Chapter 5

Doing Business with Accounting Software

In This Chapter

Arguing the case — who needs accounting software anyway?

Putting software through its paces with some curly questions

Sizing up the main players

Implementing a new accounting system with minimum pain, maximum gain

Protecting your precious accounting data

Just in case you’re wondering, this chapter isn’t about how to use accounting software. Using accounting software and understanding how bookkeeping works are so completely intertwined that I try not to separate the two. Instead, I scatter explanations about using accounting software throughout this book, each time in the context of specific bookkeeping tasks.

In this chapter, I try to answer questions such as ‘What’s so great about accounting software anyway?’, ‘What software works best?’ and ‘Are all those promises that sweet software salesperson made going to come true?’(Sadly when it comes to software, there’s no such thing as a broken promise; only unfortunate misunderstandings.)

I also focus on how to get your new accounting system up and running, providing three unbeatable tips: Start at the right time of year (I’ll tell you when); do tasks logically step-by-step (I provide a list); and last, keep lots of fine dark chocolate close to hand. You’ll soon be firing on all four cylinders, speeding along the freeway to bookkeeping success.

What’s so Great about Accounting Software Anyway?

In my opinion, accounting software is one of those rare phenomena where a computer genuinely saves time, instead of chewing it up. If you have more than 20 or so transactions a month (and the vast majority of businesses do), then it’s a no-brainer: Accounting software is a must.

You may feel defensive reading this emphatic declaration of mine, thinking to yourself that your spreadsheet or handwritten ledgers do just fine. I implore you to stick around and read the next couple of pages, while I present the pros and cons of different methods.

Doing books by hand — is it worth it?

I still come across people who do their books by hand, and I’m well acquainted with the arguments put forward to justify this habit. True to my somewhat adversarial nature, I’m going to present these arguments to you, and refute them, one by one:

‘I prefer handwritten books because it’s easier to look things up.’ Bunkum. When you do books by hand, transactions are sorted by date, and date only. If you do books on a computer, you can search for transactions by name, date, amount, type of expense, cheque number or whatever your heart desires.

‘If the computer dies, I won’t lose all my work.’ True, but with accounting software, you won’t lose all your work if you have effective backups. And with handwritten books, you only have one copy, which makes you much more vulnerable to theft, fire, flood or any other kind of disaster.

‘Handwritten books are quicker.’ No, they’re not. Typing is usually the same speed or faster than writing by hand, and you get the added bonus that the computer adds up all the columns automatically. (I used to do books by hand; and believe me, it took hours to get everything to balance.)

‘Handwritten books are easier to understand.’ Maybe, just maybe, this is true, but only if all you’re doing is listing transactions. However, as soon as you try to generate a trial balance or Profit & Loss report, then handwritten books become as complex as understanding the psychology of the opposite sex.

‘Handwritten books are cheaper.’ I can’t argue with that one. However, entry-level accounting software is cheap as chips, starting at about $150. It doesn’t take long before you gain back $150, both in terms of lost time gained, and the benefit of having good financial reports on tap.

So, what do you reckon? It’s time to hurl that handwritten ledger out of the window, without so much as checking for innocent passers-by below.

Using spreadsheets instead

Many business owners and bookkeepers spurn accounting software and instead wax lyrical about the nifty little spreadsheet that they use to track everything from their weight-loss program to their business finances.

Spreadsheets are one step up from handwritten books, I agree. However, they don’t quite cut the mustard:

Spreadsheets are vulnerable to error: You only need to get one formula wrong, maybe missing out a row at the top or the bottom when adding up a column, and your totals are wrong also.

Spreadsheets only do half the job: Sure, you can whip up a set of books with a spreadsheet, but you can’t use a spreadsheet to generate a customer invoice, a purchase order for a supplier, or employee pay slips.

Spreadsheets don’t provide financial reports: When you key transactions into a spreadsheet, it takes just as long as keying transactions into accounting software. But when you’re done, all you get is a list of totals. You don’t get a Profit & Loss report, a Balance Sheet, a neat report showing how much GST you owe, or any of the other reports that are part and parcel of any accounting software.

In other words, why do something half-baked when you can do it superbly instead?

Choosing the One that’s Right for You

‘Choosing the One that’s Right for You’ makes me think of those hapless relationships earlier in my life that flourished and then floundered, blossomed then withered. Life could have been quite different, if only choosing the right man had been a little easier.

