In This Chapter

Using the Investment Savings Calculator

Using the Loan Calculator

Using the Refinance Calculator

Using the Retirement Calculator

Using the College Calculator

Estimating your income taxes

Doing other financial-planning stuff

The folks at Intuit provide several nifty little calculators (most are dialog boxes) with Quicken. I strongly encourage you to use these tools. At the very least, the calculators should make your work easier. And if you invest a little time, you should gain some enormously valuable perspectives on your financial affairs.

What's more, the most recent versions of some flavors of Quicken include a handful of more powerful financial planning wizards that I want you to know about. I won't walk you through the steps to using these wizards. But I do want to preview them in the same way that a restaurant critic tells you what you should and shouldn't order at some nice restaurant. You know what I mean. "Darling, you absolutely must try the foie gras, but do stay away from the chocolate mousse. It's abominable...."

My favorite Quicken calculator is the Investment Savings Calculator. I guess I just like to forecast portfolio future values and other similar stuff.

Suppose that you want to know how much you'll accumulate if you save $4,000 per year for 35 years in a stock mutual fund that you anticipate will earn 10 percent annually. Use the Investment Savings Calculator to estimate how much you should ultimately accumulate. To use it, follow these steps:

Display the Savings Calculator.

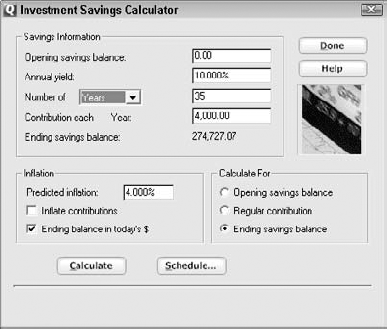

Click the Planning tab to display its buttons. Click the Financial Calculators button to display its list of calculators, and choose the Savings Calculator. Quicken displays the Investment Savings Calculator dialog box (see Figure 10-1).

Enter what you've accumulated as your Opening Savings Balance.

Move the cursor to the Opening Savings Balance text box and then type the amount of your current investments. If this amount is zero, for example, type 0.

Enter the Annual Yield that you expect your investments to earn.

Move the cursor to the Annual Yield text box and type the percent. If you plan to invest in the stock market and expect your savings to match the market's usual return of about 10 percent, for example, type 10 (don't type .10).

Indicate how long you plan to let your investments earn income.

Move the cursor to the Number Of drop-down list box and select the time period appropriate to your investment planning. (Usually, you'll select Years, as Figure 10-1 shows.) Then move the cursor to the Number Of text box and indicate how long (enter the number of time periods) you want to maintain these investments. For example, if you select Years in the drop-down list box and you plan to let your investments grow for 35 years, you type 35.

Enter the amount you plan to add to your investments every period.

Move the cursor to the Contribution Each text box and type the amount you plan to add. Figure 10-1 shows how to calculate an individual retirement (IRA's) future value, assuming a $4,000 annual contribution.

Enter the anticipated inflation rate.

Move the cursor to the Predicted Inflation text box and type the inflation rate. By the way, over the 20th century, the inflation rate averaged just over 3 percent.

Indicate whether you plan to increase your annual contribution as a result of inflation.

Select the Inflate Contributions check box if you plan to annually increase — by the annual inflation rate — the amount you add to your investment portfolio. Don't select the check box if you don't want to inflate the payments.

After you enter all the information, click Calculate.

The Ending Savings Balance field shows how much you'll accumulate in present-day, uninflated dollars: $274,727.07. Hmmm. Sweet.

If you want to know the amount you'll accumulate in future-day, inflated dollars, deselect the Ending Balance In Today's $ check box.

To get more information on the annual deposits, balances, and so on, click the Schedule button, which appears at the bottom of the Investment Savings Calculator dialog box. Quicken whips up a quick little report showing the annual deposits and ending balance for each year you plan to add into the savings. Try it. You may like it.

So you want to be a millionaire some day.

