2

Direct Materials

LEARNING OBJECTIVES

After studying this chapter you should be able to:

Understand and explain direct materials and indirect materials.

Appraise the objectives of purchase department and responsibilities of purchase department.

Distinguish between centralized and decentralized purchasing.

Explain the various stages involved in purchase procedure.

Know the various documents used in purchase procedure, their specimens, their significance etc.

Ascertain direct material cost.

Understand the duties and functions of a store keeper.

Know the meaning of inventory control and apply the techniques of inventory control.

Fix various stock levels.

Understand the perpetual inventory system and the periodic inventory system and the differences between them.

Understand the significance of issue of materials.

Understand and apply the various methods used for the pricing of materials.

Account for material losses, such as scrap, waste, spoilage, defective work.

Explain the meaning of certain important terms used in this chapter.

In a manufacturing industry, material cost forms an important element of total costs. It is estimated that the investment in material constitutes up to 90% of total capital. The word ‘material’ generally represents raw material. Since material constitutes a major chunk of economic resources, a proper cost accounting system with respect to materials is indispensable for manufacturing industries. Raw material is the keystone of the cost of product. In this chapter all the aspects with respect to materials are discussed in detail.

2.1 DIRECT MATERIALS

Raw materials may be defined as goods purchased for incorporation into products for sale. Materials may be classified into (1) direct materials and (2) indirect materials.

2.1.1 Meaning of Direct Material and Its Constituents

The materials which are easily identifiable with the product are known as direct materials. Direct materials form part of finished product. Cost of direct material forms an important element of prime cost. It may be said otherwise as all such materials the costs of which can be conveniently measured and charged directly to the products. Generally, the following items are included in direct materials:

- All materials which have been purchased

- All materials which were issued from stores department for a specified order, job or process

- All materials which have been specially purchased for a specified order, job or process

- All materials which have been transferred from one process to another

- Materials used for primary packing

2.1.2 Indirect Materials

All those materials which cannot be classified under direct materials are called indirect materials. Direct materials having small values, quantities are also treated as indirect materials. Cost of indirect materials is to be treated as overhead. The segregation of materials into direct and indirect categories facilitates control. While direct materials having high value require strict control, indirect materials having low value need not require so.

2.2 PURCHASING FUNCTION

Purchasing of raw material for trading and manufacturing concerns is performed by the purchasing department under an official designated as purchase manager.

2.2.1 Objectives of Purchase Department

The following are the objectives of the purchase department:

- To purchase materials at the lowest cost

- To purchase quality materials

- To ensure that the materials are available on time

- To ensure continuity in supply of materials.

Following are the responsibilities of purchase department:

- To know about the sources from where materials are to be purchased and their lead time

- To act as a proper link between the suppliers and production department

- To be aware of the requirement of materials

- To have proper knowledge about their specifications

- To update continuously the price, availability, various available sources, competition, substitutes and the like factors

- To keep an updated supplier list duly rated

2.2.2 Methods of Purchasing

The management has to devote much attention to the task of purchases, failing which may lead to collapse of the entire edifice. The methods of purchasing may be broadly classified into: (1) centralized purchasing and (2) decentralized (localized) purchasing.

2.2.2.1 Centralized Purchasing

When purchasing department is located at only one place and the entire purchases are made by it, such purchasing is known as centralized purchasing. All purchases are made by a single unit for various manufacturing units of an organization.

Following are the advantages of centralized purchasing:

- Facilitates uniform procedure and policies to procure materials

- Advantages of bulk purchases

- Ensures standardization of materials

- Reduces cost of purchase

- Facilitates the task in case import

- Development of expertise in purchasing

- Reduces investment in inventories

- Exercises greater control

2.2.2.2 Decentralized Purchasing

If purchase department is situated at different places and is responsible for purchasing the materials for that manufacturing unit, such purchasing is known as decentralized purchasing. Each unit makes its own purchases.

Following are the advantages of decentralized purchasing

- Facilitates direct contact with suppliers

- Reduces time lag between indent and receipt of materials

- Leads to reduction in paper work

- Reduces operation cost

- Easy replacement of defective materials

Factors that determine the choice between centralized and decentralized purchasing are:

- Type of product (homogeneity)

- Type of material bought

- Location of plant

- Availability of expertise

- Availability of local suppliers

- Management policy

2.3 PURCHASE PROCEDURE

Each concern adopts its own procedure regarding purchase of materials. Forms and records may differ slightly but the procedure is the same which is explained as follows:

Stage I: |

Indenting for materials |

Stage II: |

Issuing tenders |

Stage III: |

Receiving quotations |

Stage IV: |

Placing order |

Stage V: |

Inspecting stores received |

Stage VI: |

Receiving the stores accepted in inspection |

Stage VII: |

Passing bills for payment |

Let us explain each stage in detail.

2.3.1 Stage I: Indenting for Materials

Actually the purchase procedure starts from the stores department. The stores department prepares indents for the purchase of materials and forwards the same to the purchase department. Indents may be classified into two categories: (1) regular indents and (2) special indents.

Regular indents: (i) These indents are meant for replenishment of stocks. (ii) Regular indents are prepared periodically. (iii) They are placed when the ordering level for various items of stocks are reached. (iv) They must be certified by the stores department.

Special indents: (i) Special indents are meant for a special job. (ii) They are prepared only when necessity arises. (iii) Special indents are based on the demands received from respective departments (planning or production). (iv) These indents are to be certified by the department from where it gets originated.

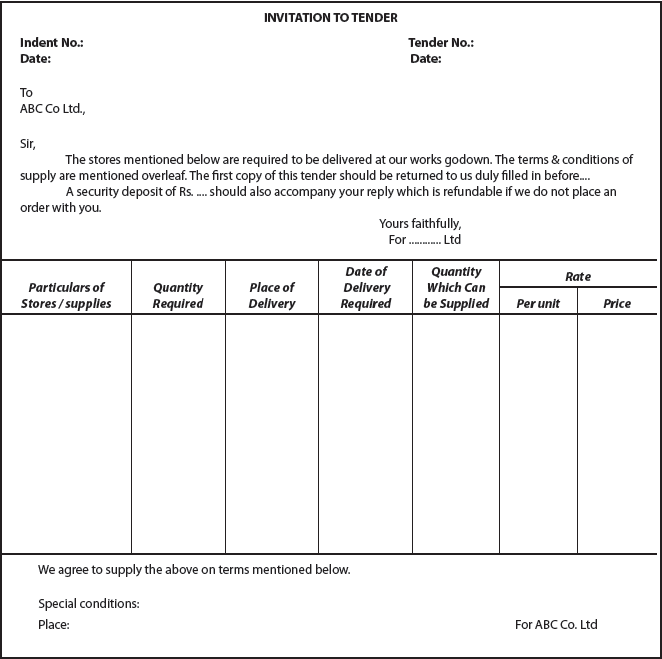

2.3.2 Stage II: Issue of Tenders

It is the duty of the purchase department to issue tenders to suppliers. In order to obtain quotations from prospective suppliers of goods and services, business organizations float tenders. Specific type of tender may be adopted for different types of tenders:

- Single tender: Enquiries are issued to one supplier only. It holds good for propriety items.

- Open tender: In case of large quantity of goods with high value, this type is adopted. Usually this type is published in leading newspapers and reputed trade journals.

- Limited tender: Tenders are issued only to limited number of suppliers chosen from the list of vendors.

- Global tender: The firms advertise in international trade journals. This method is used when international financial institutions are involved and when the order value is high.

Tenders are prepared in triplicate. Two copies will be sent to the supplier. Of these two, one copy will be retained by the supplier, the other copy (usually original) will be sent by the supplier to the purchase department by stating their terms and conditions of supply of goods or services. The third one is retained by the firm (purchase department).

2.3.3 Stage III: Receiving Quotations

When quotations are received from suppliers, they have to be processed cautiously. A comparative statement is used. The prospective suppliers are to be ranked based on the prices quoted by them. Further, the following factors have to be considered while processing the tenders:

- The quality of goods

- Time to be taken for delivery

- Financial capability of the supplier

- Integrity of the supplier

At times, purchases may be made without inviting quotations. In such cases, the cost component and the price have to be taken into consideration for such cost plus contract basis purchases.

2.3.4 Stage IV: Placing Purchase Orders

After receiving and analysing the tenders, the purchase order is to be prepared. The purchase order is prepared in six copies. They are routed to (i) accounts department, (ii) the supplier, (iii) purchase department, (iv) receiving department, (v) originating department, and (vi) inspection department, one copy each.

In general, the order is issued to the supplier who has offered the lowest price and who has committed to supply the goods with required specification within the stipulated period.

The purchase order has legal and accounting significance. Legally, it binds both the parties in terms of contract. From the accounting point of view, it envisages the stores department to accept the goods and the accounts department to accept the bill.