Fortunately, choosing accounting software is much easier than choosing husbands. You can reduce your decision down to a series of logical questions, a simple list of features, and an analysis of the pros and cons. Oh yes, and don’t worry if a product offers extra features that you don’t absolutely need (after all, a man that’s happy to shop as well as cook suits me just fine).

Playing with that test bunny

Looking for accounting software? Here’s how to find the perfect partner for life:

Ask your nearest and dearest for their opinions: Just as most mothers don’t hesitate to provide incisive commentary as regards your future partner, many accountants get pretty vocal about what’s best in terms of software. So, if you’re tossing up between a couple of products and your accountant much prefers working with one of these in particular, you’re likely to minimise accounting fees by following that recommendation.

Be clear about your preferences: If Apple Macs are your thing, you’re going to be unhappy crossing over to PCs. So look for accounting software willing to play on your Macintosh. (In Australia and New Zealand, MYOB and Xero are probably your only choices.)

Calculate the long-term costs: Software companies aren’t shy about their annual upgrade and/or licence fees, which often clock in at about 70 per cent of the original purchase price, payable year after year after year.

Find out about support: Can you get local support and training? How many consultants nationwide support this product? If you live in the bush, find out what the local support consists of, and which product is supported best in your particular locality.

Look for a good communicator: Nobody wants to be in a relationship with someone who only speaks in a series of grunts, so make sure your accounting software is a good communicator. Can you email invoices directly to Microsoft Outlook? Export data into other programs? Or hook up custom applications so that everyone talks to each other?

Look them up and down from head to toe: Download product demos and put the program through its paces. (If a product doesn’t offer a trial demo, give it a miss. A blind date is one thing, but life-long commitment without so much as a one-hour conversation is asking a bit much.) Focus on anything in your business that’s unusual or requires special reports.

Stick to familiar ground: If you’re already accustomed to working with Quicken (a popular personal finance product), then QuickBooks makes for an easy transition. On the other hand, if you’ve worked in the past as a bookkeeper or accounts assistant, you’re going to feel very comfortable with the more structured layout of MYOB.

Think to the future: No, I’m not talking about the possible physical appearance of your partner in 20 years time. I’m talking about the option to buy something relatively easy and inexpensive when you’re first getting started and then upgrade to the next product in the range as your business grows.

Focusing on the pain points

When you’re putting accounting software through its paces, don’t focus too much on all the standard stuff such as entering transactions, reconciling the bank or generating a Profit & Loss report. Instead, fix your beady eye on all the flash points most likely to give you (or the business that you’re working for) grief:

Complex inventory: If you’re a manufacturer, wholesaler or retailer, then concentrate on the trickiest aspects of managing inventory in your business. Focus on backorder management, bills of material management, matrix pricing features, multiple warehouses, negative stock features and re-order reports.

Customer relationships: Do you want to track prospects and customer activity and automate communications based on customer buying patterns? Then look for customer relationship management (CRM) features. Focus on ability to connect with other software applications, management reporting, remote access for salespeople in the field and email-based marketing.

Foreign costing: Do you import or export in foreign currency? Foreign currency features in off-the-shelf accounting software products are notoriously dodgy, so test and try before you buy. Look for the ability to calculate gain or loss on foreign exchange transactions, reporting features and the ability to manage multiple currencies.

Job costing: If a business does many jobs, and each one is unique, then sophisticated job costing features are probably the name of the game. But beware: Job costing is a real weakness with most off-the-shelf accounting products. Beware of software that doesn’t let you cost labour into product manufacture, that doesn’t provide salesperson reports or that can’t report on jobs or projects that span financial years.

Payroll: Three employees or more? Then you need payroll features. Ideally, look for payroll features that come as part and parcel of the accounting software, or look for payroll software that integrates easily with your accounting software. If you have many employees, look for software that caters for multiple super funds, payroll tax and multiple industrial awards (Australia), or that can manage complex leave entitlement calculations (New Zealand).

Remote access: Do you (or anybody else in the business for that matter) prefer to work from home, dressed in fluffy slippers and teddy-bear pyjamas? Then look for software that either operates ‘in the clouds’ (meaning you do your accounts online via a web browser), or that allows some other method of remote access. This way you can do the books from an office in Perth, at the same time as another employee logs in and works on reports while on a trip to New York.

Time billing: If a business bills for time in small segments — maybe a solicitor charging by the millisecond, or an engineer accounting for time out in the field — then time billing features come in pretty handy.