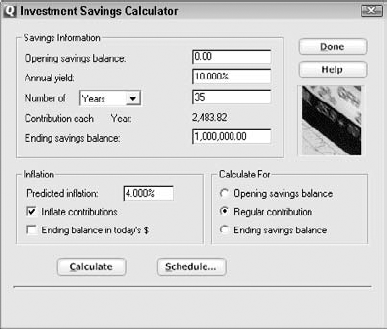

To find out how to realize this childhood dream, use the Calculate For option buttons, which appear in the Investment Savings Calculator dialog box (refer to Figure 10-1). With these option buttons, you click the financial variable (Opening Savings Balance, Regular Contribution, or Ending Savings Balance) you want to calculate. For example, to determine the annual amount you need to contribute to your investment so that your portfolio reaches $1,000,000, here's what you do:

Select the Regular Contribution option button.

Select the Inflate Contributions check box.

Deselect the Ending Balance In Today's $ check box.

Enter all the other input variables.

Remember to set the Ending Savings Balance text box to 1000000 (the Ending Savings Balance field becomes a text box after you select the Regular Contribution option).

The Investment Savings Calculator computes how much you need to save annually to hit your $1,000,000 target.

Starting from scratch, it'll take 35 years of roughly $2,500-per-year payments to reach $1,000,000.00, as shown in Figure 10-2. (All those zeros look rather nice, don't they?) Note that this calculation assumes a 10 percent annual yield.

"Jeepers, creepers," you say. "This seems too darn good to be true, Steve."

Well, unfortunately, the calculation is a little misleading. With 4 percent inflation, your million bucks will be worth only $253,415.55 in current-day dollars. (To confirm this present value calculation, select the Ending Savings Balance option button and then the Ending Balance In Today's $ check box.)

Note

Tip

One of my pet ideas is that it really is possible for most people to become millionaires. There are just three tricks to doing so. First, make sure that you use tax-advantaged investments like 401(k) plans and IRAs. Second, invest this money into an index stock mutual fund like the Vanguard Total Stock Market Portfolio to make sure that, over time, your returns average out to the average. Third, use Quicken and your computer to make smarter financial decisions — by doing this, you can rather easily free up an extra $50, $100, or even $200 per month. I talk about this subject in Chapter 18.

To help you better manage your debts, Quicken provides a neat Loan Calculator that computes loan payments and balances.

Suppose that one afternoon, you're wondering what the mortgage payment is on one of those monstrous houses: tens of thousands of square feet, acres of grounds, cottages for the domestic help, and so on. You get the picture — something that's a really vulgar display of wealth.

To calculate what you would pay on a 30-year, $5,000,000 mortgage if the money costs 6 percent, use the Loan Calculator:

Display the Loan Calculator.

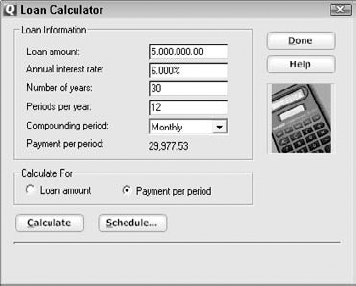

Click the Planning tab. Click the Financials Calculators button to display Quicken's list of financial calculator tools. Then choose the Loan Calculator. Quicken displays the Loan Calculator dialog box. (See Figure 10-3 for a picture of this handy tool.)

Enter the loan amount.

Move the cursor to the Loan Amount text box and type the amount of the loan. (If you're checking the lifestyle of the ostentatious and vulgar, type 5,000,000.)

Enter the annual interest rate.

Move the cursor to the Annual Interest Rate text box and type the interest rate percent. If a loan charges 6 percent interest, for example, type 6.

Enter the number of years you want to take to repay the loan.

Move the cursor to the Number Of Years text box and type the number of years you plan to make payments.

Indicate how many loan payments you plan to make per year.

Move the cursor to the Periods Per Year text box and type the number of loan payments you plan to make per year. If you want to make monthly payments, for example, type 12.

Indicate how frequently the lender will calculate, or compound, interest.

Move the cursor to the Compounding Period box and select the interest compounding period. If a loan uses monthly compounding, for example, select Monthly. (By the way, just so you know, most loans use compounding periods equal to the payment period. Some don't. But most do.)

If you click Calculate or move the selection cursor, Quicken calculates the loan payment and displays the amount in the Payment Per Period field. Hey, wait. $29,977.53. That doesn't seem so bad, does it? I mean, you could almost make an annual — oh, never mind. That's a monthly payment, isn't it? Yikes!