2.3.5 Stage V: Inspecting Stores Received

After receipt of the goods, the stores department checks the goods (against the supplier’s delivery challan) with the purchase order. It is ascertained whether materials conform to the order in respect of description and quantity.

After this, materials are sent to inspection department, where an inspection note is prepared. The material inspection note is a document which depicts the material code, description, specifications, quantity received for inspection, quantity accepted, quantity rejected and reasons for rejection. An inspection note has to be prepared in four copies. One copy is sent to the stores department, one copy is sent to the supplier, one to the purchase department and one to accounts department.

2.3.6 Stage VI: Receiving Stores

After inspection is completed, goods are sent back to the stores department. At this stage, the stores department prepares a stores receipt note or goods received note. It shows the materials received from suppliers. This is a document which shows the material code, description, specifications, quantity, unit price and value of materials. After issuing stores receipt note (goods received note), the storekeeper is responsible for stocks. This is a document for the posting of receipts in bin card and stores ledger. The stores note is circulated to the production planning and control department, accounts department, inspection department and the costing department.

2.3.7 Stage VII: Passing Bills for Payment

Bills sent by suppliers were received first by the purchase department. Then they are forwarded to stores accounting section. They check the authenticity regarding quantity and price and its arithmetical accuracy. Other special items shown in the bill like packaging and forwarding charges are verified with the purchase order. The bill is finally passed for payment.

(or)

Goods Received Note

2.4 PRICING OF STORES RECEIPTS (ACCOUNTING FOR DIRECT MATERIAL COST)

All expenses incurred in receiving and storing the material form part of the cost of materials. When the direct material that is used in the manufacture of finished goods is translated into financial terms, the resultant is direct material cost.

Direct material cost can be easily identified with a cost unit.

Direct material cost is the price per unit paid to the supplier with respect to items purchased from the supplier. It comprises of:

- Purchase of item

- Local taxes and duties

- Inward freight

- Cash discount

- Volume discount

- Trade discount

- Rebates, duty drawback, modvat and subsidies

- Packing expenses, delivery

- Joint purchase cost

- Extra/spare parts

- Cost of containers (in case of returnable containers, the difference between the charge for returnable containers and the sum refunded on return of containers) is taken as expense

- Provisional pricing of materials

Illustration 2.1

Model: Direct material cost and issue price of materials to jobs.

X Ltd purchased two kinds of raw materials for the manufacture of its product. From the following information given in the supplier’s bill, you are required to calculate (a) direct material cost and (b) issue price of materials:

|

Rs. |

Raw material X: 250 Nos of Rs. 5 each |

1,250 |

Raw material Y: 500 Nos of Rs. 2 each |

1,000 |

Insurance |

45 |

Central excise duty: Raw material X: |

80 |

Raw material Y: |

120 |

Packing, storage and delivery charges |

150 |

Sales tax |

270 |

Freight |

300 |

The purchaser paid Octroi duty at Rs. 2 per unit. During the checking of incoming materials at the buyer’s factory, it was found that 5 units of raw material X and 10 units of raw material Y were in broken condition. It was found from past experience that 20% of materials deteriorate in storage.

Solution

The following calculations will have to be made, before computing material cost.

Working *1: Insurance will have to be distributed in the ratio of material value purchased as:

Purchase price of raw materials purchased:

Insurance for raw material

*2: Packing, storage and delivery will be distributed among the raw material X and Y in the ratio of quantity raw materials.

∴ Packing, storage & delivery expenses for raw material

Packing, storage & delivery expenses for raw material : Y

*3: Freight would be distributed in the same ratio as in (2).

Freight inward for material

Freight inward for material

*4: Sales tax will be distributed in the same ratio as in (1): that is, 5:4

Sales tax for raw material

Sales tax for raw material

(a) Statement showing computation of direct material cost

| Particulars | Raw Material X Rs. | Raw Material Y Rs. |

|---|---|---|

Step 1 → Purchase price (excluding excise duty) |

1,250 |

1,000 |

Step 2 → ADD |

|

|

(i) Central excise duty (given) |

80 |

120 |

(ii) Packing, storage and delivery (Ref: *2) |

50 |

100 |

(iii) Insurance (Ref: *1 (value basis)) |

25 |

20 |

(iv) Freight inward (Ref: *3 (quantity basis)) |

100 |

200 |

(v) Sales tax: (Ref: *4 (Value basis)) |

150 |

120 |

(vi) Octroi (X: 250 Nos × 2; Y: 500 Nos × 2) |

500 |

1,000 |

Step 3 → Direct material cost |

2,155 |

2,560 |

(Step 1 + Step 2 (i to vi)) |

|

|

(b) Statement showing issue price of materials

| Particulars | Raw Material X Rs. | Raw Material Y Rs. |

|---|---|---|

|

Nos. |

Nos. |

Step 1 → Purchase of raw materials (in nos) (Given) |

250 |

500 |

Step 2 → Less: Damage in transit (Given) |

5 |

10 |

|

245 |

490 |

Step 3 → Less: Deterioration in storage − 20% (Given) |

49 |

98 |

Step 4 → Quality available for issue |

196 |

392 |

Step 5 → Direct material cost |

|

|

Rs. |

2,155 |

2,560 |

Step 6 → Issue Price per Unit |

|

|

Important note

- Insurance and sales tax are to be apportioned based value, that is, in the ratio of purchase price of raw materials.

- Packing, storage and delivery charges and freight are to be apportioned based on quantity i.e numbers.

2.4.1 Joint Purchase Costs

Sometimes, supplier’s invoices contain item of materials having more than one specification. Usually they will be shown as a lot and consolidated amount is mentioned against it. In such a situation, the purchaser will ascertain the current market price of each kind of material. The consolidated amount is to be apportioned based on value, that is, in the ratio of market prices. In case market prices are not given, technical estimates serve as a basis of apportionment. Insurance charges based on the value of materials, carriage inwards based on quantity (volume or weight) should form the basis of apportionment (as explained in Illustration 2.1) for consolidated amount.

2.4.2 Storage and Issue Losses

From the date of receipt of materials till the date of issue of the same, that is, during the storage period, some losses are unavoidable. Some losses occur in the stores department due to the following factors:

- Evaporation, shrinkage, drying and the like

- Inability to measure precisely

- Difference in units of issue from units of purchase (some materials are purchased on weight basis and are issued by number basis)

By inflating the material price per unit, such losses can be recovered.

Abnormal loss will be duly charged against costing profit and loss account.

Illustration 2.2

Model: Storage and issue losses

A firm purchases 1000 litres of a chemical at Rs. 75 a litre. The normal loss from issue and storage is 25%. You are required to compute the material issue price per unit.

Solution

Normal loss from issue and storage = 25%

2.5 STORES FUNCTIONS

Store keeping (stores functions) is an important function. Store keeping is the function of receiving materials, storing them and issuing them to workshops or departments. The stores department is headed by a stores manager (store keeper).

2.5.1 Main Objectives of Store Keeping

The main objectives of store keeping are:

- To protect stores against losses

- To keep materials ready for issue

- To avoid overstocking and understocking

- To facilitate perpetual inventory

2.5.2 Duties and Functions of a Store Keeper

Important functions of store keeping (stores department) are as follows:

- Receipt of materials: Materials are received and verified properly. Then they are transferred to stores.

- Maintenance of materials: The store keeper classifies the materials and stores them in appropriate places. They are maintained in an orderly manner in the stores.

- Record keeping: The stores records are maintained properly. Records are to be maintained in such a way that any information can be obtained quickly and without difficulty. Records are to be maintained up to date.

- Storage: Materials should be protected safely. Proper storage devices have to be installed.

- Issuing stores: All issues from the stores should be recorded promptly and accurately. All issues should be duly authorized. Procedures laid down should be complied with utmost care.

- Periodical check-up: Materials should be checked by reconciliation of stores balance as per bin card with the physical stock on a periodical basis.

- Coordination: The store keeper is responsible for coordination with materials control.

- Desired level: Stores should be maintained at required optimum levels of stock.

- Periodical review: Periodical review of various scales, measuring instruments, conversion ratios should be undertaken with utmost sincerity.

- Protection: Proper protection of stores from fire, rust, erosion, theft, deterioration and other Nature furies is necessary.

2.5.3 Centralized Stores

When stores department of an organization is located at one place only, it is known as centralized stores. If the stores department is situated at different places, it is known as decentralized stores. Where there is only one stores department, it is called a central store. Where more than one stores department exists, they are called sub-stores or subsidiary stores.

2.5.3.1 Advantages of Centralized Stores

- There will be adequate security of stores department.

- Stock may be maintained at a lower level.

- Location, layout, mechanization of stores may be well designed.

- Lesser staff, fewer records result in economy and lower expenditure.

- Better control is possible.

2.5.3.2 Disadvantages of Centralized Stores

- There may be delay in service.

- Cost of handling materials is higher.

- Any risk (such as loss of fire) might result in great loss.

- In case if a central store is large and unwieldy, it is difficult to manage it.

