Forensic Accounting Guidelines and Standards

Executive Summary

Forensic accountants in conducting their professional services should comply with a set of applicable laws, rules, regulations, and professional standards. Practicing forensic accountants are subject to several professional responsibility standards and ethical codes of conduct. Responsibilities of forensic accountants are governed by authoritative guidelines of several professional organizations and government agencies. This chapter presents authoritative guidelines for professional responsibilities and codes of conduct for forensic accountants.

Introduction

Forensic accountants should perform their professional services in compliance with standards and codes of conduct established by authoritative bodies relevant to their practices. Forensic accountants should observe authoritative guidelines of professional organizations that they belong to and government agencies and other authoritative bodies that license them to practice. Forensic accountants should observe and comply with many laws, rules, regulations, and standards applicable to their professional services and practices. For example, CPAs who perform forensic accounting services should observe the AICPA professional responsibilities and code of conduct. Forensic accountants who perform valuation services should follow the National Association of Certified Valuators and Analysts (NACVA) professional standards. Many public and private organizations’ professional standards are applicable to forensic accountants and this chapter discusses their relevance and importance to forensic accounting practices. This chapter presents professional standards and codes of conduct of these organizations that influence forensic accounting practices as well as forensic accounting best practices, education, and research.

Standards and Authoritative Guidance for Forensic Accountants

Authoritative guidance issued by several public and private professional organizations influence forensic accounting practices.

Court Systems

Forensic accountants investigate forensic cases including alleged fraud incidents, perform forensic analyses, gather sufficient, competent, and persuasive evidence, reach conclusions, and testify to their findings in compliance with applicable laws, rules, regulations, and guidelines including court deliberations. Thus, forensic accounting practices are influenced by court guidelines. Forensic accounting services of expert witnessing, fraud investigation, and litigation consulting among others require application of specialized knowledge and investigative skills in gathering, analyzing, and evaluating evidential matters, ascertaining their compliance with a set of guidelines, and interpreting and communicating findings in the courtroom, boardroom, or other legal or administrative venues that are suitable for use in a court of law.1

There are many court systems in the United States, including the federal court system and 50 state court systems with their own structures and procedures.2 Legal cases and forensic accountants’ investigation of these cases often start at a lower court and may advance to a higher court and possibly the federal court system. Thus, forensic accountants in performing fraud, litigation, valuation, and expert witnessing services among others should be familiar with all state and federal court systems. In general, there are two types of court systems, state courts and federal courts. Many of investigative and legal issues are initiated and resolved in state trial courts that could be city or municipal courts, county or circuit courts, or regional trial courts. These state trial courts can address different types of cases with limited jurisdiction or specific jurisdiction. Lower court decisions can be appealed and be retailed by a higher-level court of appellate courts and/or further be heard by the state Supreme Court. The state Supreme Court decisions are final with a state court system and can be appealed to the U.S. Supreme Court. Court systems in the United States based on their structure and hierarchy are Supreme Court, District Courts of Appeal, Circuit Courts, and County Courts.

Federal courts are typically divided into districts and circuits with at least one federal district court in every state, whereas federal circuit courts include more than one district. The U.S Supreme Court is the highest level of federal courts and its legal interpretations are the ultimate court decisions. The nine justices of the U.S Supreme Court are nominated by the president, approved by the U.S. Senate, and tenured until they resign or die. Forensic accountants should understand and follow the judicial processes and decisions of the legal system in the United States, which is based on the adversarial process. This adversarial process dictates that all parties in a legal dispute have an equal opportunity to present their case to a neutral jury or judge, with an equal chance to win subject to the same set of rules to ensure the fairness of the process.