I guess if you have to ask how much the mortgage payment is, you really can't afford it.

To get more information on the loan payments, interest and principal portions of payments, and outstanding loan balances, click the Schedule button, which appears on the face of the Loan Calculator dialog box. Quicken whips up a quick loan amortization schedule showing all this stuff.

To calculate the loan principal amount, select the Loan Amount option button under Calculate For in the Loan Calculator dialog box. Then enter all the other variables.

For example, those $29,977.53-per-month payments for the monster mansion seem a little ridiculous. So calculate how much you can borrow if you make $2,000-per-month payments over 30 years and the annual interest rate is 6 percent:

Select the Loan Amount option button.

Type 6 in the Annual Interest Rate text box.

Type 30 in the Number Of Years text box.

Type 12 in the Periods Per Year text box.

Type 2000 in the Payment Per Period text box.

After you click the Calculator button or move the selection cursor, the Loan Calculator computes a loan amount of $333,583.23, as shown in Figure 10-4.

You won't read about the Refinance Calculator here — but not because I'm lazy. Believe it or not, I enjoy writing about things that help you make better financial decisions. The Refinance Calculator merely calculates the difference in mortgage payments if you make new, lower payments; then it tells you how long it would take the savings from these lower payments to pay back the refinancing costs you incur.

For example, if you save $50 per month because you refinance and it costs $500 to refinance, the Refinance Calculator tells you that it would take ten months of $50-per-month savings to recoup your $500.

You know what? Although you may want to know how long it would take to recoup the refinance costs, that information doesn't tell you whether refinancing is a good idea. Deciding whether to refinance is very, very complicated. You can't just look at your next few payments, like the Refinance Calculator does. You also need to look at the total interest you would pay with the old mortgage and the new mortgage.

I can't think of any good reason to use the Refinance Calculator; it just doesn't do what it purports to do.

So that I don't leave you hanging, however, let me give you two general rules to help you make smarter refinancing decisions:

Tip

First, if you want to save interest costs, don't use refinancing as a way to stretch out your borrowing. That is, if you refinance, make sure that you make payments large enough to pay off the new mortgage by the same time you would have paid off the old mortgage. In other words, if you have 23 years left on your old mortgage, don't go out and get a 30-year mortgage. Find a lender who will let you pay off the new mortgage in 23 years.

Here's a second trick, if you can find a willing lender. Ask the lender to calculate the annual percentage rate (APR) on the new mortgage, assuming that you'll pay off the mortgage by the same time you would have paid off the old mortgage. (An APR includes all the loan's costs — interest, points, miscellaneous fees, and so on — and calculates an implicit interest rate.) If the APR on the new loan is lower than the current loan's interest rate, refinancing would probably save you money.

Warning

Let me issue one caveat. When you base your refinancing decision on the comparison between the new loan's APR and the current loan's interest rate, you assume that you'll live in your current house until the mortgage is paid.

I hope this information helps. As I said, mortgage-refinancing decisions are tough if you truly want to save money.

I think that this section is the most important one in this book. No joke. Your financial future is much too consequential to go for easy laughs or cheap shots.

By the time the 30-something and 40-something crowd reaches retirement, Social Security coverage almost certainly will be scaled back.

But the problem isn't just Social Security. More and more often, employer-provided pension plans are defined contribution plans, which add specific amounts to your pension (such as 2 percent of your salary), rather than defined benefit plans, which promise specific pension amounts (such as $1,000 per month). As a result, although you know that someone will throw a few grand into your account every so often, you don't know how much you'll have when you retire.

So what does all this mean? In a nutshell, you need to think about your retirement now. Fortunately, the Quicken Retirement Calculator can help you.

Note

Imagine that you decide to jump into your employer's 401(k) thing (a type of profit-sharing plan), and that it allows you to plop $6,000 into a retirement account that you think will earn about 9 percent annually.

Fortunately, you don't need to be a rocket scientist to figure this stuff out. You can just use the Retirement Calculator:

Display the Retirement Calculator.