Getting Down to Specifics

In both Australia and New Zealand, the two main players are MYOB and QuickBooks, sharing up to 95 per cent of the desktop small biz accounting software market. Both products are excellent, respected worldwide and offer good local support. The upstart online product Xero is also gaining market share, and is part of a general trend towards SaaS — Software as a Service — products. (I readily own up to having a vested interest in both MYOB and QuickBooks. A true glutton for punishment, I’m the author of both MYOB Software For Dummies and QuickBooks QBi For Dummies, Wiley Publishing Australia Pty Ltd.)

The market gets much more fragmented for accounting software catering to medium-sized or larger businesses, and includes products such as ABM, Accomplish, Accredo, Attaché, Avanti, Microsoft Dynamics GP, Jiwa, Sage, SAP and Sybiz. I don’t spend time describing these products in this chapter, because I reckon that if the job of choosing accounting software is falling on your shoulders as a bookkeeper, then you’re probably working for a smaller-sized business. That’s why I focus on MYOB, QuickBooks and Xero in the next few pages.

Information about accounting software dates almost as fast as my Facebook entries. So for the latest goss, make your way to the Choosing Accounting Software page of my website at www.veechicurtis.com.au.

Checking out the MYOB family

MYOB holds the lion’s share of the accounting software market in both Australia and New Zealand. Its products are solid, user-friendly and offer excellent support.

When choosing what software is going to work best, remember to work through what features you really need, and tick them off one by one. I give a quick run-down here, but for more information, go to the Products page, and then the Accounting and Finance page, at www.myob.com.

MYOB BusinessBasics and MYOB FirstEdge (available in Australia only): If you’re a small service business with only a couple of employees — or maybe none, for that matter — then MYOB BusinessBasics (for Windows) or FirstEdge (for Macintosh) makes an excellent starting point. Both of these products are simple and relatively easy to use.

MYOB AccountRight Standard: The next rung up the ladder is MYOB AccountRight Standard, which includes sales, purchases and detailed reporting. Unlike BusinessBasics and FirstEdge, AccountRight Standard includes inventory, providing a practical solution for manufacturers, retailers and wholesalers, as well as service-type businesses.

MYOB AccountRight Plus: Further up the ladder, AccountRight Plus has everything that AccountRight Standard has, but also includes payroll and time billing.

MYOB AccountEdge: AccountEdge includes sales, purchases, inventory, time billing and multi-currency. You can purchase AccountEdge as a single user version or as a network edition, meaning that multiple users can work in the software at the same time. In Australia, MYOB AccountEdge also includes payroll.

MYOB AccountRight Premier: The matriarch of the family is AccountRight Premier. This grandma has everything that you see in lower-end products, but has one big difference: The software is multi-user. AccountRight Premier also includes multi-currency reporting — a life-saver for importers and exporters.

MYOB AccountRight Enterprise: Last on the scene is the great-grandma, AccountRight Enterprise. Identical in almost all respects to AccountRight Premier, the important distinction here is that AccountRight Enterprise can cater for businesses that run from multiple locations, enabling not only remote access to the file, but also inventory in multiple warehouses. In addition, this version allows for negative stock levels.

The MYOB range also includes a solution called MYOB LiveAccounts, where you use a web browser to do your books online. This product is the perfect play partner for businesses that are just starting out and want to be able to access their accounts at any time, from any location.

The features in MYOB LiveAccounts are similar to MYOB BusinessBasics and FirstEdge, allowing you to raise invoices, track expenses and manage GST. Added bonuses include the ability to connect your bank account to LiveAccounts to automatically update transactions, and being able to invite your accountant or bookkeeper to log on to access data or help finalise your books. For more info, visit www.liveaccounts.com.au or www.liveaccounts.co.nz.

Zooming in on QuickBooks

Although QuickBooks plays second fiddle to MYOB in Australia and New Zealand, QuickBooks is actually the most popular accounting software in the world, with more than 4.4 million users. This huge user base enables lots of dollars to be invested in development, resulting in a slick, user-friendly, well-designed product.

Again, I can’t give you a definitive explanation of which version is best, because the decision varies according to the size and nature of your business. I provide a rough guide to finding the perfect QuickBooks partner here, but for more info, go to www.reckon.com.au (in Australia) or www.quicken.co.nz (in New Zealand).

QuickBooks EasyStart: QuickBooks EasyStart is aimed at small service businesses just getting started and running from home. The simplicity of this version can work to your advantage: Because you have less to learn, your chances of making a mess are massively reduced!