2.5.4 Imprest Stores

Imprest stores system is based on the imprest system of petty cash. This system is introduced to overcome the disadvantages of centralized stores. A sub-store is attached to each production department. This operates with an operating stock marginally higher than the normal requirements. At the end of specified period, the exact quantity is replenished just as in the system of petty cash.

2.5.4.1 Advantages

- Issue of stores will be quick.

- As materials are requisitioned only once in the period, there is much reduction in clerical work.

- It leads to the simplification of control of stores.

- It reduces inventory-handling costs.

- Delay in production is avoided as raw materials are available in the production department itself.

- It combines the advantages of both the centralized and decentralized storing systems.

2.6 CLASSIFICATION AND CODIFICATION OF MATERIALS

To identify materials easily and quickly and to prevent mixing of one type of materials with another, a proper system of classification and codification of materials is of vital importance to any organization.

Stores are classified either by nature or usage of stores. Similar items are classified into sub-groups and a number of such sub-groups constitute the major group.

Codification is a unique procedure of assigning codes for each item of store.

2.6.1 Some Important Methods of Codification of Materials

- Alphabetical method: In this method, each item is denoted by a combination of alphabets. For instance, iron rods may be coded as IR and iron wires may be coded as IW.

- Numerical method: Each item is given a number. A list of materials is prepared comprising entire materials. Each type of material is assigned a number. Usually the first two digits of the code number may indicate the department for which the materials are meant and the other two digits may indicate the name of materials shown in the list. For example, if the code number of the material is 1111, the first two digits 11 (represent) indicate the department for which the materials are meant, and the other two digits 11 indicates material number.

- Alphanumerical method: It is a combination of both the alphabetical and Numerical methods for codification of materials.

- Decimal method: Basically it is a numeric system. In this method sub-group may be indicated by decimals.

2.6.2 Advantages of Codification

- It is easy to identify.

- It reduces clerical work.

- It facilitates mechanized accounting.

- It ensures secrecy.

2.7 INVENTORY CONTROL

2.7.1 Meaning of Inventory Control

As materials constitute a major part of the total production cost of a product, they occupy an important position in manufacturing enterprises. Hence the need arises for a proper control on it. In fact, inventory control is the core of materials management. Inventory control should be planned in such a way that purchasing and storing should be done judiciously without affecting production in any manner. Funds should not get locked unnecessarily in surplus stocks. Lack of control over inventory may result in an increase in the cost of production. Inventory control is the systematic control and regulation of purchase, storage and usage of materials in such a way as to maintain the even flow of production and at the same time avoiding excessive investment in inventories.

2.7.2 Techniques of Inventory Control

A number of techniques and mathematical models are employed in the process of inventory control. Inventory control is exercised over raw materials and work-in-progress.

The main aim of inventory control is to maintain optimum level of inventory. For this, an organization has to determine:

- The quantity that they should be ordered and

- The time when they should be ordered.

The first aspect—the quantity—how much to order is associated with the determination of economic order quantity.

The second one—the time—when they should be ordered is associated with the determination of re-order level.

2.7.3 Economic Order Quantity (EOQ)

This method makes an attempt to resolve the issue: How much to order at a time? EOQ refers to the quantity of order which gives maximum economy in acquiring materials. It puts much thrust on standard ordering quantity. In order to understand EOQ, the costs associated with it have to be analysed first. They are (i) carrying costs, (ii) ordering costs and (iii) costs of stock-out (shortage).

- Carrying costs: These are “costs of holding” the inventory. These are the costs of keeping items in stock. These costs include store-keeping cost, interest on capital blocked in inventory, insurance premium, handling costs, stores staff, maintenance of equipment costs, cost of warehousing, cost of perpetual inventory and continuous stock taking, deterioration, obsolescence etc.

- Ordering costs: These are the costs of placing an order and receiving the supplies. These costs include expenses involved in purchasing, raising of stores requisition, follow-up, transportation, receipt in store, sorting inspection, storage etc.

- Stock-out costs (shortage/inadequate inventory): These costs incur due to the shortage of inventories for meeting the needs of production and consumer demand. These costs include uneconomic production schedules, push-up cost of production, crash and expedite purchases at high costs, customer loss, erosion of goodwill etc. These costs are not easy to measure as many of the costs are intangible. These two costs, ordering costs and stock-out costs, are called “cost of acquiring”.

The optimum ordering quantity—the quantity for which the cost of holding plus the cost of acquiring is the minimum—is referred to as “economic ordering quantity”.

The economic ordering quantity is computed by using the formula:

where E.O.Q = Economic ordering quantity

U = Units purchased (or) used in a year

P = Cost of placing an order

S = Annual cost of storage of one unit

Model: EOQ

X Ltd manufactures a product and the particulars relating to it are as follows:

Monthly demand (units): 500

Cost of placing an order: 90

Annual carrying cost per unit: 10

Normal usage (units/week): 40

You are required to calculate economic ordering quantity.

Solution

First, annual consumption has to be calculated.

Normal usage per week = 40 units

... Normal usage per year = 40 × 52 weeks

Cost of placing an order = Rs. 90 (P) Given

Annual carrying cost/unit = Rs. 10 (S) Given

Formula ![]()

Substituting the values we get,

Sometimes, stock holding cost may be given in percentage (i.e., the inventory-carrying charges). In such cases the formula differs a little, which is shown below:

where U = Annual consumptions during the year (units)

P = Cost of placing an order

H.C = Holding cost as percentage of average stock value

C = Price/unit

Depending on the figures (given in the problem), we have to choose the formula and compute EOQ.

Illustration 2.4

Model EOQ

You are provided:

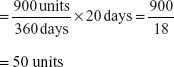

Cost of placing an order = Rs. 10 (ordering cost)

Annual demand = 900 units

Price per unit = Rs. 5

Normal lead time = 10 days

Safety stock = 20 days

You are required to compute:

- What is the quantity that should be ordered each time?

- How many orders should be placed with the supplier during a year?

- What would be the level of stock just before the material which has been ordered is received?

- Economic order quantity is the quantity that should be ordered each time.

where U = Annual consumption during the year = 900 units

P = Cost of placing an order = Rs. 10

H.C = Stock holding cost = 15%

C = Price per unit = Rs. 5 Substituting the figures in the formula, we get

Substituting the figures in the formula, we get

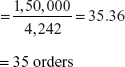

- No of order to be placed in year

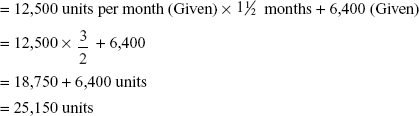

- Safety stock is the level of stock immediately before the material order is received.

Safety stock = Average usage × Period for which safety stock is kept

Illustration 2.5

A computer manufacturer purchases 800 units of a certain component from a supplier. The annual usage is 800 units. The order placing cost is Rs. 100 and the cost of carrying one unit for the year is Rs. 4. You are required to compute economic ordering quantity, number of orders and time interval between two orders in a year and to tabulate your results.

Solution

First EOQ is ascertained as follows:

Formula:

Substitute the values in the formula,

Table showing the economic ordering quantity:

- From the above table we can see that the total cost is minimum when each order is of 200 units. Total cost is only Rs. 800, when order level is of 200 units. EOQ = 200 units.

- Number of orders in a year will be 4 only. Refer column number 2.

- The time interval between two orders

- The same may be represented in the form of graphical chart as below:

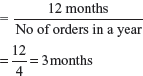

Illustration 2.6

X Ltd manufactures a product which has a monthly demand of 2,500 units. The product requires a component AA1, which is purchased at Rs. 10. For every finished product, one unit of component is required. The ordering cost is Rs. 100 per order and the holding cost is 10% p.a. You are required to calculate:

- Economic ordering quantity

- If the minimum lot size to be supplied is 5,000 units, what is the extra cost the company has to incur?

- What is the minimum cost the company has to incur?

- As holding cost percentage is given along with the price per unit, the formula for computation of EOQ is:

where U = Annual consumption = 12 × 2,500 = 30,000 units

P = Cost of placing an order = Rs. 100

H.C = Holding cost percentage = 10%

C = Purchase cost (price) per unit = Rs. 10

Substituting the values in the formula, we get:

- Computation of extra cost incurred by the company:

(i) Total cost (when order size is 5,000 units)

(ii) Total cost (when order size is 2,450 units)

- Computation of minimum carrying cost = The carrying cost (or) storage cost depends on the size of the order. Hence, it will be minimum when the order size is less.

In this problem, there are two order sizes, viz., 2,500 units and 5,000 units. Of these 2,500 units is the least one. As such, carrying cost will be minimum at this order size.

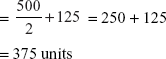

Minimum carrying cost

2.7.4 Quantity Discounts and EOQ

In practice, when the size of order increases, suppliers allow quantity discounts. Due to this, the price per unit comes down. But EOQ assumes that the unit purchase price is constant.

