14. Compensation

Beware the Black Box

Of all the topics organizations need to communicate, you’d think they’d be most effective at communicating about pay. After all, although you hope that employees love their jobs, they work to earn money—to pay their mortgage, put gas in the car, and buy their children shoes. So employees care deeply about how they’re compensated.

But here’s the tricky part. Compensation is, appropriately, a delicate subject. For many good reasons, Person A may be paid differently than Person B, even though they’re doing the same job. So although you can broadly communicate your philosophy and framework for how you pay people, what you pay them needs to be discussed privately, between an employee and his or her manager.

Because of the need for confidentiality, companies often undercommunicate about compensation. The result is that employees experience compensation as a “black box”—a device whose workings are incomprehensible and inaccessible. The black box becomes like a frustrating magic trick. Information (such as performance management ratings) goes into the box, a secret process occurs, and what comes out—a salary increase or bonus amount—seems mysterious. This can cause employees to become confused, frustrated, and even unmotivated.

How can you demystify pay so that it engenders positive feelings? Read on.

Money Does Not Equal Motivation

We would be remiss if we didn’t make this point: Money alone is not a motivator. We’re a fan of Daniel Pink, whose book Drive1 draws on four decades of scientific research to identify three elements of motivation—autonomy, mastery, and purpose—that surpass money as a motivator. He notes that humans have a deep need “to direct our own lives, to learn and create new things, and to do better by ourselves and our world.”

In terms of pay, Pink says most of us just want to know we’re being paid equitably both inside and outside our organization. In short, we’d like to think our salary is about what it would be if we left to join a competitor. And we’d like to think that someone with a comparable job inside our company doesn’t make a lot more than we do—unless, of course, it’s obvious that our colleague merits a lot more money.

We share this information because at the start of any communication challenge, we think it’s a good idea to learn a bit more about your topic from outside your company. You’ll also want to know how employees in your company feel about pay in order to create communications that will resonate with them.

The Magic Number Is 5

All the advice we shared with you in Part I of this book applies to communicating about pay, of course, but we especially recommend that you focus on these five strategies:

3. Help managers talk about pay

5. Provide examples to bring numbers to life

Use Simple Language

Have you heard this advice before? Of course you have—in Chapter 5, “Write Simply and Clearly.” But it’s worth repeating, because if we see one consistent problem with compensation communication, it’s just too complicated.

We know what you’re thinking: Communication is complicated because so is compensation these days. It used to be easy when the only component was straight salary. But many companies have added variable pay to the mix, which is tied to company and/or individual performance. Then there are bonuses (also known as short-term incentives). And finally, you may have long-term incentives, which might take the form of stock options or restricted stock.

Have we mentioned everything? Maybe not. Compensation consultants are always coming up with new approaches to paying employees. In any case, we don’t disagree that your overall compensation program can get pretty complicated.

But that doesn’t mean your communication has to be complicated, too. In fact, the greatest service you can offer employees is to make communication simple, so that employees can understand how even the most gnarly pay plan works.

Don’t Do This

For an example of how not to communicate, we bring you this excerpt from a brochure on compensation created for VPs at a major corporation. (The company name and details have been changed to protect the guilty.)

Acme pays for performance by directly linking pay levels to company business performance. To ensure that pay levels are aligned with business performance, an analysis is performed each year comparing Acme to relevant peer companies. In this analysis, Acme’s performance on key financial metrics is first compared to the performance of a number of direct competitors. Financial metrics may include such items as sales volume, revenue growth, earnings per share, return on investment, and shareholder returns. These financial metrics in aggregate are used to establish a measure of overall company performance. In addition, total compensation, which is comprised of total cash (Base Salary plus Annual and Premium Bonuses) and long-term awards, is compared against the pay levels of more than 13,000 executives in over 500 large companies. This analysis ensures that pay levels reflect emerging marketplace practices and are competitive relative to the market. The completed analysis shows how Acme compares to the peer companies on both overall performance and total compensation by quartile. Acme’s targeted level of pay is in the third quartile, which means that, depending on Acme’s performance, pay levels will be better than at least half of the companies in the peer group.

Aaaargh! Believe us, it doesn’t have to be this way! Here, for example, is the introduction we wrote for a technology company when it launched a new salary structure:

In this booklet, you’ll read about how we manage pay in our company and learn the basics of the new compensation structure. This will supplement the in-person meetings you are having with your manager. The new structure—which features seven salary bands—is being launched this month to all associates.

Why a new compensation structure now? Quite simply, the old one wasn’t working very well. A compensation structure should be simple, consistent, and aligned with the business strategy. The old structure, with 32 salary grades, had too many levels, wide disparities within grades, and was applied inconsistently across the businesses. The result was that many of us spent a lot of time talking about pay and experienced frustration trying to figure out how the structure applied to us.