Professional Standards

Forensic accountants are required to follow the Professional Code of Conduct set out by many professional organizations. The following subsections describe many of these guidelines. For example, the AICPA’s code of conduct consists of the following areas: Objectivity and Independence, Due Care, Scope and Nature of work, Integrity, and Responsibility to the Public. First, all actions taken must be in the public’s best interest. This is called the public interest principle. The public contains groups such as creditors, investor clients, and governmental agencies. Second, the due care principle is required in observance of ethical and professional standards. It also requires the member of the AICPA’s ability to adhere to quality control and responsibility for actions taken. Third, the Scope and Nature of work principle pertains to a member of the AICPA using the Code of Professional conduct to determine the level of service for clients. Fourth, the Integrity principle is designed to enhance the public’s trust in the member providing professional service. Finally, the Objectivity and Independence principle demand that members strictly avoid conflicts of interest and relationships that may subject the member to objective impairment.3

Outside of the AICPA Code of Professional conduct, several other organizations have written its code of conduct for Forensic Accountants. These organizations are the ACFEs, the American Accounting Association (AAA), the International Forensic Accounting Association (IFAA), the International Institute of Certified Forensic Accountants (IICFA) and the American Board of Forensic Accounting. Each organization’s code of conduct resembles the AICPA’s guidance, as it is the main board in the United States. The IFAA and IICFA are international organizations for forensic accountants and their codes of professional conduct are very much similar to their counterparts in the United States (e.g., AICPA, ACFE).

AICPA, AU-C Section 240 is a set of rules concerning the auditor’s duties when encountering fraud in an audit. The AICPA states that the primary purpose of AICPA is to expand upon existing Sections 315 and 330 that deal with risk of material misstatement and audit procedures, respectively. The document also states that in fraud investigations, the main requirement for the auditor is to be professionally skeptical; an auditor is skeptical when observing data regarding material misstatement. Valuation standards are set by the AICPA and cover the scope and engagement of practitioners performing valuations. VS 100 pertains to business ownership and intangible assets, while VS 9100 are interpretations of VS 100. The AICPA is used heavily during litigation, which is of importance to forensic accountants. The areas that fall under litigation are disputes, dissolution, and bankruptcy.4

Nonauthoritative Guidelines

The AICPA offers nonauthoritative guidelines through its website. The guidance is very thorough; however, and covers most relevant areas of forensic accounting. The AICPA is the only organization that offers nonauthoritative guidance to practitioners in America. In Canada, The Chartered Professional Accountants (CFA) must follow the 2006 Standard Practices while conducting investigations and engagements. Similar to public accounting, the standards must be applied to ensure integrity and disclosure of accurate information to the public. The CFA website contains seven sections—planning and accepting and engagement, information analysis, documentation and reporting, testimony, and applying the standards to the practice. These practices are authoritative, as opposed to most standards in the United States, which are nonauthoritative. The CFA standards are set by the Investigative and Forensic Accounting (IFA) committee. The standards provide guidance in seven major areas—standard practices, engagement acceptance, planning and scope of work, information collection and analysis, file documentation, reporting, and expert testimony.5

Forensic Accountant Code of Ethics

Ethics in general is defined as an honorable behavior and “ethics includes: action, foreseeable consequences and people, with their virtues or lack of virtues, involved in any human activity.”6 The principles of accounting theory and practice were founded upon the basis of moral principles and ethical values; therefore, upholding a high standard of ethics is expected of forensic accountants engaged in professional activities. The concept of ethics in business as related to forensic accountants can be hard to define because individuals have their own moral compass and they often think differently, and every business has its own set of standards. Business ethics consist of a set of codes of: business conduct, laws, rules, regulations, and best practices. Business ethics focuses on upholding ethical values in business, including values like honesty, integrity, trust, fairness, and objectivity, whereas noncompliance with these standards can lead to cases of unethical behavior and sometimes even illegal behavior. Forensic accountants should investigate for the truth and report the truth on the basis of their investigation. They should avoid any conflicts of interests and advocacies, should not compromise their objectivity and professional responsibilities, hold the highest standards of integrity and ethics, share their skills, knowledge, and experience with other forensic accountants in a professional manner, express their opinions on the basis of the evidence gathered, and keep abreast of the latest developments in their profession through continuing education, seminars, workshops, and other studies.