QuickBooks Accounting: For an established service business that requires solid accounting, streamlined bank reconciliations or cost centre analysis, QuickBooks Accounting is an excellent choice. Examples of businesses using this product include graphic designers, journalists and sales consultants.

QuickBooks Online: This online product offers a feature set almost the same as QuickBooks Accounting, but with the difference that you pay a monthly subscription and access your accounting software online.

QuickBooks Plus (QuickBooks Small Business in NZ): Further up the ladder, QuickBooks Plus has everything that QuickBooks Accounting has, but also includes payroll, inventory and class tracking.

QuickBooks Pro: Tradespeople and builders, or anyone else who needs to draw up quotes or bill customers progressively, need QuickBooks Pro. This product also includes advanced inventory features and integration with Microsoft Outlook.

QuickBooks Premier: QuickBooks Premier provides multi-user access, multiple price levels and advanced financial forecasting. QuickBooks Premier also comes in five industry-specific flavours, with versions for subcontractors, manufacturers and wholesalers, not-for-profit organisations, professionals and retailers.

QuickBooks Enterprise: Available as an annual licence fee, QuickBooks Enterprise is the matriarch of the QuickBooks family, offering multi-user capacity for up to ten employees, multi-company reporting across subsidiaries and remote access from multiple locations.

Going online with Xero

Xero is a relative upstart in the accounting software market, but is attracting a lot of attention and experiencing very rapid growth. Like its competitors, Xero is a complete double-entry accounting software application; unlike its competitors, Xero is one of the first companies in Australia and New Zealand to enter the market with an accounting application that is entirely online.

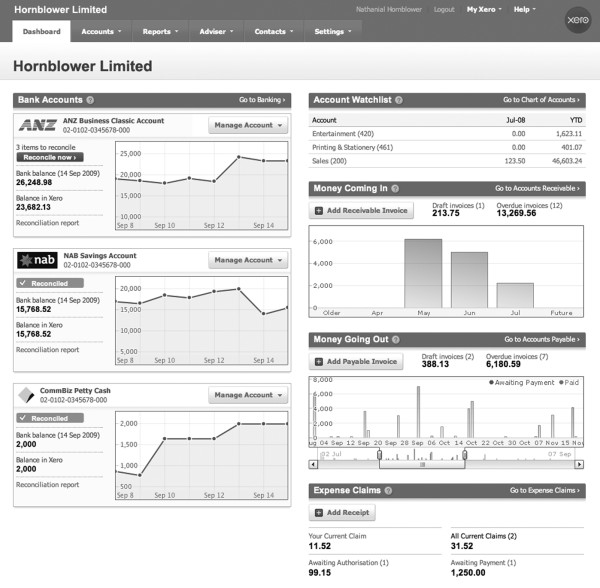

The look and feel of Xero is super-smart and super-cool (see Figure 5-1). All your data is online, meaning that you, the business owner or the accountant, can access info wherever you are using a Mac, a PC, an iPhone, a BlackBerry or any Windows Mobile device. For example, you can ask your accountant to log in, check data and view reports. You can both view the same info online, and discuss and fix things over the phone. One of the features of Xero is that it supports unlimited concurrent users, so several people can work on a single company file at one time. Security is taken care of too, allowing you to assign different roles to different users, with security mechanisms that are similar to Internet banking. In short, the tyranny of distance is crushed.

Xero is ideal for freelancers, subcontractors, tradespeople or small service and consulting businesses, but the absence of inventory management makes it an unlikely choice for manufacturers or wholesalers (unless these businesses decide to use a separate product to manage the whole inventory shenanigans). Also, Xero doesn’t offer built-in payroll features, although you can get around this limitation by subscribing to one of Xero’s partner services that specialise in payroll. For example, you can use a product such as ADP or ePayroll to process employee pay, and then send summary payroll info in the form of an accounts payable transaction into Xero. However, this does mean that you pay for an additional payroll product on top of your regular Xero subscription.

Figure 5-1: Xero provides accounting software using a clever online model.

Xero works on a subscription basis, offering three flavours: $29 per month, $49 per month or $64 per month, all GST-inclusive. Each price level comes with different features, but all include product upgrades and full technical support. Xero is also available to accountants, where the accountant or professional adviser manages Xero for the client, including invoicing and other services that may be provided.