We think the new compensation structure is a big improvement. With seven salary bands, the compensation structure aligns with our business strategy, provides an effective means to pay our people competitively, and recognizes achievements based on individual and company results.

Here’s the new structure at a glance:

Aaaah, that’s better, isn’t it? Even though pay has changed a lot in the years we’ve been communicating, the fundamentals—being clear and simple—haven’t. For instance, here is the cover copy from a compensation brochure Jane produced some 30 years ago:

Here’s something you’ll like.

A brochure only for company officers that discusses:

MONEY

Specifically, it covers how you earn it, how you can earn more of it, how you can accumulate it, and how you can protect what you’ve got.

This straightforward, direct language would encourage potential readers to turn a page or click to get more information as well today as it did in the past. An interesting feature of this brochure was that it summarized features of a special executive compensation program that most of the readers of this brochure were not even eligible for.

Why include this? Although everyone knew about the special executive compensation program, most officers didn’t know what it covered. So, instead of talking about it factually, officers would speculate about what must/might be included. Putting a summary in this brochure gave them the facts, so they didn’t need to waste time wondering about it. Perhaps it also provided a bit of motivation for them to get to the next level.

At any rate, the response to the brochure was overwhelmingly positive, based on surveys sent to a sampling of officers after the brochure went out.

What Not to Include in Compensation Communications

You don’t need to include photos or videos of the head of HR or the head of Compensation in your compensation communications. Why? It’s kind of like trying to sell a car with videos of the engineers who designed it. What excites them about the vehicle may or may not excite the potential buyer, who doesn’t need to know all the exciting terms and functions of the parts under the hood.

You also don’t need to include empty language or jargon, such as this:

• “Our people represent our greatest long-term sustainable asset.” In fact, avoid starting sentences with the phrase “Our people represent. . .” It’s way too lofty, not conversational, hard to read, and difficult to reconcile with the reality of work today. Someone reading the “Our people. . .” platitudes will do a rewrite for you that goes something like this: “Our people are fabulous, until they’re not, and then we get rid of them.”

• “To achieve our goals, we need extraordinarily talented leaders and a world-class rewards program to match.”

If you decide to feature senior managers talking about the goals of the compensation program, include quotes from them in a conversational tone. One of our favorites quotes from the CEO of a financial firm is “If making a lot of money is the only reason you’re here, we’re probably not the right company for you.” He went on to describe why the caliber of the people you work with, what you learn, and the work you’ll do should be important enough reasons to race into work each day. It was a great way to put pay in its proper place for that firm.

Create Visuals to Simplify Complicated Information

You’ve never needed visuals (see Chapter 6, “Leverage Visuals”) more than when you set out to communicate compensation. After all, you’re dealing with three attributes that lend themselves to a visual treatment: numbers, relationships (how an aspect of performance affects pay, for instance), and time.

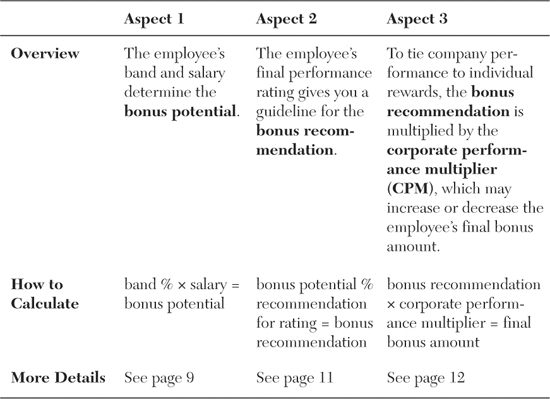

The easiest visual to use is a table. For example, here’s one we created for a compensation guide for managers at a biotech company:

Overview: Calculating Bonus Compensation

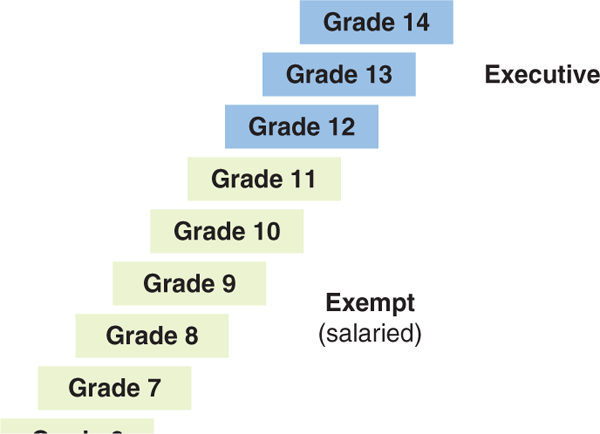

Here are two more examples of how visuals can create clarity about aspects of compensation. Figure 14-1 illustrates a company’s new career ladder, showing the job bands or levels that determine the pay range for a set of jobs.