When quantity discounts are involved, the computation of EOQ will be as follows.

First ascertain the EOQ using the standard formula.

- In case the derived figure is equal to (or) higher than the quantity necessary to avail of quantity discount, it is known as optimal order size.

- If the resultant figure is less than the minimum quantity to be ordered for availing quantity discount, the change in profit resulting from increasing the order quantity has to be calculated.

Illustration 2.7

Model: EOQ and quantity discounts

JP Ltd manufacturers of a special product, follows the policy of EOQ for one of its components. The component’s details are as follows:

|

Rs. |

Purchase price per component |

200 |

Cost of an order |

100 |

Annual cost of carrying unit in inventory |

10% of purchase price |

Total cost of inventory and ordering per annum |

4,000 |

The company has been offered a discount of 2% on the price of the component provided the lot size is 2,000 components at a time.

- Compute the EOQ

- Advise whether the quantity discount offer can be accepted [Assume that the inventory carrying cost does not vary according to discount policy.]

- Would your advice differ if the company is offered 5% discount on a single order?

[CA. (Inter), November 1994]

Solution

STAGE I: EOQ is calculated as follows:

Step 1 → Figures given in the question have to be written one by one:

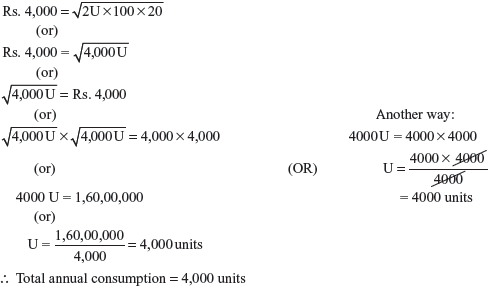

Step 2 → Total annual consumption is to be found out by using the following equation:

Substituting the figures in this equation, we get:

Formula

Substituting the values we get,

STAGE II: Decision on Discount Offer: |

Rs. |

Step 1 → When order size is 2,000, number of orders (4000/2000) = 2 |

|

Step 2 → Ordering cost (2 × cost of an order (Rs. 100)) |

200 |

Step 3 → Add: Storage cost (1,000 × Rs. 20) |

20,000 |

Step 4 → Less: Savings due to discount |

20,200 |

|

|

Step 5 → Net cost |

4,200 |

Decision: The net cost is Rs. 200 higher (Rs. 4,200 − Rs. 4,000) than the present cost.

Hence this offer should not be accepted.

STAGE III: If the discount offer is 5% on a single order: |

Rs. |

Step 1 → No. of order = 1 |

|

Step 2 → Ordering cost (1 × Rs. 100) = |

100 |

Add: Step 3 → Storage cost (2,000 × Rs. 20) = |

40,000 |

|

40,100 |

Less: Step 4 → Savings due to discount (5% × 4000 × 200) |

40,000 |

Step 5 → Net cost |

100 |

Decision: Net cost is Rs. 3,900 (Rs. 4,000 − Rs. 100) less than the present cost.

Hence, this offer must be accepted.

NOTE: To arrive at a decision, compare the net cost with the present cost.

If the net cost is higher than the present cost, such offer should not be accepted.

If the net cost is lower than the present cost, such offer SHOULD BE ACCEPTED.

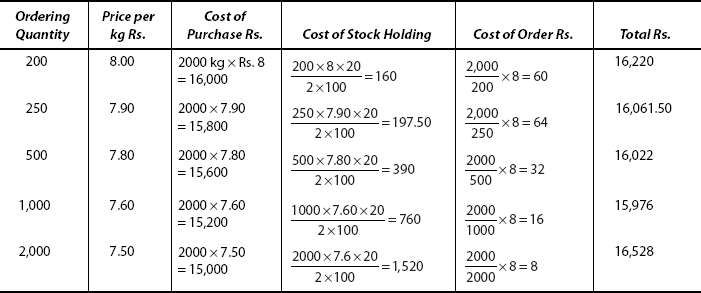

Illustration 2.8

A firm is able to obtain quantity discounts on its orders of material as follows:

Price per kg |

|

Rs. |

kg |

8.00 |

less than 250 |

7.90 |

250 and less than 500 |

7.80 |

500 and less than 1,000 |

7.60 |

1,000 and less than 2,000 |

7.50 |

2,000 and above |

The annual demand for the material is 2,000 kg. Stock holding costs are 20% of material cost per annum. The delivery cost per order is Rs. 8.

You are required to calculate the best quantity to order.

[CA. (Inter). Modified]

First, EOQ is computed by using the formula:

NOTE: It is assumed that staggering the delivery in 146 kg is not possible. The best quantity to order is computed as:

Decision: Least cost is Rs. 15,976 when the order quantity is 1,000 kg.

The optimum ordering quantity = 1,000 kg.

2.8 FIXATION OF STOCK LEVELS

One of the important functions of a store keeper is to replenish the stock in stores department. In fixing stock levels, the vital factors to be considered are:

- Maximum level

- Minimum level

- Re-order level

- Danger level

2.8.1 Maximum Stock Level

The maximum level is the largest quantity of a particular material that should be kept in the store at any period. This represents the stock level beyond which stock should not be allowed. This is to avoid blocking up of capital in inventories.

The factors that should be considered to fix maximum stock level are:

- Capital required and available

- Storage space

- Rate of consumption of materials

- Lead time—the time necessary to obtain deliveries of materials from the date of order

- Cost of storage, insurance

- Seasonal considerations

- Nature and quality of materials like evaporation, deterioration etc.

- Price considerations on bulk purchase

- Possibilities of changes in habit, fashion

- Government regulations

- Economic ordering quantity

Formula to determine maximum level of stock:

2.8.2 Minimum Stock Level

This is also known as “safety or buffer stock.” Stocks must not be allowed to fall below this level. This is to avoid stoppage of production for want of materials.

The factors that should be decided in determining the minimum stock level are:

- Average rate of consumption of materials

- Lead time

- Stock-out costs like loss of goodwill, loss of combination, margins etc.

- Re-order level

- In case of compulsory or emergency or special acquisition of materials, the question of minimum level does not arise

Formula to determine the minimum level of stock:

2.8.3 Danger (or) Safety Level

This is the level of stock fixed below the minimum level of stock. When this level is reached, the purchase manager has to take speedy efforts to acquire the needed materials. The storekeeper at the same time should not issue materials to production department.

At times, the danger level is fixed above minimum level but below the re-order level.

To take corrective action, this level is fixed below the minimum level, and to take preventive action, this level is fixed above the minimum level.

Formula to determine the safety level of stock:

2.8.4 Ordering Level (or) Re-Order Level

This is the level fixed between maximum and minimum stock levels. Further supplies should be ordered once the level of stock reaches this state. The re-order level is fixed at a level, higher than minimum stock level to protect against (i) abnormal usage and (ii) unexpected delay in supply of materials.

The factors to be determined for fixing re-order level are

- The minimum level

- The expected maximum consumption

- The lead time, that is, the time lag between the date of issuing orders and the date of receipt of materials

Formula to determine the re-order level of stock:

Illustration 2.9

Model: Fixation of level of stock

Materials A and B are used as follows:

You are required to calculate for each material:

- Maximum level

- Minimum level

- Re-order level

- Average stock level

[I.C.W.A (Inter). Modified]

Solution

NOTE:

- For answering questions relating to stock level, the required figures for each level have to be computed first, and then substituted in the formula to determine desired stock level.

- Generally, re-order level is computed first because this figure is a base for computing other stock levels.

(1) Re-order level:

Step (i) Formula:

(2) Minimum level:

Step (i) Formula:

Step (ii) Needed figures = Re-order level (worked out in step 1)

Step (iii) Substituting the figures in the formula, we get:

For material A |

= |

750 units − (100 units × 4 weeks) |

|

= |

750 − 400 = 350 units |

For material B |

= |

1,050 units − (100 units × 6 weeks) |

|

= |

1,050 − 600 = 450 units |

(3) Maximum level:

Step (i) Formula:

|

A |

B |

Re-order level |

750 |

1,050 |

|

(Stage 1) |

(Stage 1) |

Re-order quantity |

500 |

800 |

|

(Given) |

(Given) |

Minimum consumption |

50 |

50 |

|

(Given) |

(Given) |

Minimum re-order period |

3 weeks |

5 weeks |

|

(Given) |

(Given) |

Step (iii) Substituting the figures in the formula, we get:

For material A = 750 + 500 − (50 × 3) = 1,250 − 150 = 1,100 units

For material A = 10,50 + 800 − (50 × 5) = 1,850 − 250 = 1,600 units

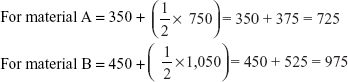

(4) Average-stock level.