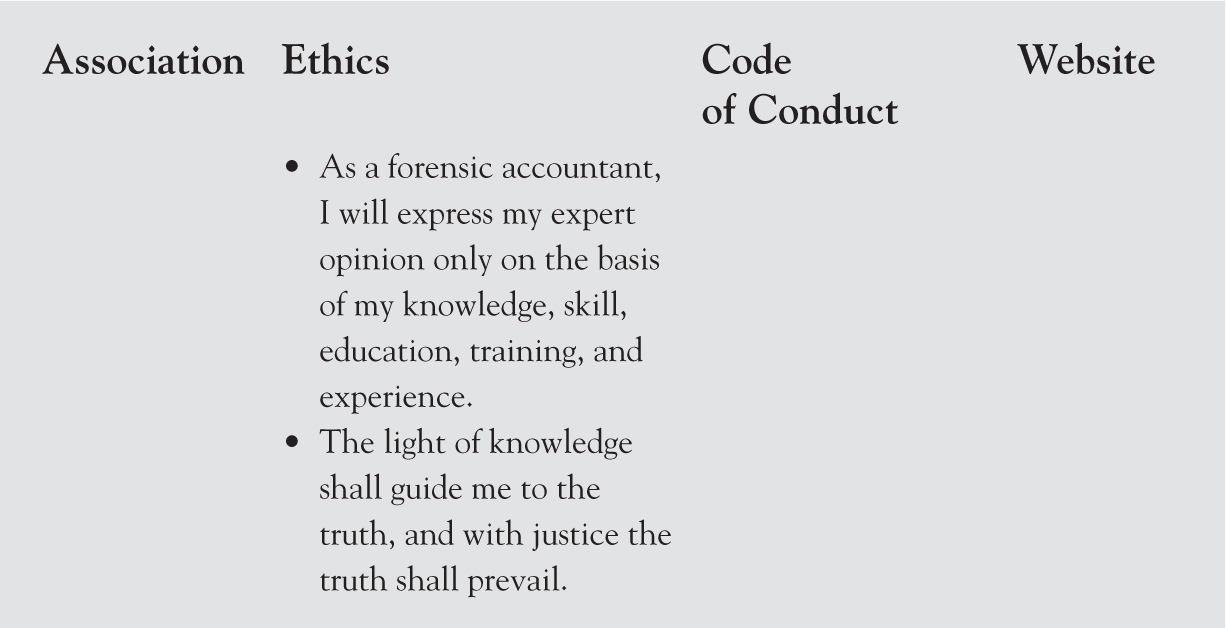

The above-mentioned rules are also addressed by several organizations such as the American Accounting Association (AAA), American Institute of Certified Public Accountants (AICPA), Association of Certified Fraud Examiners (ACFE), and the National Association of Certified Valuators and Analysts (NACVA). Exhibit 4.1 presents these organizations and their codes of ethics relevant to forensic accounting practices. The most common codes of ethics and professional standards are as follows:

- Integrity/Objectivity/Impartiality

- Competency/Training/Proper skills

- Confidentiality/Public trust

- Independence/Duty to the Public

- Conflicts of Interest/self-dealings

- Transparency/Fair presentation

- Good faith/Due diligence

- Authority/Proper conduct

- Professional Judgment/ Skepticism

- Fairness/Mutual respect

Regulations Relevant to Forensic Accounting

The question that has currently and repetitively being asked is that whether forensic accounting should be regulated.7 With many certifications relevant to forensic accountants including certified fraud examiners, certified forensic specialists, certified financial crime specialists, certified forensic accountants, certified forensic financial analysts among others discussed in the previous chapter, it is perhaps time to regulate forensic accounting practices. The regulation of forensic accounting is expected to improve the quality of fraud and nonfraud services performed by forensic accountants. Thus, the following subsections present laws, rules, regulations, and standards relevant for forensic accountants.

