Chapter 1

Free Enterprise and Wealth Creation

In the United States, businesses—large and small, public and private—create the beating heart of individual and national wealth creation. At the end of 2018, our nation boasted more than 32 million enterprises, of which just over 6 million had paid employees.1 The latter equated to a business for every 55 Americans, or, better still, a business having paid employees for roughly every 30 Americans in the labor force.

Given those statistics, if one were to look at the total number of businesses, there would be a business for every five Americans in the labor force, which is astounding.

How has this been made possible?

The abundance of businesses in America owes itself to three factors: An educated workforce, a ready supply of capital, and a strong rule of law. The United States is not alone in this; in no small way, these contributors to business formation lie at the foundation of the economy of every highly developed nation.

In the Beginning Is the Idea

Most businesses start with an idea, which usually takes the form of a solution to a problem. The key question is how to build a profitable business model around the idea.

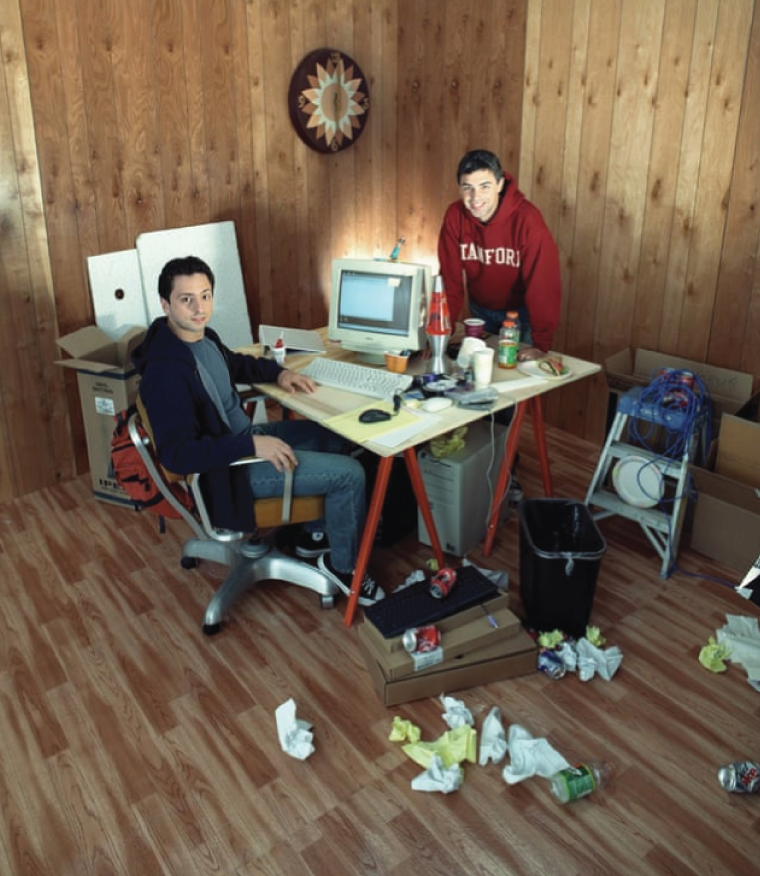

In 1995 Larry Page and Sergey Brin, who had met as graduate students at Stanford, saw that searching the internet for relevant information was a cumbersome process. Their idea was to make internet searches efficient, productive, and user-driven, applying the technology they created to drive a high level of search demand.

They didn't know how this idea could translate into a profitable business model. No one could have foreseen how dominant and profitable Google, the company they created, was to become. Certainly not Page and Brin, who in 1999 briefly entertained selling Google to Excite, a more established search engine company, for $750,000, which would have allowed them to turn a tidy profit and return to their graduate studies. No one could have blamed them for unloading their money-losing venture; that year, Google had posted a $3.1 million loss on revenues of just $220,000.

Sergey Brin, left, and Larry Page posing in a messy office setting in October 2002

Credit: © Michael Grecco Productions, Inc./Grecco.com, ALL RIGHTS RESERVED.

Just two years later, the company would produce its first profit of $32 million on revenues of $86.4 million, and it would never look back. Three years after that, they took Google public. Between 2004 and 2019, Page and Brin sold over $10 billion of Google shares apiece, and yet still held onto corporate shares valued at more than $25 billion for each of them.

Over the next two years, the company they founded continued to prosper. By the end of 2021, with a net worth estimated by Forbes of $123 billion, Larry Page ranked as the fifth-richest person in the world. His former partner, Sergey Brin, was effectively tied at number six, with a reported net worth of $118.5 billion.

Unicorn Likelihood

This brings up the interesting topic of the likelihood of anyone—including you or me—becoming a billionaire. Looking to the richest among us makes an interesting study, because these subjects provide insight into the most compelling business models in each generation.

As of the end of 2020, there were over 3,200 billionaires in the world, of which over a quarter resided in the United States.2 The odds of an American being a billionaire are roughly 1 in 355,000, or far better than the extremely long odds of winning a Powerball lottery, which is approximately 1 in 300 million.

