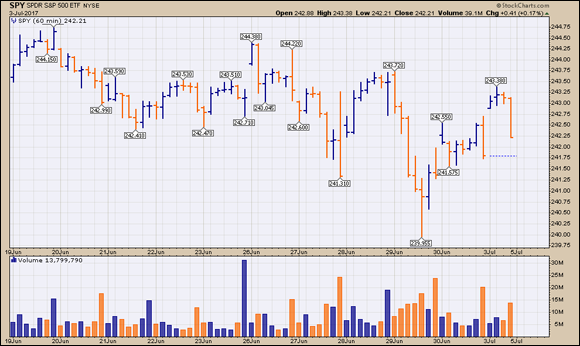

Using 60-minute charts for index watching

News events throughout the day may make stocks wobble on an intraday chart. One display we like to use is a 60-minute chart of a market index or ETF so we can see how the large-cap index has moved over the last two weeks.

Figure 8-16 shows one such chart using the ETF that tracks large-cap stocks, the SPY. Using a range setting of 11 days with 60-minute bars, you can see that the market is making a series of lower highs and lower lows during late June 2017. Seeing where the market is relative to the preceding two weeks is helpful. In Figure 8-16, each time the SPY rallies, it is unable to make a high above the previous high. It is also making lower lows. If the trend starts to change to higher highs and higher lows, like in Figure 8-15, investors can see the price momentum start to improve throughout the trading days.

Chart courtesy of StockCharts.com

FIGURE 8-16: Eleven-day, 60-minute chart.

If you want to be a short-term trader, you need to use short-term charts. A smart practice is to look at the daily chart to see the main short-term trend, and then look at the 60-minute chart to help you with entries into or exits out of the stock. If the daily chart is falling and the 60-minute chart is weak, you may need to wait until the trend on the larger period (daily) is improving. A pullback within an uptrend is the best combination to help on your entry. Trading results on 60-minute charts improve greatly if you’re trading with the main trend on the daily chart.

It is hard to hold a winning stock for months to capture a big gain by looking at short-term 60-minute charts. Short-term charts are helpful only for short trades.

Seeing the Big Picture with Weekly Charts

Weekly charts are hidden gems for chartists. Understanding weekly charts is the best way to stay on the right side of longer trends.

Weekly bar charts

The daily chart of Nike (NKE) in Figure 8-10 earlier in this chapter looks a lot cleaner if we convert the daily bars to weekly bars. Figure 8-17 shows the same range setting on the chart with weekly bars instead. The legend in the top left corner highlights the period for the chart. With nine years of information on it, the chart is cleaner because one weekly price bar represents five daily bars. By removing 80 percent of the price bars, the chart is better. However, it is still very compressed.

Chart courtesy of StockCharts.com

FIGURE 8-17: A weekly bar chart.

The breakout above the $15 price line is easy to see on the weekly chart as well. It is not quite as easy to see the detail in price. This chart stops at 2016 to focus on the long historical trend rather than later price action.

Weekly line charts

Switching to a line chart improves the nine-year chart a little bit more. We have used a thick line chart in Figure 8-18. The color coding for up and down is not that valuable on historical chart analysis. Weekly analysis suggests looking at the general trend. Notice that as we drop detail from the chart, the number of meaningful price reversals also drops, as annotated by the price labels.

Chart courtesy of StockCharts.com

FIGURE 8-18: A weekly line chart.

The big benefits of weekly analysis

For investors trying to capture a longer trend, the weekly charts keep the big picture in perspective. Daily charts and 60-minute charts (both covered earlier in this chapter) give short-term chart signals that a longer-term investor would prefer to hold through due to a larger uptrend. Each year the market has some sort of a pullback. Investors trying to hold their positions may find weekly charts can help them hold through periods of weakness or consolidation.

Looking at the weekly chart to start with can help establish a directional bias. Knowing the larger trend before looking at the daily chart can provide a strong ballast.

Institutional investment houses use monthly and weekly charts to help stay with long-term trends. If the large institutions are holding through short-term pullbacks, it’s probably wise for you to hold everything, too. By using the weekly charts, there is a major advantage to riding the trends longer with the support of institutions.

One of the difficulties of short-term trading is the constant tax payment on profits, reducing your working capital. If you can keep your money invested longer, like Warren Buffett, the entire amount will continue to build wealth rather than the after-tax portion. This subtle change is quite important.

Knowing When a Monthly Chart Can Come in Handy

Typically, monthly charts are underappreciated. Monthly charts are not usually a key component for individual investors. However, monthly charts are the anchoring charts for institutional investors. For this reason alone, keeping track of the monthly chart is helpful.

Recognizing major long-term lows and highs

By providing long-term awareness, monthly charts allow you to analyze major historical highs and lows. Figure 8-19 shows a chart of Natural Gas prices reaching monthly long-term lows in 2016 that fell to the same lows back in 1999.

Chart courtesy of StockCharts.com

FIGURE 8-19: Monthly long-term lows.

In 2016 a lot of commodity prices dropped to long-term lows. Long-term investors aware of where each commodity had bottomed before made significant gains in many different commodity-related trades. By seeing where the long-term support was on Natural Gas in Figure 8-19, they started buying Natural Gas futures contracts or Natural Gas–related exploration companies near the lows. The gains in some of the exploration companies were 150 percent from February to December 2016.