Step (i) Formula:

Average stock level = Minimum stock level ![]()

Step (ii) Needed figures:

|

A |

B |

Minimum stock level (Ref: Stage 2 (iii)) |

350 |

450 |

Re-order level (Ref: Stage 1 (iii)) |

750 |

1,050 |

Step (iii) Substituting the figures in the formula, we get:

2.9 ABC ANALYSIS

So far we have discussed what quantity has to be ordered at a time, the time to place an order, and the various stock levels to be maintained. Now, monitoring and control of inventories will be explained.

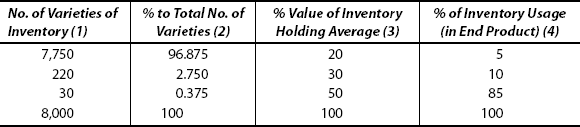

It is also known as “always better control”. Its origin is attributable to General Electric Company, America. This is based upon segregation of materials according to their value for control. A small percentage of inventory items account for a large percentage of usage value and vice versa. It is found that

- 15% of items have 80% of value

- 35% of items have 15% of value, and

- 50% of items have 5% of value

Applying this yardstick, the first category is classified into “A”, the second category into “B” and the third category into “C”.

A category is composed of items which are relatively highly expensive or used in large quantities. Hence, tight inventory control is essential. The management has to monitor and control inventories by adopting all possible and needed devices.

Category B consists of items which are of moderate quantity and of moderate value. They are neither expensive nor cheap. This category requires moderate inventory control.

Category C consists of items which are used in small quantities. These items are comparatively inexpensive. This category requires control but not that much compared to other categories.

2.9.1 Steps Involved in ABC Analysis

- Ascertain future use of each item of stock (in terms of physical quantities).

- Price per unit of each item has to be ascertained.

- Ascertain the total project cost of each item (this is done by multiplying the units by the price/unit of respective item).

- Arrange different items in descending order of their total cost (as determined in the previous step).

- Units of each item has to be expressed as a percentage of total costs of all items.

- Finally, compute the total cost of each item as a percentage of total costs of all items.

Example:

2.10 VED ANALYSIS

The ABC analysis system gives priority to usage value and ignores the criticality of items, which is not so in practice. Really there are many items which do not possess high usage value but are critical. One component may not belong to either of the groups in the ABC category, but may make matters worse.

To overcome this limitation, another technique known as VED analysis is an important device for management of materials. Under this technique, inventory items are classified and grouped in descending order of criticality. Items are grouped into three categories V, E and D, where V denotes items which are Vital, E denotes Essential and D stands for Desirable.

V category of items are vital for process of production. The production will come to a standstill, if the items of these category are not available in time. Hence, strict and proper analysis has to be carried out, stock level has to be maintained adequately and network of suppliers should be proper and reliable. Items grouped under category E are essential, but their absence would not do much harm in production. D category items will not have an immediate consequence on production.

2.11 PARETO ANALYSIS

This analysis is also known as 80:20 rule. Pareto’s rule stipulates that 20% of stock must be strictly controlled by adopting suitable policies, procedures and devices. The balance 80% of stocks will have to be analysed in established norms, procedures. Pareto analysis may be said to be a technique of selective inventory management.

2.12 FNSD ANALYSIS

FNSD F stands for Fast moving

N stands for Normal moving

S stands for Slow moving

D stands for dead/dormant stock

Under this technique, inventory is classified into four different categories for the analysis of movement of inventory. This technique is based on stock turnover ratio.

F—Fast moving items are consumed within a short period of time. Generally, stock velocity of items belonging to this category is relatively very high. Every effort should be made to ensure that no stock-outs occur.

N—Normal moving items are consumed within a year. Their stock turnover ratio may be moderate.

S—Slow moving items are consumed in a period extending over 2 years. They have very low stock turnover ratio.

D—Dormant or dead stock denotes stock which remains idle in stores. For them no present demand exists. Nor forecast can be made on future demand.

Continuous and proper monitoring is an essential and indispensable task of inventory management control.

2.13 TWO BIN SYSTEM

The very name indicates the usage of two bins for maintaining stock of materials. In general, material is used from one bin only till it gets emptied. Under this system, for each item of stock, two bins or piles or bundles are used for maintaining stock of materials. The first bin stocks sufficient quantity of inventory for the specified period (period between receipt of an order and placing of next order). The second bin contains stock (safety stock—normal level) to provide service till new stocks arrive and fill the first bin. Reorder takes place when the stock in the first bin is empty. No need to wait for the re-order date. Perpetual inventory record is not in practice under this system because no bin-tag (quantity record of materials) card is in vogue, which is a great disadvantage of the two-bin system.

2.14 CONTINUOUS STOCK TAKING

The terminology of CIMA defines continuous stock taking as “the process of counting and valuing selected items at different times on a rotating basis”.

Under this method, the stock-taking work is planned in such a way that all items of work are to be verified during the year. Stock-taking plan may vary from one firm to other. Some employ man hour basis, while some other firms use category basis for stock verification.

Stock as shown in company’s records is compared with stock taken physically. Differences may arise. Such differences should be checked with bin card balance. Bin card shows the actual stock in hand. So adjustments can be made in stores ledger. The balance in stores ledger and bin card must be reconciled.

Discrepancies should be analysed by causes and responsibility centres, and properly investigated. If the value is high due to surplus/deficiency, it should be reported to authorities for approval.

2.14.1 Advantages of Continuous Stock Taking

- It helps in early detection of discrepancies.

- As it is of routine affair, more time is available for physical verification—no need to rush through.

- It does not cause any disruption—normal and routine work is carried out without any interruption.

- It serves as a moral check on stores personnel.

- No man power is wasted unnecessarily.

- It facilitates better control.

- Corrective measures may be undertaken immediately.

2.15 PERPETUAL INVENTORY SYSTEM

The terminology of CIMA defines perpetual inventory system as “the recording as they occur of receipts, issues and the resulting balances of individual items of stock in either quantity or quantity and value.”

The aim of a perpetual inventory system is to keep proper track of inventory and provide accurate information to the management timely.

Under this system, receipts, issues, returns, work-in-progress etc. of materials are recorded on a daily and continuous basis. Up-to-date records are always available. Hence, it facilitates verification of stock at any time. The important functions of perpetual inventory are:

- Continuous recording of receipts, issues and returns of materials in (a) bin card and (b) stores ledger.

- Continuous verification of physical stock.

2.15.1 Advantages of Perpetual Inventory System

- Stocks can be checked continuously thereby avoiding any malpractices

- Production is unaffected.

- It facilitates proper inventory control, production planning and production control.

- This promotes moral health on personnel.

- On detection of discrepancies, remedial measures can be taken immediately.

- Reliable and accurate financial statements can be prepared from these records.

- Stocks may be kept at minimum level, thereby effecting savings in investment in stock.

- Loss of interest on capital invested in stock, loss due to deterioration can be avoided or kept at minimum.

- A proper perpetual inventory system leads to the introduction of continuous stock taking.

- These records reveal the cost of materials, which in turn facilitates exercising control over costs.

Most important records used in this system are (1) bin card and (2) stores ledger. Let these be discussed in detail in Sections 16 and 17.

2.16 BIN CARD

This record (document) is prepared by the stores department. It is a quantitative record of receipts, issues and balances of materials in stores. Quantity of any specified materials can be easily known from bin, at any point of time.

How does is function? Each item of material is entered in a separate bin card. It is attached to the bin or rack when the materials are stored. When a transaction takes place (issue or receipt), the bin card is posted. Only after the transaction is recorded, the items are received or issued. When materials are received, the quantity is entered in the bin card. The balance is updated. The various levels indicated in a bin card facilitate the task of store keeper in the preparation of requisition materials as and when required. Similarly all issues, return of materials are entered in bin card. Quantity on order and quantity reserved are also shown separately.

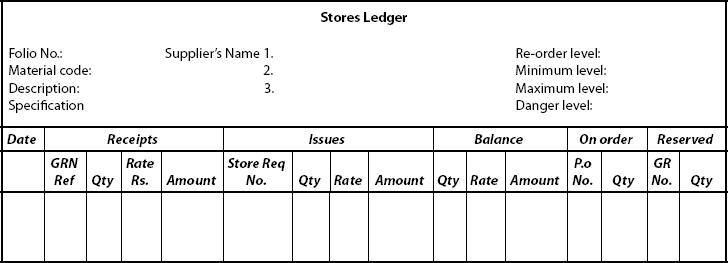

2.17 STORES LEDGER

The stores ledger is a record maintained by the accounts department. All receipts and issues of materials are recorded in it. Once receipt or issue or return of goods is entered in the bin card, the same document is used for posting in stores ledger. It has a separate page or folio for each material code. It is a subsidiary ledger. It constitutes part of double-entry book-keeping.