Foreign Corrupt Practices Act of 1977 (FCPA)

The Foreign Corrupt Practices Act (FCPA) was released in 1977 in response to several high-profile fraudulent schemes in the mid-1970s.8 The FCPA itself pertains to disallowing upper management from engaging in business activities with foreign agents that would aid in acquiring and disposing of business through payment of illegal monies. To make the FCPA as effective as possible, the Department of Justice (DoJ) requires all U.S. upper management to abide by the rules contained within the act. In 1998, another amendment was added to the FCPA that required foreign companies that conducted business within the United States to be subject to the same rules and regulations that U.S. firms had to follow. As part of keeping track of all business processes, the DoJ also mandates that firms disclose and document all accounting activities in accordance with accounting provisions stated within United States Code 78m.9 Code 78m deals with the periodical reports issued by securities firms during a normal business year.10

Despite the FCPA being put into practice in 1977, there are concerns about its effectiveness. On November 9, 2017, Steven R. Peiken of the SEC shared his thoughts in a speech at the School of Law at the University of New York. In the speech, there was a highlight regarding Halliburton’s vice president violating FCPA guidelines.11 A counter to these concerns has been presented by the Big 4 (Deloitte, PricewaterhouseCoopers, Ernst & Young, and KPMG) accounting firms through forensic services. For example, PricewaterhouseCoopers has 3,000 specialists that focus on the Foreign Corrupt Practices Act (FCPA). The firm claims that forensic services help implement strategies that mitigate the risk of FCPA violations.12

A framework was introduced by the DoJ in 2016 that listed rules that companies must follow. These rules are13

- Firms must voluntarily report FCPA violations

- Firms that committed an FCPA violation must cooperate with the DoJ

- Firms should act swiftly to repair the damage caused by the violation and must work to enact barriers to prevent another such event from happening in the future14

The Sarbanes-Oxley Act of 2002 (SOX)

The wave of financial scandals of Enron, Global Crossing, WorldCom, Tyco among others in the early 2000s eroded public trust and investor confidence in public financial information and the financial markets.15 The turn of the twenty-first century was a challenging and rather difficult year for corporate America as evidenced by the stock market’s swift decline, a significant number of earnings management and financial restatements, a rash of corporate and accounting scandals, and a resulting loss of confidence in public financial information and financial markets. The Sarbanes-Oxley Act (SOX) of 2002 was passed in July 2002 to improve investors’ confidence that had been eroded because of the reported financial scandals of high-profile companies (e.g., Enron, WorldCom, Global Crossing, Qwest).16

The act was intended to rebuild investor confidence and protect investors by improving the reliability, completeness, accuracy, and transparency of corporate disclosures, including financial reports.17 Many provisions of SOX pertain to financial reporting, including Sections 302 and 404, which require public companies’ management to certify financial statements and report on the effectiveness of the company’s internal control over financial reporting (ICFR) and require auditors to attest to and report on both financial statements and ICFR. Section 301 requires that the audit committee oversee the work of management and the independent auditor as related to ICFR. The audit committee’s oversight of Section 404 is essential as mandatory ICFR is becoming an integral part of financial reporting. SOX provisions directed the SEC to issue rules and Interpretive Guidance and the PCAOB to issue Auditing Standards No. 2 and 5 in requiring the use of the Integrated Financial and Internal Control Reportingconcept.18 The provisions of SOX that were not previously practiced by public companies and that are intended to benefit all companies include the following:

- Creating the PCAOB to regulate and oversee the audit of public companies and to improve the ineffective self-regulatory environment of the auditing profession;

- Improving corporate governance through more independent and vigilant boards of directors, particularly effective and mandatory audit committees for public companies;

- Enhancing responsibilities of executives of public companies by requiring certification of financial statements by both CEO and CFO;

- Improving internal control reporting for public companies by requiring certification of ICFR by both CEO and CFO.