At first, the monthly subscription fees to Xero may seem a bit pricey. However, when you’re weighing up costs remember that traditional off-the-shelf products not only involve a one-off purchase fee, but annual upgrade and support fees also. With some products, the annual upgrade and support fees exceed the original purchase price of the product.

Setting Up Accounting Software

The process of getting accounting software up and running can be pretty daunting. So it pays to have a plan of action and get organised.

In the next couple of pages I outline a step-by-step strategy for transforming your accounting software into a dream partner that does what it’s told, is reliable and punctual, and never snores at night.

Preparing for battle

I’ve done literally hundreds of accounting software setups over the years, taking anything from 30 minutes for a simple service business to several days for a complex manufacturing business with 25 employees.

If you’re implementing accounting software into a simple service business, preparing to go live isn’t a big deal. You can simply install software at any time, pick a start date (which can be either a date that’s past or a date that’s some weeks ahead), and get going.

If you’re implementing accounting software into a more complex business, with customer accounts, inventory or payroll, then the planning process becomes more important. I like to set a date that’s some distance in the future and plan towards that, doing things like organising customer and supplier lists and the chart of accounts well in advance. Here’s a step-by-step guide to help you prepare in advance.

1. Decide on a start date.

Here’s something I learned the hard way: The very best time of year to start off with accounting software is the beginning of the financial year (1 July for most Aussie businesses, and 1 April for most Kiwi businesses). Even if you’re a few months after this date by the time you’re reading this book, you’re probably still best to buy accounting software now, and to go back and enter your accounts from the first day of your financial year onwards.

Why? If you start on the first day of a new financial year, the transition from your old accounting system to your new one is a cinch, because your accountant always finalises your tax at the end of each year. You also avoid the situation where you have one set of books for part of the year and another set of books for the rest of the year, making it hard for you or your accountant to piece the whole story together.

2. Install your accounting software.

Over to you. This nerdy stuff varies depending what software you use.

3. Work your way through the start-up interview.

Most accounting software offers some kind of start-up interview, with pretty simple questions such as the business name, phone numbers, legal structure and so on. Follow your nose and do your best.

Take special care to enter the correct start date and year-end date when going through the interview. For some accounting software, this information can’t be changed once set.

4. Customise your chart of accounts.

I always recommend tweaking the chart of accounts, adding accounts, changing account names or deleting accounts that you don’t need. I explain all about this process in Chapter 2.

5. Create listings for customers, suppliers and items.

If you already have lists sitting elsewhere on your computer (for example, maybe you have a detailed customer listing sitting in Excel), I suggest you try to import this information rather than typing it all again from scratch.

6. Customise templates for invoices, customer statements and purchase orders.

Most accounting software allows you to customise your business forms to generate personalised invoices, customer statements and so on. You may also need to customise pay advices, remittance advices and receipts.

7. As the start date approaches, make sure your paperwork is as up to date as possible.

In particular, make sure that customer accounts (recording invoices and customer payments) are up to date and the bank account is reconciled.

8. Think about how you intend to record everyday transactions, such as payments, deposits, sales and payments.

Unless you’re already experienced with accounting software, make life easier for yourself by hiring a consultant to help get you started. Although training fees can be expensive, your money will be well spent.

Firing live on D-Day

Okay, so I’m assuming that you’ve already installed your accounting software and set up things like customer lists, accounts lists and templates (if not, refer to ‘Preparing for battle’ earlier in this chapter). You’ve arrived at ‘D-Day’: The date where the new accounting system is due to go live.

What happens next?

1. Enter opening balances for customers and suppliers.

If you plan to use your accounting software for invoicing and you have customers that owed money as of your start date, then you need to set up opening balances for each one. The same deal applies if you want your accounting software to keep track of supplier bills — specify how much was owed to each supplier at your start date.

2. If you have employees, set up payroll.

If you’re going to use payroll, you’re best to do so from the very beginning of the payroll year (July in Australia, April in New Zealand). Setting up payroll can be hideously technical and time consuming, so if you’re running short of time, get some help from a consultant. (Chapter 10 covers payroll in depth.)

3. If you have inventory, set up stock on hand.

If you want the accounting software to keep tabs on stock levels, you need to enter opening counts and cost prices for each stock item. Chapter 13 focuses more on this delightful topic.

4. Decide on a backup system and set it in place.

Backing up is important, so be sure to establish a backup system. See ‘Devising a backup strategy’ later in this chapter to find out more.