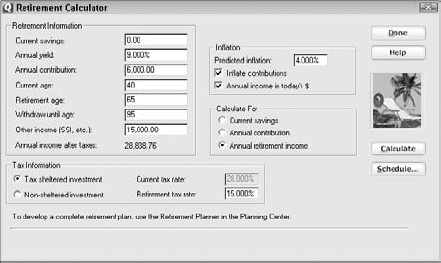

Click the Planning tab. Click the Financial Calculators button. Choose the Retirement Savings command. Quicken displays the Retirement Calculator dialog box, shown in Figure 10-5.

Enter what you've already saved as your current savings.

Move the cursor to the Current Savings text box and type your current retirement savings: for example, if you have some IRA money or you've accumulated a balance in an employer-sponsored 401(k) account. Don't worry if you don't have anything saved — most people don't.

Enter the annual yield that you expect your retirement savings to earn.

Move the cursor to the Annual Yield text box and type the percent. In the little example shown in Figure 10-5, I say the annual yield is 9 percent. This is, I'll remind you, about the average return that the stock market produces over long periods of time.

Warning

You can use the long-term return the stock market delivers as your expected yield if you're taking a do-it-yourself approach, investing in a diversified portfolio of stocks (such as through mutual funds), and you're really watching your investment expenses — such as would be the case if you're using low-cost index funds to keep costs low. If you're working with a financial planner that charges you, say, 1 percent a year, obviously, your return will be 1 percent less in effect. Also, if you're investing some of your money into lower-risk investments like bonds, that approach, although perhaps very prudent, will also reduce your annual yield.

Enter the annual amount added to your retirement savings.

Move the cursor to the Annual Contribution text box and type the amount that you or your employer will add to your retirement savings at the end of each year. In the example, I say that I plan to add $6,000 (refer to Figure 10-5).

Enter your current age.

Move the cursor to the Current Age text box and type a number. You're on your own here, but let me suggest that this is a time to be honest.

Enter your retirement age.

Move the cursor to the Retirement Age text box and type a number. Again, this is purely a personal matter. (Figure 10-5 shows this age as 65, but you should retire when you want.)

Enter the age to which you want to continue withdrawals.

Move the cursor to the Withdraw Until Age field and type a number. I don't want to beat around the bush here. This number is how old you think you'll be when you die. I don't like the idea any better than you do. Let me say, though, that ideally you want to run out of steam — there, that's a safe metaphor — before you run out of money. So go ahead and make this age something pretty old — like 95.

Enter any other income you'll receive — such as Social Security.

Move the cursor to the Other Income (SSI, etc.) text box and type a value. (Figure 10-5 shows $15,000.) Note that this income is in current-day, or uninflated, dollars. By the way, you can request an estimate of your future Social Security benefits (this is the PEBS statement I talk about in the "The truth about Social Security" sidebar in this chapter) by visiting the Social Security Administration (SSA) Web site at

www.ssa.govor by contacting your local SSA office. Also, note that if you haven't received a benefits estimate already, the SSA is actually supposed to send every worker an estimate of his or her future benefits.Indicate whether you plan to save retirement money in a tax-sheltered investment.

Select the Tax Sheltered Investment option button if your retirement savings earns untaxed money. Select the Non-Sheltered Investment option button if the money is taxed. Tax-sheltered investments are such things as IRAs, annuities, and employer-sponsored 401(k)s and 403(b)s. A 403(b) is kind of a profit-sharing plan for a nonprofit agency.

Tip

As a practical matter, tax-sheltered investments are the only way to ride. By deferring income taxes on your earnings, you earn interest on the money you otherwise would have paid as income tax.

Enter your current marginal tax rate, if needed.

If you're investing in taxable stuff, move the cursor to the Current Tax Rate text box. Then type the combined federal and state income tax rate that you pay on your last dollars of income.

Enter your anticipated retirement tax rate.

Move the cursor to the Retirement Tax Rate text box, and then ... hey, wait a minute. Who knows what the rates will be next year, let alone when you retire? I think that you should type 0, but remember that the Annual Income After Taxes is really your pretax income (just as your current salary is really your pretax income).

Enter the anticipated inflation rate.