- Enhancing the quality, reliability, transparency, and timeliness of financial disclosures through executive certifications of both financial statements and internal controls;

- Prohibiting nine types of nonaudit services considered to have an adverse effect on auditor independence and objectivity;

- Regulating the conduct of auditors, legal counsel, and financial analysts, and their potential conflicts of interest;

- Increasing civil and criminal penalties for violations of security laws; and

- Rebuilding public trust and investor confidence in public financial reports and financial markets.

The primary focus of SOX is to improve the quality, reliability, and transparency of public financial reports, quality of the audit process, and the effectiveness of corporate governance. These provisions of SOX have implications for forensic accounting practices. High-quality financial information can contribute significantly to the integrity and efficiency of the capital markets. Financial reporting provisions of SOX and SEC-related rules include the following:

- Certification of financial statements and internal controls by CEOs and CFOs;

- Disclosure of off–balance sheet transactions;

- Disclosure pertaining to the use of non-GAAP (generally accepted accounting principles) financial measures;

- Disclosure of material current events affecting companies;

- Mandatory internal control reporting by management;

- A study of principles-based accounting standards;

- Convergence of accounting standards;

- Recognition of adequate funding for the FASB as an accounting standard-setting body; and

- The oversight function of the FASB by the SEC.

A fundamental objective of SOX was to enhance the reliability and integrity of audit functions and the audit process as well as the credibility of audit reports provided in financial statements and to improve investor confidence in the auditing profession. Provisions of SOX and SEC-related rules addressing audit functions include the following:

- Creation of the PCAOB to oversee the accounting profession;

- Adoption of new rules related to auditor independence;

- Issuance of new rules related to improper influence on auditors;

- Issuance of new rules pertaining to retention of records and audit evidence relevant to review and audit of financial statements;

- The oversight function of the PCAOB by the SEC; and

- Attestation of and report on Internal Control over Financial Reporting (ICFR).

The following are some important provisions of the SOX that have relevance to forensic accounting practices: The SOX (Sec. 301) explicitly requires that every public company establish procedures for the confidential, anonymous reporting by employees of concerns regarding questionable accounting, internal control, or auditing matters. Yet, the act leaves great flexibility to companies in their implementation of this requirement. Under the SOX (Sec. 301), audit committees of public companies are responsible for establishing and overseeing procedures for employees to confidentially and anonymously report concerns regarding questionable accounting, internal control, or auditing matters. This regulatory requirement is consistent with the belief that the availability of an anonymous channel to report questionable accounting matters can enhance an organization’s internal control by fostering communication and bringing FSF to light as early as possible.

Anonymous reporting channels may be particularly useful in encouraging the reporting of wrongdoing by organizational members because anonymity should minimize personal “costs” of reporting, such as retaliation and other potential penalties. A benefit of such channels is that employees often discover FSF before other monitors (e.g., internal auditors, external auditors, and/or regulators) and, consequently, often have the ability to inform the organization earlier than others. In this regard, the 2018 Report to the Nations issued by the Association of Certified Fraud Examiners (ACFE) reports the results of a survey of their members indicating that “tips” including unanimous information obtained from employees and nonemployees were more effective in identifying and discovering fraud than any other methods and mechanisms (40 percent).19 The other two main methods were internal audit and management review, at 15 percent and 13 percent, respectively. As a result of detection, corruption is the most prevalent scheme in every area of the globe. In total, fraudulent behavior inflicted approximately $7 billion in losses, with 22 percent of cases causing losses of more than $1 million.20 Many provisions of SOX pertaining to financial reporting, the audit process, and corporate governance are relevant to forensic accounting practices as discussed earlier and summarized in Exhibit 4.2.