5. Start entering transactions!

Every business is different, but I tend to start with customer invoicing (if there’s no sales, there’s no dosh) and customer payments, and then I move on to payroll transactions. After that, I teach bookkeepers how to record purchases and supplier payments.

When you’re getting started with accounting software, don’t feel you have to get everything up and running at once. Depending on the business, sometimes doing things incrementally makes sense. For example, I may start by setting up sales and inventory. Later I implement payroll, and later still, I train my clients in electronic payments and automatic remittances. I can’t give a hard-and-fast rule as to what to do first, but do be careful not to bite off more than you can chew, especially if you haven’t used accounting software before.

Mopping up when the dust has settled

So, you’ve installed the accounting software, set up lists for customers and suppliers, and started entering transactions. What comes next?

1. Reconcile your bank account.

As soon as you have a month’s worth of transactions, figure out how to reconcile the business bank account (and credit card accounts also, if relevant). Not sure how? Then mosey on over to Chapter 11.

2. Put formal end-of-month or end-of-quarter procedures into place.

All this effort isn’t worth a brass razoo unless you put procedures in place that help you double-check your work. Chapter 15 is all about health-check routines that keep your accounts in top shape.

3. Enter opening balances for all asset, liability and equity accounts.

You can’t enter opening balances until the accountant has finished last year’s accounts (it can take up to nine months to give birth to tax accounts), so you may be waiting several weeks, if not months, before this info is available. In the meantime, enter the balances that you know are correct, such as your bank balance, debtors, creditors and GST. The other balances can be added later.

4. Review the state of play.

After a few months have passed, spend a few hours reviewing the state of play. Is the accounting system working as well as it could? Do you get all the reports you need? If not, go back to the consultant who helped you install the software, or contact the support line for the accounting software, and ask for help to ensure the system is as good as it possibly can be.

Protecting Your Accounting Data

When you record financial transactions using accounting software, the backups of the accounting software company file effectively take the place of traditional handwritten ledger books. To forget to back up is like leaving all your precious ledger books sitting out in the rain.

The accounting data backup is probably the single most important backup in any business because all the financial information ends up sitting in one single file, building up and up throughout the financial year until it contains a massive amount of information.

If you want to do your job well as a bookkeeper, you must aim to

Back up your accounting data every time you work. See ‘Planning for disaster’ later in this chapter for how best to organise these backups.

Get in the habit of taking backups off-site, away from the office, so that if the office burns down or the computers are stolen, you still have your accounting data.

Devising a backup strategy

In case you’re wondering, a backup is when you make an extra copy of the stuff on your computer and then store the copy elsewhere (preferably well away from your computer). The idea is that should something dreadful happen to your computer (such as a fire, theft or data corruption), your life’s work isn’t lost.

Although you, as bookkeeper, are probably most focused on backing up accounting data, remember that a business needs to have a backup solution for all data, including documents, emails, graphic files and so on. When deciding how to back up your accounting data, consider what other backup systems are already in place — or need to be put into place — for other business data.

CDs, DVDs and flash drives

For small amounts of data, backing up onto a CD, DVD or flash drive works fine. CDs generally have a smaller capacity than DVDs (650 MB compared to 5 GB or so), and DVDs have a smaller capacity than flash drives (which can hold anything up to 64 GB, probably more by the time you read this!). I find CDs and DVDs are slower to copy files onto, but are a fair bit cheaper (a rewriteable CD or DVD costs a few dollars a pop; a flash drive costs 25 bucks or so). Note: CDs come in two flavours: CD-Rs and CD-RWs. You can use a CD-R only once, but you can use a CD-RW (the ‘RW’ stands for rewriteable) over and over again. The same principle applies with DVDs.

I generally prefer flash drives to CDs and DVDs because they’re a bit quicker at copying and retrieving data, and they fit on something that’s smaller than a lipstick. (I hope male readers excuse this rather girly take on things.) Simply plug the thingamajig into a USB port and an icon appears on your desktop showing another drive on your system. Drag and drop the files you want to back up onto this drive, and there you have it.

The main drag with flash drives is that they get full pretty quick, and if you want to back up more than just your accounting company file, you’re going to need more storage capacity. That’s when removable hard drives come into their own.

Removable hard drives

Businesses with any more than a couple of computers quickly find that neither DVDs nor flash drives offer sufficient capacity to act as efficient backups. The solution is a removable hard drive.