Move the cursor to the Predicted Inflation text box and type the inflation rate. By the way, in recent history, the inflation rate has averaged just above 3 percent (refer to Figure 10-5).

Indicate whether the annual additions will increase.

Select the Inflate Contributions check box if the additions will increase annually by the inflation rate. (Because your salary and 401(k) contributions will presumably inflate if there's inflation, Figure 10-5 shows the Inflate Contributions check box selected.)

After you enter all the information, click Calculate and take a peek at the Annual Income After Taxes field.

Figure 10-5, for example, shows $28,838.76. Not bad really. If you want to see the after-tax income in future-day, inflated dollars, deselect the Annual Income In Today's $ check box but leave the Inflate Contributions check box checked.

To get more information on the annual deposits, balances, income, and so on, click the Schedule button, which appears on the face of the Retirement Calculator dialog box. Quicken whips up a quick little report showing the annual deposits, income, and ending retirement account balances for each year you plan to add to and withdraw from your retirement savings.

First, don't feel depressed. At least you know now if your golden years seem a little tarnished. After all, you acquired Quicken to help you sort out your finances. Now you can use Quicken and your newly gained knowledge to help improve your financial lot.

Basically, retirement planning depends on just three things:

The number of years that the retirement savings will accrue interest

The real yield (that is, adjusted for inflation) you earn — in other words, the annual yield minus the predicted inflation

The yearly payments

Anything you do to increase one of these variables increases your retirement income.

If you invest, for example, in something that delivers higher real yields, such as the stock market, you should see a big difference. (Of course, you usually bear more risk.) Or if you wait an extra year or two to retire, you wind up making more annual payments and earning more interest. Finally, if you boost the yearly payments (for example, by participating in an employer-sponsored 401(k) or 403(b) plan, where your employer matches a portion of your contribution), you'll see a huge change.

Noodle around with the variables. See what happens. You may be surprised.

Use the Calculate For option buttons in the Retirement Calculator (refer to Figure 10-5) to determine a retirement income variable. You can calculate current savings, annual contribution, or, as I describe earlier in the section, "Retirement planning calculations," the annual after-tax income.

To calculate the yearly payment required to produce a specific level of retirement income, for example, select the Annual Contribution option button. Then enter all the other variables — including the desired after-tax income — and click Calculate. The Retirement Calculator figures how much you need to save to hit your target retirement income.

Ouch. I have a couple of daughters, so I know how you feel. Man, oh, man, do I know how you feel.

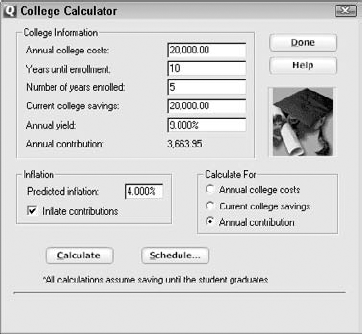

Suppose that you have a child who may attend college in ten years, and you haven't started to save yet. If the local university costs $20,000 per year and you can earn 9 percent annually, how much should you save?

The College Calculator works like the Retirement Calculator:

Display the College Calculator.

Click the Planning tab. Click the Financial Calculators button. Choose the College Savings command. Quicken displays the College Calculator dialog box, shown in Figure 10-6.

Enter the annual college costs.

Move the cursor to the Annual College Costs text box. Then type the current annual costs at a school Junior may attend. Figure 10-6 shows this amount as $20,000.

Enter the number of years until enrollment.

Move the cursor to the Years Until Enrollment text box and type a number. For example, if Junior will start college in 10 years, type 10.

Enter the number of years enrolled.

Move the cursor to the Number Of Years Enrolled text box and type a number. Assuming that Junior doesn't fool around, type 4 or 5.

Enter the amount of the current college savings.

Move the cursor to the Current College Savings field and type an amount. Figure 10-6 shows this amount as $20,000. Perhaps Grandpa has really come through for little Junior on this.

Enter the annual yield that you expect the college savings to earn.

Move the cursor to the Annual Yield text box and type the percent. Figure 10-6 shows the yield as 9 percent.

Enter the inflation rate anticipated in college tuition.

Move the cursor to the Predicted Inflation text box and type the inflation rate percent. Figure 10-6 shows this rate as 4 percent.