Financial Reform and Consumer Protection Act of 2010 (Dodd-Frank Act)

The existence and persistence of financial crisis in the United States and the resulting global economic meltdown is commonly viewed as serious since the Great Depression. The global competitiveness of U.S. capital markets to a significant extent depends on the reliability of financial information in assisting investors to make sound investment decisions, cost-effective regulation in protecting investors, and efficiency in attracting global investors and companies. The U.S. free enterprise system has transformed from a system in which public companies including banks and other financial institutions were traditionally owned and controlled by small groups of investors to a system in which businesses are owned by global investors. The United States has achieved this widespread participation by adopting sound regulations, maintaining high-quality disclosure standards and enforcement procedures that protect the interests of global investors. Recent financial regulatory reforms including the SOX and the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (DFA) are intended to protect global investors and consumers.21 Dodd-Frank Act is named after Senate Banking Committee Chairman Christopher Dodd (D-CT) and House Financial Services Committee Chairman Barney Frank (D-MA) and its provisions pertain to banks, hedge funds, credit rating agencies, and the derivatives market.

Investor confidence in public financial information and the financial markets is the key driver of global competition, financial stability, and economic growth. Investors are confident when stock prices are on an upward trend and the news about future stock performance is optimistic. The Dodd Frank Act (DFA) is intended to restore investor confidence in corporate America and its financial system and financial services provided through the banking system. Reliable and transparent financial information contributes to the efficient functioning of the capital markets and the economy. In recent years, investment banks and the major brokerage firms have grown rapidly and generated record revenue. Failures of the five major financial institutions of Goldman Sachs Group Inc., Bear Stearns Co., Morgan Stanley, Lehman Brothers Holdings Inc., and Merrill Lynch & Co and subsequent government costly bailout of these firms raise serious concerns about the value-adding activities of financial services firms, their ethics and governance as well as the professional accountability of their board of directors, senior management, internal and external auditors, and other corporate governance participants. The lack of public trust and investor confidence in corporate America, the Wall Street and its financial dealings and reports, has continued to adversely affect the vibrancy of the capital market as bailout banks and subsequent continuous excessive executive compensation have left us with a legacy of mistrust. This challenged policy makers and regulators to establish and enforce more effective and efficient regulatory reforms as well as business leaders to change their culture, behavior, and attitudes to restore confidence and trust in the Wall Street.

Provisions of the Dodd Frank Act (DFA) that are relevant to forensic accounting practices are summarized as follows:

- Broadening the supervisory and oversight role of the Federal Reserve Board to regulate all entities that own an insured depository institution and other large and nonbank financial services firms that could threaten the nation’s financial system.

- Establishing a new Financial Services Oversight Council to identify and address existing and emerging systemic risks threatening the health of financial services firms.

- Developing new processes to liquidate failed financial services firms.

- Establishing an independent Consumer Financial Protection Bureau to oversee consumer and investor financial regulations and their enforcement.

- Creating rules to regulate over-the-counter derivatives.

- Coordinating and harmonizing the supervision, standard-setting and regulatory authorities of the SEC and the Commodities Futures Trading Commission.

- Mandating registration of advisers of private funds and disclosures of certain information of those funds.

- Empowering shareholders with a say on pay of nonbonding votes on executive compensation.

- Increasing accountability and transparency for credit rating agencies.

- Creating a Federal Insurance Office within the Treasury Department.

- Restricting and limiting some activities of financial firms, including limiting bank proprietary investing and trading in hedge funds and private equity funds, as well as limiting bank swaps activities.

- Maintaining consistency in adhering to international financial and banking standards.

SEC Enforcement Actions

The SEC was created by Congress to ensure proper disclosure of financial information by public companies. The SEC has taken enforcement actions against firms that are identified as having violated the financial reporting requirements of the Securities Exchange Act of 1934.22 The SEC Enforcement Manual (SEC 2010b) provides guidance to employees about the handling of complaints, tips, and referrals (leads) received concerning violations of SEC requirements. The SEC obtains leads for investigation from several sources: (1) public complaints and tips from short sellers and others; (2) the reporting requirements of federal, state, and local law enforcement agencies under the Bank Secrecy Act; (3) the enforcement staff of the PCAOB; (4) the enforcement of “blue sky laws” by state securities regulators; (5) complaints and other information from members of Congress on behalf of constituents whom they represent; and (6) trading-related referrals from domestic self-regulatory organizations (SEC 2010b).