2.17.1 Differences between Bin Card and Stores Ledger

| Basis of Distinction | Bin Card | Stores Ledger |

|---|---|---|

1. Nature of record |

Bin card is a record of quantity. |

Stores ledger is a record of quantity and value. |

2. Maintenance of record |

It is maintained by the store keeper. |

It is maintained by the costs/accounts department. |

3. Place where it is kept |

It is kept in the stores. |

It is not kept in the stores. |

4. Time of posting |

The postings are done before the transactions take place. |

The postings are done after the transactions take place. |

5. Posting |

Each transaction is posted individually. |

Transactions are posted in total. |

6. Role |

Bin card cannot take the role of ledger and it is not a subsidiary book. |

It takes the role of ledger and it is like a subsidiary book. |

2.18 PERIODIC STOCK TAKING SYSTEM

The terminology of CIMA defines periodic stock taking system as “a process whereby all stock items are physically counted and then valued”.

Physical stocktaking is conducted at the end of fixed intervals, under periodic stock taking. A “cut-off date” is selected during which no movement of stock takes place. Bin cards and stores ledgers have to be kept up-to-date and they must have been reconciled with physical stocks. Then only stock taking takes place. During the physical verification of stock, one item has to be verified at a time and the physical stock noted down in the stock sheet. Discrepancies between physical stock and stock as per records, if any, have to be reported to the top-level management. After the stock taking, the details are to be entered in pre-printed stock sheets. They are serially numbered. The main drawback of this method is that during stock taking no movement of materials is permitted and the production is stopped abruptly.

2.19 CONTROL RATIO—INVENTORY TURNOVER RATIO

Inventory turnover ratio depicts the relationship between the cost of goods sold and average inventory. This ratio indicates the velocity of stock.

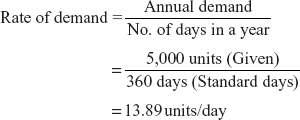

Formula:

where

Any increase in stock turnover ratio indicates that stocks consumption is high. It is a good indicator. On the other hand, any decrease in ratio will indicate negative results, to be observed cautiously and required corrective measures to be undertaken to improve this ratio.

2.19.1 Advantages of Inventory Turnover Ratio

- This ratio helps the management to identify excess stocks and through proper control minimize capital being locked up in inventories.

- It helps in inventory control regarding obsolescence and idle stocks, thereby minimizing loss to the management.

- It assists in improving stock-keeping efficiency. The inventory turnover ratio (in terms of days) can be computed by using the formula:

This formula is used to calculate the number of days for which the stocks are held up in stores department.

Illustration 2.10

Model: Inventory turnover ratio

From the following data compute inventory turnover:

| Material A | Material B | |

|---|---|---|

|

Rs. |

Rs. |

Opening stock |

1,000 |

1,500 |

Purchases made during the year |

2,000 |

2,500 |

Closing stock |

500 |

1,000 |

Solution

(A) First, average inventory has to be calculated:

*3 Since only materials are given, they are cost of goods sold.

(B) Computation of inventory turnover ratio:

| Particulars | Material A | Material B |

|---|---|---|

Step 1 → Opening stock |

1,000 |

1,500 |

Step 2 → Add: Purchases |

2,000 |

2,500 |

|

3,000 |

4,000 |

Step 3 → Less: Closing stock |

500 |

1,000 |

Step 4 → Consumption of materials during the period |

2,500 |

3,000 |

Step 4 → Inventory turnover ratio= *3 |

|

|

|

= 3.33 |

= 2.4 |

Result: Turnover ratio for material A is 3.33 and for B is 2.4. Material A is being turned over 3.33 times. Material B is being turned over 2.4 times. Material B is being held for a longer period. Hence, the stock of material B is always high.

Decision: The management should take the needed action to manage Material B.

2.20 ISSUE OF MATERIALS

2.20.1 Factors to Be Considered on Issue of Materials

- Planning: All requirements of materials have to be well planned in advance. The bill of materials assists in providing estimates of different items of stores.

- Requisition of materials: The bill of materials serves as a basis for placing material requisition note. Materials cannot be issued in excess of quantities mentioned in the bill of materials. Such situations warrant additional bill of materials.

- Audit of issues: All issue of materials must be audited. Any discrepancies should be explained and accounted for.

- Wastage control: It should be seen that actual wastage should not exceed standard and normal wastage. Any variance should be reported and remedial action should follow.

- Sundry items: Certain stores (materials) are required in more than one department. Such sundry items are in need of special attention.

Bill of material and material requisition are noted above. Now we have to discuss the above records—specimen, purpose, features and advantages of each.

2.20.2 Material Requisition Note

Material requisition may be defined as “a document which authorizes and records the issue of material for use”. This document is prepared by the production or other departments. Materials should be issued by the store keeper only on presentation of a duly authorized material requisition note. This is an instruction to the stores department to issue materials for the department which is in need of materials. A material requisition note is prepared in triplicate. One copy is sent to the stores, one copy to the costing department and the third is retained by the department that made such note.

2.20.3 Bill of Materials

This document is prepared by the design or engineering or production planning and control department. This document contains the quantity required by such departments. Following are the purpose underlying the preparation of bill of materials:

- It serves as a basis for the computation of direct material cost when quotations are submitted.

- It serves the purpose of intimation to purchase department to purchase materials.

- It serves as a guideline to production department.

- It facilitates accounting of materials consumed as needed data can be passed on to relevant jobs or processes.

- It functions as a controlling technique.

Four copies of bill of materials are prepared. One copy each is sent to the production, stores and cost accounting departments, and one copy is retained by the planning or engineering department.

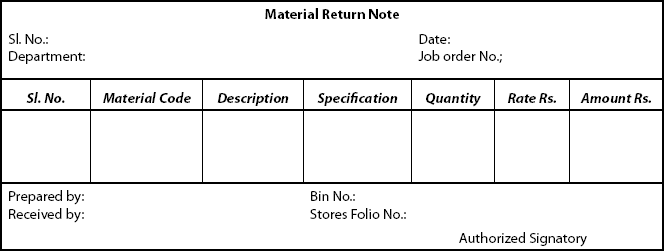

2.20.4 Material Return Note

When the materials issued to production or other departments are defective or no longer required, this document is prepared by the concerned department. The materials are returned to the stores department along with this material return note. This is prepared in duplicate, one copy will be kept by the stores and the other copy is returned to the department by the stores with proper acknowledgement.

2.20.5 Material Transfer Note

When materials are transferred from one department to another department, the transferrer department raises a material transfer note. It is sent to the transferee department along with the materials. One copy is sent to cost accounting department, and the other copy is sent to production planning and control department.

2.20.6 Kardex System

This technique is of latest development. It can also be said that it is an improvement over loose leaf card system. Under this technique a card has to be maintained for each item of material. The cards are kept in Kardex cabinets, specially designed for this purpose.

These cards have columns both in terms of quantity and value for the materials (i) received—receipt column, (ii) issued—issue column and (iii) balance column, just similar to stock ledger sheets. Whenever transactions take place, they are to be entered in the respective columns.

2.21 PRICING OF MATERIAL ISSUES

Objectives of materials pricing are:

- To provide a satisfactory basis for the valuation of closing stock to prepare financial accounts

- To charge cost of materials used for measuring the cost of production and cost of sales

Materials are issued from stores to various processes or contracts or jobs or work orders etc. These jobs are charged with the value of materials issued to them. Here arises the difficulty regarding the price at which materials issued are to be charged. This is due to the fact that the stock of materials consists of different consignments received at different dates and at different prices. The various methods used for the pricing of materials are as follows:

- Based on cost price: Cost Price Methods

- Specific Price Method

- First in First Out Method (FIFO)

- Last in First Out Method (LIFO)

- Highest in First Out Method (HIFO)

- Next in First Out Method (NIFO)

- Base Stock Method

- Average Price Method

- Simple Average Method

- Weighted Average Method

- Periodic Simple Average Method

- Moving Simple Average Method

- Moving Weighted Average Method

- Notional Price Method—Based on notional price

- Standard Price Method

- Current standard

- Basic standard

- Inflated Price Method

- Market Price Method

- Replacement Price Method

- Realizable Price Method

- Re-use Price Method

- Standard Price Method

Let us discuss the methods one by one:

2.21.1 Specific Price Method

In this method, materials are issued at the price at which they were purchased. This involves identification of each lot purchased. This method can be used when the materials have been purchased for a specific job. Materials are to be issued only against the job for which such materials are purchased. This method cannot be used when the material is meant for all jobs, that is, general use. Because of this, this method has limited applications.