Figure 14-2 illustrates a change in a pay cycle—when employees will receive an annual bonus.

Help Prepare Managers to Talk About Pay

Critical information about an employee’s pay—such as salary increases and bonus amounts—usually is communicated to that employee in a one-on-one conversation with his or her manager. Especially when compensation is complex, or when the system is changing, it’s essential that you prepare managers for success by giving them the context and information they need to speak confidently and persuasively about pay.

Helping managers usually begins with making sure they understand the process. For example, here’s a checklist Alison’s firm created for a manager’s guide to compensation for a global company:

What you need to do:

By September 1 of this year, you’ll need to have a year-end conversation with each of your employees to discuss their final rating and compensation. Ideally, salary and bonus information is communicated in an individual face-to-face meeting with an employee.

Share the following information with all employees:

![]() Tell the employee his or her final rating for the previous plan year.

Tell the employee his or her final rating for the previous plan year.

![]() Communicate the salary increase amount. If no salary increase was awarded, share the reasons why, and describe what needs to occur for the employee to be considered for future increases.

Communicate the salary increase amount. If no salary increase was awarded, share the reasons why, and describe what needs to occur for the employee to be considered for future increases.

![]() Give specific developmental feedback to help the employee improve, grow, and/or add new skills.

Give specific developmental feedback to help the employee improve, grow, and/or add new skills.

![]() Reinforce the employee’s goals for the new plan year.

Reinforce the employee’s goals for the new plan year.

Share additional information with bonus-eligible employees:

![]() Communicate the bonus amount, and reinforce why the bonus is being granted.

Communicate the bonus amount, and reinforce why the bonus is being granted.

![]() Describe how the employee’s role and performance contributed to the company’s success.

Describe how the employee’s role and performance contributed to the company’s success.

![]() Explain how the company and business unit met or exceeded performance indicators and how this impacts all bonuses in the Corporate Performance Multiplier. Detailed information about this is included in the previous section, “What you need to know about bonuses.”

Explain how the company and business unit met or exceeded performance indicators and how this impacts all bonuses in the Corporate Performance Multiplier. Detailed information about this is included in the previous section, “What you need to know about bonuses.”

![]() If no bonus was awarded, share the reasons why, and describe what needs to occur for the employee to be considered for future bonus awards.

If no bonus was awarded, share the reasons why, and describe what needs to occur for the employee to be considered for future bonus awards.

![]() Thank the employee for his or her work in achieving corporate and business unit objectives.

Thank the employee for his or her work in achieving corporate and business unit objectives.

When we helped a client roll out a new sales incentive plan, we learned that typically the client simply announced the new plan each year at the national sales meeting. Company management perceived, and our research confirmed, that the sales staff’s understanding of the new plan was highly uneven, which was translating into lost sales for the company, plus lower sales bonuses for employees.

Our approach was to use a variety of communications and tools, both before and after the national sales meeting, to engage sales managers in the process, give them a variety of tools, and provide “just in time” information rather than bombarding them with all the materials for a one-year campaign at one time.

This approach worked wonders. Sales went up significantly, as did the average bonus payout.

Here’s an overview of what happened before and after the national sales meeting:

Personalize if Possible

About 40 years ago, companies began producing what they called total compensation reports: a personalized communication showing an employee the cumulative value of his or her job. Somewhere in the report you found a grand total that added up the value of your vacation time, sick days, holidays, medical coverage, plus, of course, your pay.

The early reports were not beautiful to look at—and when you saw a lot of white space, you knew that someone, somewhere was probably getting something terrific and you were not. For example, when the page about Supplemental Compensation featured one tiny sentence and the rest was white space, you knew you were, essentially, a bottom feeder.

These early reports were extremely popular and extremely expensive to produce. As technology caught up with need, the reports became seamless—filled with lots of details and no telltale white space to signal a void in your life.

Today’s reports don’t even need to be printed. Many organizations provide employees with confidential online access to the same information in the total compensation report—and more. Employees can use modeling tools to make their own assumptions and projections. For saving and investing purposes, these new tools are an important resource to help employees make good decisions and take actions so that they will have the income they would like to have at retirement, or if they were to stop working.

Of course, many companies still need to produce printed total compensation reports for many reasons—for example, if many employees don’t have access to online resources. If your organization does produce a printed report, we recommend that you also mail it to employees at home. The report contains the type of information that employees will want to share with their families, because it serves as an important document for financial planning.