Indicate whether you plan to increase your annual contribution as a result of inflation.

Select the Inflate Contributions check box if you plan to annually increase — by the annual inflation rate — the amount you save. Figure 10-6 shows this check box selected.

After you enter all the information, click Calculate or move the selection cursor. The Annual Contribution field shows how much you need to save each year until the child graduates from college.

Just to beat this thing to death, Figure 10-6 shows that the lucky student will attend five years at a college that currently costs $20,000 per year and that you expect to earn 9 percent annually and anticipate 4 percent annual inflation. Given these cold hard facts, you need to start saving $3,663.95 every year.

Tip

Because I'm a CPA, I want to offer you a quick tax-planning tip. If you do embark on a serious college savings program for a child or grandchild, take a look at the Sec. 529 college savings plans that are offered by most banks, brokers, and mutual fund companies. With a Sec. 529 plan, neither you nor the future college student gets taxed on the interest the college savings earn as long as the money is ultimately used for college expenses.

To get more information on the annual deposits, tuition, and balance, click the Schedule button, which appears on the face of the College Calculator dialog box. Quicken whips up a quick little report showing the annual deposits, tuition, and ending college savings account balances for each year you add to, and Junior withdraws from, the college savings money.

Look at the positive side: You now understand the size of the problem and the solution.

College planning depends on four things:

College costs

The number of years that the savings earn interest

The real yield (that is, adjusted for inflation) you earn — in other words, the annual yield minus the predicted inflation

The yearly payments

I don't mean to sound like a simpleton, but you can successfully save for a college education in three basic ways:

Reduce the costs (find a less expensive school)

Invest in things that deliver higher yields

Boost the yearly payments

Use the Calculate For option buttons (refer to Figure 10-6) to compute a specific financial variable. Select the variable you want to calculate and then input the other values. The College Calculator computes the flagged variable.

Tip

Finding a less expensive school isn't necessarily the same thing as looking for the cheapest tuition fees. Another huge factor these days is whether a program takes four years or five years to complete. A cheap-tuition school that requires five years may be more expensive than, say, a good private school that gets a student out — and working — in four years.

Quicken also comes with a very powerful, very useful Tax Planner. The Tax Planner helps you make a precise estimate of the taxes that you'll owe. To use the Tax Planner, take the following steps:

Display the Tax Planner.

Click the Planning tab. Click the Tax Tools button. Choose the Tax Planner command. Quicken displays the Tax Planner window. To move past the introductory information, click Let's Get Started and then click Next. Quicken shows the second page (see Figure 10-7).

Note: Quicken may display a dialog box that asks whether you want to learn how TurboTax can help with year-round tax planning. Click No if you see this message. You have my help.

Verify the tax year and filing status.

In the upper-left corner of the Tax Planner window, notice that the tax year (labeled Year) and the filing status (labeled Status) appear. These are probably correct. Quicken can guess the year by looking at your computer's clock. It determines your filing status based on information that you supply when you set up Quicken. But if one of these bits of information is wrong, click the Year or Status hyperlink. The hyperlinks are those bits of text along the left edge of the Tax Planner window. Quicken displays the Tax Planner Options text boxes, which let you specify the Tax Year and the Filing Status and choose a Scenario.

Note: A Scenario is just a set of income tax inputs. You may have only one Scenario. Or you may have several Scenarios based on different guesses about your income and deductions.

Enter the wages and salaries that you and your lovely or handsome spouse expect.

Click the Wages hyperlink. Then, when Quicken displays the Wages text boxes, type your wages and, if you're married, those of your spouse. Quicken totals your wages and then makes a first rough calculation of the amount you'll owe in taxes. Of course, Quicken needs to collect some more data before this number is accurate, so don't freak out yet.

Tip

You can move to the next set of input text boxes by clicking the Next hyperlink and to the previous window of input text boxes by clicking the Previous hyperlink. The Next and Previous hyperlinks appear near the bottom of the Tax Planner window. (You may have to scroll down to see them on your computer.)

Enter the other income you'll have from interest, dividends, capital gains, and so on.