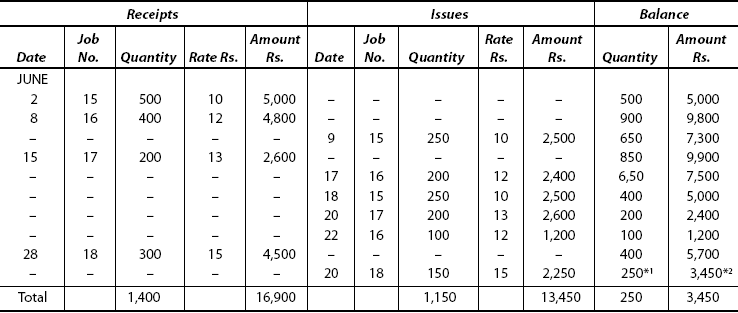

Illustration 2.11

Following is the record of receipt of materials:

2 June |

Received 500 units for Job No. 15 @ Rs. 10 per unit |

8 June |

Received 400 units for Job No. 16 @ Rs. 12 per unit |

15 June |

Received 200 units for Job No. 17 @ Rs. 13 per unit |

28 June |

Received 300 units for Job No. 18 @ Rs. 15 per unit |

During the same month, following issues of materials are made:

9 June |

Issued 250 units for Job No. 15 |

17 June |

Issued 200 units for Job No. 16 |

18 June |

Issued 250 units for Job No. 15 |

20 June |

Issued 200 units for Job No. 17 |

22 June |

Issued 100 units for Job No. 16 |

29 June |

Issued 150 units for Job No. 18 |

You are required to show how these transactions will appear in the stores ledger.

Note that job numbers are given. This implies that materials have been purchased for specific jobs. When they are issued for the particular job, they are priced at the respective prices only. For example, materials were received on 2 June, for job no. 15 @ Rs. 10 per unit. Whenever materials are issued for job no. 15, they are to be priced at Rs. 10 per unit. (9 June and 18 June). The same principle has to be applied, in a similar manner, to other job orders and tabulated as follows in the stores ledger:

*2 This balance amount consists of: |

Rs. |

100 units for job no 16 @ Rs. 12/unit: |

1,200 |

150 units for job no 18 @ Rs. 15/unit: |

2,250 |

*1 250 units |

3,450 |

2.21.2 First in First Out Method

Under this method, it is assumed that the materials first received are the first to be issued. This method seeks to price issues based on the order in which they are received. Units issued are priced at the oldest cost price listed on the stock ledger.

2.21.2.1 Advantages

- This method is simple to understand and easy to operate.

- The clerical work is minimal.

- As the oldest units are issued first, it results in good inventory management.

- Accounting standard recognizes this method.

- It facilitates inter-firm and intra-firm comparisons.

- Valuation of inventory and cost of finished goods is consistent and realistic (as it is near to replacement cost).

2.21.2.2 Disadvantages

- When prices are rising, the product cost tends to be understated.

- Comparison of cost of various jobs will be difficult, as they are charged with different prices in respect of the same materials.

- When prices are falling, the product costs tend to be overcharged resulting in high value of quotations which may be deterrent to sales volume.

- The cost of production is not linked to current costs.

- The pricing of “material returns” will be difficult.

- Replacement of used materials will create additional problem especially during high inflation period.

- True picture will not emerge when many lots are purchased at different prices.

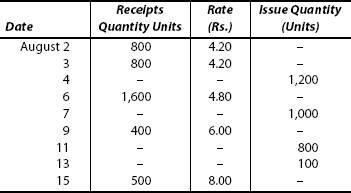

Illustration 2.12

Model: FIFO method

A firm maintains its stores ledger on the FIFO method. During the month of June 2009, the following receipts and issues of materials were made. You are required to record these transactions in the stores ledger.

Receipts:

1 June |

Balance 100 units @ Rs. 5 per unit |

4 June |

Purchase Order No. 101, 80 units @ Rs. 4/unit |

8 June |

Purchase Order No. 103, 60 units @ Rs. 5/unit |

15 June |

Purchase Order No. 102, 40 units @ Rs. 3/unit |

25 June |

Purchase Order No. 104, 80 units @ Rs. 6/unit |

Issues:

11 June |

Material Requisition No. 21, 120 units |

14 June |

Material Requisition No. 22, 50 units |

16 June |

Material Requisition No. 23, 40 units |

20 June |

Material Requisition No. 24, 20 units |

27 June |

Material Requisition No. 25, 30 units |

Solution

Under FIFO method, materials purchased first are to be issued first.

In this problem, “Balance—100 units—price Rs. 5/unit” is to be taken as first received. This price has to be charged for the materials that are issued first, that is, on 11 June—first issue takes place. Those issues must be charged @ Rs. 5/unit. Units issued are 120 units. 100 units are to be charged @ Rs. 5/unit. There are 20 units more. These units have to be charged on the next in order, that is, 4 June level of price @ Rs. 4/unit. This method of pricing is to be carried out for other issues which are shown in the stores ledger as follows:

*1 Stock consists of 20 units purchased on June 15 @ Rs. 3 |

= Rs. 60 |

80 units purchased on June 25 @ Rs. 6 |

= Rs. 480 |

100 units |

Rs. 540 *2 |

2.21.3 Last in First Out Method (LIFO)

Under this method, materials which had been received last are issued first. This is also called the replacement cost method, as the current cost of materials is applied to the cost of units. The purchase price of the latest batch of materials (received from suppliers) is used for pricing the issue of materials. Once this gets exhausted, then the next latest consignment pricing is used and so on.

2.21.3.1 Advantages

- It is simple and easy to operate.

- As issues are priced at the current market price, this method is suitable when prices are rising.

- This method gives realistic product cost.

- Unrealized gains from stock is minimized.

- It is a good method for tax calculations.

- It is in compliance with the principle of matching, that is, matches current costs with current revenues.

2.21.3.2 Disadvantages

- Accounting standard does not recognize this method of pricing issues.

- This method may not be suitable when price fluctuation dominates the market.

- Inter-and intra-firm comparisons may not be possible, as there is great variation in the cost of materials belonging to different lots.

- This method involves much clerical work.

- Statutory auditors do not accept this method of valuation of stocks for preparation of financial accounts.

- When prices fall, the stocks require to be adjusted, which is a complicated procedure.

This method may be explained by the following illustration:

Illustration 2.13

Model: LIFO method

A firm maintains the stores ledger on the LIFO method. During the month of July 2009, the following receipts and issues of materials were made. You are required to record these transactions in the stores ledger:

Receipts:

1 July |

Balance 100 units @ Rs. 10 per unit |

5 July |

Purchase Order No. 15, 80 units @ Rs. 8/unit |

8 July |

Purchase Order No. 16, 60 units @ Rs. 9/unit |

15 July |

Purchase Order No. 17, 40 units @ Rs. 10/unit |

28 July |

Purchase Order No. 18, 80 units @ Rs. 6/unit |

Issues:

10 July |

Materials Requisition No. 11, 140 units |

12 July |

Materials Requisition No. 12, 20 units |

20 July |

Materials Requisition No. 13, 40 units |

25 July |

Materials Requisition No. 14, 20 units |

31July |

Shortage 10 units |

Solution

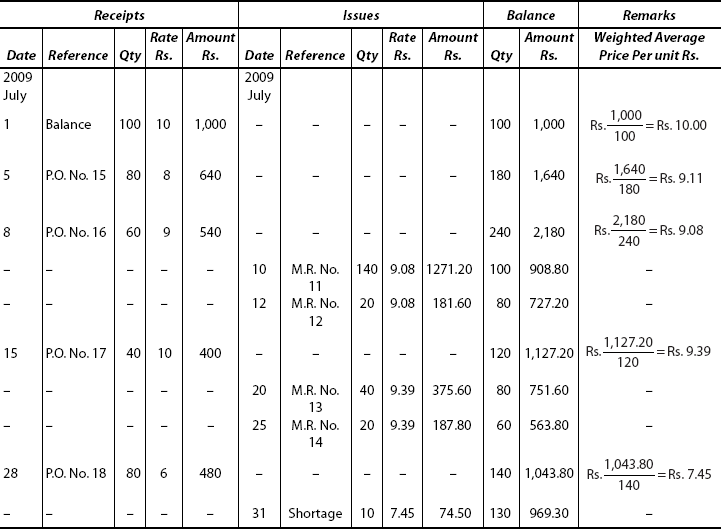

Under this method, the purchase price of the latest batch of materials is used for pricing the issue of materials.

In this question the issue on 10 July is priced @ Rs. 9/unit, being the latest purchase, that is, on 8 July. Materials issued are 140 units, whereas the lot on 8 July consists of 60 units only so the remaining units are to be priced at the next latest purchase, that is, on 5 July @ Rs. 8/unit and so on. All the other issues are priced in the same way and the results are tabulated in the stores ledger as follows:

*1 This balance consists of: |

Rs. |

60 units of balance on July 1 @ Rs. 10 = |

600 |

70 units of balance on July 28 @ Rs. 6 = |

420 |

130 units |

1,020*2 |

2.21.4 Highest in First Out Method (HIFO)

Under this method, materials having highest prices are issued first. This is based on the assumption that the inventory should be valued at the lowest possible price. Costliest materials are issued first, irrespective of the date of purchase. The main factor underlying this method is that when market prices of materials are fluctuating, the product will be able to absorb the cost of materials and provide product costs. This method is widely used for monopoly products, cost plus contracts and the like. A secret reserve has to be created when stocks are undervalued.