Analyzing investor behavior

To continue the story of NKE, by looking through a monthly candlestick chart, you can see that Nike does not have a lot of major down months. That information is hard to capture from the daily or weekly charts. We have extended the Nike monthly chart to July 2017 in Figure 8-20. In July 2017, NKE looks like it is ready to turn higher as it makes new one-year highs.

Chart courtesy of StockCharts.com

FIGURE 8-20: A monthly candlestick chart.

Using stock charts for investing is about improving the timing of investing to participate in major gains. This may not work out on every trade. NKE is a very strong chart, rising from bottom left to top right, and it has built an 18-month consolidation.

With the new one-year highs, the chart is signaling that it is ready to move higher. It could easily ramp up and make a sustained run to significantly higher highs. While it may not work out as a trade, being aware of major setups like this on institutional-size market-cap companies definitely improves your odds for finding strong stocks.

Picking the Right Chart for the Right Range

If an institutional investor likes the monthly setup and a hedge fund likes the weekly setup, they will both be interested in a stock. Investors trading the daily and intraday time frames are also tuning in and may find some compelling short-term signals. This merging of signals across various types of investors is very helpful. You can use this to your advantage.

Other key multiple periods to watch include the following:

- To trade a 10-minute chart, use a 60-minute chart for confirmation. There are six periods of 10 minutes in a 60-minute chart.

- To trade from 60-minute charts, use a daily chart for perspective. There are 6.5 periods of 60-minutes each in a daily chart (9:30–10 a.m. is 0.5 hours).

- To trade daily charts, use weekly charts for the trend. There are five daily periods in a weekly chart.

- To trade weekly charts, use monthly charts. There are 4.3 weeks per month.

Shifting Your Focus to Closing Prices

Earlier in this chapter, we examine Amazon on different period charts. The information is the same for Amazon’s daily closing highs on all daily charts. The monthly and weekly closing highs are probably different from those shown on the daily charts.

There are a lot of crosscurrents just discussing a new high for different periods. For Amazon in June 2017:

- May 30, 2017, is the highest monthly close at $994.62.

- The June 30 monthly close at $968 is not higher than May’s monthly close, but daily new highs were recorded in June.

- Monday, June 5, shows the highest daily close at $1,011.34

- Friday, June 2, shows the highest weekly close at $1,006.73

- The highest intraday price is the same on all period charts at $1,017.00.

Each chart period has a different closing high. We prefer to use daily closing highs rather than an intraday high. They are all different but correct.

The biggest advantage charts give you is the view from the perspective of buyers and sellers. The most important opinion on the direction of the stock can be seen in the actions taken by buyers and sellers with money invested in the stock. Charts can help you see what the collective group of owners think about the stock relative to what they were thinking a few months ago. If they are bidding up the price daily, they aggressively want to own the stock. If the price has been falling for months, the investor mood of optimism is declining.

A share of stock is worth what the next person is willing to pay for it. The underlying value of the company is based on variables such as growth prospects, stability of cash flow, ability to raise prices, debt, market dominance, new products, earnings growth, industry group, and access to markets, which all affect how different investors view the company. Because the markets have many participants, there is no single right way to value a stock. Here are some signals to look for in your charts:

- The closing price each day is an important price. Whoever owns the stock is willing to hold it overnight. Holding it over a weekend is a bigger commitment. Holding it for years is a solid commitment.

For some reason, stocks seem to drop more often in the morning during an uptrend, and then rally up for the rest of the day. During a downtrend, stocks rally in the morning only to lose investor interest before the close, and the stock sells below the open. While this trend is hard to prove on every stock, you may find it helps you avoid selling into a morning pullback in a strong uptrending market.

Pay attention to the closing price of the day and the week. It is very difficult to get out at the top and very difficult to get in at the bottom. Intraday prices can be very difficult to watch. Sometimes the price will break out to new highs during the day but close the day slightly down. Closing above the breakout level and holding the breakout level for two to three days is an important signal.

Pay attention to the closing price of the day and the week. It is very difficult to get out at the top and very difficult to get in at the bottom. Intraday prices can be very difficult to watch. Sometimes the price will break out to new highs during the day but close the day slightly down. Closing above the breakout level and holding the breakout level for two to three days is an important signal.The concept of watching the price action to understand what is going on with the investors in a stock is more helpful than watching the news about a stock. When we wouldn’t touch a stock because of the news around it, Warren Buffett was buying it. Price speaks louder than words.

By looking at the daily price of the stock, you can see the mood changing over the near term. There are great companies you may have never heard of, but if the price of the stock is steadily rising on a daily chart, the investors are choosing to own the stock. Charting the stock price tells you the sentiment of the investors, not the sentiment of the president of the company.

By looking at the daily price of the stock, you can see the mood changing over the near term. There are great companies you may have never heard of, but if the price of the stock is steadily rising on a daily chart, the investors are choosing to own the stock. Charting the stock price tells you the sentiment of the investors, not the sentiment of the president of the company.

Charting one-minute candles during the day and putting money into the market based on these candles is particularly stressful trading that requires a precise strategy and discipline. The period is so short that it is called day-trading. This book is not designed for day-trading chart analysis.

Charting one-minute candles during the day and putting money into the market based on these candles is particularly stressful trading that requires a precise strategy and discipline. The period is so short that it is called day-trading. This book is not designed for day-trading chart analysis.