Here’s an overview of the types of information you can include in a total compensation report:

• Salary plus any incentive pay or awards

• Company investments in 401(k) or similar plans or any matching gifts

• Company investment in the benefits package

• Medical and dental reimbursements for the past year, plus what the company paid and the employee paid for this coverage, plus a summary of coverage (deductible, copay, out-of-pocket maximum)

• A reminder of how the healthcare spending account can save money (if the employee doesn’t currently take advantage of it)

• Projected tax savings based on the amount the employee contributes to the healthcare spending account

• An overview of projected financial support from various sources if the employee became disabled or died

• An overview of paid time off and its value

• An overview of any additional services the company provides to help employees get assistance with personal problems, find information on family care, spend more time with their families, invest in others (matching-gifts programs), and invest in themselves (for example, tuition reimbursement). Be sure to show the actual dollar amounts for any applicable programs.

• Show current and projected values for any retirement savings accounts. Include information that will help employees determine if they need to increase their savings, and by how much, to have more at retirement. (And include instructions on how to do just that.) Include estimated social security monthly payments for different possible retirement ages. Give employees information about what percentage of their salaries they’ll need during retirement to continue their current standard of living.

• Whenever you present information that may cause an employee to take action, make it easy for him to do just that. Include a link to the appropriate website or a toll-free phone number.

Here’s the introduction to a printed total compensation report called “Pay Plus” that Jane produced:

Dear Employee,

Our success starts with people like you. One of the important benefits that all of us share is our total compensation package: salary, incentives and awards, and benefits.

That’s what this booklet is all about. It describes your total compensation package in a form that’s completely customized for you. For example, you’ll see a report on your earnings, including the value of your benefits. You’ll find a summary of your benefit choices and some tips on how to get more from the programs offered to you. There’s even a section on long-term financial planning. It’s designed to help you determine whether your current level of savings will meet your future needs.

You might be wondering why we’ve invested in this statement. It’s because we believe it will help you become more informed about your total compensation and how to use your benefits to meet your life needs and goals. The statement gives you a new tool for making financial decisions and planning for the future. And, it may provide you with a new perspective on your compensation and the ways we can share success.

[signed by the chairman of the company]

How did we measure the effectiveness of this report? We included a one-page survey for employees to complete and return anonymously. The survey included questions such as the following, each followed by a four-point scale moving from Strongly Disagree on the left to Strongly Agree on the right:

• The personal statement improves my understanding of my total compensation.

• The personal statement improves my appreciation of the value of my total compensation.

• Based on my understanding, I am getting as much value out of the total compensation plan as I can.

• Based on my understanding, I plan to reevaluate how I’m using certain benefits in order to get more out of them.

• I intend to increase my current level of savings in order to meet my financial goals.

Then we included one opportunity for comments:

• What’s the single most important improvement the company can make in the personal total compensation statement? Any other comments?

Survey results proved overwhelmingly that this report was a good investment.

Provide Examples

Even if your company doesn’t produce a personalized compensation/benefits statement, you can make compensation more tangible for managers and employees. How? By providing examples of how pay works. One easy way to do so is to create semifictional characters and then illustrate what happens to them as a result of different pay events.

For example, we created the character of “Michael” so that managers at a healthcare company would understand how salary increases and bonuses work:

Meet Michael

Michael is a Band 4 employee with an annual salary of $50,000. He just received a “strong” rating for his performance last year.

Band and salary determine bonus potential

As a Band 4, Michael’s bonus potential is 15% of his annual salary. Since his salary is $50,000, this means his bonus potential is $7,500.

Final rating determines bonus recommendation

Since Michael’s final rating is “strong,” the guideline for his bonus recommendation is between 81% and 90% of his bonus potential, with a midpoint of 86%. At the midpoint, his bonus recommendation would be $6,450, or 12.9% of his salary.

Since Michael performed well on an important project that helped increase revenue, his manager recommends him for a slightly higher bonus of $6,600, which is 88% of his bonus potential and 13.2% of his annual salary.

Michael’s bonus recommendation is reviewed and approved by his second-level manager in the calibration process.

See how this example helps bring pay to life?

Checklist for Getting Value from Your Substantial Investment in Compensation

To make sure your compensation communications succeed, you’ll want to do the following:

![]() Use simple, clear, conversational language to talk about pay. This isn’t brain surgery. It doesn’t require technical terms that only a compensation professional could love.

Use simple, clear, conversational language to talk about pay. This isn’t brain surgery. It doesn’t require technical terms that only a compensation professional could love.

![]() Produce visuals to show how components add up and work together. Graphs create a succinct, easy-to-understand picture.

Produce visuals to show how components add up and work together. Graphs create a succinct, easy-to-understand picture.

![]() Create ways for employees to see how the value of everything the company provides really does add up.

Create ways for employees to see how the value of everything the company provides really does add up.

![]() Give employees information that helps them make good long-term plans.

Give employees information that helps them make good long-term plans.

![]() Go the extra mile to give managers “just in time” information to help them talk effectively one-on-one or in small groups about pay and incentive plans.

Go the extra mile to give managers “just in time” information to help them talk effectively one-on-one or in small groups about pay and incentive plans.