Of course, many of the world's richest inherited their wealth, and so might be excluded from the competition to become billionaires. A better question might be this: What are the odds of being a self-made billionaire? Not too bad, actually; of the global population of billionaires surveyed at the end of 2020, 60% were self-made, which is an astonishing statistic.3 The amount of wealth created in the 50 years between 1970 and 2020 is indeed almost without precedent. One would have to look to the same period a hundred years earlier for a comparative period of productivity and creativity. Instead of names like Bezos, Musk, Gates, and Buffett, one might have spoken of Rockefeller, Carnegie, and Morgan. Still, the numbers of the world's most affluent today dwarf those of the Gilded Age, or what is also called the Age of the Second Industrial Revolution.

Of course, much of the difference in the magnitude of today's superrich lies in population growth. Much is also owed to enhancements in capital formation, including resources such as the Small Business Administration, venture capital, and pervasive private equity firms. These resources, together with technological advances, gave rise to what is today called the Third Industrial Revolution, with economic and productivity growth propelled by digital and technology advances.

The numbers show that being a billionaire is statistically easier than winning the Powerball. It is also statistically easier than making a living on the PGA Tour. There were an estimated 927 billionaires in the US at the end of 2020. Meanwhile, the career earnings of the active golfer ranked 927 on the PGA Tour amounted to less than $25,000.4 There are more self-made billionaires in America than there are PGA Tour pros who can earn a good living playing the game.

Getting into the NBA is nearly equally hard, with just 450 players scattered across 30 teams, and each earning a median salary of approximately $3.5 million in 2019.5 Getting into the NFL is a little easier, with about 1,900 players and a far lower median salary under $850,000.6 Yet, you would be right to say that all these people are virtual “unicorns,” or mythical creatures, which is also a term used today for start-up businesses having valuations of a billion dollars and up.

Odds of Success

To my way of thinking, the real action in business lies in the middle markets, which I would characterize as companies having from $10 million to $1 billion in revenues. This is where most of the job growth and business creativity is in the United States. This is the most common fertile ground for growing businesses that have the best chances for material wealth creation.

To be among the broad group of thousands of middle market businesses is broadly attainable.

By contrast, smaller companies often serve as vehicles for independent employment, which can be personally rewarding but generally lessen the chances for wealth creation.

The bottom line is this: If you can harness an idea and transform it into a business model, what are the odds of success?

It turns out that the odds of having a business that survives at least five years are about the same as the odds of consistently breaking 100 at golf. The odds of business survival for longer than 10 years are somewhat better than regularly posting golf scores under 90.

Golf vs. Business

| Golf1 | Business2 |

|---|---|

| 50% Can't Break 100 | 20% Don't survive a year |

| 25% Shoot between 90 and 100 | 50% Survive at least five years |

| 20% Shoot between 80 and 90 | 33% Survive more than 10 years |

| 5% Shoot below 80 | ?? Survive and create MVA |

1 Data from National Golf Foundation

2 US Small Business Administration Office of Advocacy June 2016

Actually, the odds may be about the same, since golf statistics are based up players who report their scores. Of course, many golfers elect not to report their scores, while among those who do report their scores, there are well-founded suspicions of score embellishment.

In business, there are generally no free mulligans, and statistics are not compiled from self-reporting, which makes reported business survival rates more reliable.

Businesses that survive 10 or more years are apt to have better business models than those who do not. The outliers in business are the companies that do two things: They survive; and then having survived, they become worth more than they cost to create. These lie at the heart of wealth creation. The aggregate creation of value beyond the cost to create a company is called market value added (MVA). A company's owners tend to be the prime beneficiaries of MVA, though creditors also typically benefit. The principal driver of MVA creation is centered in the ability of a business to realize rates of return that exceed the overall cost of capital, which includes both equity and interest-costing proceeds from other people and institutions. At an extreme level, outlier businesses can enable their shareholders to become unicorns. I expect that most of the founders of such rarified companies end up as surprised as Sergey Brin and Larry Page. But there are thousands of MVA-creating businesses that individually and collectively lie at the center of our economy and the prosperity of our communities.

The Six Variables

While there is a limitless supply of ideas that might be applicable to business formation, there is not, at a high level, a limitless supply of business models. When viewed abstractly, just Six Variables combine to deliver equity returns and create equity market value added. They are:

- Sales

- Business investment

- Operating profit margin

- Amount of interest costing proceeds (other people's money)

- Cost of other people's money

- Annual maintenance capital expense

This is not to say that buried within the Six Variables lie far more diverse operational fundamentals. Henry Ford created the first scalable automotive assembly line, and Albert P. Sloan was an administrative and marketing genius who grew General Motors to surpass Ford and become the largest company in the world. These and other operationally minded business leaders are illustrative of the immense creativity that can be harnessed to enhance business models. Still, behind all this effort and operational creativity lie Six Variables, which demand the attention of—and can help—every business leader.

Notes

- 1. 2021 Small Business Profile, US Small Business Administration Office of Advocacy.

- 2. Wealth-X's Billionaire Census 2021.

- 3. Wealth-X's Billionaire Census 2021.

- 4. Career money leaders list through February 2021, Professional Golf Association.

- 5. Dimitrije Curcic, “The Ultimate Analysis of NBA Salaries [1991–2019],” August 6, 2021, https://runrepeat.com/salary-analysis-in-the-nba-1991-2019.

- 6. 2020 Player Salaries, https://www.pro-football-reference.com/.