SEC staff members from the Division of Corporation Finance examine financial statements and other filings for routine screening criteria violations and for suspicious subjective factors. When the initial investigation exposes factors that warrant further investigation, an informal investigation is conducted, and persons with relevant information are invited to provide pertinent documents and testimony. The SEC need not formally notify the target firm during this investigation, thus protecting firms that are cleared by the informal investigation. If strong evidence of a securities law violation is uncovered during the informal investigation, then the SEC may pursue a formal investigation. If the SEC informs the target of the formal investigation, the 1934 Act Release No. 5092 requires disclosure to shareholders by the firm, and the investigation may become public. The SEC policy is to make its enforcement activities public only when it files a formal complaint alleging securities law violations and seeks settlement with the enforcement target. The formal investigation grants subpoena power to compel testimony and the production of documents.

The issuance of an Accounting and Auditing Enforcement Release (AAER) by the SEC signifies that a failure has occurred in the systems that are put in place by companies to prevent opportunistic behavior by company management. AAERs result when companies and/or their auditors accept an administrative action, such as a fine or other reprimand, and agree not to engage in the behavior that brought about the SEC investigation rather than formally plead guilty to a misdeed. Even though these AAERs are not legally considered an audit failure, they can be interpreted as evidence of an audit failure as well as evidence of a corporate governance failure. The discovery of firm-specific corporate governance and audit weaknesses would help auditors, investors, forensic accountants, and regulators assess the likelihood that management will engage in self-serving activities that would lead to the issuance of an AAER.

The SEC has issued AAERs during or at the end of an investigation against a company, an auditor, or an officer for alleged accounting and/or auditing misconduct since 1982.23 These releases provide varying degrees of detail on the nature of the misconduct, the individuals and entities involved, and their effect on the financial statements that could be of much interest to forensic accountants. The AAERs dataset as of September 2018 consists of 3,052 SEC AAERs (1,214 firm misstatement events) issued between May 17, 1982 and September 1, 2018. It contains 3941 firm misstatement events that affect at least one of the firms’ quarterly or annual financial statements. The dataset consists of three data files: The Details, Annual, and Quarterly files.

The Detail file contains

- Firm name and its identifiers

- AAER numbers (e.g., 1 to 3,180) pertaining to each firm

- A description of the reason the AAER was issued

- The balance sheet and/or income statement accounts affected by the violation

- One observation per firm misstatement event.

The Annual and Quarterly files are compiled from the Detail file and are formatted by reporting period when the misstatement occurred.

The Annual and Quarterly files contain

- AAERs with alleged financial misstatements

- Firm name and identifiers

- The year and/or quarter-end when the misstatements occurred

- Information on whether earnings or revenues are understated

- One observation for each year or quarter affected by the violation

Exhibit 4.3 presents the timeline of SEC investigation as reflected in AAERs. This timeline starts with Model Imperial Inc. on January 5, 2000 and ends with RSM LLC. 3943, on June 14, 2018. Exhibit 4.4 shows that two events are associated with disclosure of alleged FSF. The first event is when the allegation of FSF was initially publicly disclosed (public disclosure) and the second event is when the SEC or the DoJ officially and publicly disclose their enforcement against public companies for the allegation of FSF (enforcement disclosure).

Forensic accountants in practicing forensic accounting services must comply with their professional standards and codes of conduct of several authoritative bodies and governmental agencies. This chapter presented authoritative guidelines applicable to forensic accountants. Many professional standards applicable to forensic accountants are integrity and objectivity, skepticism, confidential information, competency, and due professional care. Professional responsibility standards and codes of conduct were discussed in this chapter. The demand for and interest in forensic accounting education and research are expected to continue to increase as more scholars conduct research in fraud and nonfraud-related issues and universities offer courses and programs in forensic accounting.