Of course, deciding to buy a hard drive is only part of the decision. You then need to decide what data you’re going to back up onto the hard drive, and how. Most hard drives come with a simple utility that lets you schedule automatic backups every night or every week, and that enables you to select what data you choose to back up.

I suggest that you don’t try to mirror all the data on your existing hard drive every time you back up, as to do so is very time-consuming and causes unnecessary wear and tear on both drives. Instead, I suggest that you back up data folders only, as opposed to program folders. Of course, if you work in this way, it pays to be organised about where you store information, making sure you store all your critical data in the same area of your hard drive (many smaller businesses simply choose to store all critical data in a folder called My Documents, other businesses develop slightly more complex filing systems).

Probably the worst thing that happens with removable hard drives is that they can lull you into a false sense of security. You think that everything is safe, because you know that all data automatically copies across onto the other hard drive each night. However, remember to rotate at least two removable hard drives, removing one from the office on a regular basis. Ideally, organise the data on these drives using the grandfather–father–son method that I outline in ‘Planning for disaster’ later in this chapter.

Unless you maintain an offsite backup, your data isn’t adequately protected from fire or theft.

Online storage

If you’re travelling around from place to place, uploading files to a remote server is a great backup method. The idea is that you log onto to a remote website, follow the prompts to select the files you want to copy, and upload these files to a remote location. That way, if your computer explodes, gets stolen or mysteriously turns into a frill-necked lizard, you can still hop on any old machine and access your data.

Benefits of using online backups include economy (prices start from $10 a month), and peace of mind (you can usually schedule backups to occur automatically). Premium business services also guarantee that data is backed up in duplicate at two separate data storage facilities.

You can find many online storage services on the Web, but in Australia, two that I’d recommend (because they’re both local and offer services attuned to backing up accounting files) are Reckon Tools Backup (Reckon is the company that distributes QuickBooks) and Secure Internet Storage Solutions (who are approved MYOB Developers). Visit the Reckon Tools page at www.reckon.com.au or www.secure-iss.com for details. In New Zealand, you can find a list of online backup providers by searching the NZS directory for backups at www.nzs.com/business.

Planning for disaster

Even if you have two or three backup drives on the go, you still run the risk that if data is corrupted and you don’t notice immediately, you could end up with a stack of backups, each one with corrupt data. The best way to guarantee data integrity is the GFS method (standing for grandfather–father–son).

Assuming you work on your data on a daily basis — if you don’t, adapt the principles of this system to suit your own work pattern — here’s how it works: On the first day of the week, make a full backup onto a removable hard drive, DVD or flash drive — this backup forms part of your weekly backup set. On the next four days, back up at the end of each day, again onto a removable hard drive, DVD or flash drive — these four backups form your daily backup set. (If you like, your daily backups can be differential backups, saving only the files that changed since the last full backup.)

Keep recycling your daily backups. For example, each Tuesday you can overwrite the backup from the previous Tuesday. Similarly, recycle your monthly backups, so that in the first week of each month, you overwrite the data from the first week of the previous month. On the first day of the last week of each month, make yet another separate backup — this forms part of your monthly backup set.

By the end of the year, you end up with four daily backups, three weekly backups and thirteen monthly backups (you get 13 four-week cycles in a year), as I show in Figure 5-2 — a true family dynasty.

If you choose to use backup software to automate your daily backups, make sure you test that you can restore data easily, and that you can restore this data onto a different machine. (Somewhat unbelievably, some backup software chucks a wobbly if you try to restore data onto a machine that’s different to the one where you did the backup.)

Figure 5-2: A hierarchical backup system guards against data corruption.

Keeping private stuff under wraps

I don’t know about you, but I feel quite private about my finances. And just as I wouldn’t leave my tax return lying around on the coffee table when friends are visiting, I like to protect my accounting data from uninvited inspection.

If you’re a sole owner/operator, or a bookkeeper who is the only person working in the accounting file, protecting privacy is easy. All you have to do is create an administrator or master password which you enter every time you open up the software.

With most accounting software, you can create restrictions for any user who has a sub-password. For example, you can restrict access so that sales staff can view customer details and sales history, and possibly even enter invoices, but they can’t view financial reports or record other kinds of financial transactions.

When defining levels of access for employees, I suggest you restrict payroll data so that only the owner or the bookkeeper can access this information. Keeping payroll data under wraps not only respects employee privacy but also helps maintain peace in the office, avoiding tricky questions as to why one employee gets paid more than another.