To record the other income that you'll need to pay taxes on, click the Interest/Dividend Inc, Business Income, Capital Gains, and Other Income hyperlinks and provide the information that Quicken requests. Some of these numbers are pretty easy to guess. Some of them aren't. You can also look at last year's tax return or at the year-to-date information you've already collected by using Quicken.

Identify any adjustments to your gross income.

Click the Adjustments hyperlink and then, using the Adjustments to Income text boxes, identify or estimate any adjustments to gross income that you'll have. Most people make only one adjustment — contributions to a deductible IRA. Self-employed individuals, however, also typically have several other adjustments, including half of their self-employment tax (which Quicken automatically calculates and enters), a portion of any health insurance paid, and Keogh and SEP pension contributions.

Estimate your itemized deductions.

Click the Deductions hyperlink and then use the Standard and Itemized Deductions text boxes to estimate your deductions for expenses, such as state and local taxes, mortgage interest, and charitable contributions. Alternatively, if you'll probably or possibly use the standard deduction, carefully check any of the boxes that Quicken uses to determine which standard deduction you should use.

Tell Quicken how many personal exemptions you'll claim.

Click the Exemptions hyperlink and then specify the number of dependents you'll claim on your return. The basic rule is that you get one exemption for every person in your family (you, your spouse if you're filing jointly, and your kids) as long as they live in your house. I should mention, however, that things become tricky if you have shirt-tail relatives (your Aunt Enid, for example) living at your house, if your kids live away from home or are married, or if some of the kids in the house have divorced parents. If you have questions because one of these situations sounds vaguely familiar, get the IRS preparation instructions and read the part about who is and is not a dependent.

Indicate whether you owe any other taxes or have tax credits you can use to reduce your taxes.

Click the Other Tax, Credits hyperlink and then use the Other Taxes & Credits text boxes to describe any of the federal taxes you'll pay in addition to the usual federal income tax. The other taxes, by the way, typically include just two taxes: self-employment tax (which is the tax that self-employed people pay in place of Social Security and Medicare tax) and, in special cases, the alternative minimum tax. A bunch of different tax credits exist. You can very possibly look at your prior years' returns to see if they apply (typically) in your situation.

Enter any estimated taxes you've paid or any federal income taxes your employer has withheld from your paycheck.

Click the Withholding hyperlink and use the Withholding text boxes to record how much money you've paid through withholding. Then click the Tax Payments hyperlink and use the Estimated Tax Payments text boxes to record how much you've paid in estimated tax payments and to guess how much you'll pay in the coming months.

Return to the Tax Planner Summary and review the Quicken program's calculations.

After you complete the preceding steps, click the Tax Planner Summary hyperlink and review the calculations that Quicken makes. Quicken estimates the total tax you'll pay (which is useful and interesting in itself), the estimated refund or payment you'll have to make, and one other particularly useful bit of information — your marginal income tax rate (which Quicken labels Marginal Rate). If you want to print a copy of the Tax Planner's information and calculations, click Print (in the upper-right corner of the window).

Tip

Knowing your marginal income tax rate enables you to make more precise investment calculations. For example, the Retirement Calculator — described earlier in the chapter in the section cleverly titled, "The Retirement Calculator" — uses your marginal income tax rate to make more precise calculations. You can also use the marginal income tax rate to calculate the after-tax return that taxable investments deliver. Simply multiply the taxable return by the factor (1 – marginal tax rate).

In the preceding pages of this chapter, I talk about the personal financial planning tools that are most useful. Before I wrap up my discussion, let me quickly mention that Quicken provides some other interesting and, for some people, useful tax and financial planning tools.

If you open the Tax Tools menu, for example, you'll notice Tax Category Audit, Deduction Finder, Itemized Deduction Finder, and Tax Withholding Estimator commands. These calculation tools walk you through specific tax accounting and planning projects — and may be helpful to some taxpayers.

If you open the Other Tools menu, you'll notice two commands: Cash Flow Forecast and Debt Reduction Planner. These two command wizards walk you through the steps to planning for your personal cash flows or working your way out from under your debts. In my opinion, most people won't be interested in taking the time to use the wizards. But if you're really serious or worried or compulsive about one of these topics, well, it just may be worth your time to explore a bit.