2.21.4.1 Advantages

- It is useful only for certain type of products.

- When there is shortage of materials, this method will yield desired results.

2.21.4.2 Disadvantages

- It violates the basic accounting principles and hence it is not accepted by accounting authorities.

Illustration 2.14

Based on the same information provided in Illustration 2.13, you are required to prepare a stores ledger account under HIFO method.

Solution

Under this method, while issues are to priced, look at the prices of purchase and use the maximum or highest price first and then follow in the descending order of prices. Ignore the date of purchase. The results are tabulated in the stores ledger account as follows:

(Under HIFO method)

*1 This consists of: |

Rs. |

80 units purchased on July 28 @Rs. 6 = |

480 |

50 units purchased on July 5 @Rs. 8 = |

400 |

|

130 |

|

880 *2 |

2.21.5 Base Stock Method

A specified quantity of materials is always held in stock by all organizations. This quantity of stock is known as base stock. The base stock is deemed to have been created out of the first lot purchased. Hence, it is always valued at this price and it is carried forward as a fixed asset. It is important to observe here that any quantity over and above the base stock is valued in accordance with any other method (FIFO or LIFO methods).

2.21.6 Next-in-First Out Method

Under this method, the issues are to be valued at the next price. The next price denotes the price of materials which have been ordered but not yet received. In other words, the issues are priced at an actual price which is approximately equal to the market price. The policy is to keep the price at the level of the market price.

Under this method, materials will be issued at a price at which a new order is placed. Till the next order is placed, the same price will be applicable to issue of materials.

To illustrate, on May 10, 1000 kg of material are lying in the stores purchased at the cost of Rs. 25 per kg. On May 15, another order is placed to procure 500 kg @Rs. 30 per kg, on the same day. A requisition is received from the department for 300 kg, then it will be priced at Rs. 30 per kg, eventhough the materials are yet to be received.

As it is difficult to follow the procedure, this method is not in use anymore.

Illustration 2.15

With the information provided in Illustration 2.13, you are required to prepare a stores ledger account showing the receipts and issues of materials which would be recorded under LIFO method taking base stock as 80 units.

Solution

First issue took place on 10 July—no. of units to be issued is 160.

80 units are to be treated as base stock unit (Given) at Rs. 8/unit (Given). Remaining 60 units are to be priced @ Rs. 9/unit (under LIFO). The remaining issues are to be priced similarly and tabulated in the stores ledger as follows:

* Important note: Materials are to be issued on 28 July, in the place of 25 July because on that day stock available is only 80 units–which is equal to “base stock.” Only over and above the “base stock” level materials will be issued. As such it is issued only on 28 instead of 25.

|

Rs. |

**1 This consists of : |

|

80 units @ Rs. 10 per unit = |

800 |

50 units @ Rs. 6 per unit = |

300 |

|

1,100 *2 |

2.21.6.1 Advantages

- The movement of prices over a period is indicted by this method.

- Materials are charged at actual costs.

2.21.6.2 Disadvantages

- This method is acceptable only under standard accounting practices.

2.21.7 Simple Average Method

Under the method the price is calculated by dividing the total rates of materials by the number of rates of prices. It ignores the quantity of materials purchased. Every time an issue is made, a new average is computed. Unit prices of latest consignments are taken into account.

2.21.7.1 Advantages

- It is simple to understand and easy to operate.

- When prices do not fluctuate much, this method will yield good results.

- This method can be used when stock values are not high.

2.21.7.2 Disadvantages

- It does not give realistic product cost.

- It does not take into account the quantity of materials.

- On each issue, a new average price has to be worked out which involves heavy clerical work.

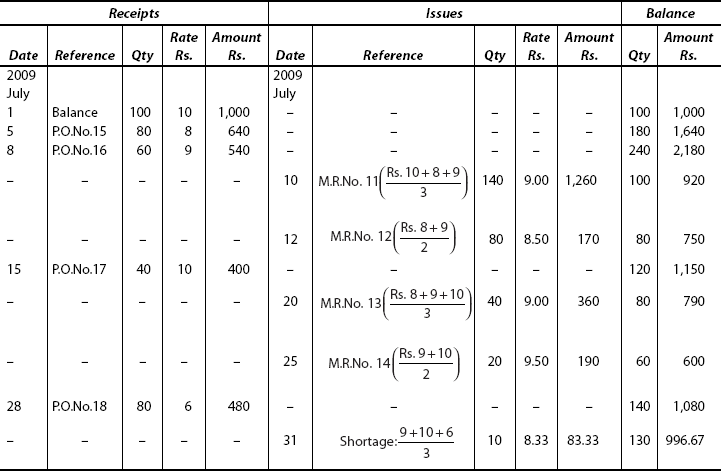

Illustration 2.16

Based on the same information provided in Illustration 2.13, you are required to prepare a stores ledger account showing the receipts and issues of materials by using simple average price method.

Solution

First issue takes place on 10 July. There are three receipts prior to this date of issue. On 1 July—price is Rs. 10, on 5 July price is Rs. 8 and on 8 July the price is Rs. 9.

Hence, the issue price of materials on 10 July is Rs. 9/unit. Similarly, for other issues simple average price is calculated and the results are tabulated as follows:

The stock on 31 July shows 130 units and its value is Rs. 996.67.

If simple average is applied 130 units × 8.33 = Rs. 1,082.90. But the stock appears at Rs. 996.67 only. This reveals that the production is overcharged by Rs. 86.23 (Rs. 1082.90 − Rs. 996.67).

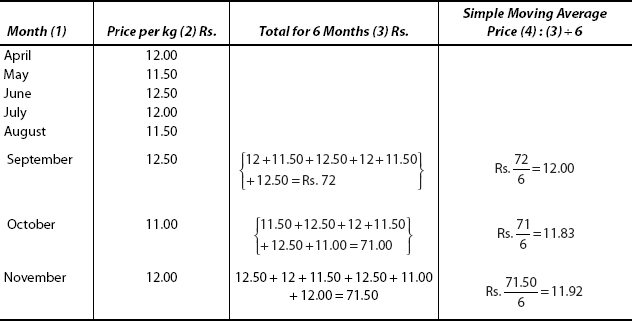

2.21.8 Periodic Simple Average Price Method

Under this method, average price is calculated periodically (weekly or monthly). It is not calculated at the time of each issue of materials as done in the previous method. The average price is to be calculated by adding all the prices (excluding the prices of opening stock—balance) during the period (say month) and dividing the sum of these prices by the number of prices.

2.21.8.1 Advantages

- All prices are taken into account during the period. Hence one calculation will be enough for one period.

- Compared to the simple average price method, this is more representative.

2.21.8.2 Disadvantages

- It does not take into account the quantities.

- It is not an exact cost method.

- It ignores fluctuations in price level.

Illustration 2.17

Based on the same information given in Illustration 2.13 you are required to prepare a stores ledger account showing the receipts and issue of materials by periodic simple average method.

Solution

No need of calculation for each issue of materials separately Periodic simple average rate is calculated as follows:

Take all prices of receipts (excluding opening balance):

i.e., Rs. 8 + Rs. 9 + Rs. 10 + Rs. 6.

Divide this by the number of prices, i.e., 4

Each issue of materials made during the month of July 2009 has to be valued at Rs. 8.25. The results are tabulated as follows:

The table shows that the book value of stocks is Rs. 1162.50.

But the average rate is 130 units × Rs. 8.25 = Rs. 1072.50.

This discrepancy arises because actual quantities are not taken into account, while computing the average rate.

2.21.9 Weighted Average Price Method

Under this method, the issue price is computed every time a receipt of materials occurs. The average price is computed based on both the quantities received and their cost. This method operates as follows: Average price is calculated after every purchase by adding the quantity received to the stock in hand and the cost of this purchase to the cost of stock in hand. Total cost is to be divided by the total quantity. The result is the average price computed under weighted average price method. A new average should be found out after each and every receipt of materials.

2.21.9.1 Advantages

- It smoothes out fluctuations in the prices of materials.

- Changes in prices would not affect issues and inventory.

- The closing stock is according to accounting principles.

- No need arises to identify each batch or lot separately.

2.21.9.2 Disadvantages

- It involves more clerical work.

- The issue price thus calculated would not reflect the actual purchase price.

Illustration 2.18

Based on the information given in Illustration 2.13, you are required to prepare a stores ledger account assuming that issues of materials are to be valued using weighted average price method.

Solution

For every receipt of materials, average price has to be calculated as follows:

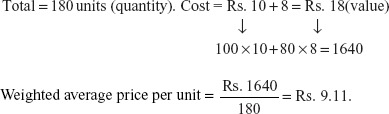

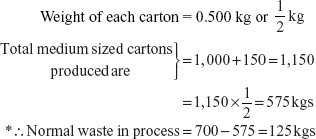

On 5 July, As per P.O. No. 15, a new receipt takes place with 80 units @ Rs. 8 per unit.