Action Items

- Comply with applicable professional responsibility standards.

- Observe applicable codes of conduct and professional ethics.

- Understand all rules and regulations relevant to practice of forensic accounting.

- Comply with all applicable laws, rules, regulations, standards, and best practices.

Endnotes

1. AICPA. 2017. Forensic Accounting.https://www.aicpa.org/interestareas/forensicandvaluation/resources/litigation.html

2. The United States Courts. 2018. http://www.uscourts.gov/

3. AICPA. August 31, 2017. AICPA Code of Professional Conduct. http://pub.aicpa.org/codeofconduct/ethicsresources/et-cod.pdf, (accessed December 5, 2017).

4. AICPA. 2007. Statements of Standards for Valuation Services. https://www.aicpa.org/interestareas/forensicandvaluation/resources/standards/downloadabledocuments/ssvs_full_version.pdf

5. Chartered Professional Accountants of Canada. n.d. Standard Practices. https://www.cpastore.ca/Catalogue/ShowSampleToc.aspx?productID=1&spID=8&expID=345608949~1

6. J. Fotrodona, D. Mele, J.M. Rosanas. 2017. “Ethics in Finance and Accounting: Editorial Introduction,” Journal of Business Ethics 140, no. 4, pp. 609–613.

7. D. Huber, and E. Charrier. 2015. Is It Time to Regulate Forensic Accounting? https://hal.archives-ouvertes.fr/hal-01277534/document

8. The Foreign Corrupt Practices Act (FCPA). 1977. Anti-Bribery and Books & Records Provisions of the FCPA. https://www.justice.gov/sites/default/files/criminal-fraud/legacy/2012/11/14/fcpa-english.pdf

9. Department of Justice. 2017. Foreign Corrupt Practices Act. https://www.justice.gov/criminal-fraud/foreign-corrupt-practices-act

10. Legal Information Institute. 2017. 15 U.S. Code 78m- Periodical and Other Reports. https://www.law.cornell.edu/uscode/text/15/78m

11. S. Peiken. November 9, 2017. Reflections on the Past, Present, and Future of the SEC’s Enforcement of the Foreign Corrupt Practices Act. https://www.sec.gov/news/speech/speech-peikin-2017-11-09

12. PricewaterhouseCoopers. 2017. FCPA, Anticorruption & Compliance: PwC Forensic Services. https://www.pwc.com/us/en/services/forensics/anti-bribery-corruption-program-integrity.html

13. Ibid.

14. Department of Justice. April 5, 2016. The Fraud Section’s Foreign Corrupt Practices Act Enforcement Plan and Guidance. https://www.justice.gov/archives/opa/blog-entry/file/838386/download

15. Much of the discussion about rules and regulations, particularly the SOX of 2002 and DOF of 2010 comes from Z. Rezaee. 2018. Corporate Governance in the Aftermath of the 2007–2009 Global Financial Crisis, Vol. 1–4, Business Expert Press.

16. Z. Rezaee. 2007. Corporate Governance Post-Sarbanes–Oxley (Hoboken, NJ: John Wiley & Sons).

17. Sarbanes–Oxley Act of 2002 (SOX). The Public Company Accounting Reform and Investor Protection Act. https://www.sec.gov/about/laws/soa2002.pdf.

18. Ibid.

19. Association of Certified Fraud Examiner (ACFE). 2018. Report to the Nations. https://www.acfe.com/report-to-the-nations/2018/

20. Ibid.

21. Dodd–Frank Wall Street Reform and Consumer Protection Act (DOF). H.R.4173. Available at https://www.congress.gov/bill/111th-congress/house-bill/4173/text

22. Securities and Exchange Commissions (SEC). Accounting and Auditing Enforcement Releases (AAAERs). http://www.sec.gov/divisions/enforce/friactions.shtml

23. Ibid.